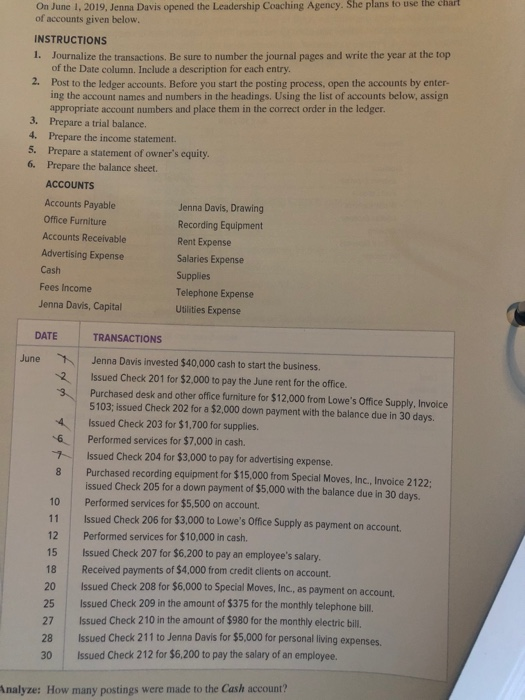

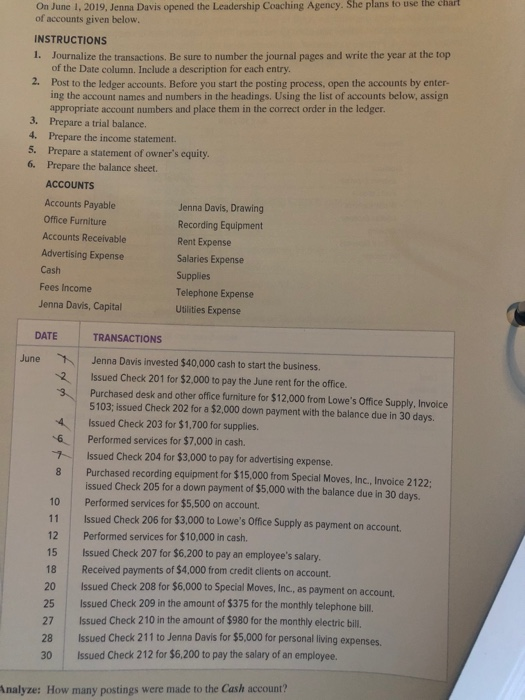

.Need Question 3 prepare a trail balance.

On June 1, 2019. Jenna Davis opened the Leadership Coaching Agency. She plans to use the chart of accounts given below. INSTRUCTIONS 1. Journalize the transactions, Be sure to number the journal pages and write the year at the top of the Date column. Include a description for each entry. 2. Post to the ledger accounts. Before you start the posting process, open the accounts by enter ing the account names and numbers in the headings. Using the list of accounts below, assign appropriate account numbers and place them in the correct order in the ledger. 3. Prepare a trial balance. 4. Prepare the income statement. 5. Prepare a statement of owner's equity. 6. Prepare the balance sheet. ACCOUNTS Accounts Payable Jenna Davis, Drawing Office Furniture Recording Equipment Accounts Receivable Rent Expense Advertising Expense Salaries Expense Cash Supplies Fees Income Telephone Expense Jenna Davis, Capital Utilities Expense DATE June TRANSACTIONS Jenna Davis Invested $40,000 cash to start the business Issued Check 201 for $2,000 to pay the June rent for the office. Purchased desk and other office furniture for $12,000 from Lowe's Office Supply, Invoice 5103; issued Check 202 for a $2.000 down payment with the balance due in 30 days. Issued Check 203 for $1,700 for supplies. Performed services for $7,000 in cash. Issued Check 204 for $3,000 to pay for advertising expense. Purchased recording equipment for $15,000 from Special Moves, Inc., Invoice 2122; issued Check 205 for a down payment of $5,000 with the balance due in 30 days. Performed services for $5,500 on account. Issued Check 206 for $3,000 to Lowe's Office Supply as payment on account. Performed services for $10,000 in cash. Issued Check 207 for $6.200 to pay an employee's salary. Received payments of $4,000 from credit clients on account. Issued Check 208 for $6,000 to Special Moves, Inc., as payment on account. Issued Check 209 in the amount of $375 for the monthly telephone bill, Issued Check 210 in the amount of $980 for the monthly electric bill Issued Check 211 to Jenna Davis for $5,000 for personal living expenses Issued Check 212 for $6,200 to pay the salary of an employee. 27 nalyze: How many postings were made to the Cash account