Need some assistance with these problems

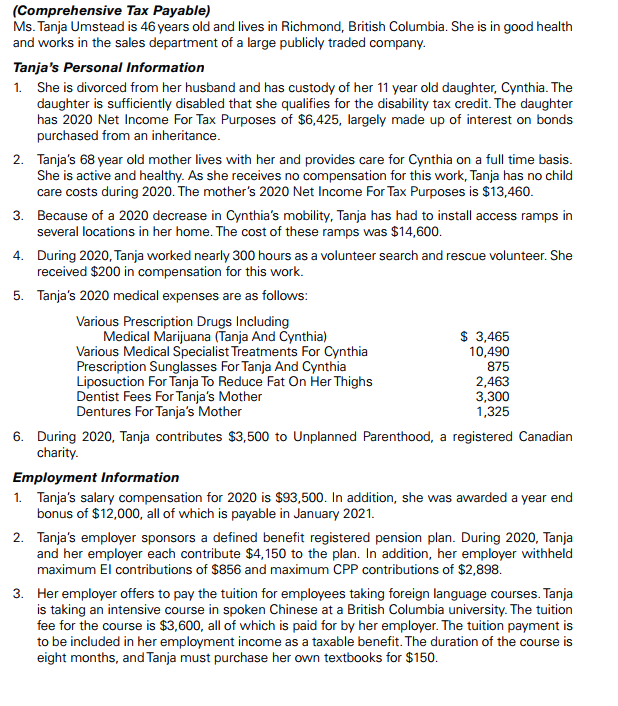

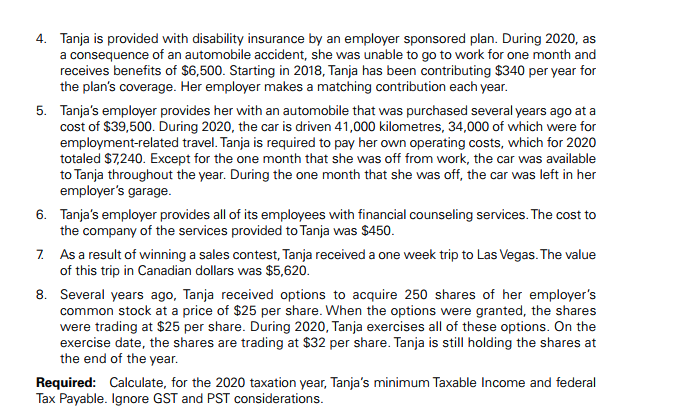

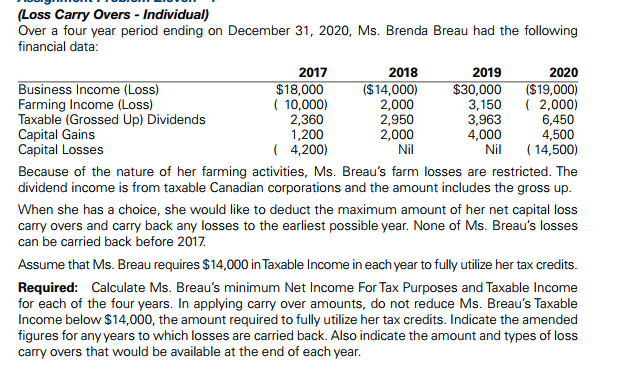

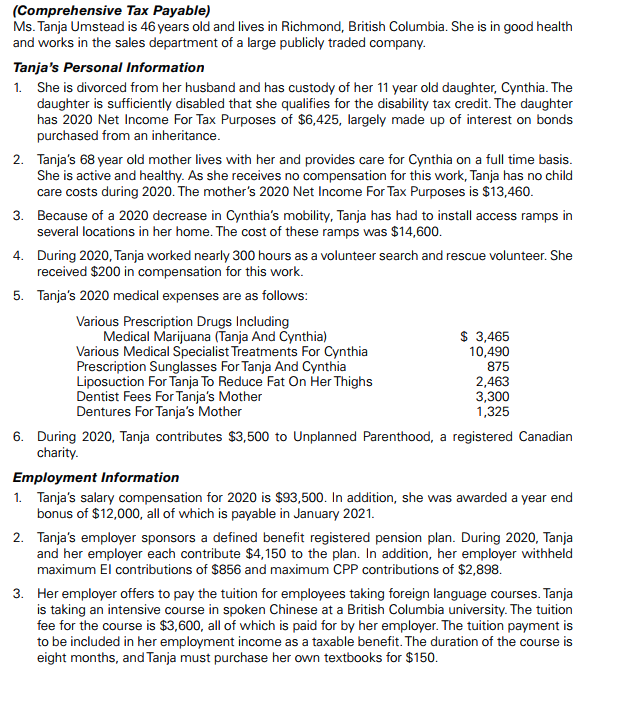

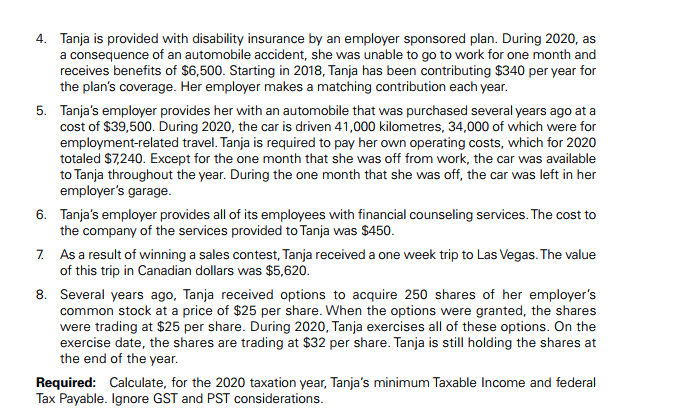

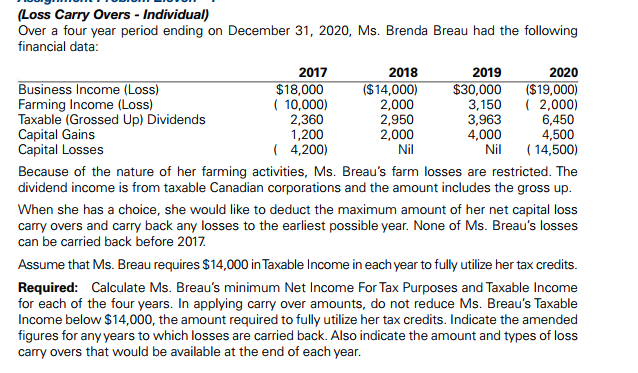

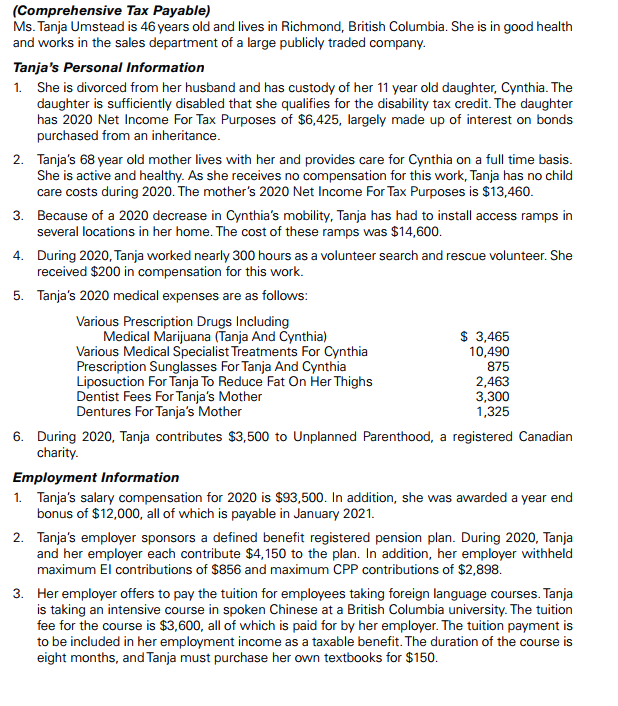

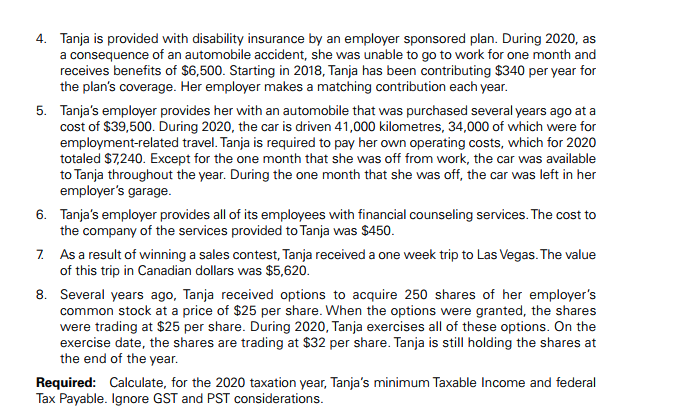

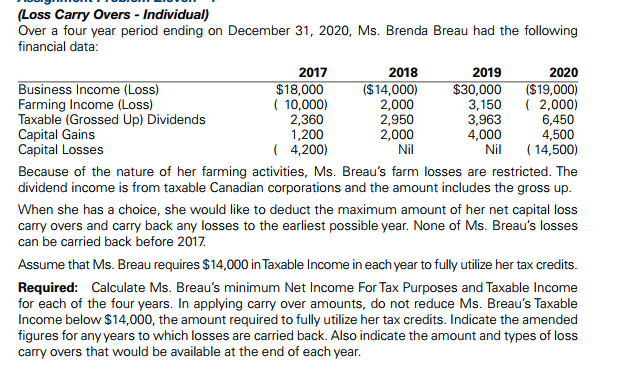

(Comprehensive Tax Payable) Ms. Tanja Umstead is 46 years old and lives in Richmond, British Columbia. She is in good health and works in the sales department of a large publicly traded company. Tanja's Personal Information 1. She is divorced from her husband and has custody of her 11 year old daughter, Cynthia. The daughter is sufficiently disabled that she qualifies for the disability tax credit. The daughter has 2020 Net Income For Tax Purposes of $6,425, largely made up of interest on bonds purchased from an inheritance. Tanja's 68 year old mother lives with her and provides care for Cynthia on a full time basis. She is active and healthy. As she receives no compensation for this work, Tanja has no child care costs during 2020. The mother's 2020 Net Income For Tax Purposes is $13,460. 3. Because of a 2020 decrease in Cynthia's mobility, Tanja has had to install access ramps in several locations in her home. The cost of these ramps was $14,600. 4. During 2020, Tanja worked nearly 300 hours as a volunteer search and rescue volunteer. She received $200 in compensation for this work. 5. Tanja's 2020 medical expenses are as follows: Various Prescription Drugs Including Medical Marijuana (Tanja And Cynthia) $ 3,465 Various Medical Specialist Treatments For Cynthia 10,490 Prescription Sunglasses For Tanja And Cynthia 875 Liposuction For Tanja To Reduce Fat On Her Thighs 2,463 Dentist Fees For Tanja's Mother 3,300 Dentures For Tanja's Mother 1,325 6. During 2020, Tanja contributes $3,500 to Unplanned Parenthood, a registered Canadian charity. Employment Information 1. Tanja's salary compensation for 2020 is $93,500. In addition, she was awarded a year end bonus of $12,000, all of which is payable in January 2021. 2. Tanja's employer sponsors a defined benefit registered pension plan. During 2020, Tanja and her employer each contribute $4,150 to the plan. In addition, her employer withheld maximum El contributions of $856 and maximum CPP contributions of $2,898. 3. Her employer offers to pay the tuition for employees taking foreign language courses. Tanja is taking an intensive course in spoken Chinese at a British Columbia university. The tuition fee for the course is $3,600, all of which is paid for by her employer. The tuition payment is to be included in her employment income as a taxable benefit. The duration of the course is eight months, and Tanja must purchase her own textbooks for $150.4. Tanja is provided with disability insurance by an employer sponsored plan. During 2020, as a consequence of an automobile accident, she was unable to go to work for one month and receives benefits of $6,500. Starting in 2018, Tanja has been contributing $340 per year for the plan's coverage. Her employer makes a matching contribution each year. 5. Tanja's employer provides her with an automobile that was purchased several years ago at a cost of $39,500. During 2020, the car is driven 41,000 kilometres, 34,000 of which were for employment-related travel. Tanja is required to pay her own operating costs, which for 2020 totaled $7,240. Except for the one month that she was off from work, the car was available to Tanja throughout the year. During the one month that she was off, the car was left in her employer's garage. 6. Tanja's employer provides all of its employees with financial counseling services. The cost to the company of the services provided to Tanja was $450. 7. As a result of winning a sales contest, Tanja received a one week trip to Las Vegas. The value of this trip in Canadian dollars was $5,620. 8. Several years ago, Tanja received options to acquire 250 shares of her employer's common stock at a price of $25 per share. When the options were granted, the shares were trading at $25 per share. During 2020, Tanja exercises all of these options. On the exercise date, the shares are trading at $32 per share. Tanja is still holding the shares at the end of the year. Required: Calculate, for the 2020 taxation year, Tanja's minimum Taxable Income and federal Tax Payable. Ignore GST and PST considerations.(Loss Carry Overs - Individual) Over a four year period ending on December 31, 2020, Ms. Brenda Breau had the following financial data: 2017 2018 2019 2020 Business Income (Loss) $18,000 ($14,000) $30,000 ($19,000) Farming Income (Loss) ( 10,000) 2,000 3,150 ( 2,000) Taxable (Grossed Up) Dividends 2,360 2,950 3,963 6,450 Capital Gains 1,200 2,000 4,000 4,500 Capital Losses ( 4,200) Nil Nil ( 14,500) Because of the nature of her farming activities, Ms. Breau's farm losses are restricted. The dividend income is from taxable Canadian corporations and the amount includes the gross up. When she has a choice, she would like to deduct the maximum amount of her net capital loss carry overs and carry back any losses to the earliest possible year. None of Ms. Breau's losses can be carried back before 2017. Assume that Ms. Breau requires $14,000 in Taxable Income in each year to fully utilize her tax credits. Required: Calculate Ms. Breau's minimum Net Income For Tax Purposes and Taxable Income for each of the four years. In applying carry over amounts, do not reduce Ms. Breau's Taxable Income below $14,000, the amount required to fully utilize her tax credits. Indicate the amended figures for any years to which losses are carried back. Also indicate the amount and types of loss carry overs that would be available at the end of each year