Answered step by step

Verified Expert Solution

Question

1 Approved Answer

need project report on all CVP Analysis and Decision-Making Decision Matum Contribution is obtained from Product wYe. So, WYE should be manufactured by using sub

need project report on all

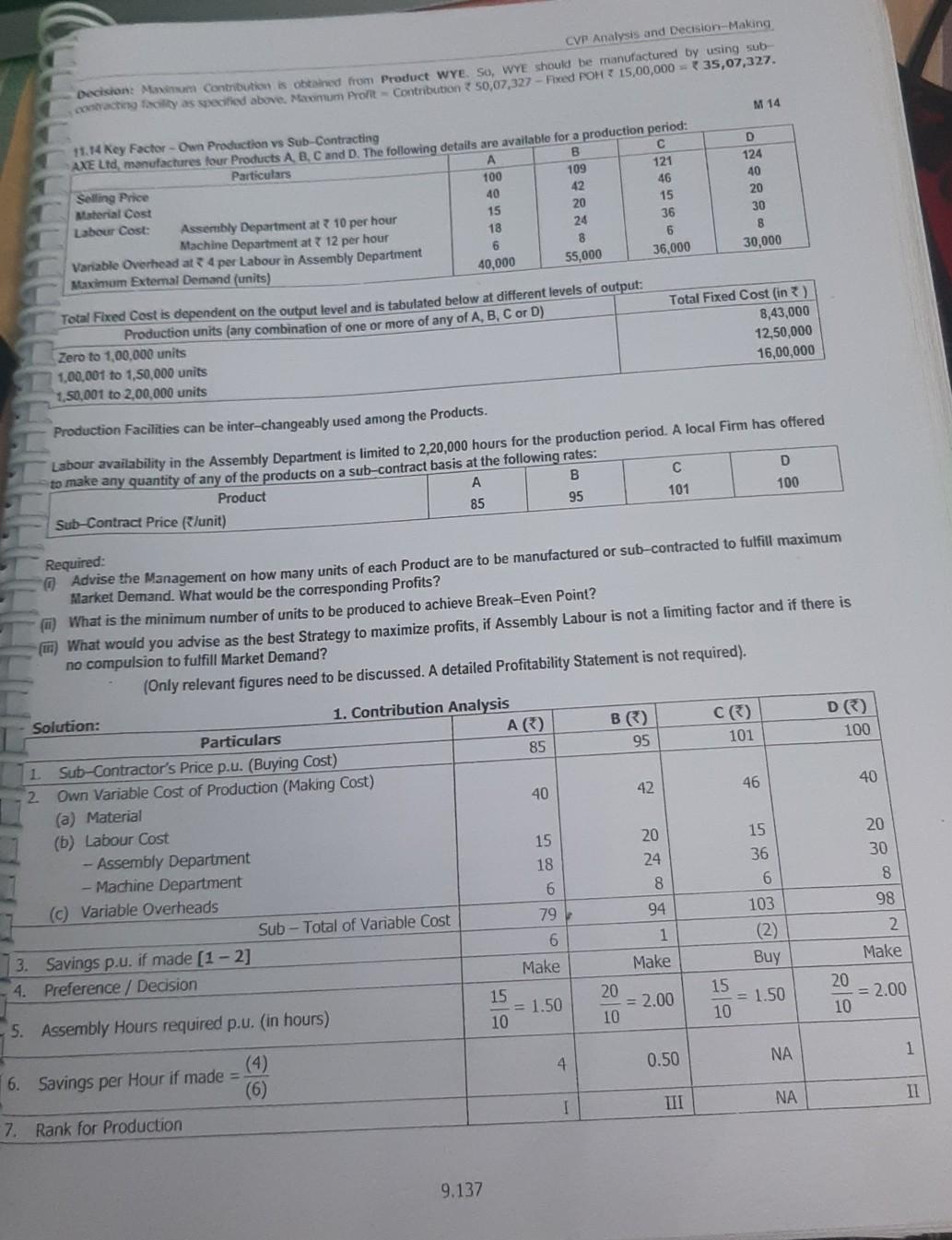

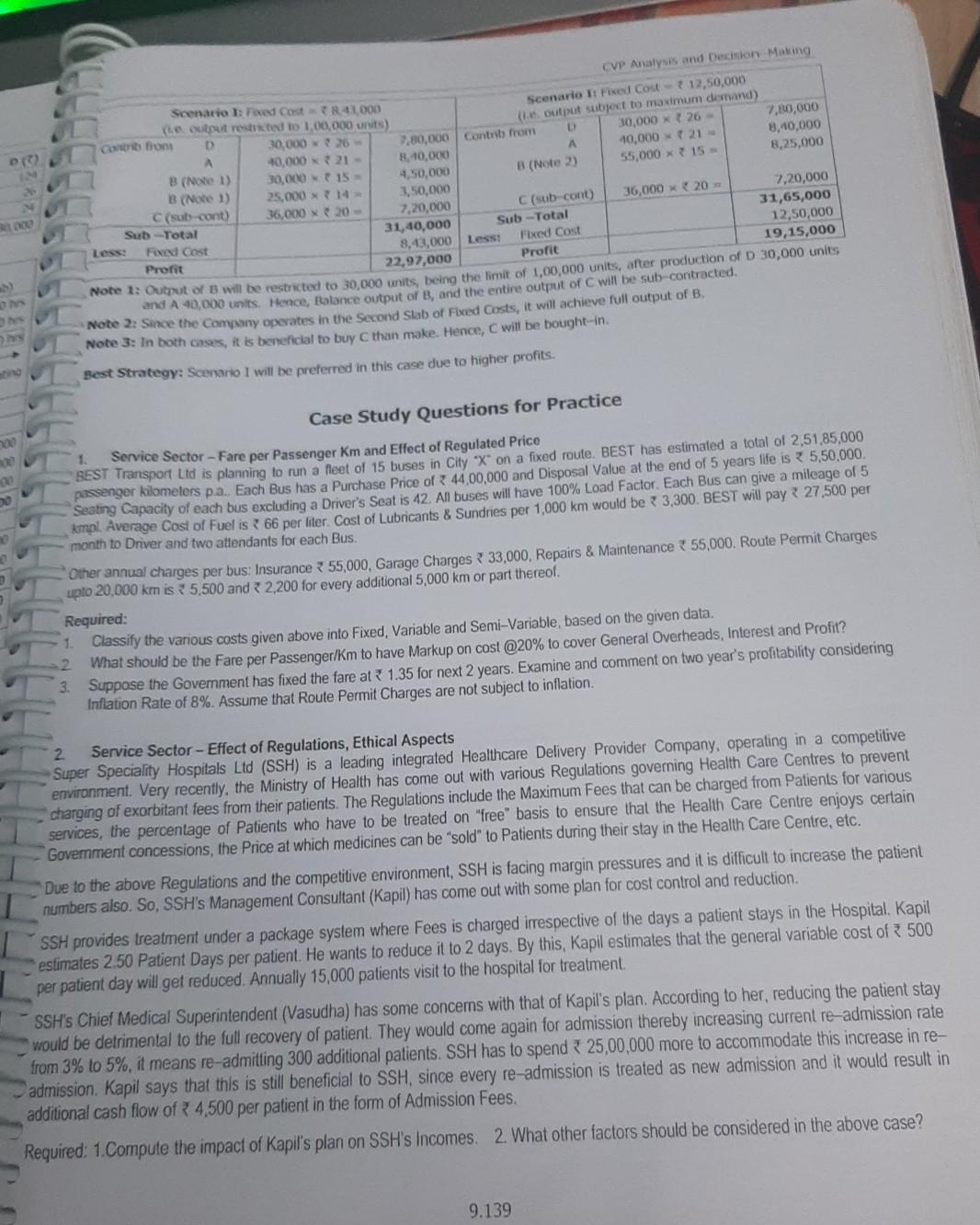

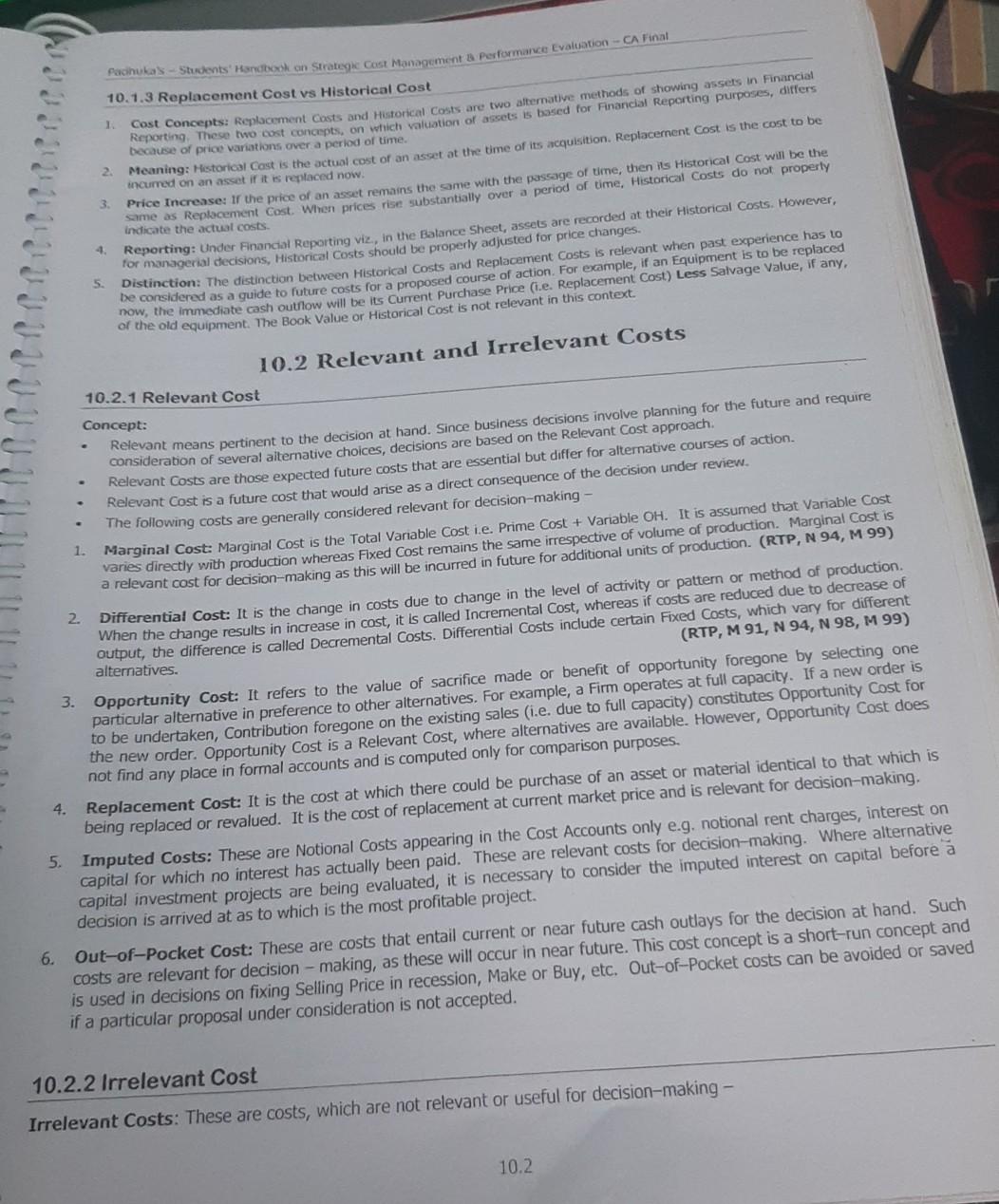

CVP Analysis and Decision-Making Decision Matum Contribution is obtained from Product wYe. So, WYE should be manufactured by using sub coating facility as specified above. Maemun Prot - Contribution 50,07,327 - Fixed POH 15,00,000 - 35,07,327, M14 11.14 Key Factor-Own Production vs Sub-Contracting AXE Ltd, manufactures four Products A, B, C and D. The following details are available for a production period: Particulars B Selling Price 121 109 100 Material Cost 46 42 40 Labour Cost: 15 Asserbly Department at 10 per hour 15 20 36 Machine Department at 12 per hour 24 18 Variable Overhead at 4 per Labour in Assembly Department 6 8 6 Maximum External Demand (units) 40,000 55,000 36,000 D 124 40 20 30 8 30,000 Total Fixed Cost is dependent on the output level and is tabulated below at different levels of output: Production units (any combination of one or more of any of A, B, C or D) Zero to 100.000 units 1,00,001 to 1,50.000 units 1.50,001 to 2,00,000 units Total Fixed Cost (in) 8,43,000 12,50,000 16,00,000 D B 95 85 Production Facilities can be inter-changeably used among the Products. Labour availability in the Assembly Department is limited to 2,20,000 hours for the production period. A local Firm has offered to make any quantity of any of the products on a sub-contract basis at the following rates: Product 101 100 Sub-Contract Price (/unit) Required: Advise the Management on how many units of each Product are to be manufactured or sub-contracted to fulfill maximum Market Demand. What would be the corresponding Profits? What is the minimum number of units to be produced to achieve Break-Even Point? am What would you advise as the best Strategy to maximize profits, if Assembly Labour is not a limiting factor and if there is no compulsion to fulfill Market Demand? (Only relevant figures need to be discussed. A detailed profitability Statement is not required). Solution: 1. Contribution Analysis AC) C) B) Particulars D) 85 95 101 100 1 Sub-Contractor's Price p.u. (Buying Cost) 2 Own Variable Cost of Production (Making Cost) 40 42 46 40 (a) Material (b) Labour Cost 20 15 15 20 - Assembly Department 18 - Machine Department 24 36 30 6 8 6 8 () Variable Overheads 79 Sub - Total of Variable Cost 94 103 98 6 1 (2) 2. 3. Savings p.u. if made (1 -2] Make 4. Preference / Decision Make Buy Make 15 20 15 20 = 1.50 5. Assembly Hours required p.u. (in hours) = 2.00 = 2.00 = 1.50 10 10 10 10 . 1 4 0.50 (4) 6. Savings per Hour if made = (6) 7. Rank for Production II NA I III 9.137 CVP Analysis and Decision Making Scenario : Foxed Cost 8,000 Scenario It Fixed Cost 12,50,000 (Le output rested to 1,00,000 units) Con from (1. output subject to maximum demand) D 30,00026 D 7.80,000 Contrib from 7,80,000 30,000 26 A 40,000 21 810,000 8,40,000 10,000+ 21- B (Note 1) 8,25,000 30,00015 4,50,000 55,000 x 15 B (Note 2) B (Note 1) 25,000 14 3,50,000 C (sub cont) 36,000 x 20 (sub cont) 7,20,000 7,20,000 36,000 x 20 Sub Total 31,40,000 Sub-Total 31,65,000 Fixed Cost 8,113,000 Less: Fixed Cost 12,50,000 Profit 22,97,000 Profit 19,15,000 Note 1: Output of 8 will be restricted to 30,000 units, being the limit of 1,00,000 units, after production of D 30,000 units and A 40,000 units. Hence, Balance output of B, and the entire output of C will be sub-contracted. Note 2: Since the Company operates in the Second Stab of Fixed Costs, it will achieve full output of B, Note 3: In both cases, it is beneficial to buy C than make. Hence, will be bought-in. sest Strategy: Scenario I will be preferred in this case due to higher profits. 1. 20 20 20 Case Study Questions for Practice Service Sector - Fare per Passenger Km and Effect of Regulated Price BEST Transport Ltd is planning to run a feet of 15 buses in City "X" on a fixed route. BEST has estimated a total of 2,51,85,000 passenger kilometers pa. Each Bus has a Purchase Price of 4400,000 and Disposal Value at the end of 5 years life is 5,50,000 Seating Capacity of each bus excluding a Driver's Seat is 42. All buses will have 100% Load Factor. Each Bus can give a mileage of 5 kmpl Average Cost of Fuel is 2 66 per liter. Cost of Lubricants & Sundries per 1,000 km would be 3,300. BEST will pay 27,500 per month to Driver and two attendants for each Bus. Other annual charges per bus: Insurance ? 55,000, Garage Charges ? 33,000, Repairs & Maintenance ? 55,000. Route Permit Charges uplo 20.000 km is 5,500 and 2,200 for every additional 5,000 km or part thereof. Required: 1. Classify the various costs given above into Fixed, Variable and Semi-Variable, based on the given data. 2 What should be the fare per Passenger/Km to have Markup on cost @20% to cover General Overheads, Interest and Profit? 3. Suppose the Government has fixed the fare at 1.35 for next 2 years. Examine and comment on two year's profitability considering Inflation Rate of 8%. Assume that Route Permit Charges are not subject to inflation 2. Service Sector - Effect of Regulations, Ethical Aspects Super Speciality Hospitals Ltd (SSH) is a leading integrated Healthcare Delivery Provider Company, operating in a competitive environment. Very recently, the Ministry of Health has come out with various Regulations govering Health Care Centres to prevent charging of exorbitant fees from their patients. The Regulations include the Maximum Fees that can be charged from Patients for various services, the percentage of Patients who have to be treated on "free" basis to ensure that the Health Care Centre enjoys certain Government concessions, the Price at which medicines can be "sold" to Patients during their stay in the Health Care Centre, etc. Due to the above Regulations and the competitive environment, SSH is facing margin pressures and it is difficult to increase the patient numbers also. So, SSH's Management Consultant (Kapil) has come out with some plan for cost control and reduction SSH provides treatment under a package system where Fees is charged irrespective of the days a patient stays in the Hospital, Kapil estimates 2.50 Patient Days per patient. He wants to reduce it to 2 days. By this, Kapil estimates that the general variable cost of 500 per patient day will get reduced. Annually 15,000 patients visit to the hospital for treatment SSH's Chief Medical Superintendent (Vasudha) has some concerns with that of Kapil's plan. According to her, reducing the patient stay would be detrimental to the full recovery of patient. They would come again for admission thereby increasing current re-admission rate from 3% to 5%, it means re-admitting 300 additional patients. SSH has to spend 25,00,000 more to accommodate this increase in re- admission. Kapil says that this is still beneficial to SSH, since every re-admission is treated as new admission and it would result in additional cash flow of 4,500 per patient in the form of Admission Fees Required: 1.Compute the impact of Kapil's plan on SSH's Incomes. 2. What other factors should be considered in the above case? 9.139 1 2. Pachukas - Students' Handbook on Strategic Cost Management a performance Evaluation - Ca Minal 10.1.3 Replacement Cost vs Historical Cost Reporting these two cost concepts, on tich caution or assets is based for Financial Reporting purposes, differs Cost Concepts: Replacement Costs and Historical Costs are two alternative methods of showing assets in Financial because of price variations over a period of time. Meaning: Historical Cast is the actual cost of an asset at the time of its acquisition. Replacement Cost is the cost to be incurred on an asset if it is replaced now. Price Increase: Ir the price of an asset remains the same with the passage of time, then its Historical Cost will be the indicate the actual costs. same as Replacement Cost. When prices rise substantially over a period of time, Historical Costs do not property Reporting: Under Financial Reporting viz., in the Balance Sheet, assets are recorded at their Historical Costs. However, for managerial decisions, Historical Costs should be properly adjusted for price changes. Distinction: The distinction between Historical costs and Replacement Costs is relevant when past experience has to be considered as a guide to future costs for a proposed course of action. For example, if an Equipment is to be replaced now, the immediate cash outflow will be its Current Purchase Price (i.e. Replacement Cost) Less Salvage Value, if any, of the old equipment. The Book Value or Historical Cost is not relevant in this context 3 4. 5 10.2 Relevant and Irrelevant Costs 10.2.1 Relevant Cost Concept: Relevant means pertinent to 1 2. decision at hand. Since business decisions involve planning for the future and require consideration of several alternative choices, decisions are based on the Relevant Cost approach. Relevant costs are those expected future costs that are essential but differ for alternative courses of action. Relevant Cost is a future cost that would arise as a direct consequence of the decision under review. The following costs are generally considered relevant for decision-making - Marginal Cost: Marginal Cost is the Total Variable Cost i.e. Prime Cost + Variable OH. It is assumed that Variable Cost vanes directly with production whereas Fixed Cost remains the same irrespective of volume of production. Marginal Cost is a relevant cost for decision-making as this will be incurred in future for additional units of production. (RTP, N 94, M 99) Differential Cost: It is the change in costs due to change in the level of activity or pattern or method of production When the change results in increase in cost, it is called Incremental Cost, whereas if costs are reduced due to decrease of output, the difference is called Decremental Costs. Differential Costs include certain Fixed Costs, which vary for different alternatives. (RTP, M 91, N 94, N 98, M 99) 3. Opportunity Cost: It refers to the value of sacrifice made or benefit of opportunity foregone by selecting one particular alternative in preference to other alternatives. For example, a Firm operates at full capacity. If a new order is to be undertaken, Contribution foregone on the existing sales (i.e. due to full capacity) constitutes Opportunity cost for the new order. Opportunity cost is a Relevant Cost, where alternatives are available. However, Opportunity Cost does not find any place in formal accounts and is computed only for comparison purposes. 4. Replacement Cost: It is the cost at which there could be purchase of an asset or material identical to that which is being replaced or revalued. It is the cost of replacement at current market price and is relevant for decision-making. 5. Imputed Costs: These are Notional Costs appearing in the Cost Accounts only e.g. notional rent charges, interest on capital for which no interest has actually been paid. These are relevant costs for decision-making. Where alternative capital investment projects are being evaluated, it is necessary to consider the imputed interest on capital before a decision is arrived at as to which is the most profitable project. 6. Out-of-Pocket Cost: These are costs that entail current or near future cash outlays for the decision at hand. Such costs are relevant for decision-making, as these will occur in near future. This cost concept is a short-run concept and is used in decisions on fixing Selling Price in recession, Make or Buy, etc. Out-of-Pocket costs can be avoided or saved if a particular proposal under consideration is not accepted. 10.2.2 Irrelevant Cost Irrelevant Costs: These are costs, which are not relevant or useful for decision-making - 10.2Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started