Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Need part B, help me!!! 1.. Given the following balance sheet, income statement, historical ratios and industry averages, calculate the Singular, Inc. financial ratios for

Need part B, help me!!!

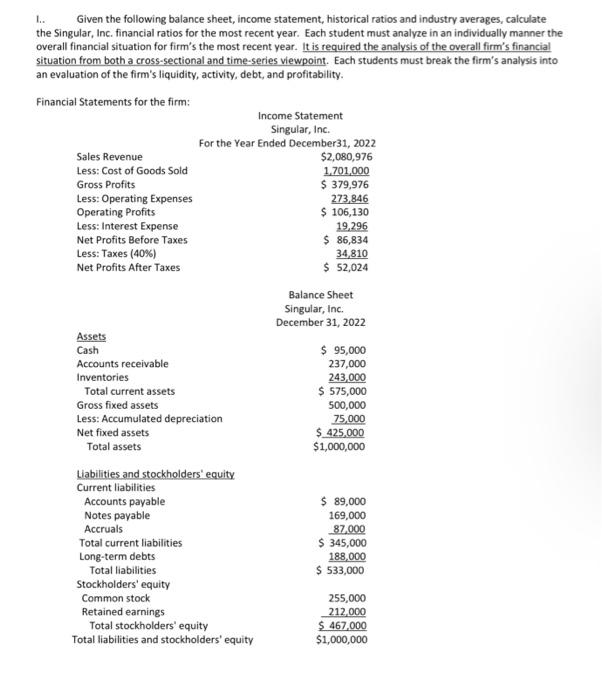

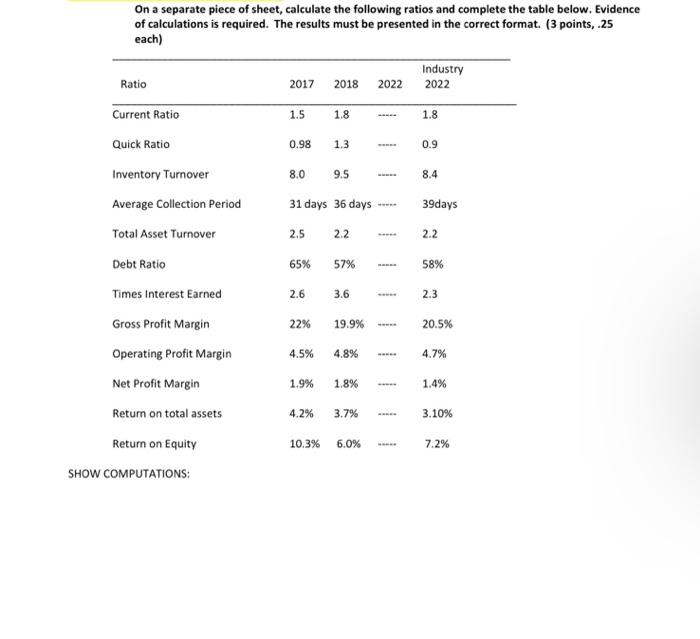

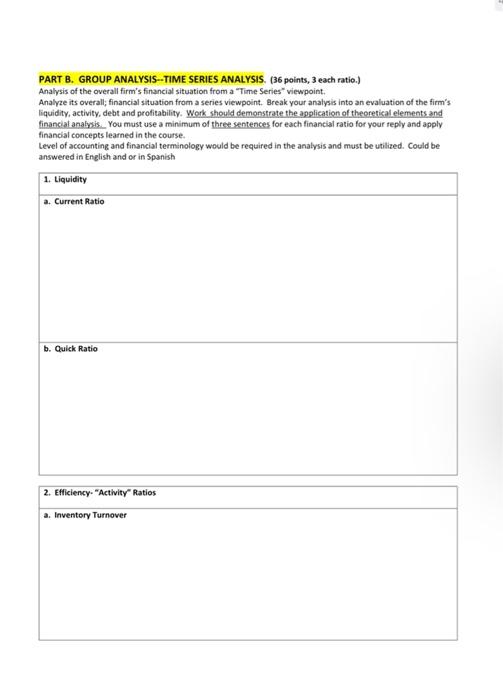

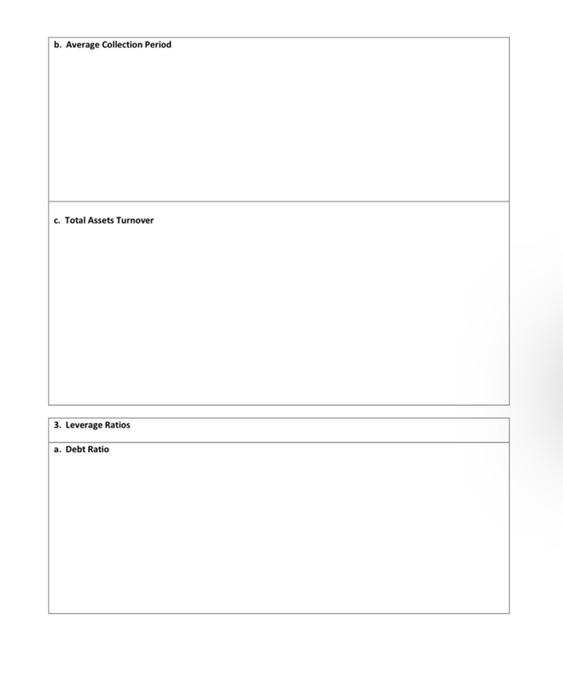

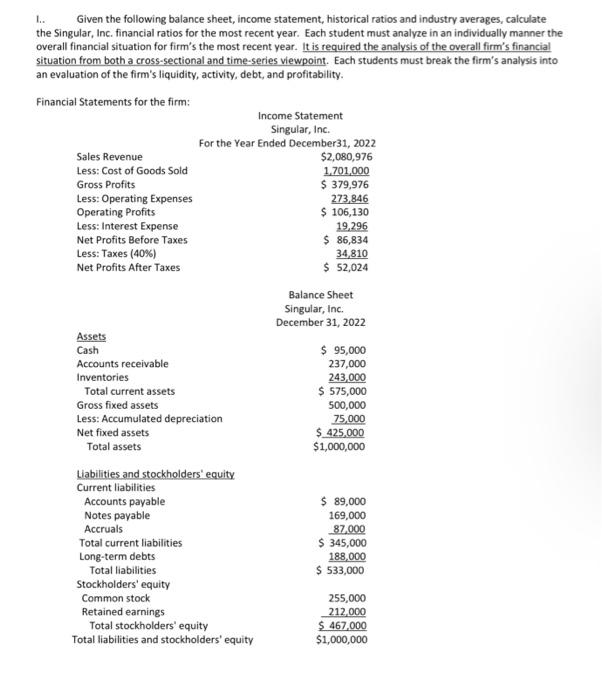

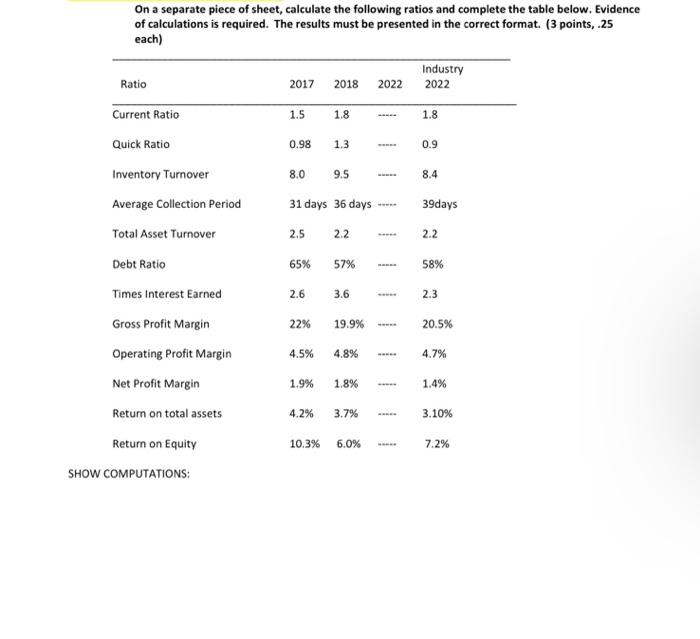

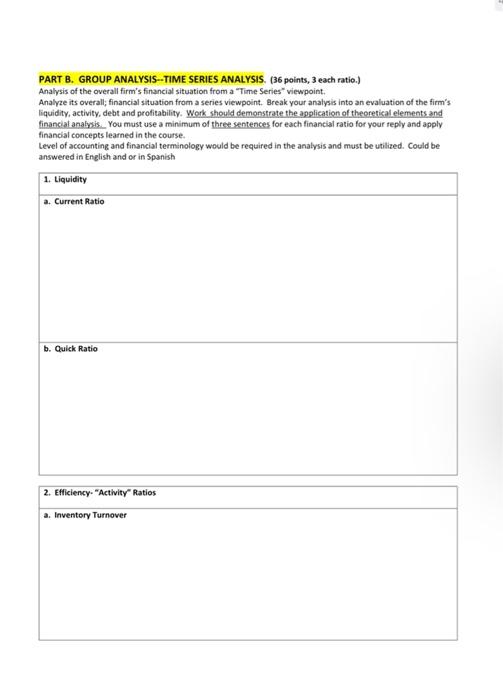

1.. Given the following balance sheet, income statement, historical ratios and industry averages, calculate the Singular, Inc. financial ratios for the most recent year. Each student must analyze in an individually manner the overall financial situation for firm's the most recent year. It is required the analysis of the overall firm's financial situa ts must break the firm's analysis into an e2 Fina On a separate piece of sheet, calculate the following ratios and complete the table below, Evidence of calculations is required. The results must be presented in the correct format. ( 3 points, . 25 each) PART B. GROUP ANALYSIS--TIME SERIES ANALYSIS. (36 points, 3 each ratio.) Analysis of the overall firm's financial situation from a "Time Series" viewpoint. Analyze its overall; financial situation from a series viewpoint. Break your analysis into an evaluation of the firm's liquidity, activity, debt and profitability. Work should demonstrate the application of theoreticalelements and financialanalysis. You must use a minimum of three sentences for each financial ratio for your teply and apply financial concepts learned in the course. Level of accounting and financial terminology would be required in the analysis and must be utilized. Could be answered in English and or in Spanish b. Average Collection Period c. Total Assets Turnover d. ROA e. ROE

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started