Answered step by step

Verified Expert Solution

Question

1 Approved Answer

need number 1 and 3 please Your firm is contemplating the purchase of a new $720,000 computer-based order entry system. The system will be depreciated

need number 1 and 3 please

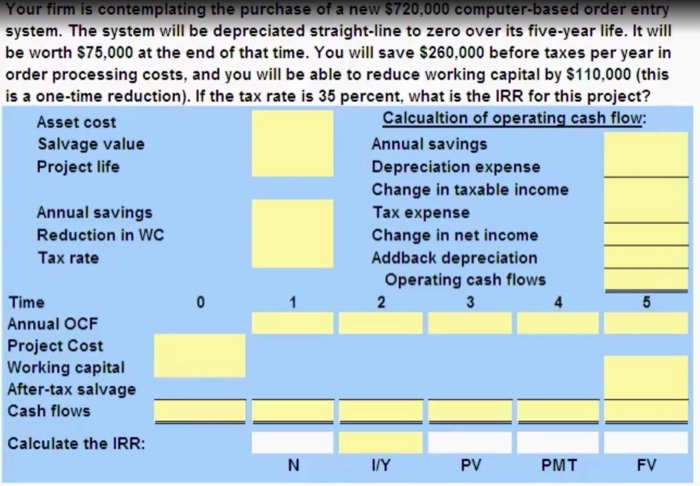

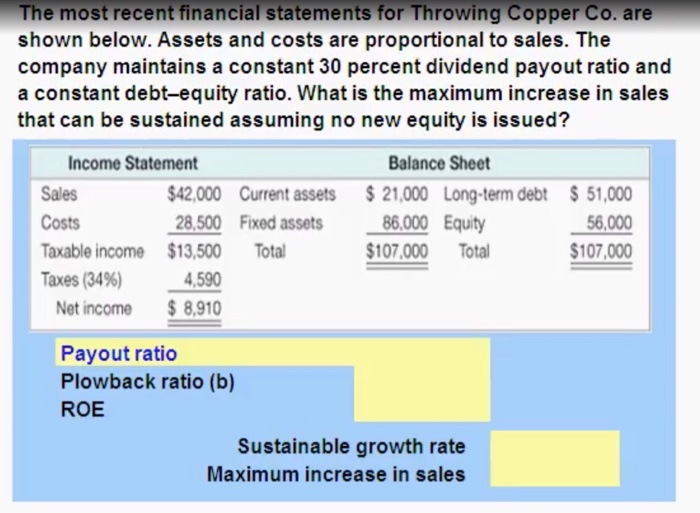

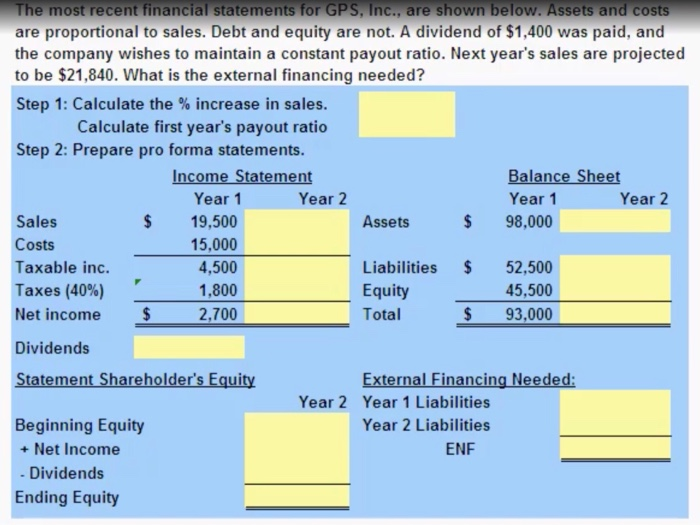

Your firm is contemplating the purchase of a new $720,000 computer-based order entry system. The system will be depreciated straight-line to zero over its five-year life. It will be worth $75,000 at the end of that time. You will save $260,000 before taxes per year in order processing costs, and you will be able to reduce working capital by $110,000 (this is a one-time reduction). If the tax rate is 35 percent, what is the IRR for this project? Asset cost Calcualtion of operating cash flow: Salvage value Annual savings Project life Depreciation expense Change in taxable income Annual savings Tax expense Reduction in WC Change in net income Tax rate Addback depreciation Operating cash flows Time 0 2 3 Annual OCF Project Cost Working capital After-tax salvage Cash flows a Calculate the IRR: N I/Y PV PMT FV The most recent financial statements for Throwing Copper Co. are shown below. Assets and costs are proportional to sales. The company maintains a constant 30 percent dividend payout ratio and a constant debt-equity ratio. What is the maximum increase in sales that can be sustained assuming no new equity is issued? Income Statement Balance Sheet Sales $42,000 Current assets $21,000 Long-term debt $ 51,000 Costs 28,500 Fixed assets 86.000 Equity 56,000 Taxable income $13,500 Total $107.000 Total $107.000 Taxes (34%) 4,590 Net income $ 8,910 Payout ratio Plowback ratio (b) ROE Sustainable growth rate Maximum increase in sales The most recent financial statements for GPS, Inc., are shown below. Assets and costs are proportional to sales. Debt and equity are not. A dividend of $1,400 was paid, and the company wishes to maintain a constant payout ratio. Next year's sales are projected to be $21,840. What is the external financing needed? Step 1: Calculate the % increase in sales. Calculate first year's payout ratio Step 2: Prepare pro forma statements. Income Statement Balance Sheet Year 1 Year 2 Year 1 Year 2 Sales $ 19,500 Assets $ 98,000 Costs 15,000 Taxable inc. 4,500 Liabilities $ 52,500 Taxes (40%) 1,800 Equity 45,500 Net income $ 2,700 Total $ 93,000 Dividends Statement Shareholder's Equity External Financing Needed: Year 2 Year 1 Liabilities Beginning Equity Year 2 Liabilities + Net Income ENE - Dividends Ending Equity Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started