Answered step by step

Verified Expert Solution

Question

1 Approved Answer

need schedule 5 form Instructions: Please complete the 2018 federal income tax return for Maria Gonzalez. Ignore the requirement to attach the form(s) w2 to

need schedule 5 form

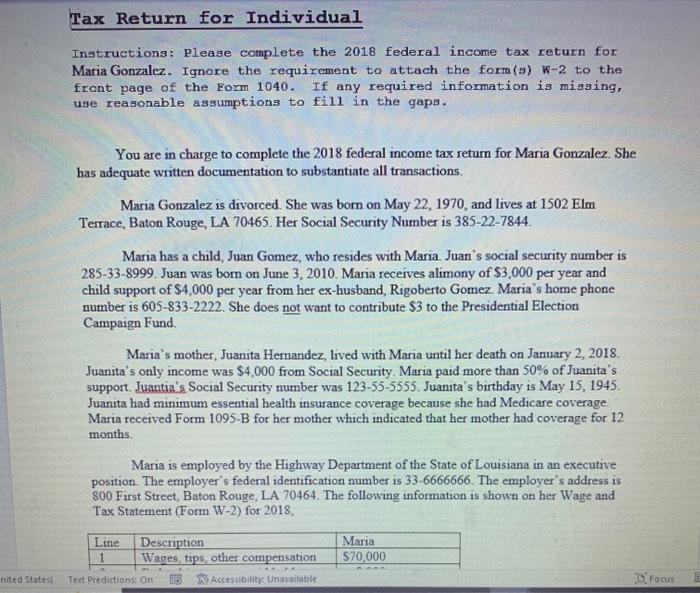

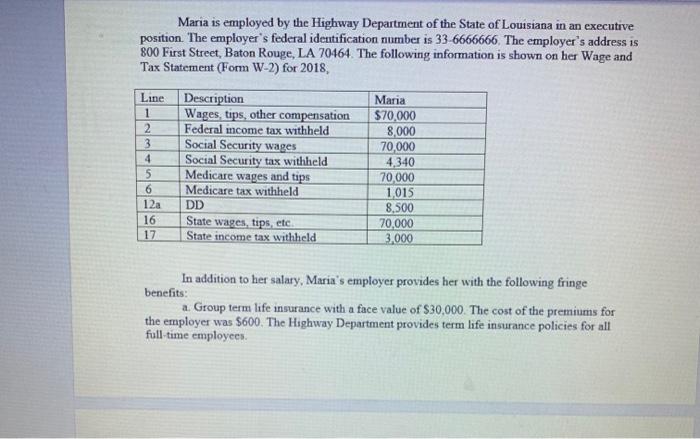

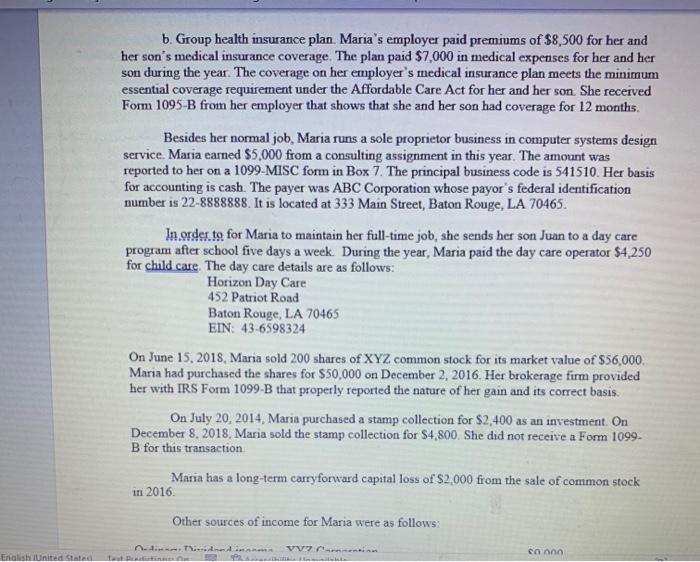

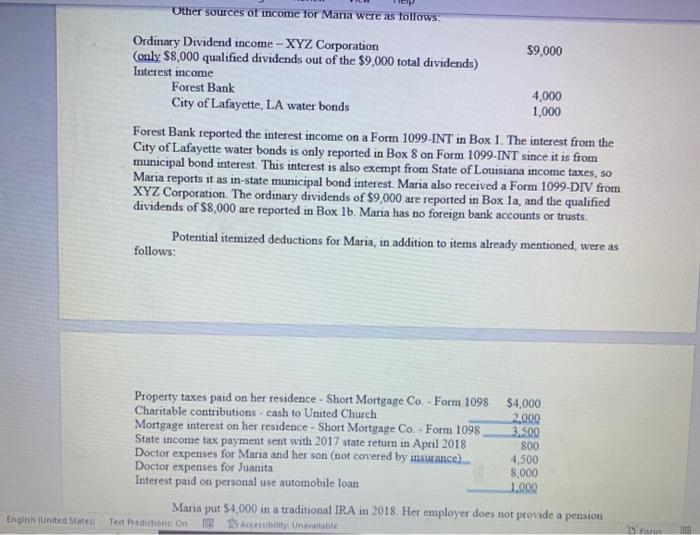

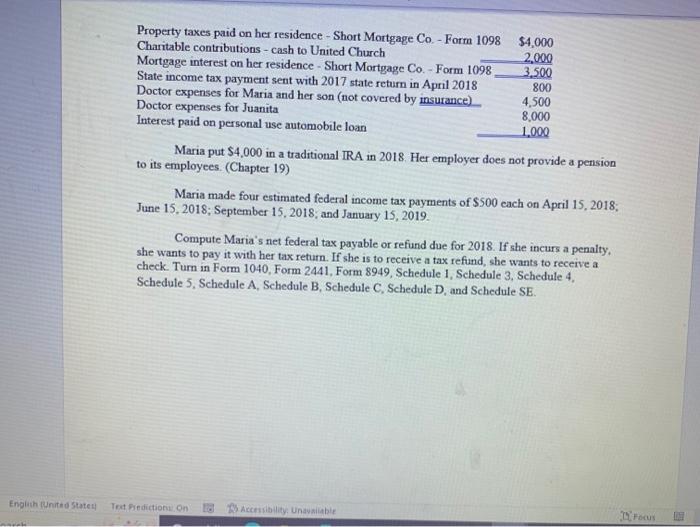

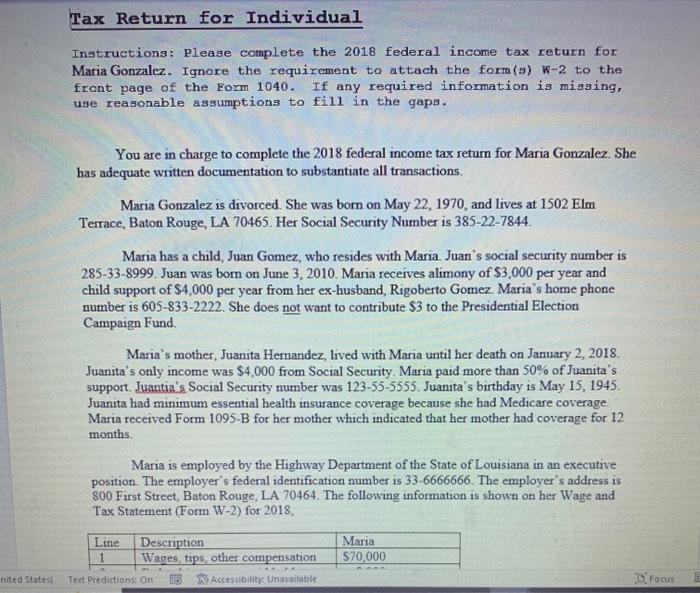

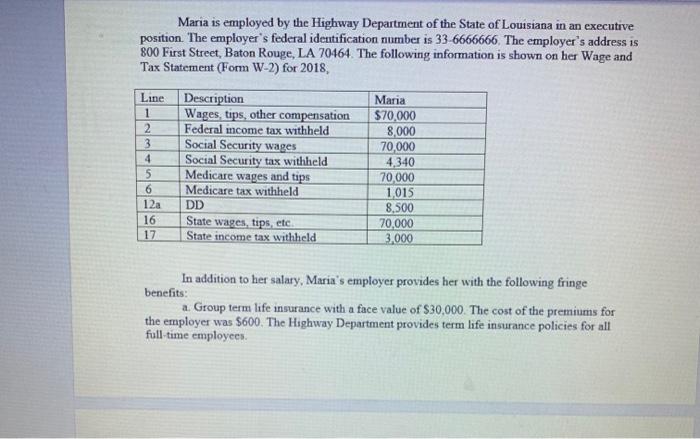

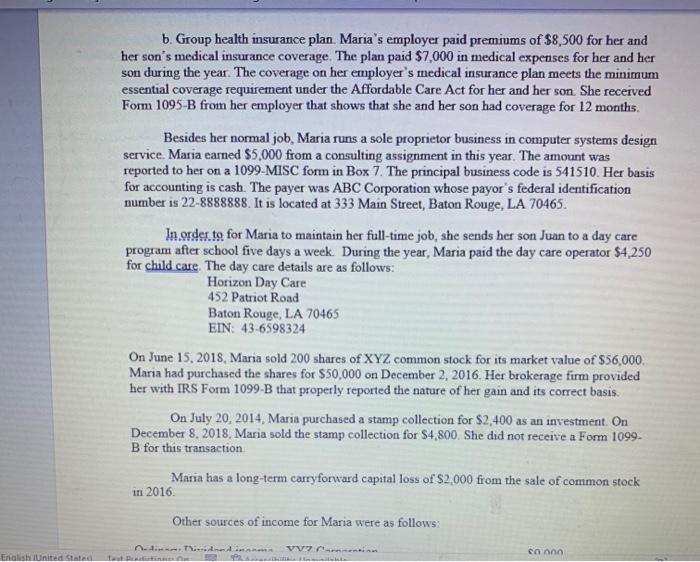

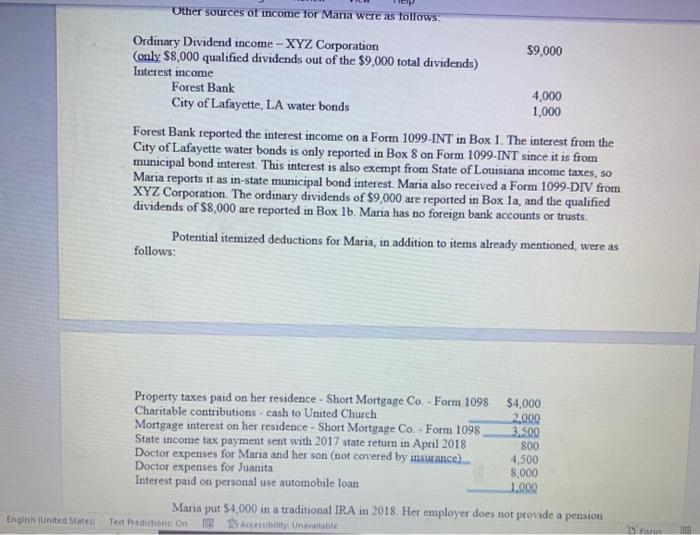

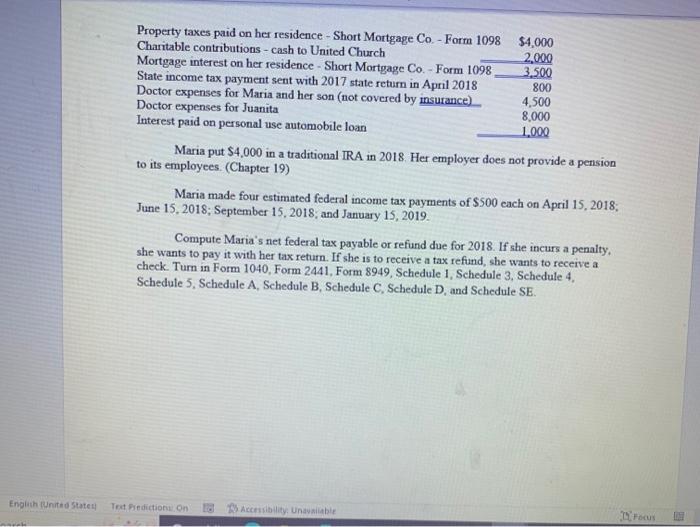

Instructions: Please complete the 2018 federal income tax return for Maria Gonzalez. Ignore the requirement to attach the form(s) w2 to the front page of the Form 1040 . If any required information is misging, use reasonable assumptions to fill in the gaps. You are in charge to complete the 2018 federal income tax return for Maria Gonzalez. She has adequate written documentation to substantiate all transactions. Maria Gonzalez is divorced. She was born on May 22, 1970, and lives at 1502Elm Terrace, Baton Rouge, LA 70465. Her Social Security Number is 385-22-7844. Maria has a child, Juan Gomez, who resides with Maria. Juan's social security number is 285-33-8999. Juan was bom on June 3, 2010. Maria receives alimony of $3,000 per year and child support of $4,000 per year from her ex-husband, Rigoberto Gomez. Maria's home phone number is 605-833-2222. She does not want to contribute $3 to the Presidential Election Campaign Fund. Maria's mother, Juanita Hernandez, lived with Maria until her death on January 2, 2018 . Juanita's only income was $4,000 from Social Security. Maria paid more than 50% of Juanita's support. Juantia's Social Security number was 123-55-5555. Juanita's birthday is May 15, 1945. Juanita had minimum essential health insurance coverage because she had Medicare coverage. Maria received Form 1095-B for her mother which indicated that her mother had coverage for 12 months. Maria is employed by the Highway Department of the State of Louisiana in an executive position. The employer's federal identification number is 336666666. The employer's address is 800 First Street, Baton Rouge, LA 70464. The following information is shown on her Wage and Tax Statement (Form W-2) for 2018, Maria is employed by the Highway Department of the State of Louisiana in an executive position. The employer's federal identification number is 33-6666666. The employer's address is 800 First Street, Baton Rouge, LA 70464. The following information is shown on her Wage and Tax Statement (Form W-2) for 2018, In addition to her salary, Maria's employer provides her with the following fringe benefits: a. Group term life insurance with a face value of $30,000. The cost of the premiums for the employer was $600. The Highway Department provides term life insurance policies for all full-time employees. service. Maria earned $5,000 from a consulting assignment in this year. The amount was reported to her on a 1099-MISC form in Box 7 . The principal business code is 541510 . Her basis for accounting is cash. The payer was ABC Corporation whose payor's federal identification number is 22-888888. It is located at 333 Main Street, Baton Rouge, LA 70465. In ,order to for Maria to maintain her full-time job, she sends her son Juan to a day care program after school five days a week. During the year, Maria paid the day care operator $4,250 for child care. The day care details are as follows: Horizon Day Care 452 Patriot Road Baton Rouge, LA 70465 EIN: 43.6598324 On June 15, 2018, Maria sold 200 shares of XYZ common stock for its market value of $56,000. Maria had purchased the shares for $50,000 on December 2, 2016. Her brokerage firm provided her with IRS Form 1099-B that properly reported the nature of her gain and its correct basis. On July 20, 2014, Maria purchased a stamp collection for $2,400 as an investment. On December 8, 2018, Maria sold the stamp collection for $4,800. She did not receive a Form 1099 . B for this transaction. Maria has a long-term carryforward capital loss of $2,000 from the sale of common stock in 2016. Other sources of income for Maria were as follows: Forest Bank reported the interest income on a Form 1099-INT in Box 1. The interest from the City of Lafayette water bonds is only reported in Box 8 on Form 1099. INT since it is from municipal bond interest. This interest is also exempt from State of Louisiana income taxes, so Maria reports it as in-state municipal bond interest. Maria also received a Form 1099-DIV from XYZ Corporation. The ordinary dividends of $9,000 are reported in Box la, and the qualified dividends of $8,000 are reported in Box 1b. Mana has no foreign bank accounts or trusts. Potential itemized deductions for Maria, in addition to items already mentioned, were as follows: Maria put $4,000 in a traditional IRA in 2018. Her employer does not provide a pension Compute Maria's net federal tax payable or refund due for 2018 . If she incurs a penalty, she wants to pay it with her tax return. If she is to receive a tax refund, she wants to recerve a check. Turn in Form 1040, Form 2441, Form 8949 , Schedule 1, Schedule 3, Schedule 4, Schedule 5, Schedule A, Schedule B, Schedule C, Schedule D, and Schedule SE. Instructions: Please complete the 2018 federal income tax return for Maria Gonzalez. Ignore the requirement to attach the form(s) w2 to the front page of the Form 1040 . If any required information is misging, use reasonable assumptions to fill in the gaps. You are in charge to complete the 2018 federal income tax return for Maria Gonzalez. She has adequate written documentation to substantiate all transactions. Maria Gonzalez is divorced. She was born on May 22, 1970, and lives at 1502Elm Terrace, Baton Rouge, LA 70465. Her Social Security Number is 385-22-7844. Maria has a child, Juan Gomez, who resides with Maria. Juan's social security number is 285-33-8999. Juan was bom on June 3, 2010. Maria receives alimony of $3,000 per year and child support of $4,000 per year from her ex-husband, Rigoberto Gomez. Maria's home phone number is 605-833-2222. She does not want to contribute $3 to the Presidential Election Campaign Fund. Maria's mother, Juanita Hernandez, lived with Maria until her death on January 2, 2018 . Juanita's only income was $4,000 from Social Security. Maria paid more than 50% of Juanita's support. Juantia's Social Security number was 123-55-5555. Juanita's birthday is May 15, 1945. Juanita had minimum essential health insurance coverage because she had Medicare coverage. Maria received Form 1095-B for her mother which indicated that her mother had coverage for 12 months. Maria is employed by the Highway Department of the State of Louisiana in an executive position. The employer's federal identification number is 336666666. The employer's address is 800 First Street, Baton Rouge, LA 70464. The following information is shown on her Wage and Tax Statement (Form W-2) for 2018, Maria is employed by the Highway Department of the State of Louisiana in an executive position. The employer's federal identification number is 33-6666666. The employer's address is 800 First Street, Baton Rouge, LA 70464. The following information is shown on her Wage and Tax Statement (Form W-2) for 2018, In addition to her salary, Maria's employer provides her with the following fringe benefits: a. Group term life insurance with a face value of $30,000. The cost of the premiums for the employer was $600. The Highway Department provides term life insurance policies for all full-time employees. service. Maria earned $5,000 from a consulting assignment in this year. The amount was reported to her on a 1099-MISC form in Box 7 . The principal business code is 541510 . Her basis for accounting is cash. The payer was ABC Corporation whose payor's federal identification number is 22-888888. It is located at 333 Main Street, Baton Rouge, LA 70465. In ,order to for Maria to maintain her full-time job, she sends her son Juan to a day care program after school five days a week. During the year, Maria paid the day care operator $4,250 for child care. The day care details are as follows: Horizon Day Care 452 Patriot Road Baton Rouge, LA 70465 EIN: 43.6598324 On June 15, 2018, Maria sold 200 shares of XYZ common stock for its market value of $56,000. Maria had purchased the shares for $50,000 on December 2, 2016. Her brokerage firm provided her with IRS Form 1099-B that properly reported the nature of her gain and its correct basis. On July 20, 2014, Maria purchased a stamp collection for $2,400 as an investment. On December 8, 2018, Maria sold the stamp collection for $4,800. She did not receive a Form 1099 . B for this transaction. Maria has a long-term carryforward capital loss of $2,000 from the sale of common stock in 2016. Other sources of income for Maria were as follows: Forest Bank reported the interest income on a Form 1099-INT in Box 1. The interest from the City of Lafayette water bonds is only reported in Box 8 on Form 1099. INT since it is from municipal bond interest. This interest is also exempt from State of Louisiana income taxes, so Maria reports it as in-state municipal bond interest. Maria also received a Form 1099-DIV from XYZ Corporation. The ordinary dividends of $9,000 are reported in Box la, and the qualified dividends of $8,000 are reported in Box 1b. Mana has no foreign bank accounts or trusts. Potential itemized deductions for Maria, in addition to items already mentioned, were as follows: Maria put $4,000 in a traditional IRA in 2018. Her employer does not provide a pension Compute Maria's net federal tax payable or refund due for 2018 . If she incurs a penalty, she wants to pay it with her tax return. If she is to receive a tax refund, she wants to recerve a check. Turn in Form 1040, Form 2441, Form 8949 , Schedule 1, Schedule 3, Schedule 4, Schedule 5, Schedule A, Schedule B, Schedule C, Schedule D, and Schedule SE

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started