Answered step by step

Verified Expert Solution

Question

1 Approved Answer

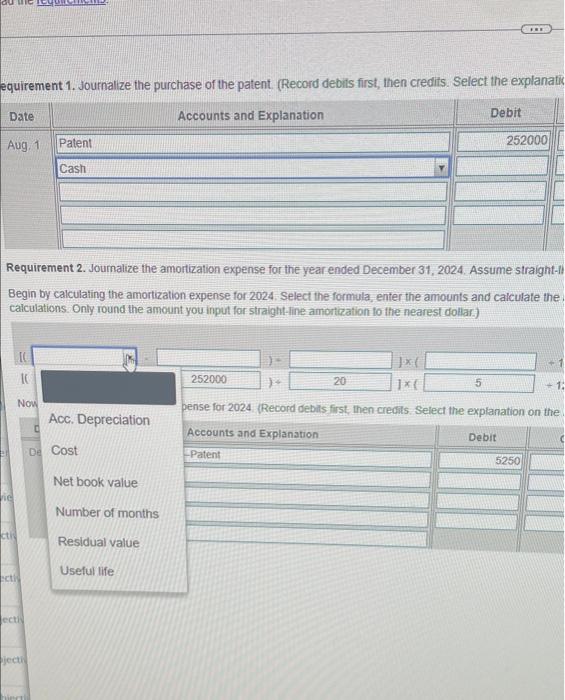

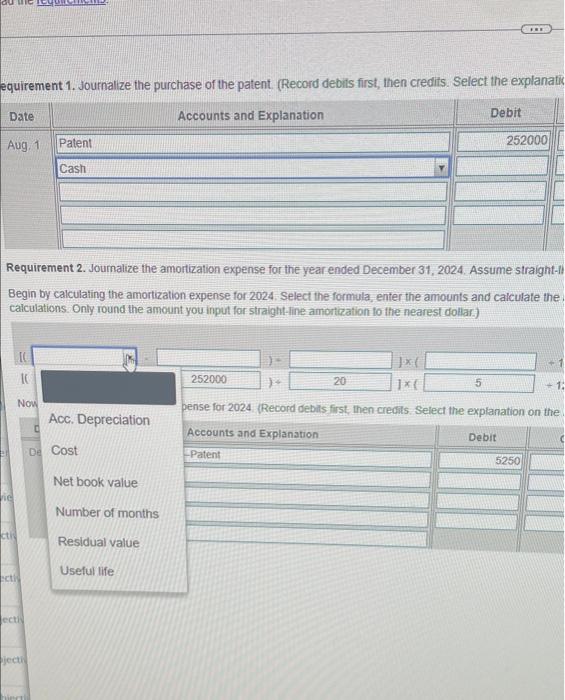

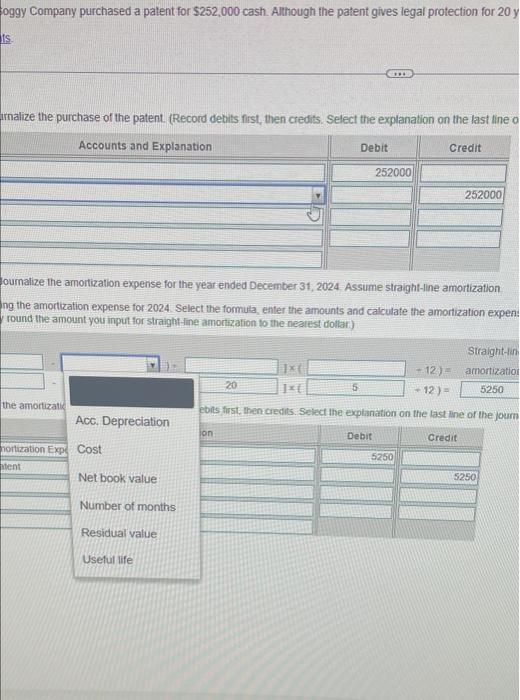

need more info equirement 1. Journalize the purchase of the patent. (Record debits first, then credits. Select the explanatic Debit Date Accounts and Explanation 252000

need more info

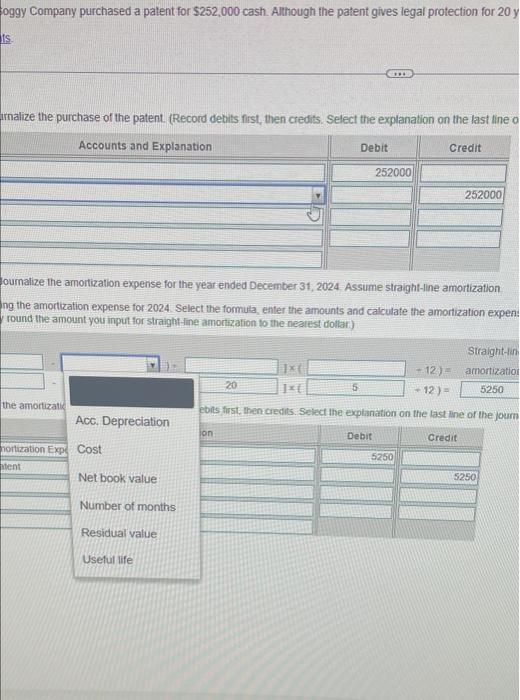

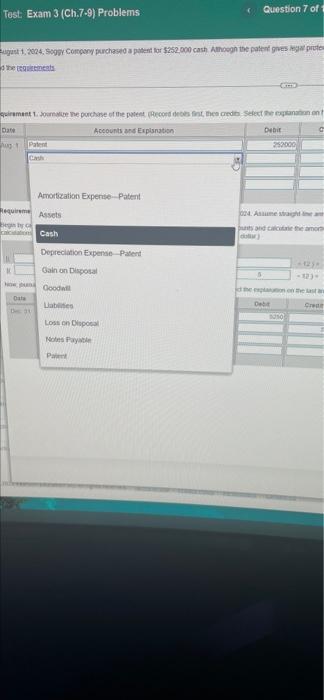

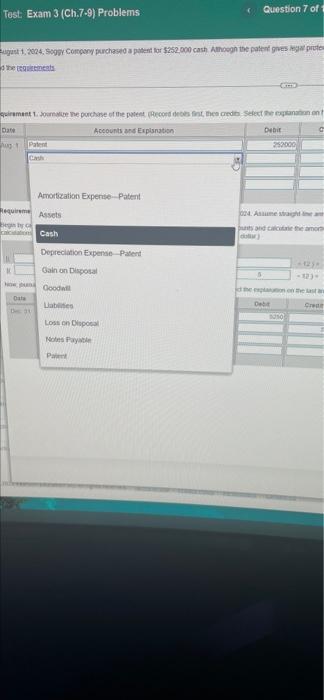

equirement 1. Journalize the purchase of the patent. (Record debits first, then credits. Select the explanatic Debit Date Accounts and Explanation 252000 Aug. 1 Patent Cash Requirement 2. Journalize the amortization expense for the year ended December 31, 2024. Assume straight-li Begin by calculating the amortization expense for 2024. Select the formula, enter the amounts and calculate the calculations. Only round the amount you input for straight-line amortization to the nearest dollar.) 252000 20 1*( 5 1. Now pense for 2024 (Record debits first, then credits. Select the explanation on the Acc. Depreciation 0 Accounts and Explanation Debit De Cost -Patent 5250 Net book value Number of months Residual value Useful life vie cti ecti ectiv jecti hinesi Soggy Company purchased a patent for $252,000 cash. Although the patent gives legal protection for 20 y ts. GIIB mnalize the purchase of the patent. (Record debits first, then credits. Select the explanation on the last line o Accounts and Explanation Debit Credit 252000 252000 Journalize the amortization expense for the year ended December 31, 2024 Assume straight-line amortization ng the amortization expense for 2024. Select the formula, enter the amounts and calculate the amortization expen round the amount you input for straight-line amortization to the nearest dollar) Straight-lin 12)= amortization 5250 20 1x( 5 12) = the amortizati ebits first, then credits. Select the explanation on the last line of the journ Acc. Depreciation lon Debit Credit mortization Exp Cost 5250 tent Net book value Number of months Residual value Useful life 5250 Question 7 of Test: Exam 3 (Ch.7-9) Problems ugust 1, 2024, Soggy Company purchased a patent for $252,000 cash Athough the patent gives legal protes the requirements. quirement 1. Journalize the purchase of the patent (Record debts first, then credits Select the explanation on t Date Accounts and Explanation Debit G Patent 252000 Cash Amortization Expense-Patent 024. Assume straight line an Assets punts and calculate the amor d) Cash Depreciation Expense-Patent Gain on Disposal +123*

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started