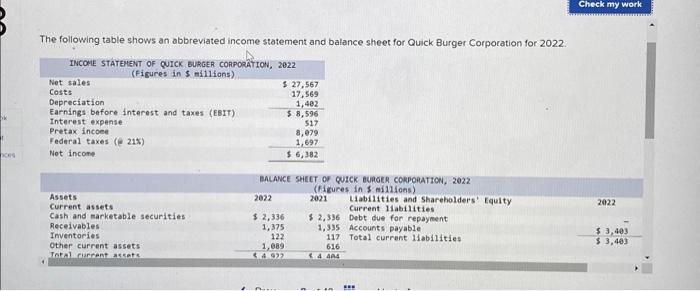

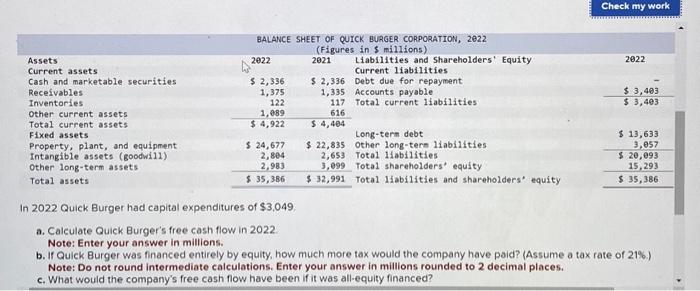

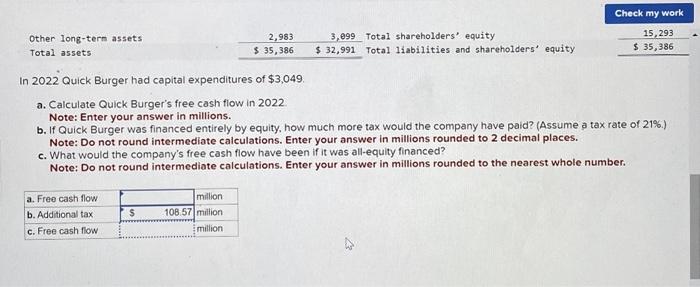

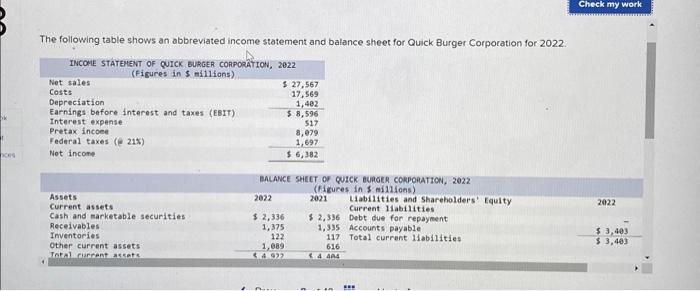

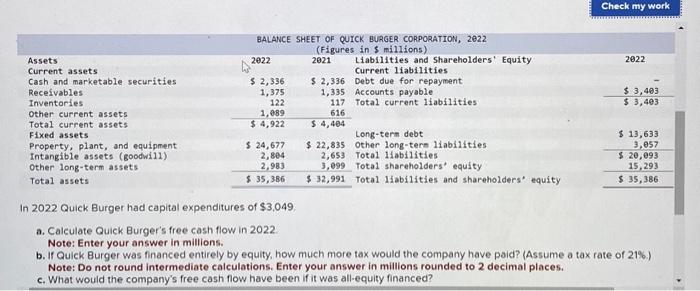

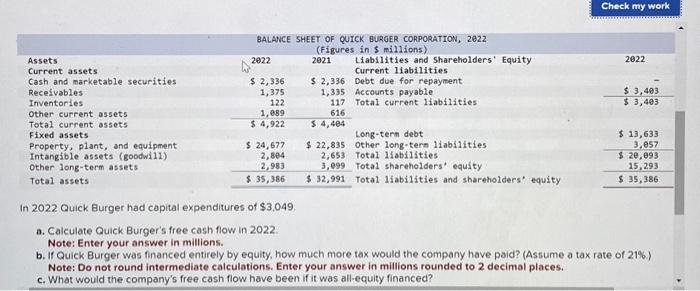

The following table shows an abbreviated income statement and balance sheet for Quick Burger Corporation for 2022 In 2022 Quick Burger had capital expenditures of $3,049. a. Calculate Quick Burger's free cash flow in 2022. Note: Enter your answer in millions. b. If Quick Burger was financed entirely by equity, how much more tax would the company have paid? (Assume a tax rate of 21% ) Note: Do not round intermediate calculations. Enter your answer in millions rounded to 2 decimal places. c. What would the company's free cash flow have been if it was all-equity financed? In 2022 Quick Burger had capital expenditures of $3,049 a. Calculate Quick Burger's free cash flow in 2022 Note: Enter your answer in millions. b. If Quick Burger was financed entirely by equity, how much more tax would the company have paid? (Assume a tax rate of 21%.) Note: Do not round intermediate calculations. Enter your answer in millions rounded to 2 decimal places. c. What would the company's free cash flow have been if it was all-equity financed? Note: Do not round intermediate calculations. Enter your answer in millions rounded to the nearest whole number. In 2022 Quick Burger had capital expenditures of $3,049. a. Calculate Quick Burger's free cash flow in 2022. Note: Enter your answer in millions. b. If Quick Burger was financed entirely by equity, how much more tax would the company have paid? (Assume a tax rate of 21% ) Note: Do not round intermediate calculations. Enter your answer in millions rounded to 2 decimal places. c. What would the company's free cash flow have been if it was all-equity financed? The following table shows an abbreviated income statement and balance sheet for Quick Burger Corporation for 2022 In 2022 Quick Burger had capital expenditures of $3,049. a. Calculate Quick Burger's free cash flow in 2022. Note: Enter your answer in millions. b. If Quick Burger was financed entirely by equity, how much more tax would the company have paid? (Assume a tax rate of 21% ) Note: Do not round intermediate calculations. Enter your answer in millions rounded to 2 decimal places. c. What would the company's free cash flow have been if it was all-equity financed? In 2022 Quick Burger had capital expenditures of $3,049 a. Calculate Quick Burger's free cash flow in 2022 Note: Enter your answer in millions. b. If Quick Burger was financed entirely by equity, how much more tax would the company have paid? (Assume a tax rate of 21%.) Note: Do not round intermediate calculations. Enter your answer in millions rounded to 2 decimal places. c. What would the company's free cash flow have been if it was all-equity financed? Note: Do not round intermediate calculations. Enter your answer in millions rounded to the nearest whole number. In 2022 Quick Burger had capital expenditures of $3,049. a. Calculate Quick Burger's free cash flow in 2022. Note: Enter your answer in millions. b. If Quick Burger was financed entirely by equity, how much more tax would the company have paid? (Assume a tax rate of 21% ) Note: Do not round intermediate calculations. Enter your answer in millions rounded to 2 decimal places. c. What would the company's free cash flow have been if it was all-equity financed