Answered step by step

Verified Expert Solution

Question

1 Approved Answer

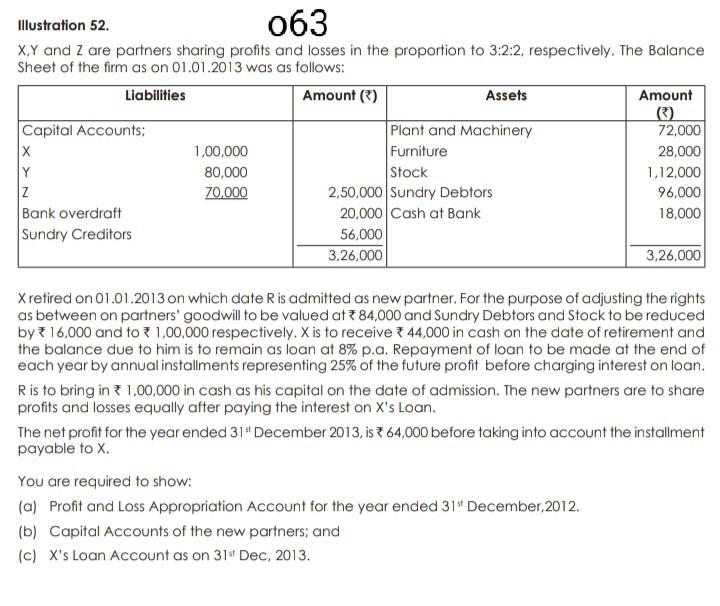

need right of my question thank you Illustration 52. 063 X Y and Z are partners sharing profits and losses in the proportion to 3:2:2,

need right of my question thank you

Illustration 52. 063 X Y and Z are partners sharing profits and losses in the proportion to 3:2:2, respectively. The Balance Sheet of the firm as on 01.01.2013 was as follows: Liabilities Amount () Assets Amount Capital Accounts: Plant and Machinery 72,000 1,00,000 Furniture 28,000 Y 80,000 Stock 1. 12,000 Z 70,000 2,50,000 Sundry Debtors 96,000 Bank overdraft 20,000 Cash at Bank 18,000 Sundry Creditors 56,000 3,26,000 3,26,000 Xretired on 01.01.2013 on which date Ris admitted as new partner. For the purpose of adjusting the rights as between on partners' goodwill to be valued at 84,000 and Sundry Debtors and Stock to be reduced by 3 16,000 and to 1,00,000 respectively. X is to receive 44,000 in cash on the date of retirement and the balance due to him is to remain as loan at 8% p.a. Repayment of loan to be made at the end of each year by annual installments representing 25% of the future profit before charging interest on loan. Ris to bring in 1,00,000 in cash as his capital on the date of admission. The new partners are to share profits and losses equally after paying the interest on X's Loan. The net profit for the year ended 31" December 2013, is 7 64,000 before taking into account the installment payable to X. You are required to show: (a) Profit and Loss Appropriation Account for the year ended 31" December, 2012. (b) Capital Accounts of the new partners; and (c) X's Loan Account as on 31' Dec, 2013Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started