Answered step by step

Verified Expert Solution

Question

1 Approved Answer

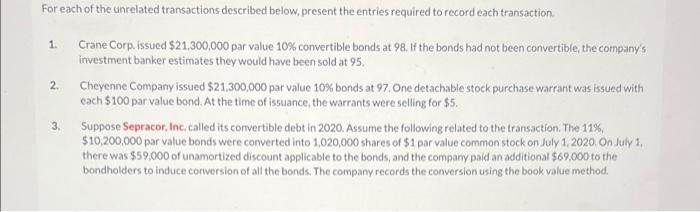

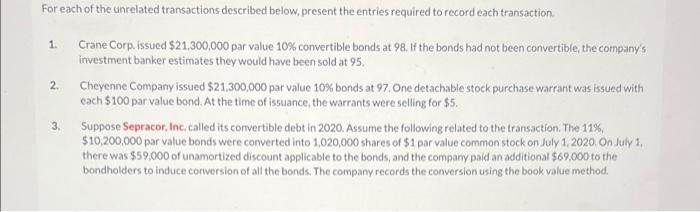

need number 3 For each of the unrelated transactions described below, present the entries required to record each transaction 1. Crane Corp. Issued $21,300,000 par

need number 3

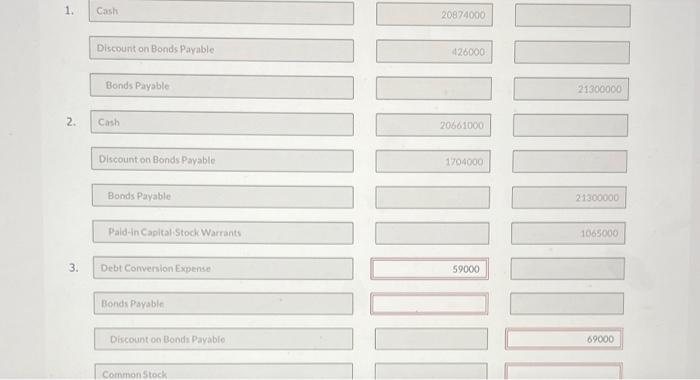

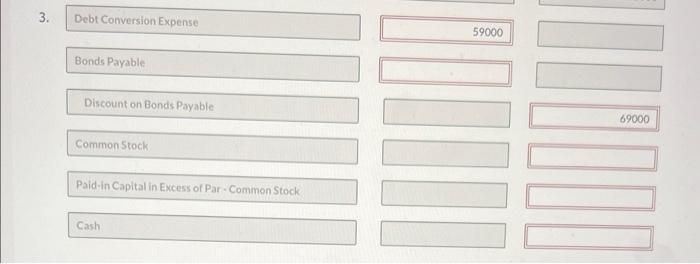

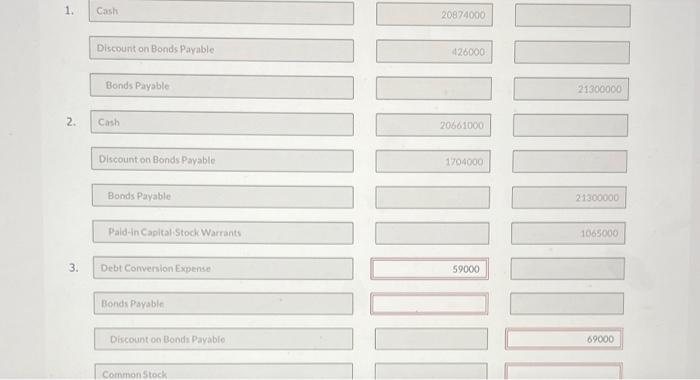

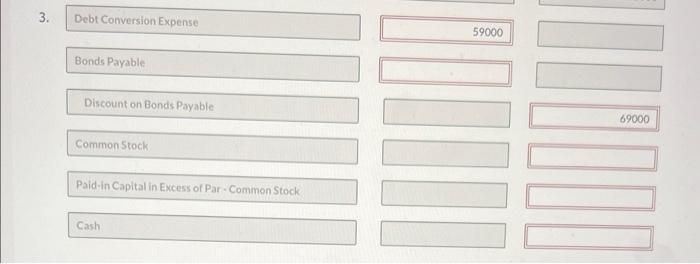

For each of the unrelated transactions described below, present the entries required to record each transaction 1. Crane Corp. Issued $21,300,000 par value 10% convertible bonds at 98. If the bonds had not been convertible, the company's investment banker estimates they would have been sold at 95. 2. Cheyenne Company issued $21,300,000 par value 10% bonds at 97 One detachable stock purchase warrant was issued with cach $100 par value bond. At the time of issuance, the warrants were selling for $5. 3. Suppose Sepracor, Inc. called its convertible debt in 2020. Assume the following related to the transaction. The 11% $10,200,000 par value bonds were converted into 1,020,000 shares of $1 par value common stock on July 1, 2020 on July 1, there was $59,000 of unamortized discount applicable to the bonds, and the company paid an additional $69.000 to the bondholders to induce conversion of all the bonds. The company records the conversion using the book value method. 1. Cash 20874000 Discount on Bonds Payable 426000 Bonds Payable 21300000 2. Cash 20661000 Discount on Bonds Payable 1704000 Bonds Payable 21300000 Pald-In Capital Stock Warrants 1065000 3. Debt Conversion Expense 59000 Bonds Payable Discount on Bonds Payable 69000 Common Stock 3. . Debt Conversion Expense 59000 Bonds Payable Discount on Bonds Payable 69000 Common Stock Paid-in Capital in Excess of Par - Common Stock NE Cash

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started