Need solution for question 1, 2, 3 with detailed formulas

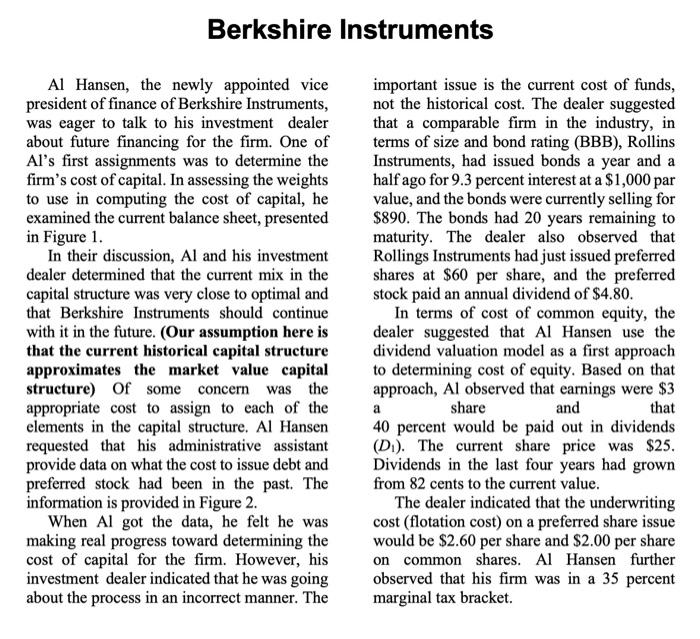

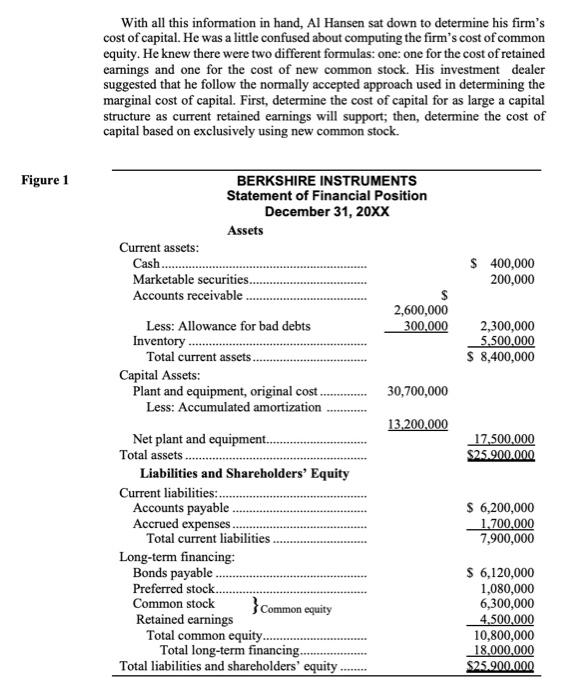

Berkshire Instruments Al Hansen, the newly appointed vice important issue is the current cost of funds, president of finance of Berkshire Instruments, not the historical cost. The dealer suggested was eager to talk to his investment dealer that a comparable firm in the industry, in about future financing for the firm. One of terms of size and bond rating (BBB), Rollins Al's first assignments was to determine the Instruments, had issued bonds a year and a firm's cost of capital. In assessing the weights half ago for 9.3 percent interest at a $1,000 par to use in computing the cost of capital, he value, and the bonds were currently selling for examined the current balance sheet, presented $890. The bonds had 20 years remaining to in Figure 1. maturity. The dealer also observed that In their discussion, Al and his investment Rollings Instruments had just issued preferred dealer determined that the current mix in the shares at $60 per share, and the preferred capital structure was very close to optimal and stock paid an annual dividend of $4.80. that Berkshire Instruments should continue In terms of cost of common equity, the with it in the future. (Our assumption here is dealer suggested that Al Hansen use the that the current historical capital structure dividend valuation model as a first approach approximates the market value capital to determining cost of equity. Based on that structure) Of some concern was the approach, Al observed that earnings were $3 appropriate cost to assign to each of the a share and that elements in the capital structure. Al Hansen 40 percent would be paid out in dividends requested that his administrative assistant (D1). The current share price was $25. provide data on what the cost to issue debt and Dividends in the last four years had grown preferred stock had been in the past. The from 82 cents to the current value. information is provided in Figure 2. The dealer indicated that the underwriting When Al got the data, he felt he was cost (flotation cost) on a preferred share issue making real progress toward determining the would be $2.60 per share and $2.00 per share cost of capital for the firm. However, his on common shares. Al Hansen further investment dealer indicated that he was going observed that his firm was in a 35 percent about the process in an incorrect manner. The marginal tax bracket. With all this information in hand, Al Hansen sat down to determine his firm's cost of capital. He was a little confused about computing the firm's cost of common equity. He knew there were two different formulas: one: one for the cost of retained earnings and one for the cost of new common stock. His investment dealer suggested that he follow the normally accepted approach used in determining the marginal cost of capital. First, determine the cost of capital for as large a capital structure as current retained earnings will support; then, determine the cost of capital based on exclusively using new common stock. Figure 2 Cost of prior issues of debt and preferred stock Required 1. Determine the weighted average cost of capital based on using retained earnings in the capital structure. The percentage composition in the capital structure for bonds, preferred stock, and common equity should be based on the current capital structure of long-term financing as shown in Figure 1 (it adds up to $18 million). (Use the historical costs on the assumption they approximate market values) Common equity will represent 60 percent of financing throughout this case. Use Rollins instruments data to calculate the cost of preferred shares and debt. 2. Recompute the weighted average cost of capital based on using new common shares in the capital structure. The weights remain the same, only common equity is now supplied by new common shares, rather than by retained earnings. After how much new financing will this increase in the cost of capital take place? Determine this by dividing retained earnings by the percent of common equity in the capital structure. 3. Assume the investment dealer also wishes to use the capital asset pricing model, as shown in Formula 11-4 in the text, to compute the cost (required return) on common shares. Assume Rf=6 percent, B is 1.25 , and Rm is 13 percent. What is the value of K ? How does this compare to the value of Ke computed in question 1