Need question 4 and 5 answered please!!

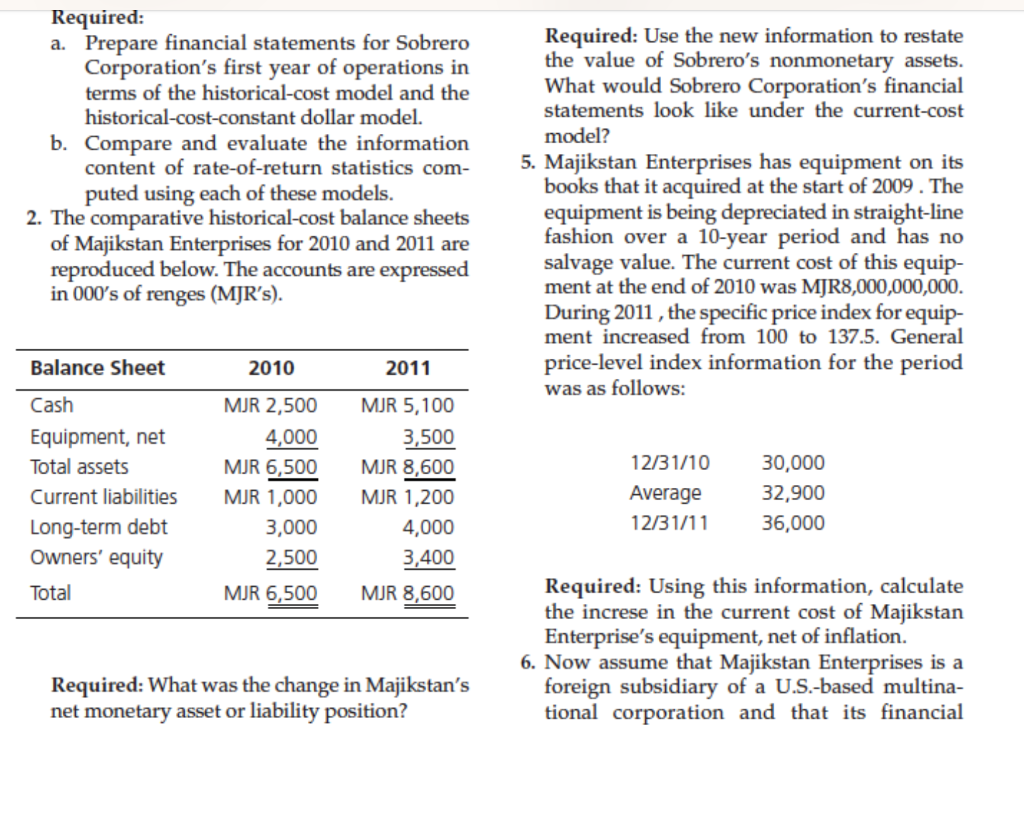

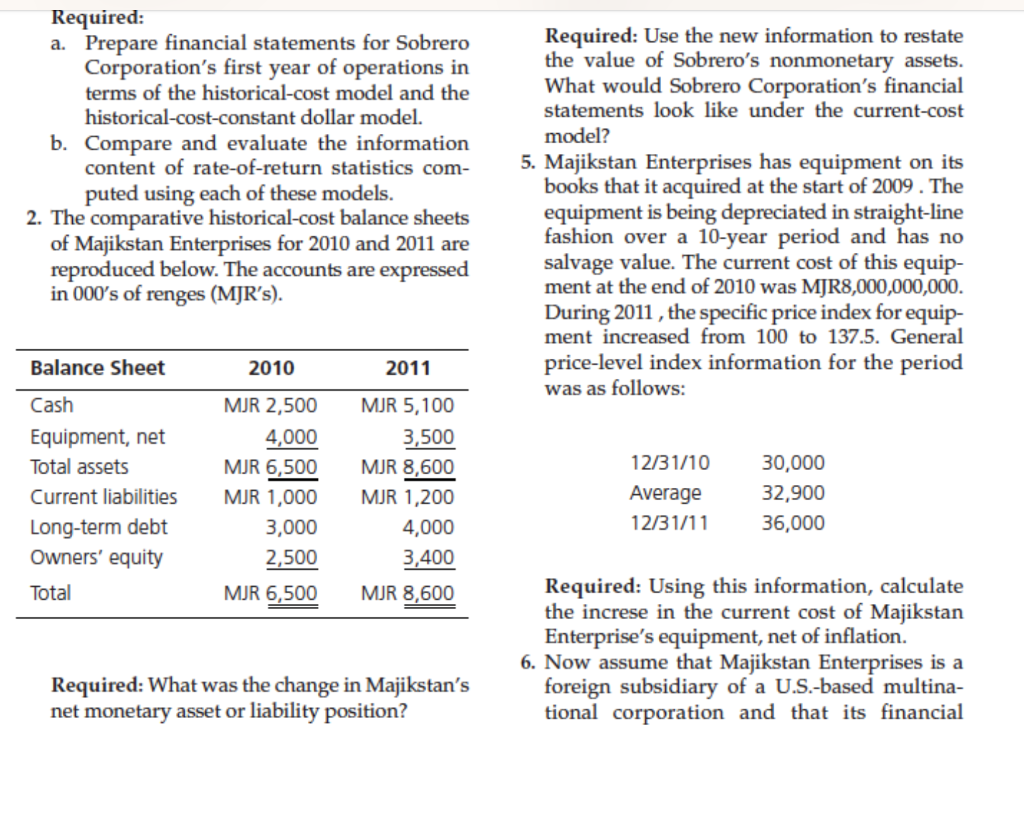

Sobrero Corporation, a Mexican affiliate of a 3. Using the information provided in Exercise 2. major U.S.-based hotel chain, starts the Calculate Majikstan Enterprises' net monecalendar year with 1 billion pesos (P) cash tary gain or loss in local currency for 2011 equity investment. It immediately acquires based on the following general price-level a refurbished hotel in Acapulco for P 900 information. million. Owing to a favorable tourist season, Sobrero Corporation's rental revenues were P 144 million for the year. Operating expenses of P 86,400,000 together with rental revenues were incurred uniformly throughout the year. The building, compris- ing 80 percent of the original purchase price (balance attributed to land), has an esti- 4. Revisit Sobrero Corporation in Exercise 1. In mated useful life of 20 years and is being addition to the information provided there, depreciated in straight-line fashion. By year- assume that Mexico's construction cost index end, the Mexican consumer price index rose increased by 80 percent during the year, while to 420 from an initial level of 263, averaging the price of vacant land adjacent to Sobrero 340 during the year. Corporation's hotel increased in value by 90 percent. Required: a. Prepare financial statements for Sobrero Required: Use the new information to restate Corporation's first year of operations in the value of Sobrero's nonmonetary assets. terms of the historical-cost model and the What would Sobrero Corporation's financial historical-cost-constant dollar model. statements look like under the current-cost b. Compare and evaluate the information model? content of rate-of-return statistics com- 5. Majikstan Enterprises has equipment on its puted using each of these models. books that it acquired at the start of 2009 . The The comparative historical-cost balance sheets equipment is being depreciated in straight-line of Majikstan Enterprises for 2010 and 2011 are_ fashion over a 10-year period and has no reproduced below. The accounts are expressed salvage value. The current cost of this equipin 000 's of renges (MJR's). ment at the end of 2010 was MJR8,000,000,000. During 2011 , the specific price index for equipment increased from 100 to 137.5. General price-level index information for the period Required: a. Prepare financial statements for Sobrero Required: Use the new information to restate Corporation's first year of operations in the value of Sobrero's nonmonetary assets. terms of the historical-cost model and the What would Sobrero Corporation's financial historical-cost-constant dollar model. statements look like under the current-cost b. Compare and evaluate the information model? content of rate-of-return statistics com- 5. Majikstan Enterprises has equipment on its puted using each of these models. books that it acquired at the start of 2009 . The 2. The comparative historical-cost balance sheets equipment is being depreciated in straight-line of Majikstan Enterprises for 2010 and 2011 are fashion over a 10-year period and has no reproduced below. The accounts are expressed salvage value. The current cost of this equipin 000's of renges (MJR's). ment at the end of 2010 was MJR8,000,000,000. During 2011 , the specific price index for equipment increased from 100 to 137.5. General price-level index information for the period was as follows: Required: Using this information, calculate the increse in the current cost of Majikstan Enterprise's equipment, net of inflation. 6. Now assume that Majikstan Enterprises is a Required: What was the change in Majikstan's foreign subsidiary of a U.S.-based multinanet monetary asset or liability position? tional corporation and that its financial Sobrero Corporation, a Mexican affiliate of a 3. Using the information provided in Exercise 2. major U.S.-based hotel chain, starts the Calculate Majikstan Enterprises' net monecalendar year with 1 billion pesos (P) cash tary gain or loss in local currency for 2011 equity investment. It immediately acquires based on the following general price-level a refurbished hotel in Acapulco for P 900 information. million. Owing to a favorable tourist season, Sobrero Corporation's rental revenues were P 144 million for the year. Operating expenses of P 86,400,000 together with rental revenues were incurred uniformly throughout the year. The building, compris- ing 80 percent of the original purchase price (balance attributed to land), has an esti- 4. Revisit Sobrero Corporation in Exercise 1. In mated useful life of 20 years and is being addition to the information provided there, depreciated in straight-line fashion. By year- assume that Mexico's construction cost index end, the Mexican consumer price index rose increased by 80 percent during the year, while to 420 from an initial level of 263, averaging the price of vacant land adjacent to Sobrero 340 during the year. Corporation's hotel increased in value by 90 percent. Required: a. Prepare financial statements for Sobrero Required: Use the new information to restate Corporation's first year of operations in the value of Sobrero's nonmonetary assets. terms of the historical-cost model and the What would Sobrero Corporation's financial historical-cost-constant dollar model. statements look like under the current-cost b. Compare and evaluate the information model? content of rate-of-return statistics com- 5. Majikstan Enterprises has equipment on its puted using each of these models. books that it acquired at the start of 2009 . The The comparative historical-cost balance sheets equipment is being depreciated in straight-line of Majikstan Enterprises for 2010 and 2011 are_ fashion over a 10-year period and has no reproduced below. The accounts are expressed salvage value. The current cost of this equipin 000 's of renges (MJR's). ment at the end of 2010 was MJR8,000,000,000. During 2011 , the specific price index for equipment increased from 100 to 137.5. General price-level index information for the period Required: a. Prepare financial statements for Sobrero Required: Use the new information to restate Corporation's first year of operations in the value of Sobrero's nonmonetary assets. terms of the historical-cost model and the What would Sobrero Corporation's financial historical-cost-constant dollar model. statements look like under the current-cost b. Compare and evaluate the information model? content of rate-of-return statistics com- 5. Majikstan Enterprises has equipment on its puted using each of these models. books that it acquired at the start of 2009 . The 2. The comparative historical-cost balance sheets equipment is being depreciated in straight-line of Majikstan Enterprises for 2010 and 2011 are fashion over a 10-year period and has no reproduced below. The accounts are expressed salvage value. The current cost of this equipin 000's of renges (MJR's). ment at the end of 2010 was MJR8,000,000,000. During 2011 , the specific price index for equipment increased from 100 to 137.5. General price-level index information for the period was as follows: Required: Using this information, calculate the increse in the current cost of Majikstan Enterprise's equipment, net of inflation. 6. Now assume that Majikstan Enterprises is a Required: What was the change in Majikstan's foreign subsidiary of a U.S.-based multinanet monetary asset or liability position? tional corporation and that its financial