Need some help for this questions:

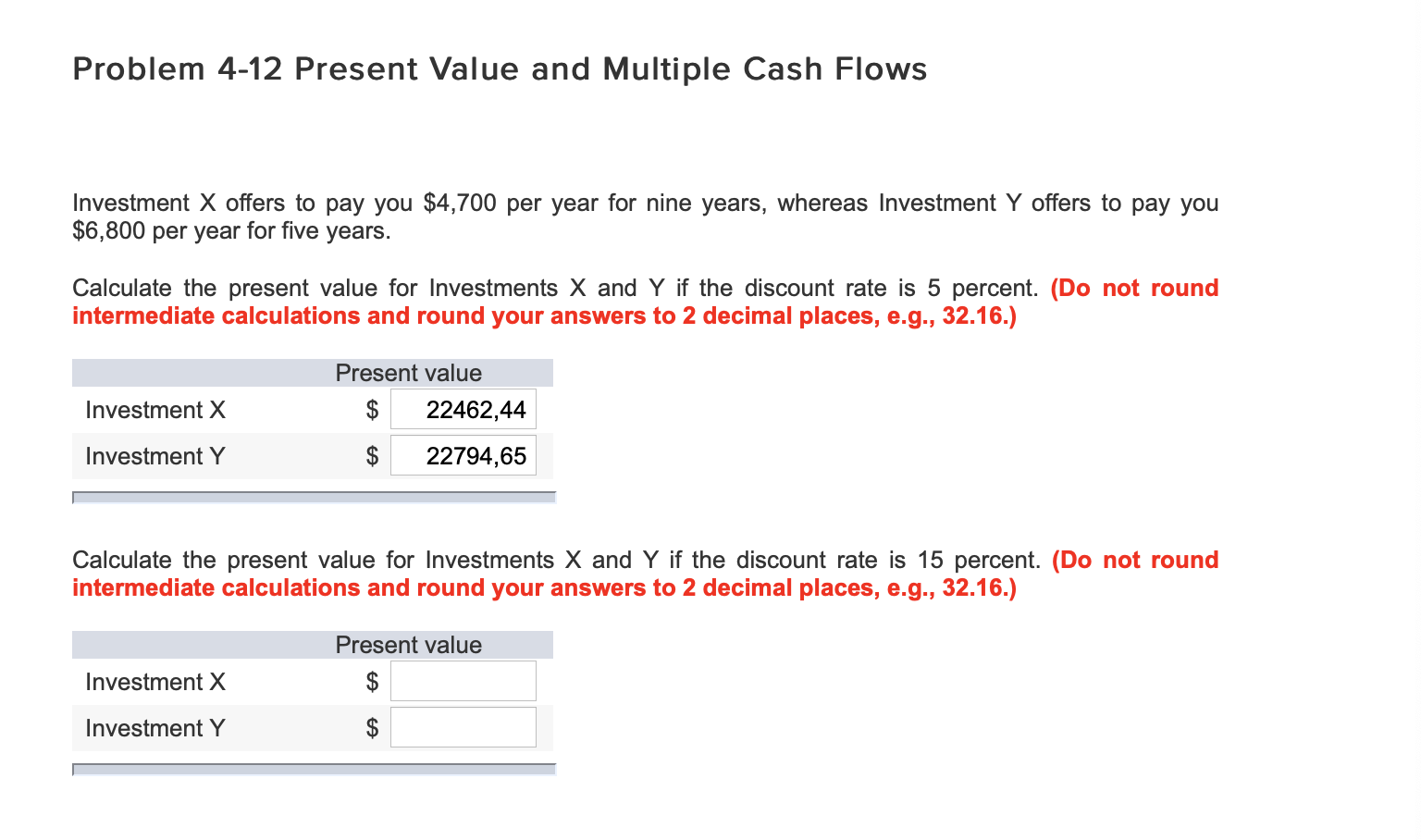

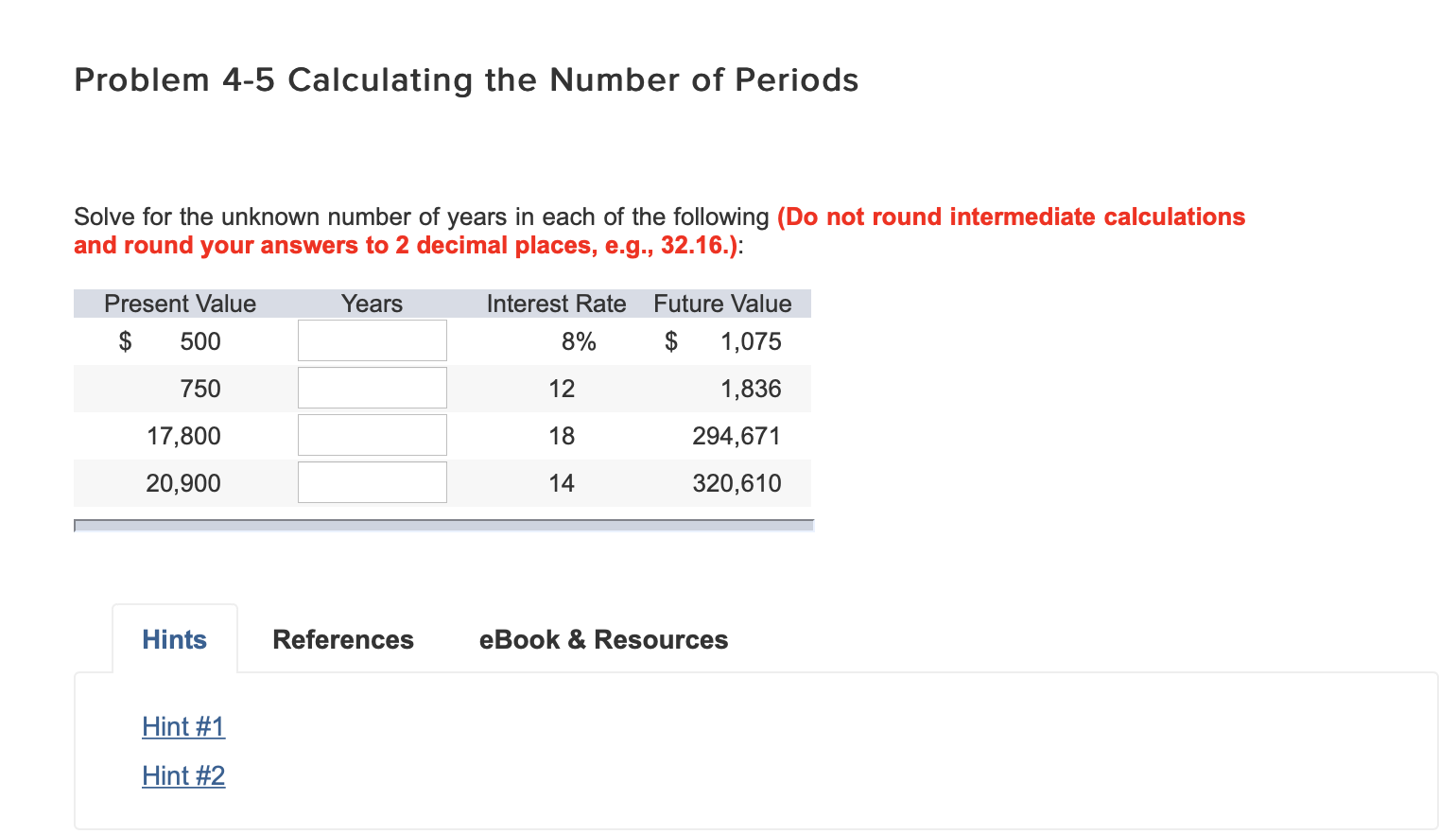

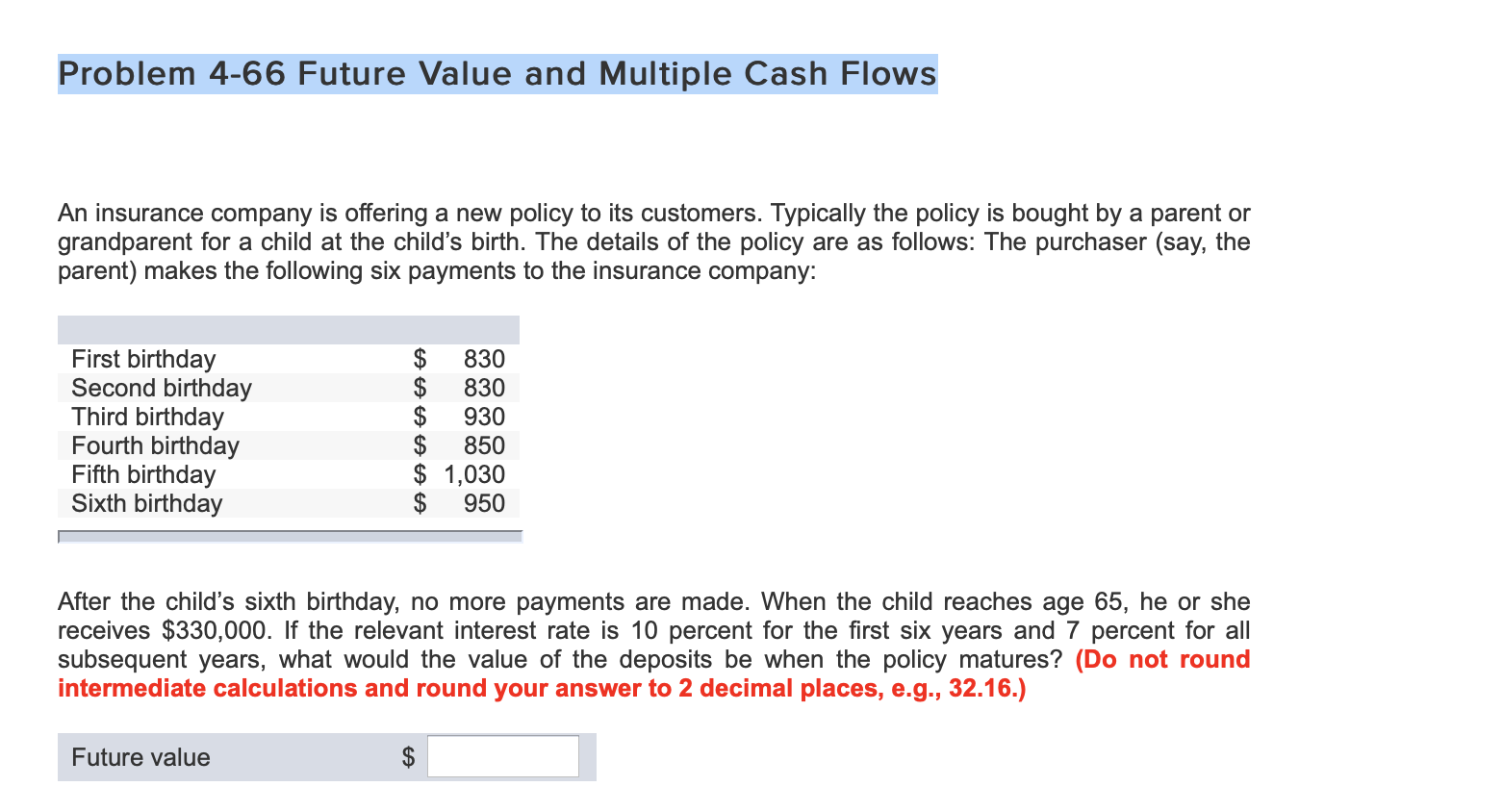

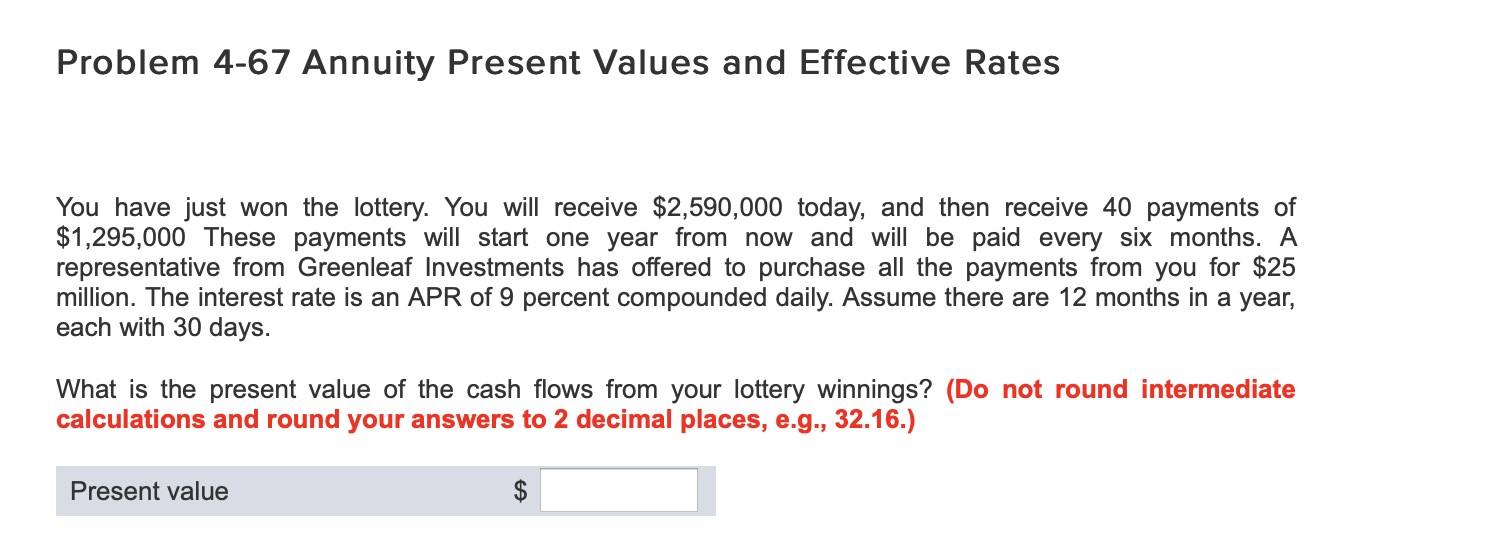

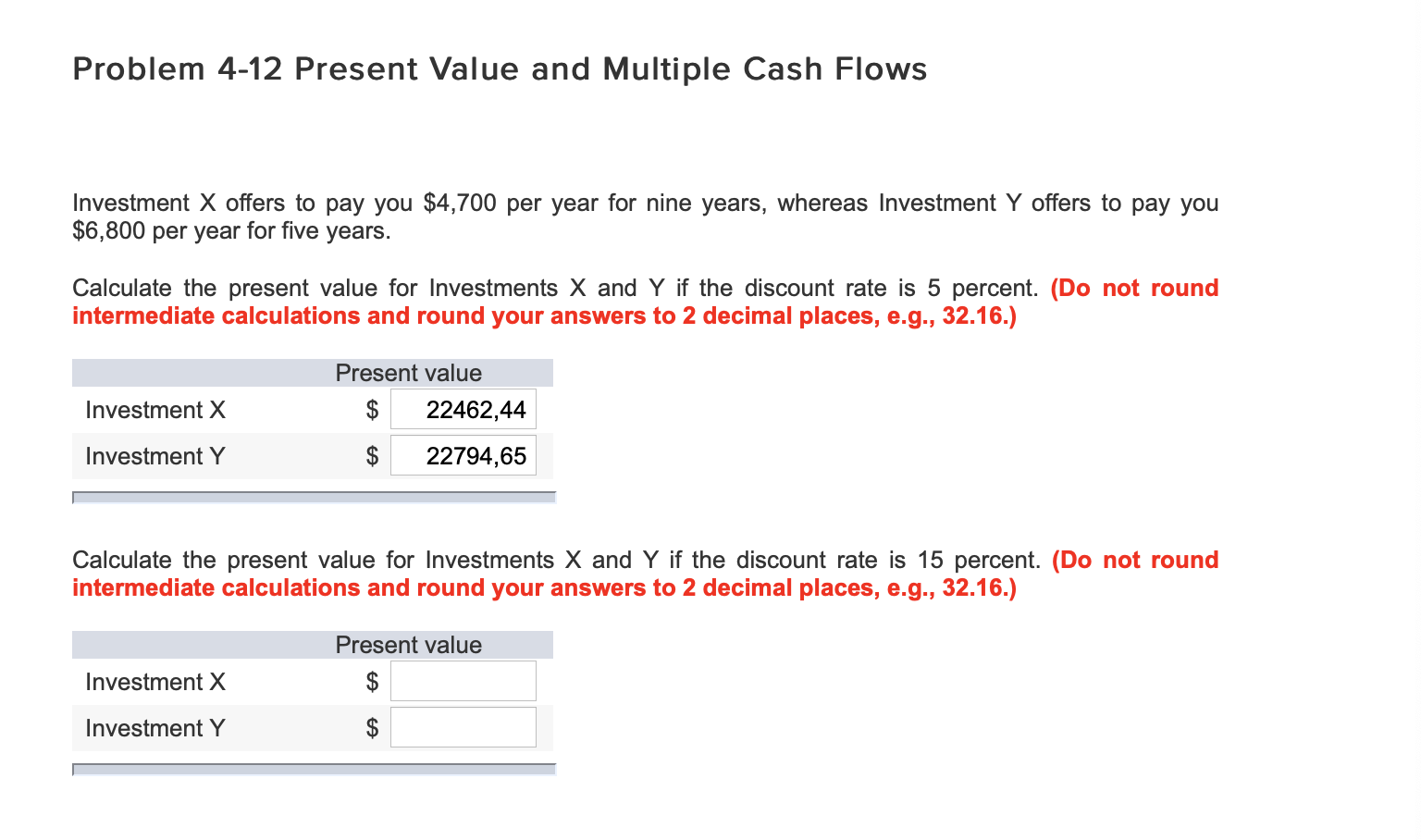

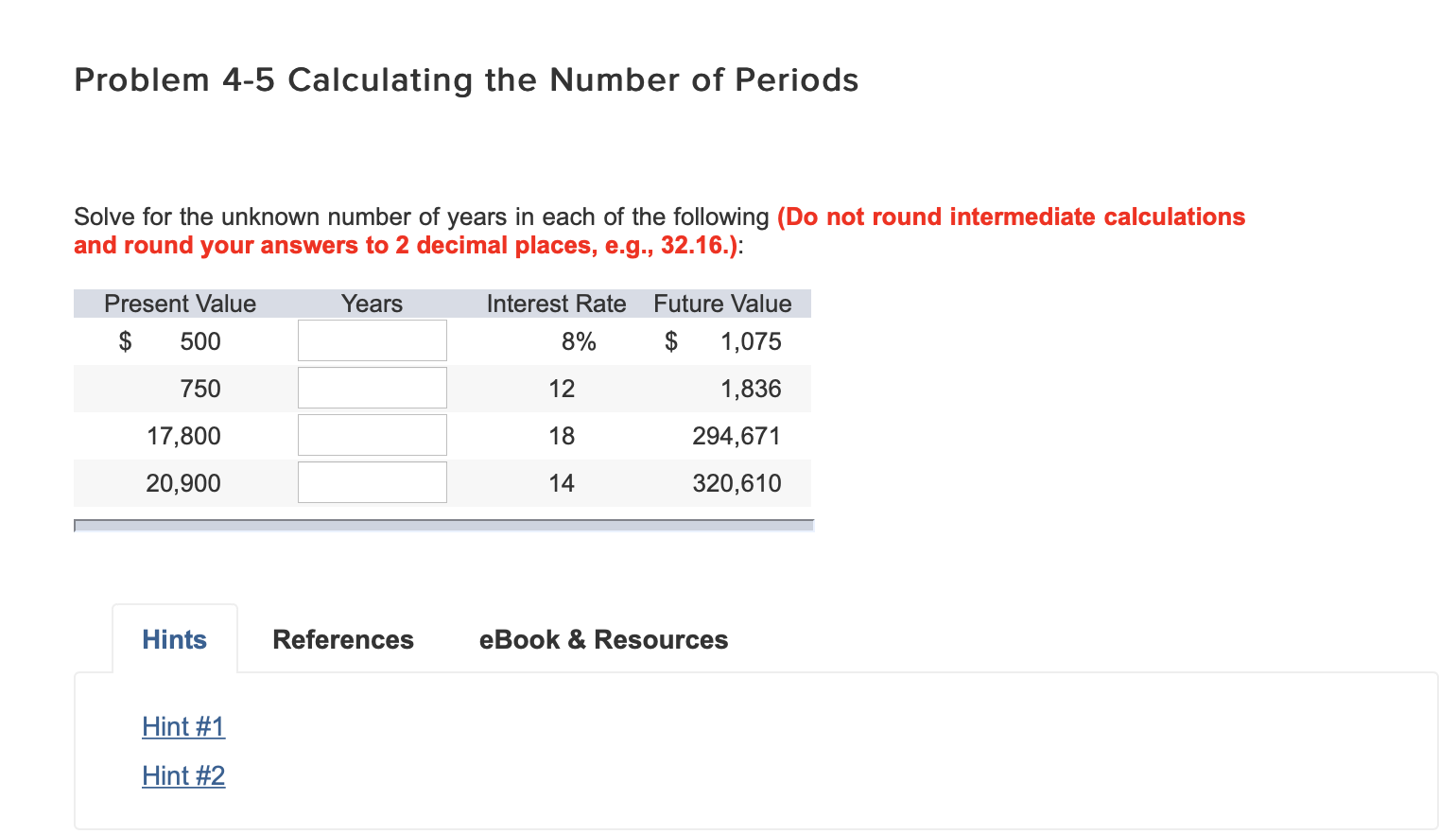

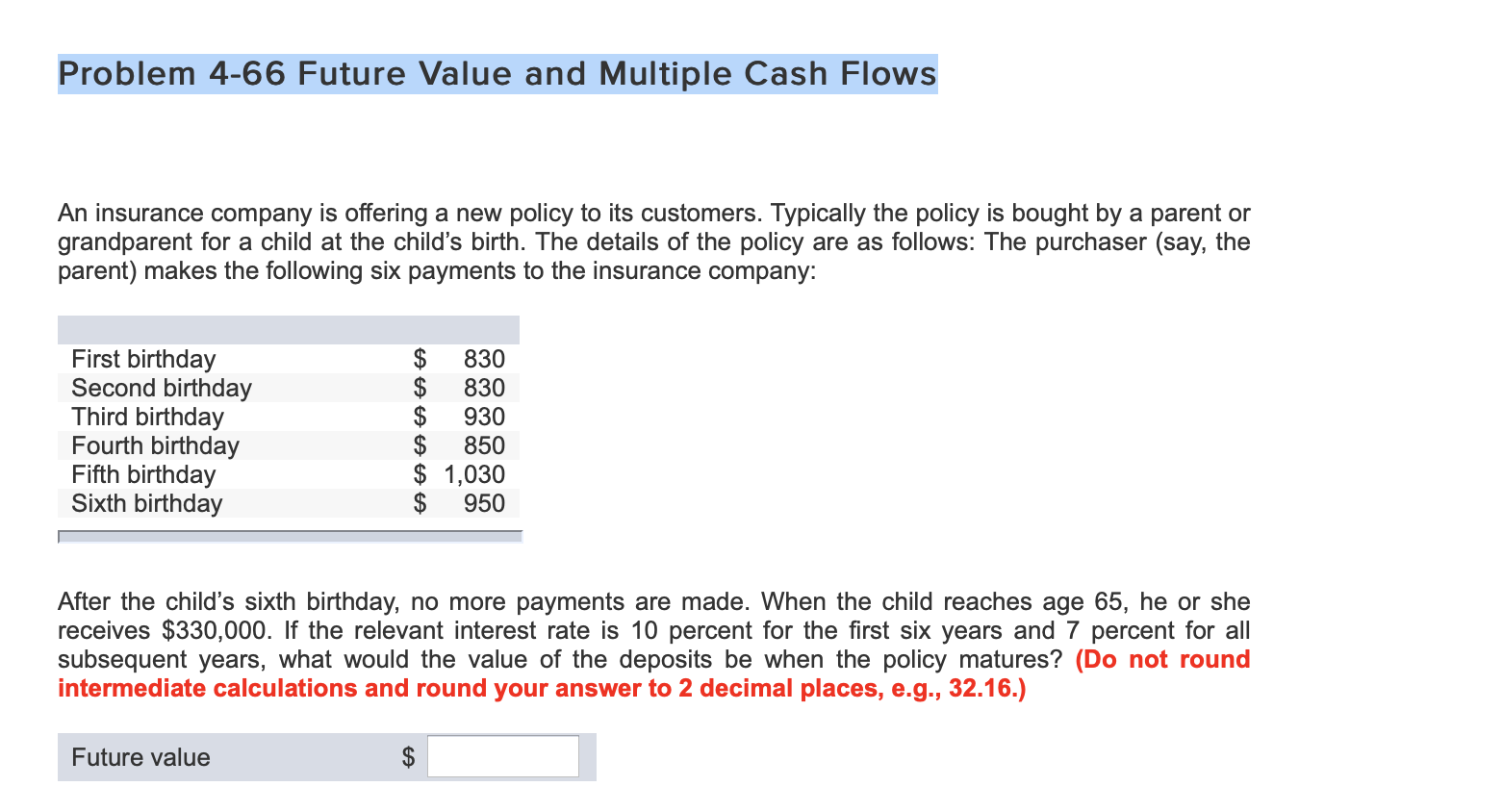

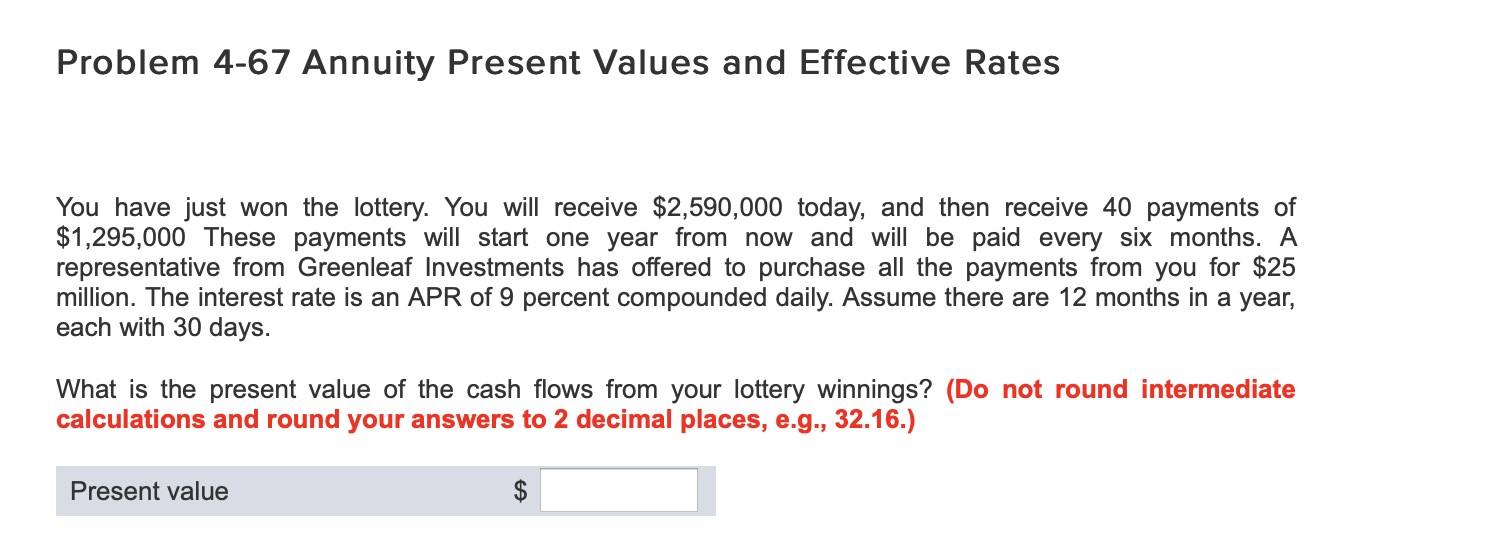

Problem 4-12 Present Value and Multiple Cash Flows Investment X offers to pay you $4,700 per year for nine years, whereas Investment Y offers to pay you $6,800 per year for five years. Calculate the present value for Investments X and Y if the discount rate is 5 percent. (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) Present value Investment X $ 22462,44 Investment Y $ 22794,65 Calculate the present value for Investments X and Y if the discount rate is 15 percent. (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) Present value Investment X $ Investment Y $ Problem 4-5 Calculating the Number of Periods Solve for the unknown number of years in each of the following (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.): Years Present Value $ 500 Interest Rate 8% Future Value 1,075 750 12 1,836 17,800 18 94,671 20,900 14 320,610 Hints References eBook & Resources Hint #1 Hint #2 Problem 4-66 Future Value and Multiple Cash Flows An insurance company is offering a new policy to its customers. Typically the policy is bought by a parent or grandparent for a child at the child's birth. The details of the policy are as follows: The purchaser (say, the parent) makes the following six payments to the insurance company: First birthday Second birthday Third birthday Foi birthday Fifth birthday Sixth birthday 68 69 68 69 68 69 830 830 930 850 $ 1,030 950 After the child's sixth birthday, no more payments are made. When the child reaches age 65, he or she receives $330,000. If the relevant interest rate is 10 percent for the first six years and 7 percent for all subsequent years, what would the value of the deposits be when the policy matures? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Future value Problem 4-67 Annuity Present Values and Effective Rates You have just won the lottery. You will receive $2,590,000 today, and then receive 40 payments of $1,295,000 These payments will start one year from now and will be paid every six months. A representative from Greenleaf Investments has offered to purchase all the payments from you for $25 million. The interest rate is an APR of 9 percent compounded daily. Assume there are 12 months in a year, each with 30 days. What is the present value of the cash flows from your lottery winnings? (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) Present value $