Answered step by step

Verified Expert Solution

Question

1 Approved Answer

need it quick and make sure it's correct and in the right form and easy to understand . o. Balance per the bank statement dated

need it quick and make sure it's correct and in the right form and easy to understand .

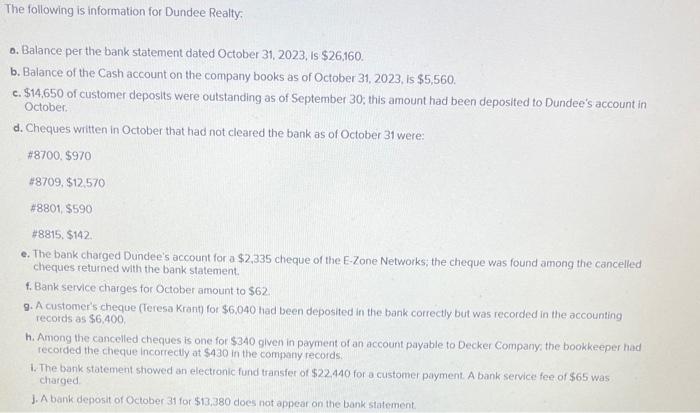

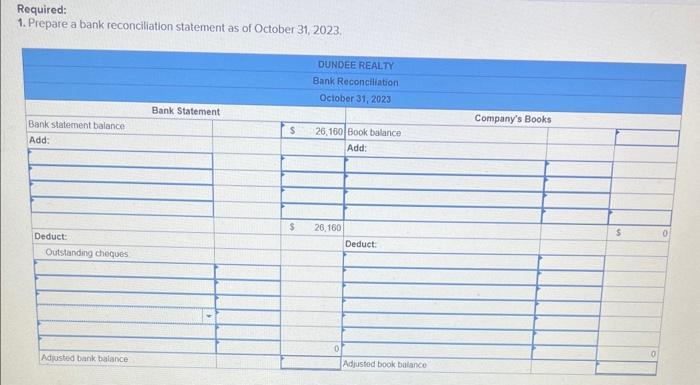

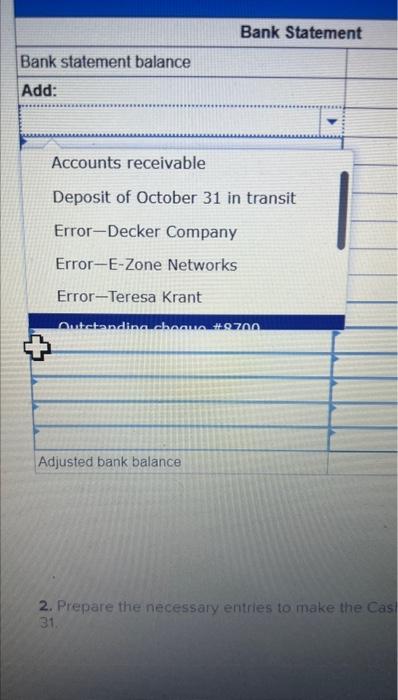

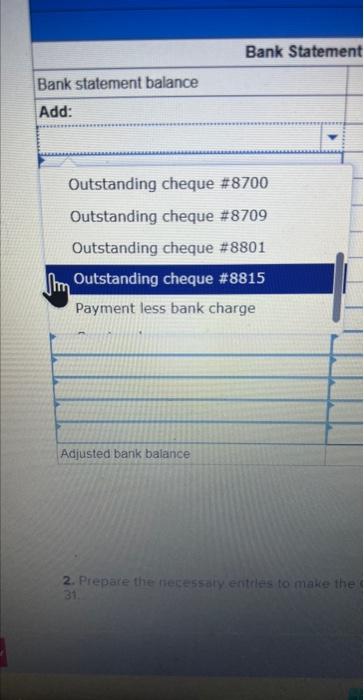

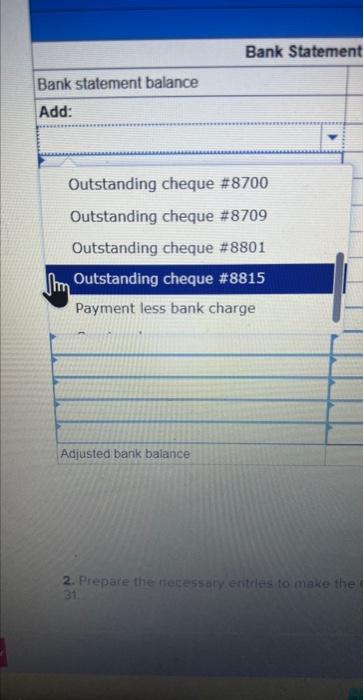

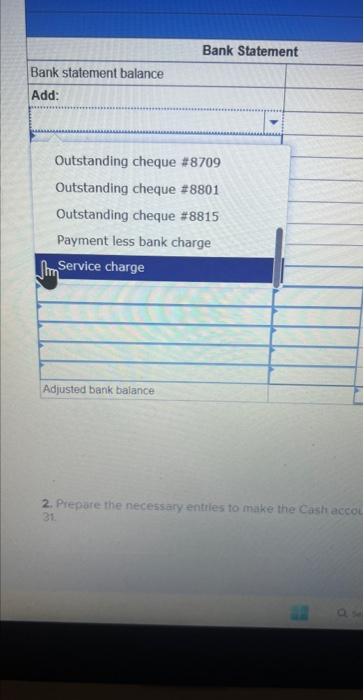

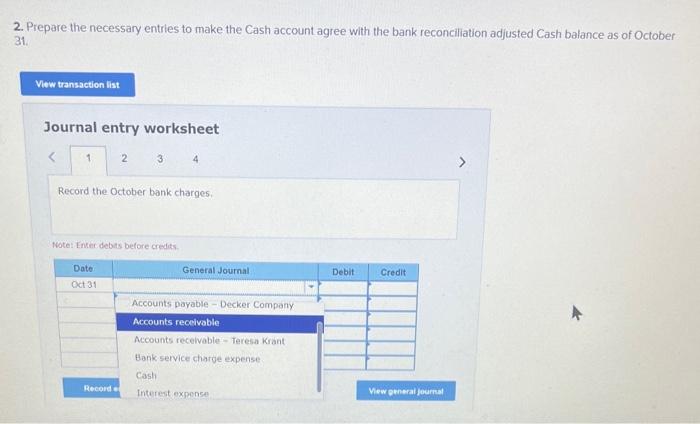

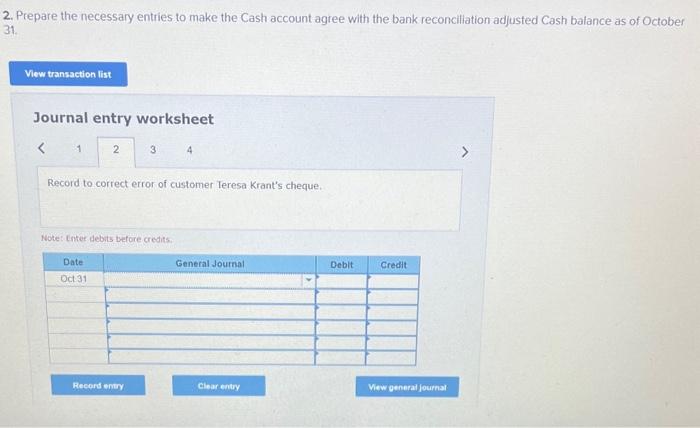

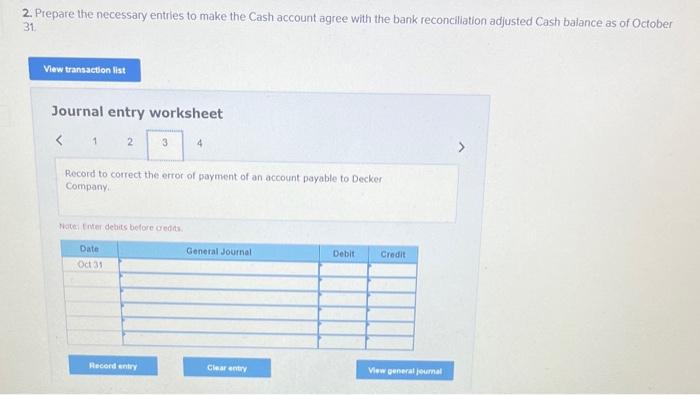

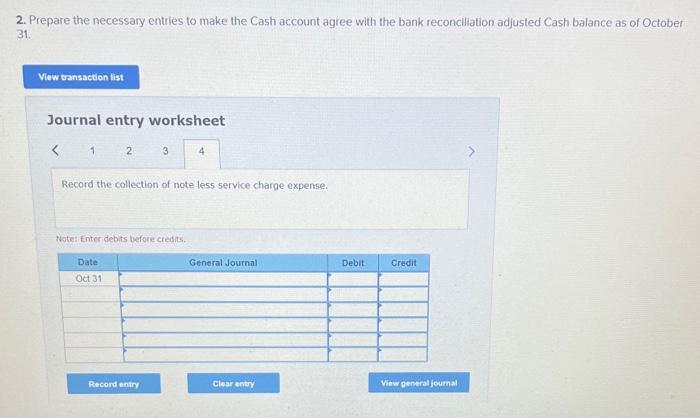

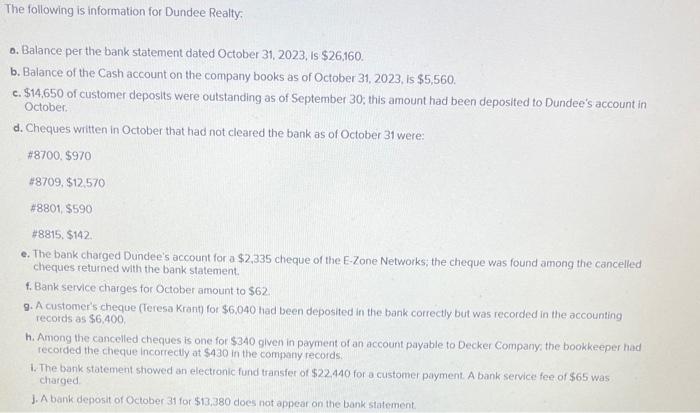

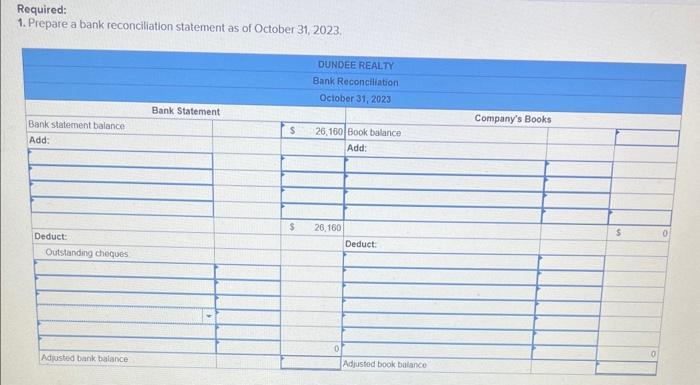

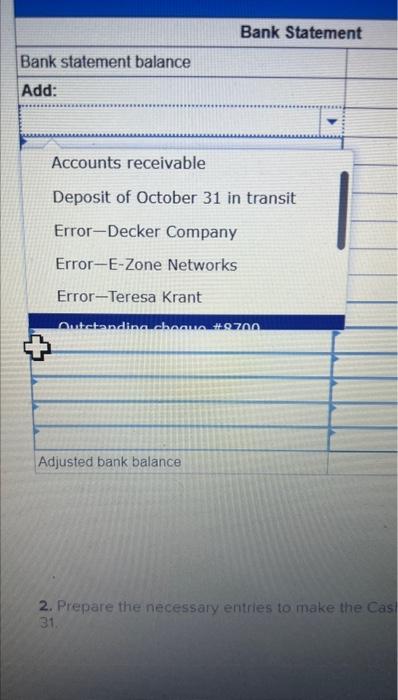

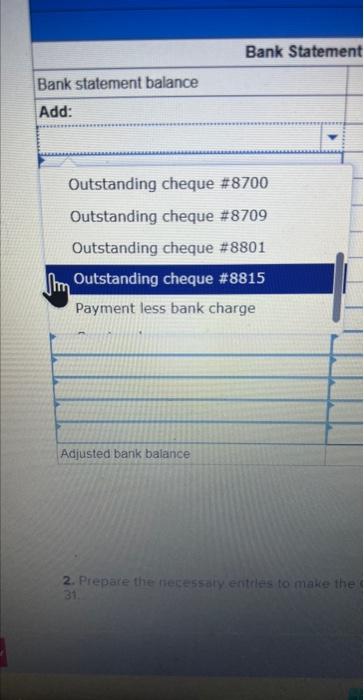

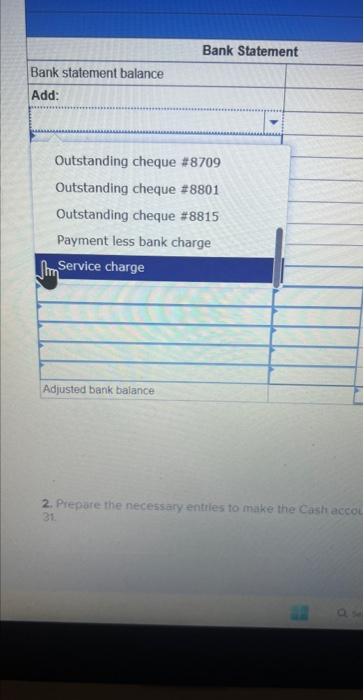

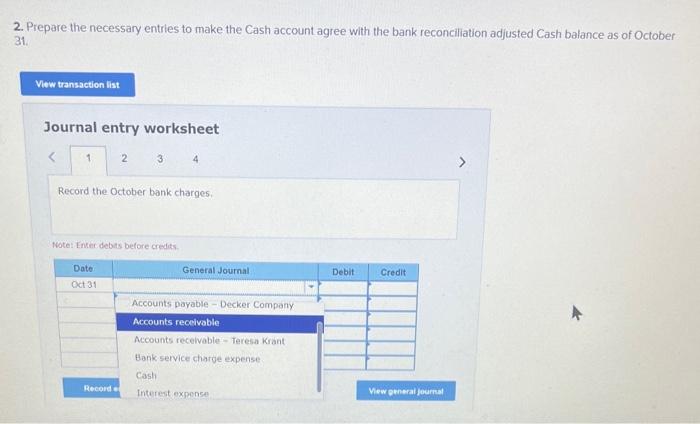

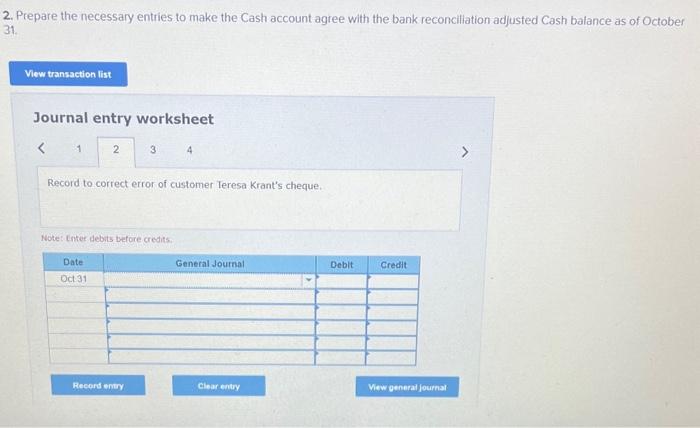

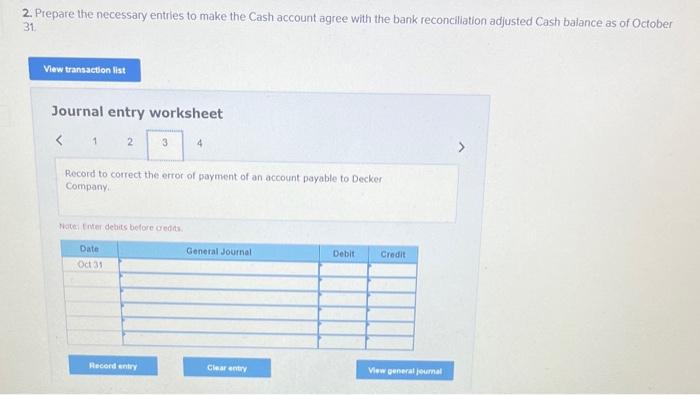

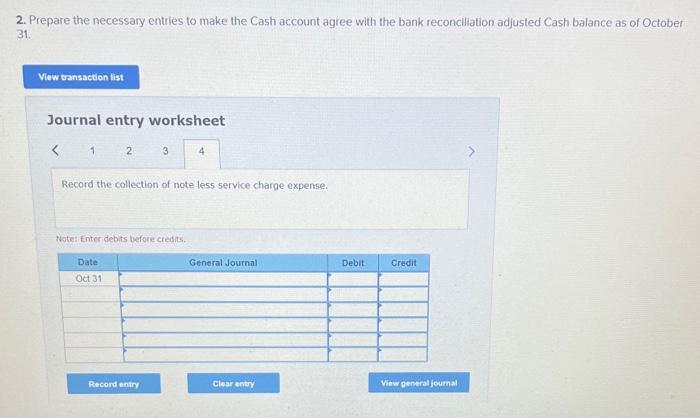

o. Balance per the bank statement dated October 31,2023 , Is $26,160. b. Balance of the Cash account on the company books as of October 31, 2023, is $5,560. c. $14,650 of customer deposits were outstanding as of September 30: this amount had been deposited to Dundee's account in October. d. Cheques written in October that had not cleared the bank as of October 31 were: #8700,$97048709,$12.570#8801,$590#8815,$142. e. The bank charged Dundee's account for a $2,335 cheque of the E-Zone Networks, the cheque was found among the cancelled cheques returned with the bank statement. f. Bank service charges for October amount to $62 9. A customer's cheque (feresa Krant) for $6.040 had been deposited in the bank correctly but was recorded in the accounting records as $6,400, h. Among the cancelled cheques is one for $340 given in payment of an account payable to Decker Company, the bookkeeper had recorded the cheque incorrectly at $430 in the company records. 1. The bank statement showed an electionic fund transfer of $22440 for a customer payment. A bank service fee of $65 was charged. 1. A bank deposit of October 31 for $13,380 does not appear on the bonk statement. Required: 1. Prepare a bank reconciliation statement as of October 21 on? 2. Prepare the necessary entries to make the Cas 31. 2. Prepate the necessaiy entries to make the 31. 2. Prepate the necessaiy entries to make the 31. 2. Prepore the necessary entries to make the Cash accol 31. 2. Prepare the necessary entries to make the Cash account agree with the bank reconciliation adjusted Cash balance as of October 31. Journal entry worksheet 4 Record the October bank charges. Wotel Inter debats before credits. 2. Prepare the necessary entries to make the Cash account agree with the bank reconcillation adjusted Cash balance as of October 31. Journal entry worksheet Record to correct error of customer Teresa Krant's cheque: Notet Lnter debits before credits. 2. Prepare the necessary entries to make the Cash account agree with the bank reconciliation adjusted Cash balance as of October 31. Journal entry worksheet

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started