Answered step by step

Verified Expert Solution

Question

1 Approved Answer

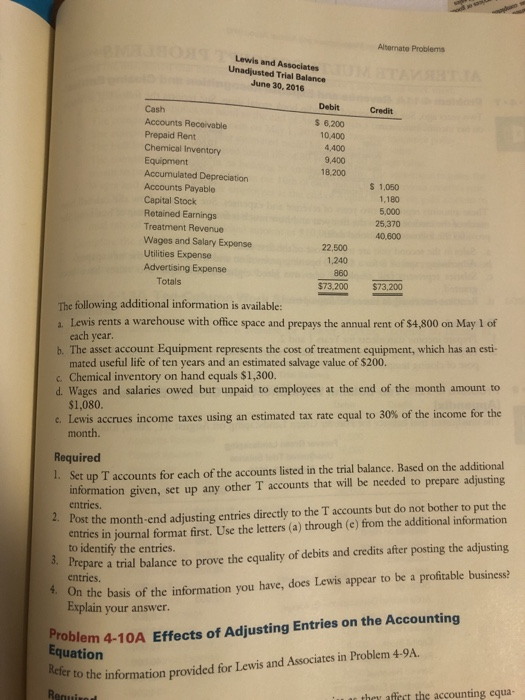

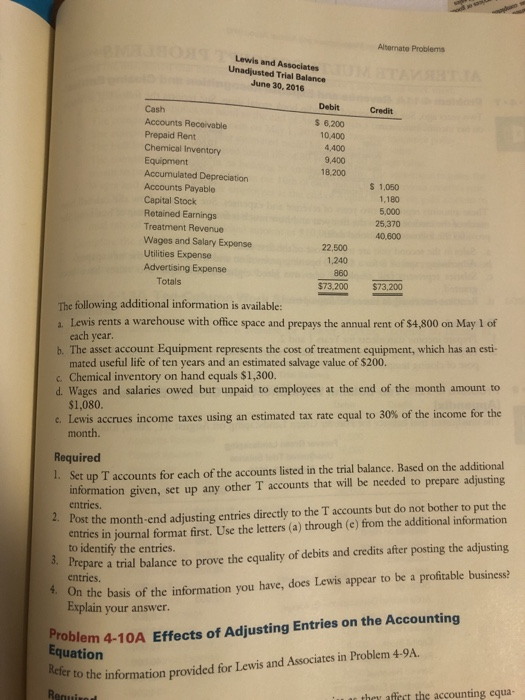

Need Problem 4-9A all parts Alternate Problems Lewis and Associates Unadjusted Trial Balance June 30, 2016 Debit Credit Cash Accounts Receivable Prepaid Rent Chemical Inventory

Need Problem 4-9A all parts

Alternate Problems Lewis and Associates Unadjusted Trial Balance June 30, 2016 Debit Credit Cash Accounts Receivable Prepaid Rent Chemical Inventory Equipment Accumulated Depreciation Accounts Payable Capital Stock Retained Earnings Treatment Revenue Wages and Salary Expense Utilities Expense Advertising Expense $ 6,200 10,400 4,400 9,400 18,200 s 1,050 1,180 5,000 25,370 22,500 1,240 860 $73.200 Totals $73,200 The following additional information is available: a. Lewis rents a warehouse with office space and prepays the annual rent of $4,800 on May 1 of each year. b. The asset account Equipment represents the cost of treatment equipment, which has an esti mated useful life of ten years and an estimated salvage value of $200. c. Chemical inventory on hand equals $1,300. d. Wages and salaries owed but unpaid to employees at the end of the month amount to $1,080 e Lewis accrues income taxes using an estimated tax rate equal to 30% of the income for the month. Required 1. Set up T accounts for each of the accounts listed in the trial balance. Based on the additional information given, set up any other T accounts that will be needed to prepare adjusting Post the month-end adjusting entries directly to the T accounts but do not bother to put the entries. entries in journal format first. Use the letters (a) through (e) from the additional information to identify the entries. 2. S Prepare a trial balance to prove the equality of debits and credits after posting the adjusting 4. On the basis of the information you have, does Lewis appear to be a profitable business? entries. Froblem 4-10A Effects of Adjusting Entries on the Accounting Equation Explain your answer the information provided for Lewis and Associates in Problem 4.9A. .u at they affect the accounting equa

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started