Answered step by step

Verified Expert Solution

Question

1 Approved Answer

need project report Petey eie unity (1) the lucrease in price will be ofiset by reduction in quantity in order to 3. Additional Profit under

need project report

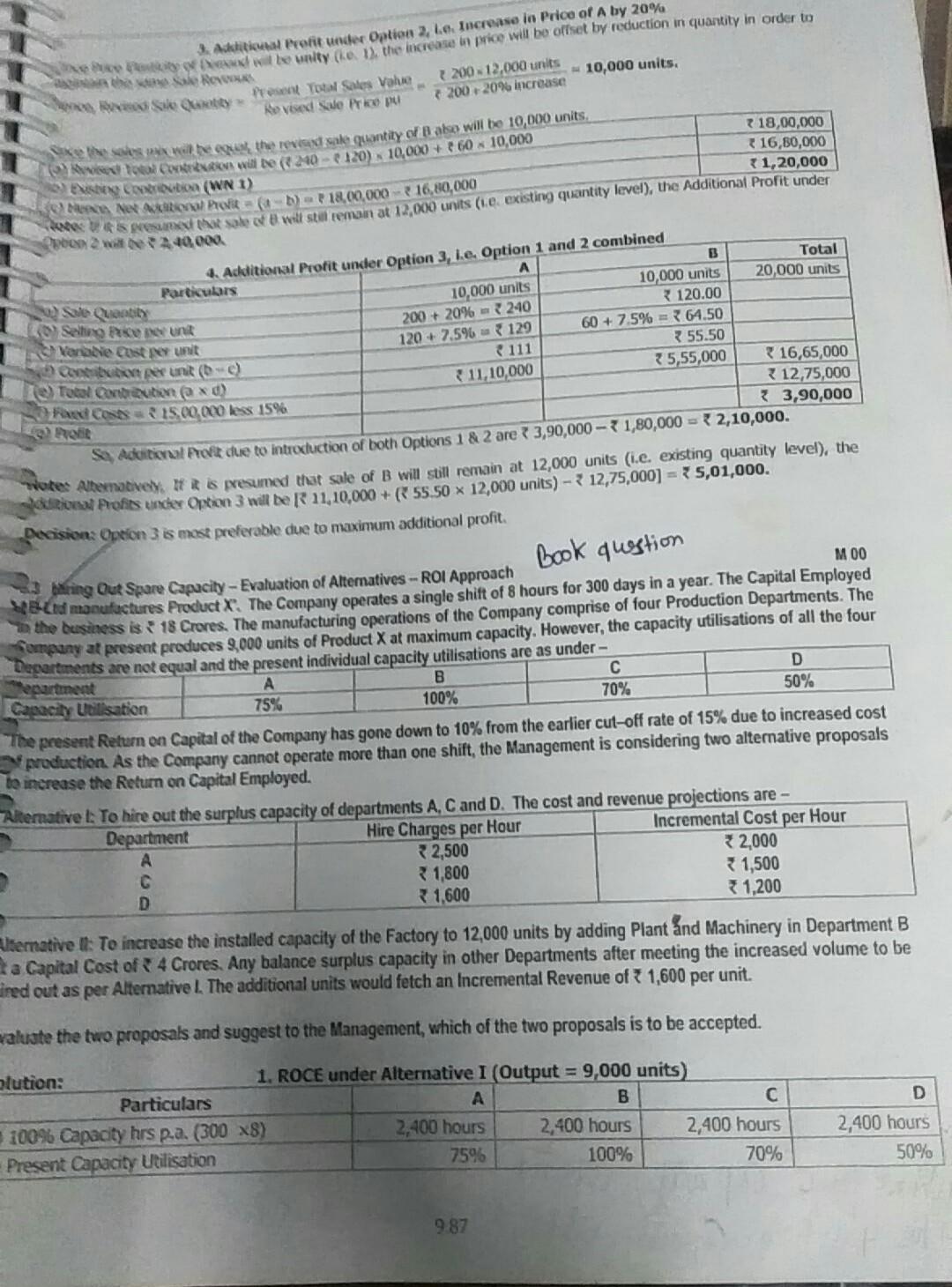

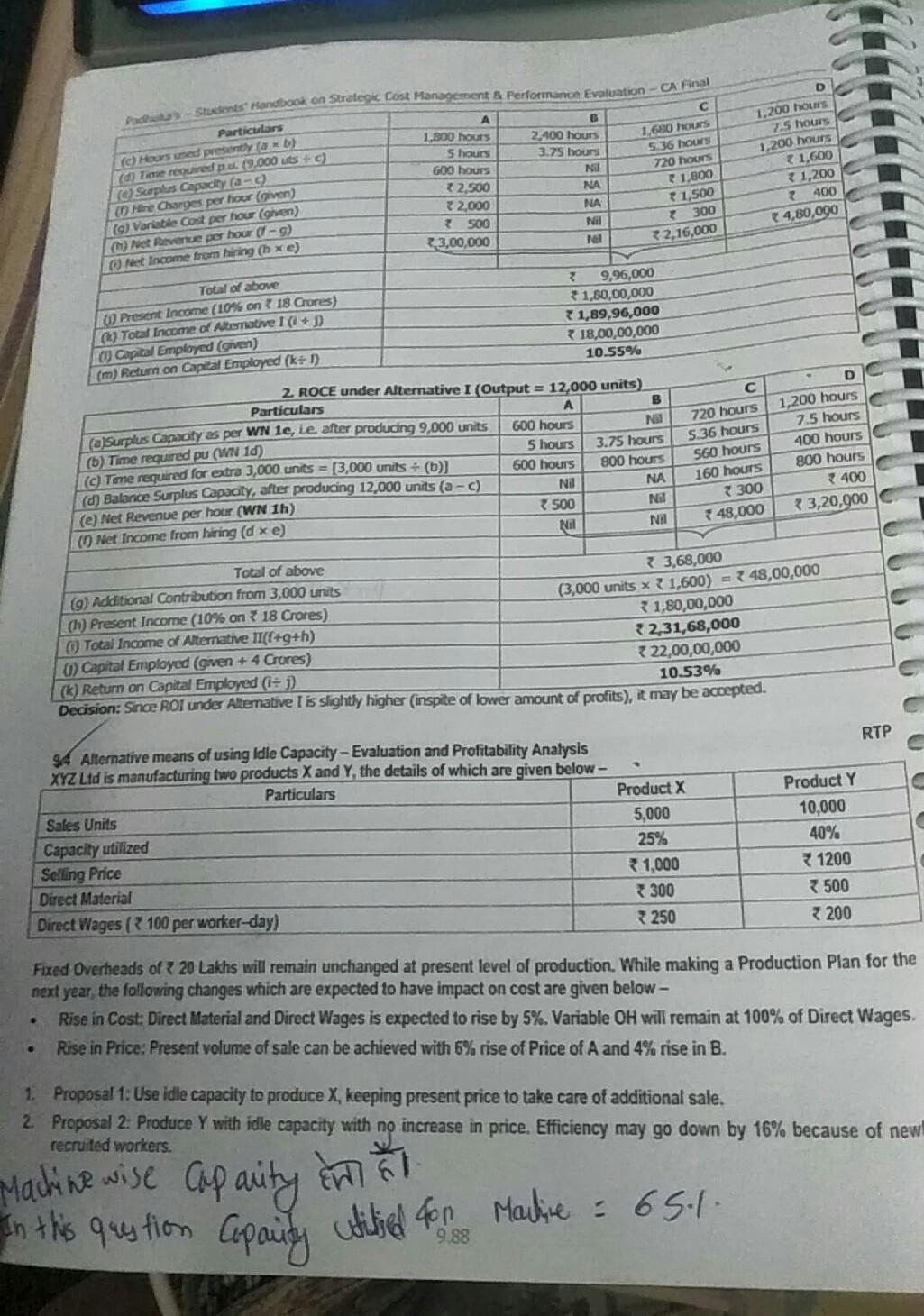

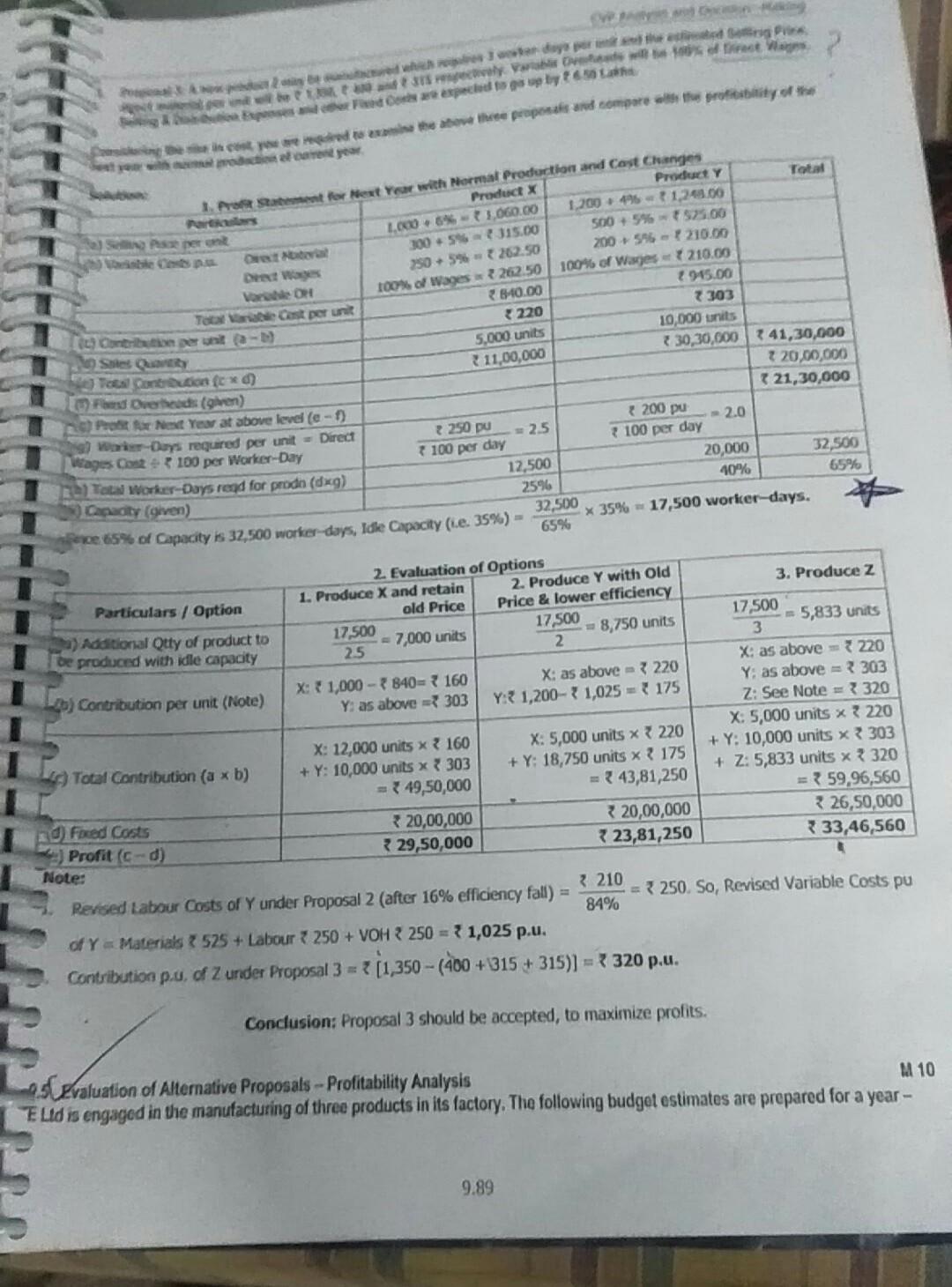

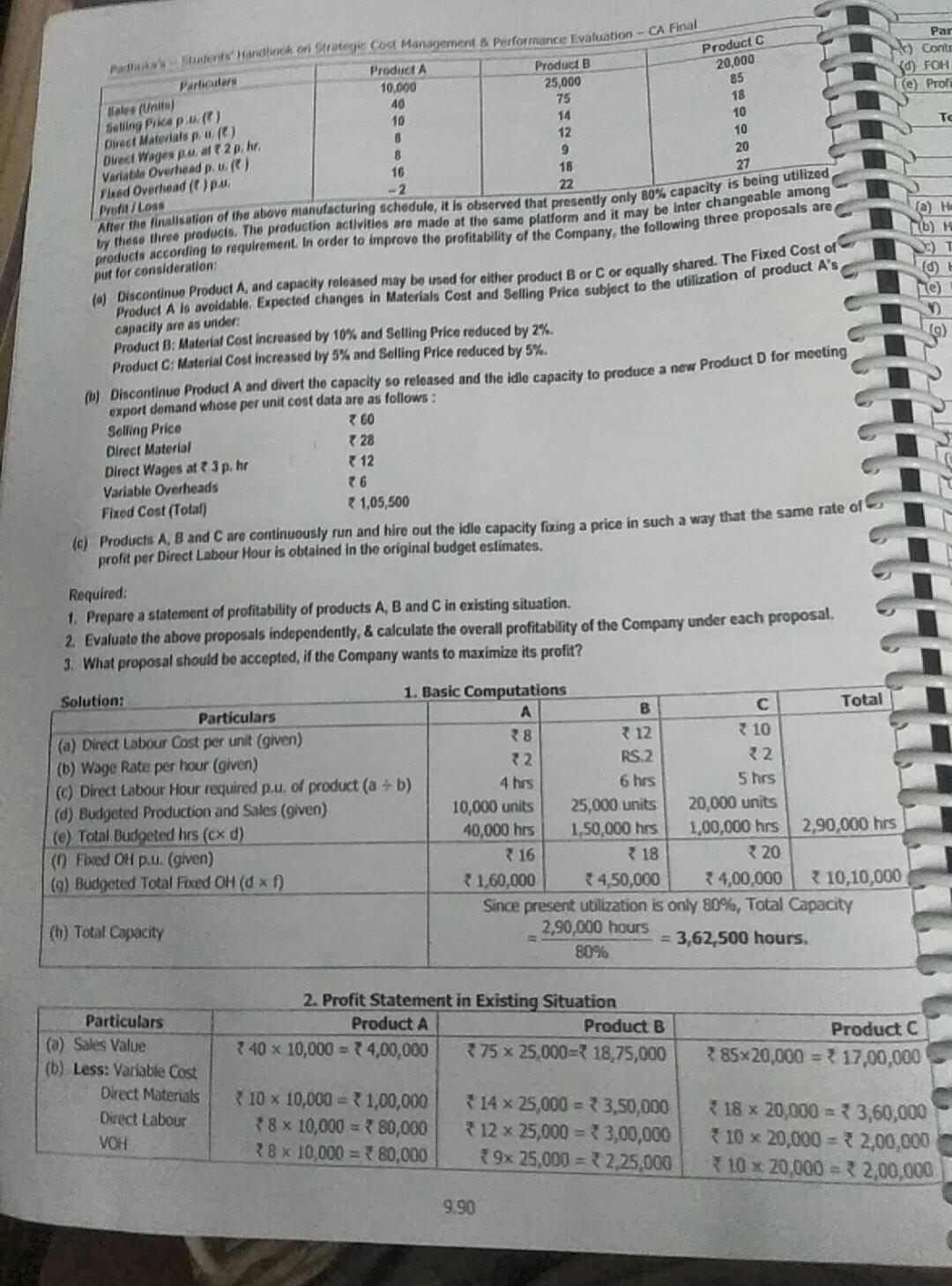

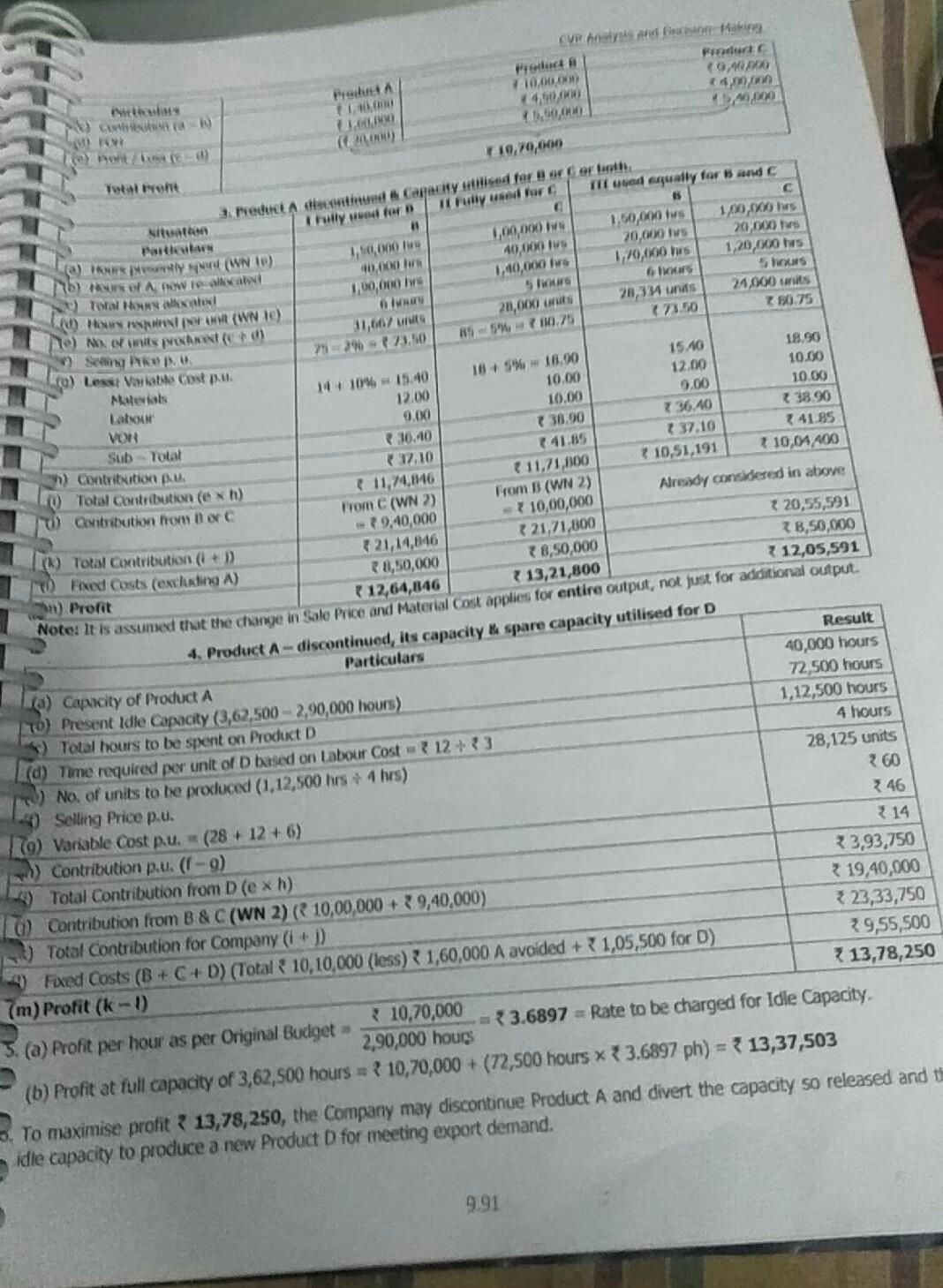

Petey eie unity (1) the lucrease in price will be ofiset by reduction in quantity in order to 3. Additional Profit under Option 2, Le. Increase in Price of A by 20% the New Present You Sales Value 200 12,000 units - 10,000 units, Kevoed Sue Price pu 200 20% increase Theses antes, the revient sake quantity of Babe will be 10,000 units, c) to contienen wilde (G200 - 120). 10,000+ 2 60 10,000 Men der AX Bee (1) 18,00,000 - 2 16,80,000 We presumed takie sale del vell seat teman at 12,000 units (10 existing quantity level), the Additional Profit under 218,00,000 16,80,000 +1,20,000 steg boa (WN 1) Qoom 2 w240,000 4. Additional Profit under Option 3, 1.e. Option 1 and 2 combined B Total Particulars 10,000 units 20,000 units 10,000 units Se Quantity * 120.00 R0 Salo cene unit 200+ 20% - 240 60 +7.5% = 64.50 Varane Cost unit 120+ 7.596 - 129 7 55.50 con bon runt (C) 111 75,55,000 11,10,000 16,65,000 Te Total Concubina 12,75,000 Fardc 1500 000 less 15% 33,90,000 St. Additional Port due to introduction of both Options 1 & 2 are 73,90,000 -- 31,80,000 = + 2,10,000. mores Allemandey presumed that sale of 8 will still remain at 12,000 units (.e. existing quantity level), the utive Profits under Option 3 will be R 11,10,000 + 55.50 X 12,000 units) - 3 12,75,000) = 75,01,000. Decision: Option 3 is most preferable due to maximum additional profit. Book question faring Out Spare Capacity - Evaluation of Alternatives - ROI Approach M00 Blid manufactures Product X. The Company operates a single shift of 8 hours for 300 days in a year. The Capital Employed the bestieness is 18 Crores. The manufacturing operations of the Company comprise of four Production Departments. The Company at present produces 9,000 units of Product X at maximum capacity. However, the capacity utilisations of all the four Departments are not equal and the present individual capacity utilisations are as under Department D Capacity Utilisation 75% 100% 70% The present Return on Capital of the Company has gone down to 10% from the earlier cut-off rate of 15% due to increased cost production. As the Company cannot operate more than one shift, the Management is considering two alternative proposals to increase the Return on Capital Employed. Alternative. To hire out the surplus capacity of departments A, C and D. The cost and revenue projections are - Department Hire Charges per Hour Incremental Cost per Hour A 2,500 32,000 1,800 1,500 D 1,600 1,200 B 50% Alternative It: To increase the installed capacity of the Factory to 12,000 units by adding Plant and Machinery in Department B a Capital Cost of 4 Crores. Any balance surplus capacity in other Departments after meeting the increased volume to be ined out as per Alternative L. The additional units would fetch an incremental Revenue of * 1,600 per unit. maluate the two proposals and suggest to the Management, which of the two proposals is to be accepted. D lution: 1. ROCE under Alternative I (Output = 9,000 units) Particulars A B 100% Capacity hrs p.a. (300 x8) 2,400 hours 2,400 hours 2,400 hours 759 Present Capacity Utilisation 100% 70% 2,400 hours 50% 9.87 D Rodos Student Handbook on Strategic Cost Management & Performance Evaluation - CA Final Particulars Hoursed present axb) Time repurred pu. (9.000 uso) Surplus Capacity (ac) ( Haine Charges per hour (given) (O) Variable Cost per hour (given) (1) roet Revenge per hour (1-9) Meet Income from hiring (h xe) A 1.300 hours 5 hours GOO hours 2,500 2.000 500 23,00,000 2,100 hours 3.75 hours Ni NA NA Nail Nel 1.690 hours 5.36 hours 720 hours 1.800 1,500 300 32,16,000 1.200 hours 7.5 hours 1,200 hours 1,600 1,200 400 4,80,000 Total of above * 9,96,000 0 Present Income (10% on 18 Crores) 1.80,00,000 (k) Total Income Alternative I (1 + 1,89,96,000 (J Capital Employed given) 18,00,00,000 (m) Return on Capital Employed (k:) 10.55% 2 ROCE under Alternative I (Output = 12,000 units) Particulars (a Surplus Capacity as per WN le, le after producing 9,000 units 600 hours Na (6) Time required pu (WN 1d) 5 hours 3.75 hours (c) Tme required for extra 3,000 units = [3,000 units - (b)] 600 hours 800 hours ( Balance Surplus Capacity, after producing 12,000 units (a -c) Ni NA (e) Net Revenue per hour (WN 1h) 7500 NI (Net Income from hiring (d xe) Na Nil C 720 hours 5.36 hours 560 hours 160 hours 7300 48,000 D 1,200 hours 7.5 hours 400 hours 800 hours 3400 3,20,900 Total of aboveStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started