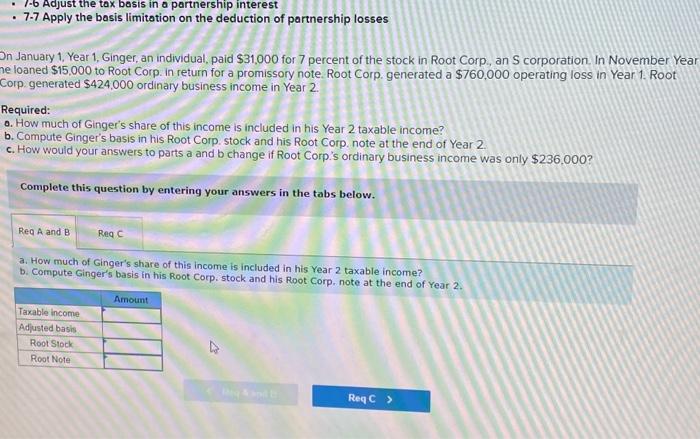

need part a, b and c

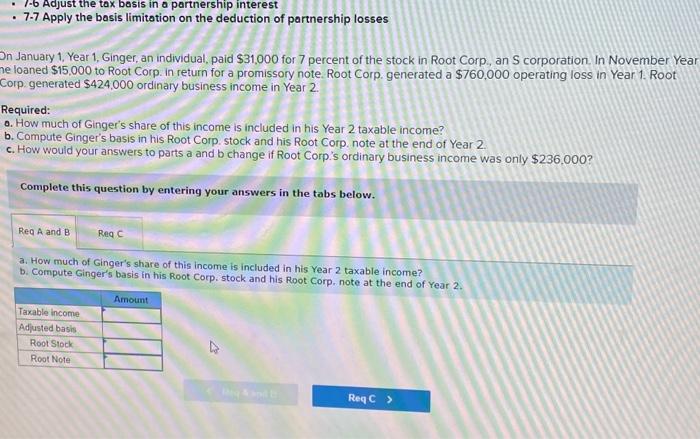

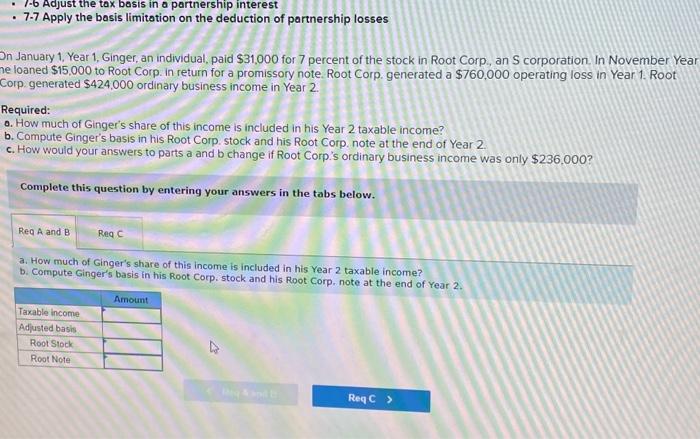

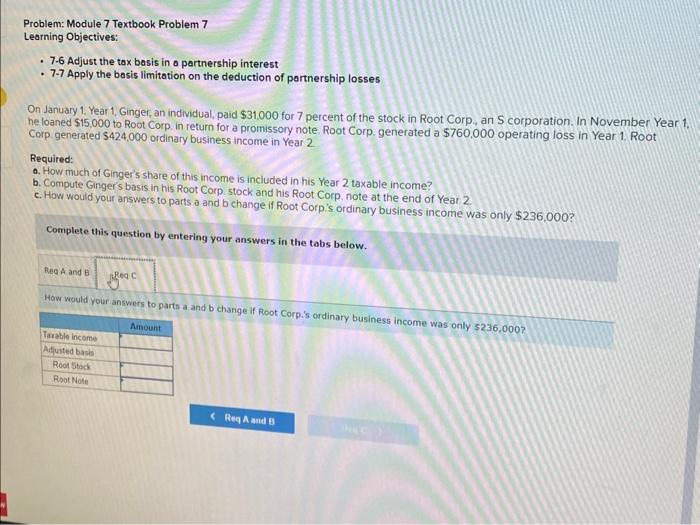

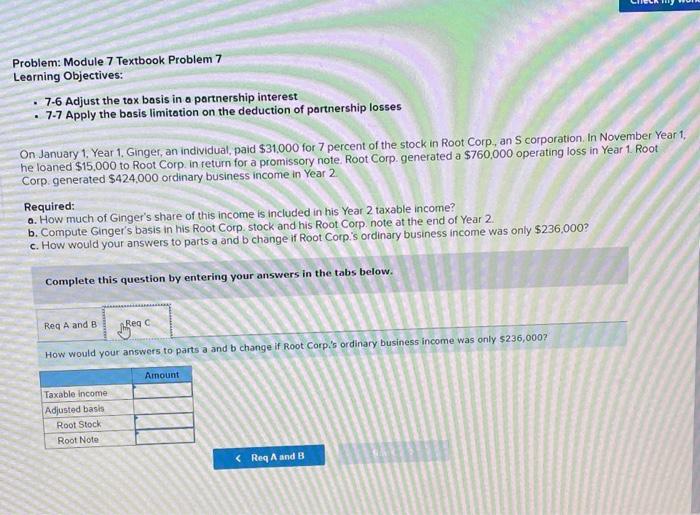

- 1.6 Adjust the tax bosis in a portnership interest - 7-7 Apply the basis limitation on the deduction of partnership losses In January 1, Year 1, Ginger, an individual, paid $31,000 for 7 percent of the stock in Root Corp, an S corporation. In November Year e loaned $15,000 to Root Corp. in return for a promissory note. Root Corp. generated a $760,000 operating loss in Year 1 . Root corp generated $424,000 ordinary business income in Year 2 . Required: 0. How much of Ginger's share of this income is included in his Year 2 taxable income? b. Compute Ginger's basis in his Root Corp. stock and his Root Corp. note at the end of Year 2. c. How would your answers to parts a and b change if Root Corp.'s ordinary business income was only $236,000 ? Complete this question by entering your answers in the tabs below. a. How much of Ginger's share of this income is included in his Year 2 taxable income? b. Compute Ginger's basis in his Root Corp. stock and his Root Corp. note at the end of Year 2 . Problem: Module 7 Textbook Problem 7 Learning Objectives: - 7.6 Adjust the tox basis in a partnership interest - 7-7 Apply the bosis limitation on the deduction of partnership losses On January 1, Year 1, Ginger, an individual, paid $31,000 for 7 percent of the stock in Root Corp, an S corporation. In November Year 1. he loaned $15,000 to Root Corp, in return for a promissory note. Root Corp. generated a $760,000 operating loss in Year 1 . Root Corp. generated $424,000 ordinary business income in Year 2 Required: 0. How much of Ginger's share of this income is included in his Year 2 taxable income? b. Compute Ginger's basis in his Root Corp. stock and his Root Corp. note at the end of Year 2 . c. How would your answers to parts a and b change if Root Corp.'s ordinary business income was only $236.000 ? Complete this question by entering your answers in the tabs below. How would your answers to parts a and b change if Root Corp.'s ordinary business income was only $236,000? Problem: Module 7 Textbook Problem 7 Learning Objectives: - 7-6 Adjust the tax basis in a portnership interest - 7-7 Apply the basis limitation on the deduction of partnership losses On. January 1. Year 1. Ginger, an individual, paid $31,000 for 7 percent of the stock in Root Corp, an S corporation. In November Year he loaned $15,000 to Root Corp. in return for a promissory note. Root Corp. generated a $760,000 operating loss in Year 1 . Root Corp. generated $424,000 ordinary business income in Year 2 a. How much of Ginger's share of this income is included in his Year 2 taxable income? Required: b. Compute Ginger's basis in his Root Corp. stock and his Root Corp. note at the end of Year 2 c. How would your answers to parts a and b change if Root Corp." ordinary business income was only $236,000 ? Complete this question by entering your answers in the tabs below. How would your answers to parts a and b change if Root Corp.'s ordinary business income was only $236,000