Answered step by step

Verified Expert Solution

Question

1 Approved Answer

need quickly, will like!!! please include exel for the calculations! ty! Problem #1 (10 points) Use Excel for the calculations for this problem. Be sure

need quickly, will like!!! please include exel for the calculations! ty!

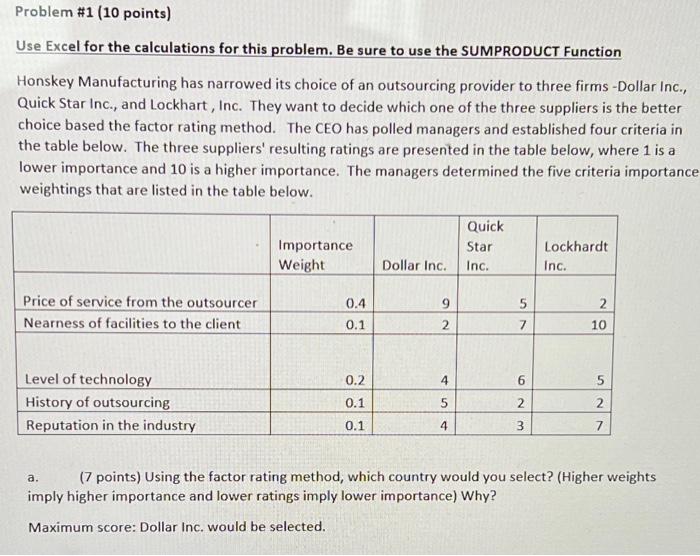

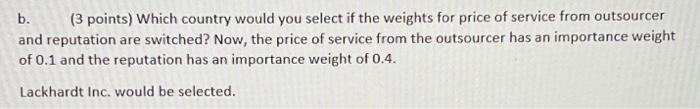

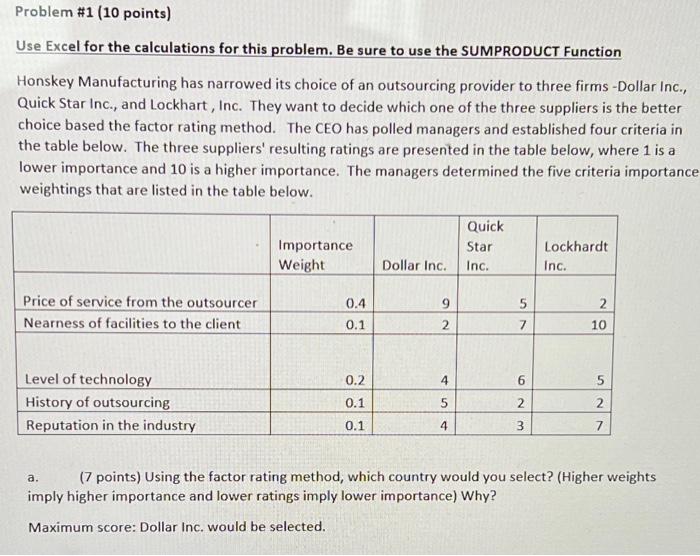

Problem #1 (10 points) Use Excel for the calculations for this problem. Be sure to use the SUMPRODUCT Function Honskey Manufacturing has narrowed its choice of an outsourcing provider to three firms -Dollar Inc., Quick Star Inc., and Lockhart, Inc. They want to decide which one of the three suppliers is the better choice based the factor rating method. The CEO has polled managers and established four criteria in the table below. The three suppliers' resulting ratings are presented in the table below, where 1 is a lower importance and 10 is a higher importance. The managers determined the five criteria importance weightings that are listed in the table below. Importance Weight Quick Star Inc. Lockhardt Inc. Dollar Inc. 9 5 2 Price of service from the outsourcer Nearness of facilities to the client 0.4 0.1 2 2 7 10 0.2 4 6 5 5 Level of technology History of outsourcing Reputation in the industry 0.1 5 2 2 0.1 4 3 7 a. (7 points) Using the factor rating method, which country would you select? (Higher weights imply higher importance and lower ratings imply lower importance) Why? Maximum score: Dollar Inc. would be selected. b. (3 points) Which country would you select if the weights for price of service from outsourcer and reputation are switched? Now, the price of service from the outsourcer has an importance weight of 0.1 and the reputation has an importance weight of 0.4. Lackhardt Inc. would be selected

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started