Answered step by step

Verified Expert Solution

Question

1 Approved Answer

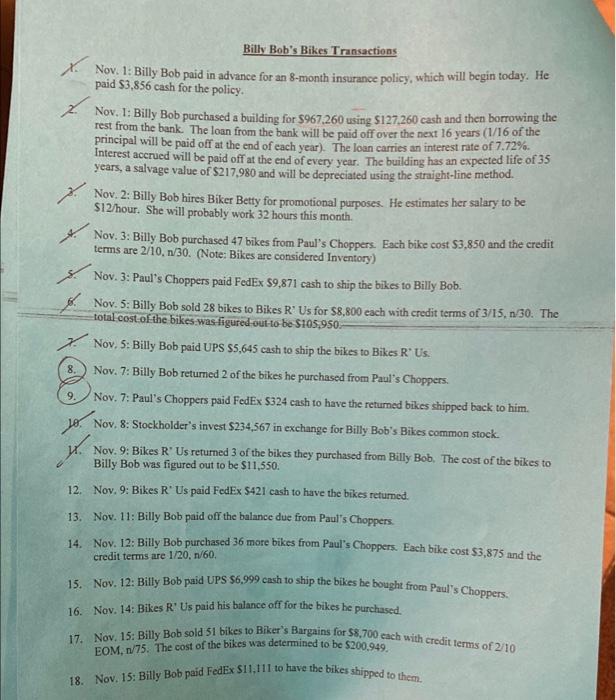

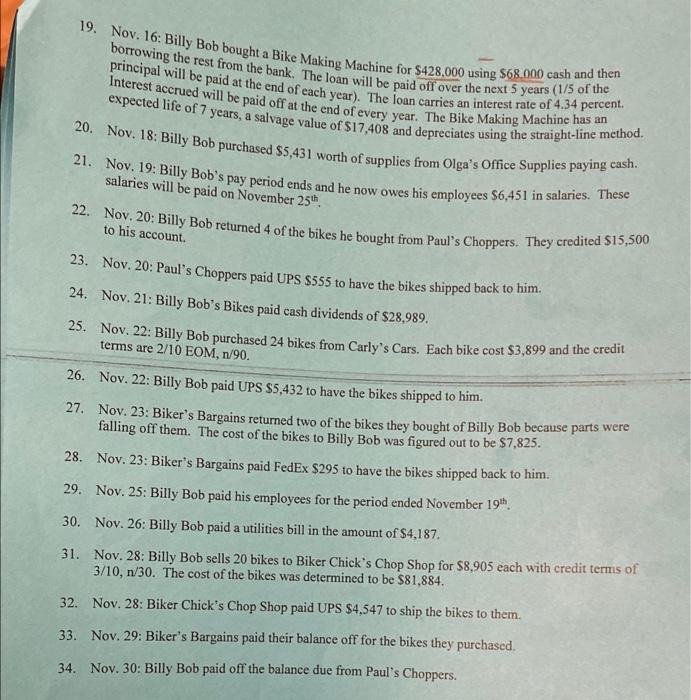

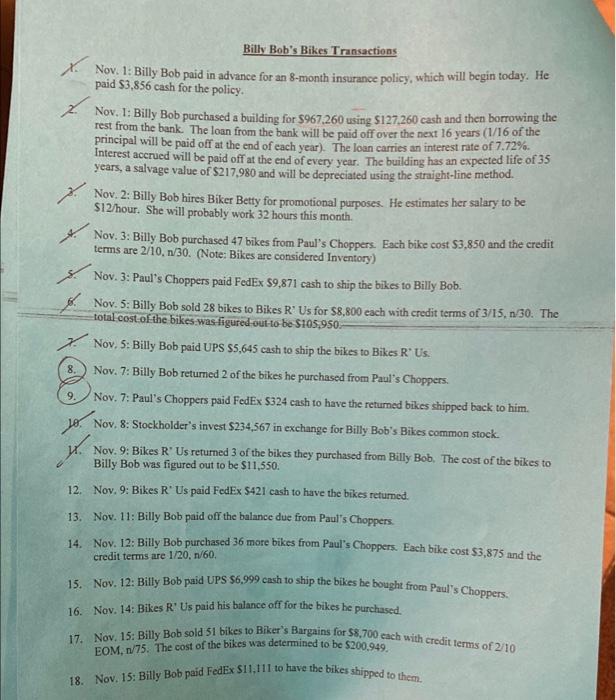

Need multistep I/S, Statement of Retained Earnings, B/S, and a classified statement of financial position. f Billy Bob's Bikes Transactions x Nov. 1: Billy Bob

Need multistep I/S, Statement of Retained Earnings, B/S, and a classified statement of financial position.

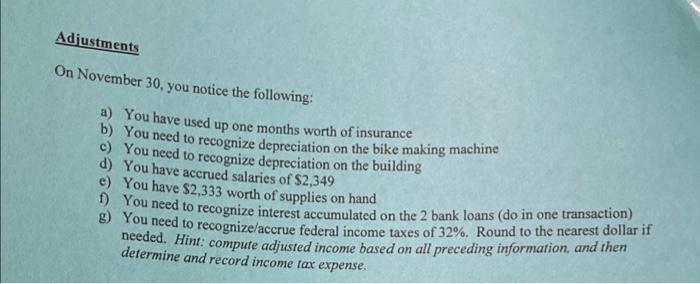

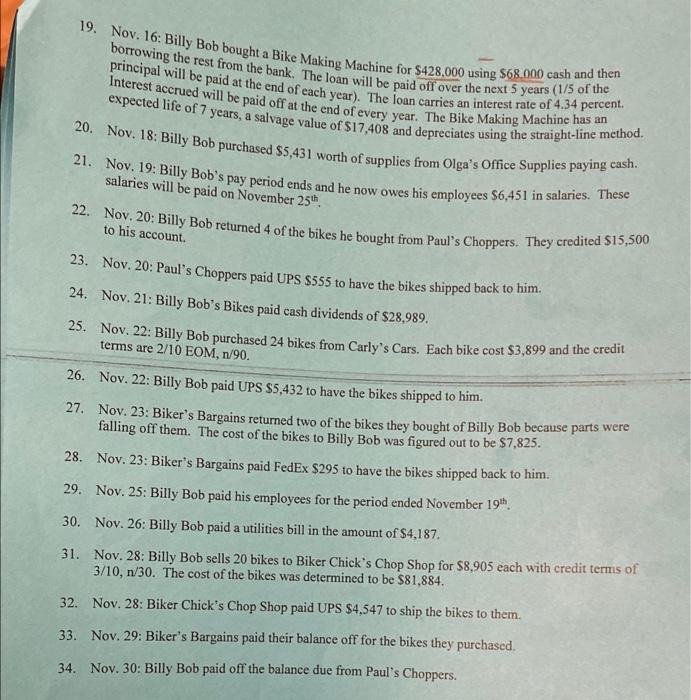

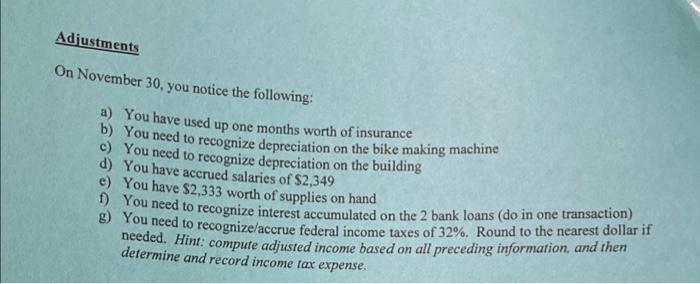

f Billy Bob's Bikes Transactions x Nov. 1: Billy Bob paid in advance for an 8-month insurance policy, which will begin today. He paid $3,856 cash for the policy. Nov. 1: Billy Bob purchased a building for $967.260 using $127.260 cash and then borrowing the rest from the bank. The loan from the bank will be paid off over the next 16 years (1/16 of the principal will be paid off at the end of each year). The loan carries an interest rate of 7.72%. Interest accrued will be paid off at the end of every year. The building has an expected life of 35 years, a salvage value of $217.980 and will be depreciated using the straight-line method. Nov. 2: Billy Bob hires Biker Betty for promotional purposes. He estimates her salary to be 512/hour. She will probably work 32 hours this month. Nov. 3: Billy Bob purchased 47 bikes from Paul's Choppers. Each bike cost $3,850 and the credit terms are 2/10, 1/30. (Note: Bikes are considered Inventory) Nov. 3: Paul's Choppers paid FedEx 89,871 cash to ship the bikes to Billy Bob. 6. Nov. 5: Billy Bob sold 28 bikes to Bikes R Us for $8.800 each with credit terms of 3/15, n 30. The total cost of the bikes was figured out to be $105,950. Nov. 5: Billy Bob paid UPS 85,645 cash to ship the bikes to Bikes R Us. Nov. 7: Billy Bob returned 2 of the bikes he purchased from Paul's Choppers. Nov. 7: Paul's Choppers paid FedEx $324 cash to have the returned bikes shipped back to him. 10. Nov. 8: Stockholder's invest $234,567 in exchange for Billy Bob's Bikes common stock W. Nov. 9: Bikes R Us returned 3 of the bikes they purchased from Billy Bob The cost of the bikes to Billy Bob was figured out to be $11,550. 8 9. 12. Nov. 9: Bikes R' Us paid FedEx $421 cash to have the bikes returned. 13. Nov. 11: Billy Bob paid off the balance due from Paul's Choppers 14. Nov. 12: Billy Bob purchased 36 more bikes from Paul's Choppers. Each bike cost $3,875 and the credit terms are 1/20, 1/60, 15. Nov. 12: Billy Bob paid UPS $6,999 cash to ship the bikes he bought from Paul's Choppers. 16. Nov. 14: Bikes R' Us paid his balance off for the bikes be purchased. 17. Nov. 15: Billy Bob sold 51 bikes to Biker's Bargains for $8,700 each with credit terms of 2/10 EOM, 1/75. The cost of the bikes was determined to be $200,949 18. Nov. 15: Billy Bob paid FedEx SI1,111 to have the bikes shipped to them. 19. Nov. 16: Billy Bob bought a Bike Making Machine for $428,000 using $68.000 cash and then borrowing the rest from the bank. The loan will be paid off over the next 5 years (1/5 of the principal will be paid at the end of each year). The loan carries an interest rate of 4.34 percent. Interest accrued will be paid off at the end of every year. The Bike Making Machine has an expected life of 7 years, a salvage value of $17,408 and depreciates using the straight-line method. 20. Nov. 18: Billy Bob purchased $5,431 worth of supplies from Olga's Office Supplies paying cash. 21. Nov. 19: Billy Bob's pay period ends and he now owes his employees S6,451 in salaries. These salaries will be paid on November 25th 22. Nov. 20: Billy Bob returned 4 of the bikes he bought from Paul's Choppers. They credited $15,500 to his account. 23. Nov. 20: Paul's Choppers paid UPS S555 to have the bikes shipped back to him. 24. Nov. 21: Billy Bob's Bikes paid cash dividends of $28,989. 25. Nov. 22: Billy Bob purchased 24 bikes from Carly's Cars. Each bike cost $3,899 and the credit terms are 2/10 EOM, n/90. 26. Nov. 22: Billy Bob paid UPS $5,432 to have the bikes shipped to him. 27. Nov. 23: Biker's Bargains returned two of the bikes they bought of Billy Bob because parts were falling off them. The cost of the bikes to Billy Bob was figured out to be $7,825. 28. Nov. 23: Biker's Bargains paid FedEx $295 to have the bikes shipped back to him. 29. Nov. 25: Billy Bob paid his employees for the period ended November 191h. 30. Nov. 26: Billy Bob paid a utilities bill in the amount of $4,187. 31. Nov. 28: Billy Bob sells 20 bikes to Biker Chick's Chop Shop for $8,905 each with credit terms of 3/10, n/30. The cost of the bikes was determined to be $81,884. 32. Nov. 28: Biker Chick's Chop Shop paid UPS $4,547 to ship the bikes to them. 33. Nov. 29: Biker's Bargains paid their balance off for the bikes they purchased. 34. Nov. 30: Billy Bob paid off the balance due from Paul's Choppers. Adjustments On November 30, you notice the following: a) You have used up one months worth of insurance b) You need to recognize depreciation on the bike making machine c) You need to recognize depreciation on the building d) You have accrued salaries of $2,349 e) You have $2,333 worth of supplies on hand You need to recognize interest accumulated on the 2 bank loans (do in one transaction) B) You need to recognize/accrue federal income taxes of 32%. Round to the nearest dollar if needed. Hint: compute adjusted income based on all preceding information, and then determine and record income tax expense

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started