Answered step by step

Verified Expert Solution

Question

1 Approved Answer

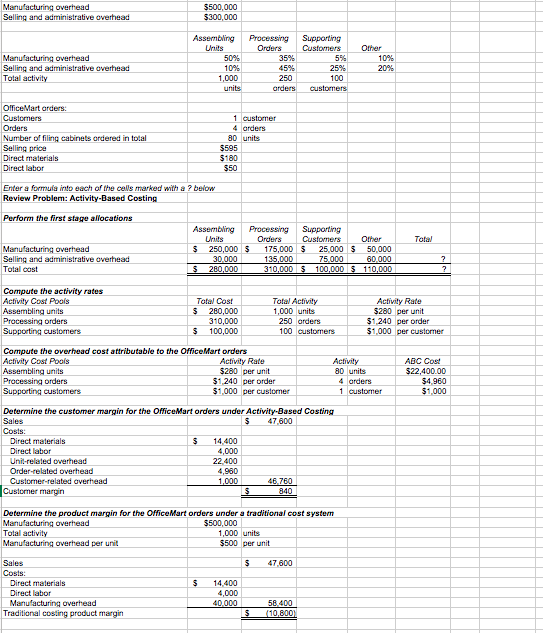

need questions A,B,C answered Manu acturing overhead Selling and administrative overhead 5500,000 $300,000 Manu acturing overhead Selling and administrative overhead Total a 50% 10% 1,000

need questions A,B,C answered

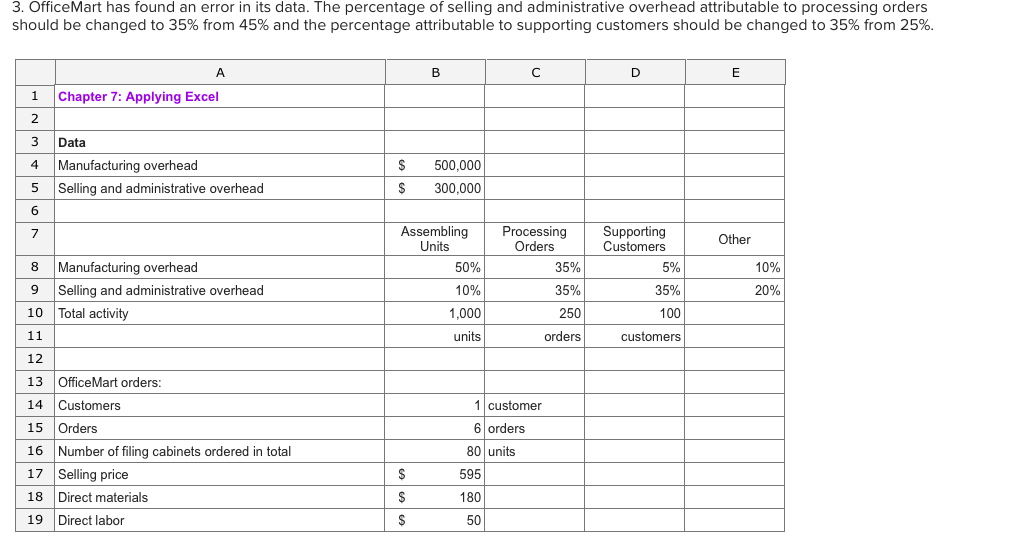

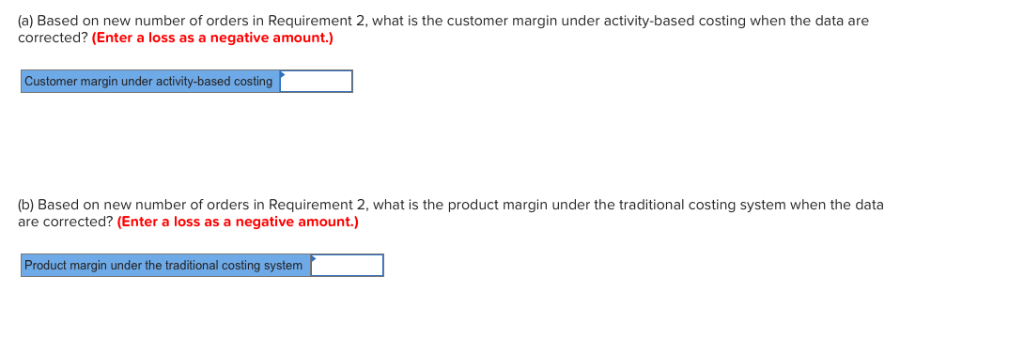

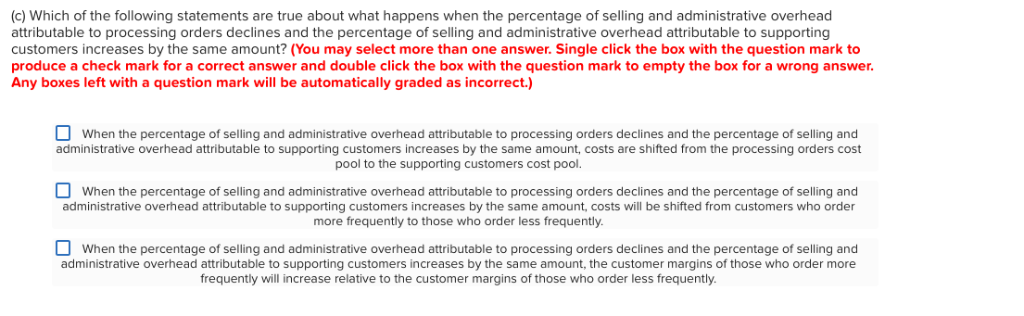

Manu acturing overhead Selling and administrative overhead 5500,000 $300,000 Manu acturing overhead Selling and administrative overhead Total a 50% 10% 1,000 100 OfficeMart arders 1 customer Orders Number of filing cabinets ordered in total Selling price Direct materials Direct labor 4 arders 80 units 5595 5180 $50 Enter &formuta into each of the cells marked with &? below Review Problem: Activity-Based Costing Perform the first stage allocations Units $ 250,000 $ 175,000 25,000 50,000 Selling and administrative Total cost Compute the activity rates Activity Cost Pools Assembling units Pracessing orders Totl Cos 280,000 310,000 $ 100,000 Total Activity 1,000 units 250 arders Activity Rate 5280 per unit $1,240 per order 100 1,000 per customer Compute the overhead cost atributable to the OfficeMart orders Activity Cost Pools Assembling units Pracessing orders Activity Rate 5280 per unit 51,240 per order ABC Cos $22,400.00 80 units 4 arders $4,960 1,000 per custorner Determine the customer margin for the OfficeMart orders under Activity-Based Costing Sales $47600 Direct materials Direct labor Uni-related overhead Order-related overhead 14.400 4,000 400 4,950 46,760 Customer margin Determine the product margin for the OfficeMart orders under a traditional cost system Total activity 5500,000 1,000 units $500 peru $47600 5 14,400 4,000 Direct labor Traditional costing product margin 3. OfficeMart has found an error in its data. The percentage of selling and administrative overhead attributable to processing orders should be changed to 35% from 45% and the percentage attributable to supporting customers should be changed to 35% from 25% 1 Chapter 7: Applying Excel 2 3 Data 4 Manufacturing overhead 5 Selling and administrative overhead S 500,000 S 300,000 Assembling Units Processing Orders Supporting Customers 7 Other 50% 10% 1,000 units 35% 35% 250 orderS 5% 35% 100 customers 8 Manufacturing overhead 9 Selling and administrative overhead 10 Total activity 10% 20% 12 13 OfficeMart orders 14 Customers 15 Orders 16 Number of filing cabinets ordered in total 17 Selling price 18 Direct materials 19 Direct labor 1 customer 6 orders 80 units 595 180 50 (a) Based on new number of orders in Requirement 2, what is the customer margin under activity-based costing when the data are corrected? (Enter a loss as a negative amount.) Customer margin under activity-based costing (b) Based on new number of orders in Requirement 2, what is the product margin under the traditional costing system when the data are corrected? (Enter a loss as a negative amount.) Product margin under the traditional costingStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started