Answered step by step

Verified Expert Solution

Question

1 Approved Answer

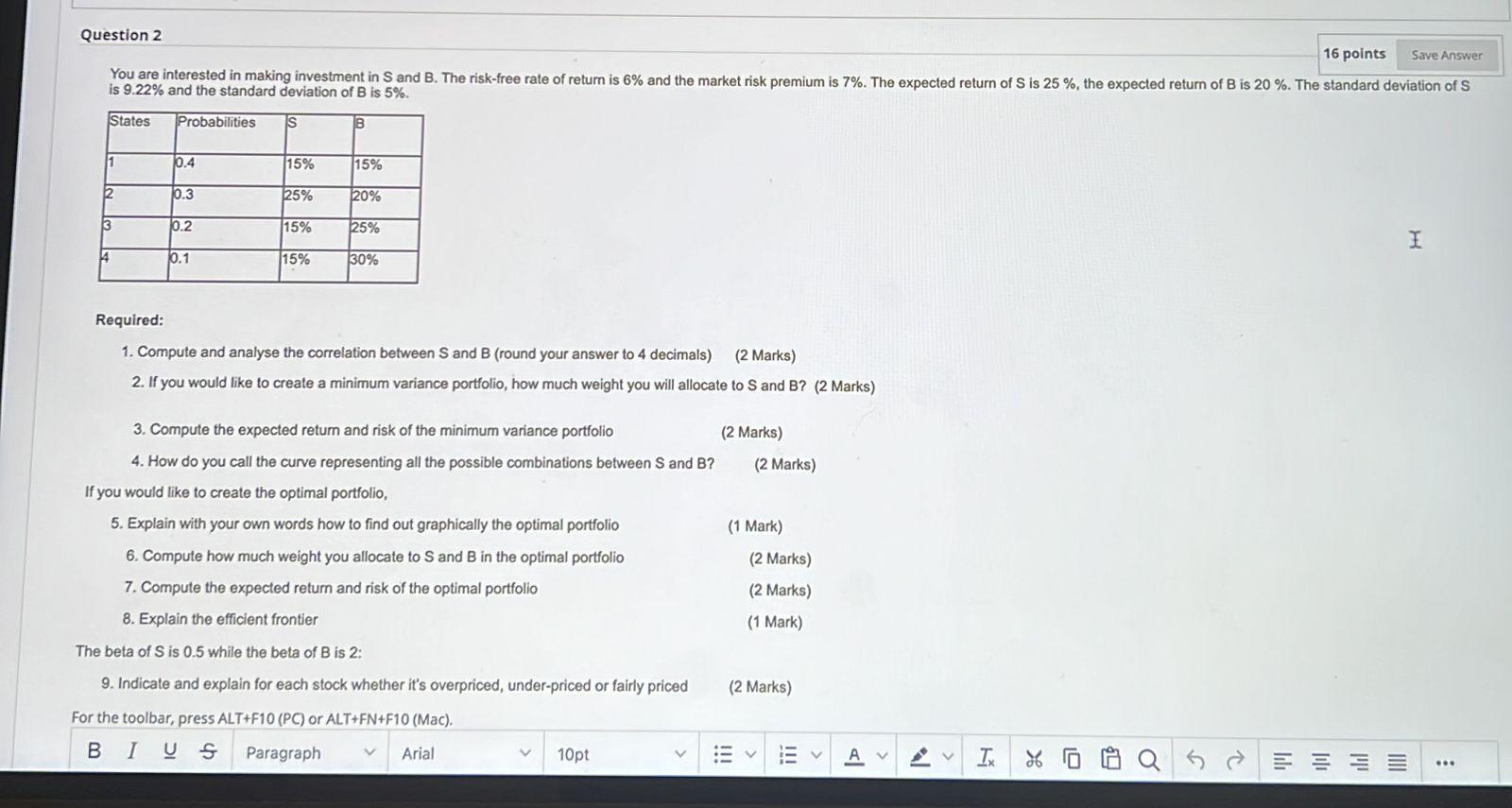

need part 5 - 9 Question 2 16 points Save Answer You are interested in making investment in S and B. The risk-free rate of

need part 5 - 9

Question 2 16 points Save Answer You are interested in making investment in S and B. The risk-free rate of return is 6% and the market risk premium is 7%. The expected return of S is 25 %, the expected return of B is 20 %. The standard deviation of S is 9.22% and the standard deviation of B is 5%. States Probabilities s B 11 10.4 (15% 15% 2 10.3 25% 20% 3 10.2 15% 25% I 4 0.1 15% 30% Required: 1. Compute and analyse the correlation between S and B (round your answer to 4 decimals) (2 Marks) 2. If you would like to create a minimum variance portfolio, how much weight you will allocate to S and B? (2 Marks) 3. Compute the expected return and risk of the minimum variance portfolio (2 Marks) 4. How do you call the curve representing all the possible combinations between S and B? (2 Marks) If you would like to create the optimal portfolio, 5. Explain with your own words how to find out graphically the optimal portfolio (1 Mark) 6. Compute how much weight you allocate to S and B in the optimal portfolio (2 Marks) 7. Compute the expected return and risk of the optimal portfolio (2 Marks) 8. Explain the efficient frontier (1 Mark) The beta of S is 0.5 while the beta of B is 2: 9. Indicate and explain for each stock whether it's overpriced, under-priced or fairly priced (2 Marks) For the toolbar, press ALT+F10 (PC) or ALT+FN+F10 (Mac). BIUS Paragraph Arial 10pt V V TX 2 Q I ... = Question 2 16 points Save Answer You are interested in making investment in S and B. The risk-free rate of return is 6% and the market risk premium is 7%. The expected return of S is 25 %, the expected return of B is 20 %. The standard deviation of S is 9.22% and the standard deviation of B is 5%. States Probabilities s B 11 10.4 (15% 15% 2 10.3 25% 20% 3 10.2 15% 25% I 4 0.1 15% 30% Required: 1. Compute and analyse the correlation between S and B (round your answer to 4 decimals) (2 Marks) 2. If you would like to create a minimum variance portfolio, how much weight you will allocate to S and B? (2 Marks) 3. Compute the expected return and risk of the minimum variance portfolio (2 Marks) 4. How do you call the curve representing all the possible combinations between S and B? (2 Marks) If you would like to create the optimal portfolio, 5. Explain with your own words how to find out graphically the optimal portfolio (1 Mark) 6. Compute how much weight you allocate to S and B in the optimal portfolio (2 Marks) 7. Compute the expected return and risk of the optimal portfolio (2 Marks) 8. Explain the efficient frontier (1 Mark) The beta of S is 0.5 while the beta of B is 2: 9. Indicate and explain for each stock whether it's overpriced, under-priced or fairly priced (2 Marks) For the toolbar, press ALT+F10 (PC) or ALT+FN+F10 (Mac). BIUS Paragraph Arial 10pt V V TX 2 Q I ... =Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started