Answered step by step

Verified Expert Solution

Question

1 Approved Answer

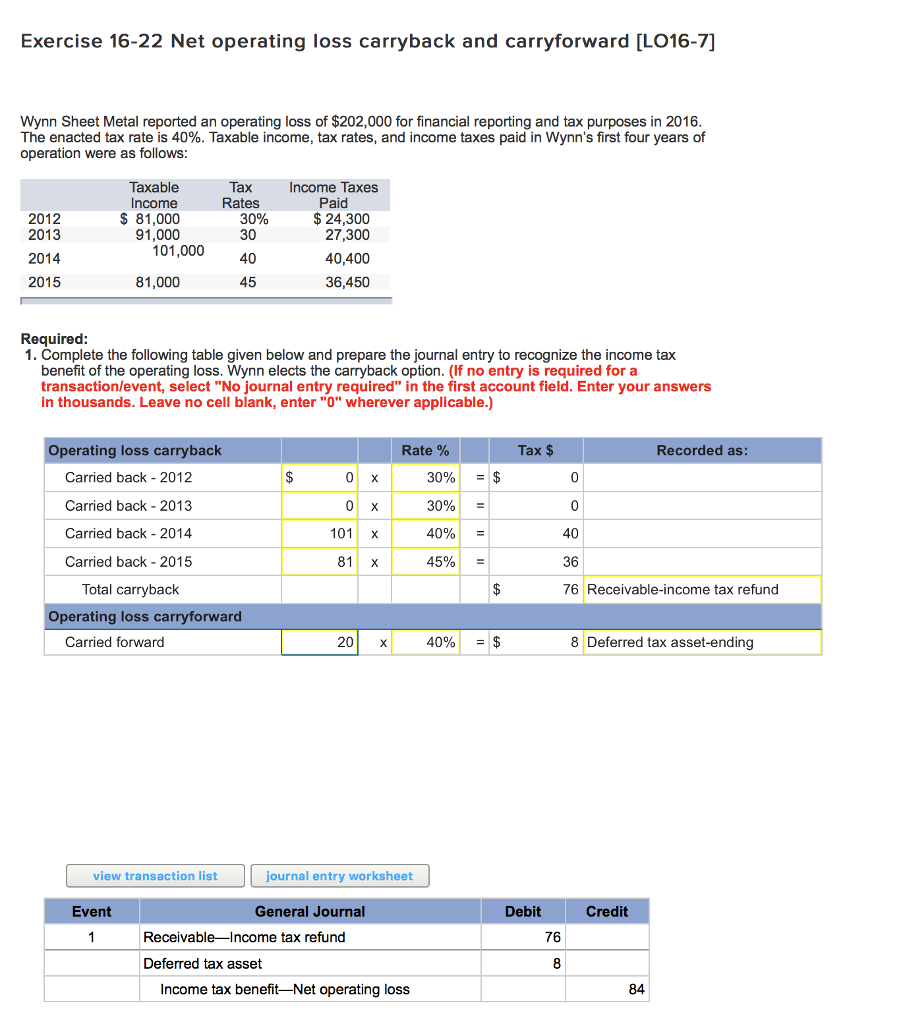

Need required 3 only? Exercise 16-22 Net operating loss carryback and carryforward [L016-7] Wynn Sheet Metal reported an operating loss of $202,000 for financial reporting

Need required 3 only?

Exercise 16-22 Net operating loss carryback and carryforward [L016-7] Wynn Sheet Metal reported an operating loss of $202,000 for financial reporting and tax purposes in 2016. The enacted tax rate is 40%. Taxable income, tax rates, and income taxes paid in Wynn's first four years of operation were as follows: Taxable Tax Income Taxes Paid Rates Income 24,300 81,000 2012 30% 2013 27,300 91,000 30 101,000 40,400 2014 40 2015 81,000 45 36,450 Required 1. Complete the following table given below and prepare the journal entry to recognize the income tax benefit of the operating loss. Wynn elects the carryback option. (lf no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in thousands. Leave no cell blank, enter "O" wherever applicable.) Tax Operating loss carryback Rate Recorded as: 0 30% ES Carried back 2012 0 x 30% Carried back 2013 101 x 40% E 40 Carried back 2014 81 x 45% 36 Carried back 2015 Total carryback 76 Receivable-income tax refund Operating loss carryforward 20 x 40% S$ Carried forward 8 Deferred tax asset-ending view transaction list journal entry worksheet Event General Journal Debit Credit 1 Receivable Income tax refund 76 8 Deferred tax asset 84 Income tax benefit Net operating lossStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started