Answered step by step

Verified Expert Solution

Question

1 Approved Answer

need it quick thanks 1. Acquired $5/,u casn by issuing common stock. 2. Paid $7,700 for the materials used to make its products, all of

need it quick thanks

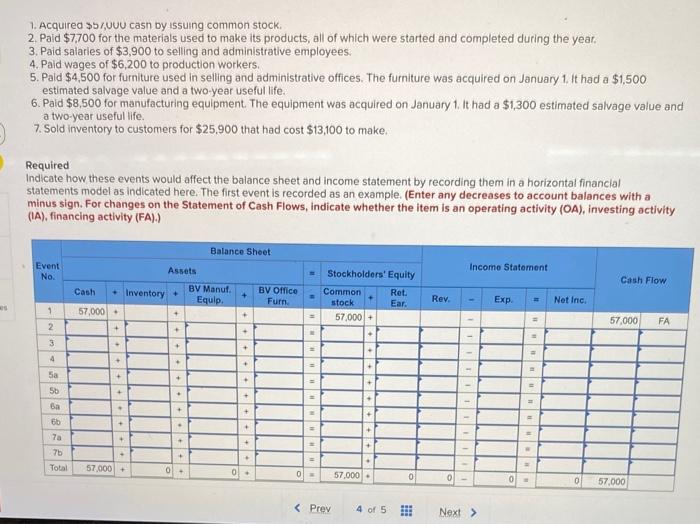

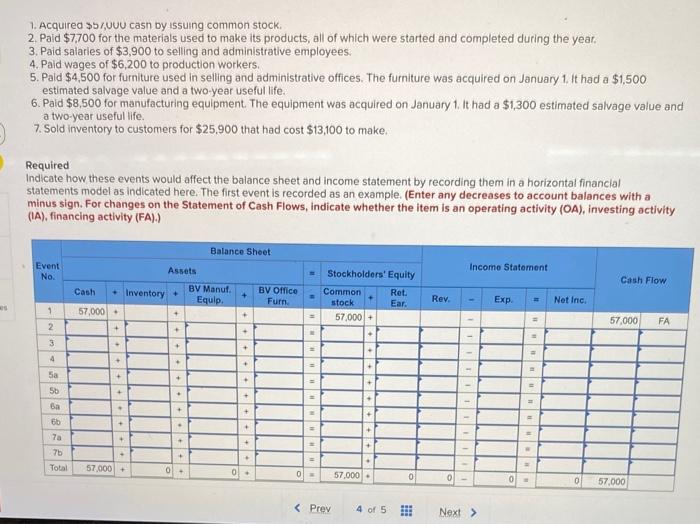

1. Acquired $5/,u casn by issuing common stock. 2. Paid $7,700 for the materials used to make its products, all of which were started and completed during the year. 3. Paid salaries of $3,900 to selling and administrative employees. 4. Paid wages of $6,200 to production workers. 5. Pald $4,500 for furniture used in selling and administrative offices. The furniture was acquired on January 1 . It had a $1,500 estimated salvage value and a two-year useful life. 6. Paid $8,500 for manufacturing equipment. The equipment was acquired on January 1 , It had a $1,300 estimated salvage value and a two-year useful life. 7. Sold inventory to customers for $25,900 that had cost $13,100 to make. Required Indicate how these events would affect the balance sheet and income statement by recording them in a horizontal financial statements model as indicated here. The first event is recorded as an example. (Enter any decreases to account balances with a minus sign. For changes on the Statement of Cash Flows, indicate whether the item is an operating activity (OA), investing activity (IA), financing activity (FA).)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started