Question

Need some help here writing and calculating journal entries for a larger problem, please. This problem applies financial reporting principles relating to intangibles, current liabilities,

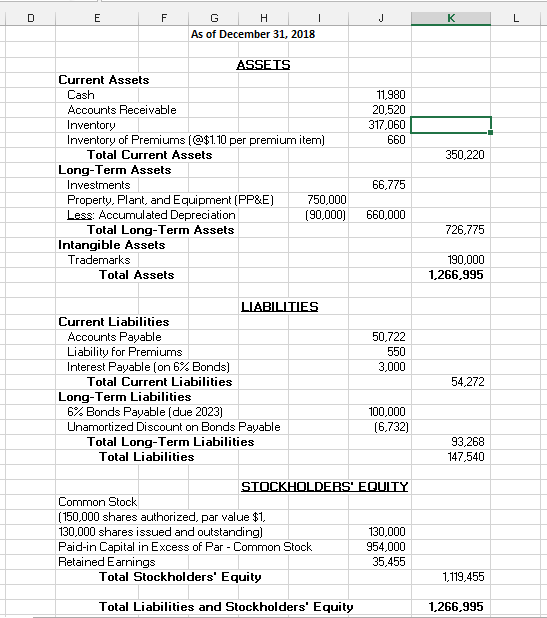

Need some help here writing and calculating journal entries for a larger problem, please. This problem applies financial reporting principles relating to intangibles, current liabilities, and long-term liabilities for a fictitious (though realistic) company scenario. GeneralProducts, Inc. was incorporated in Nevada on January 1, 2016, to take over a local retail chain and supply goods to customers at the most competitive prices, both in stores and online. To complete this project, youll need to use the financial information below provided for the year 2019 along with the prior years Balance Sheet (dated December 31, 2018).

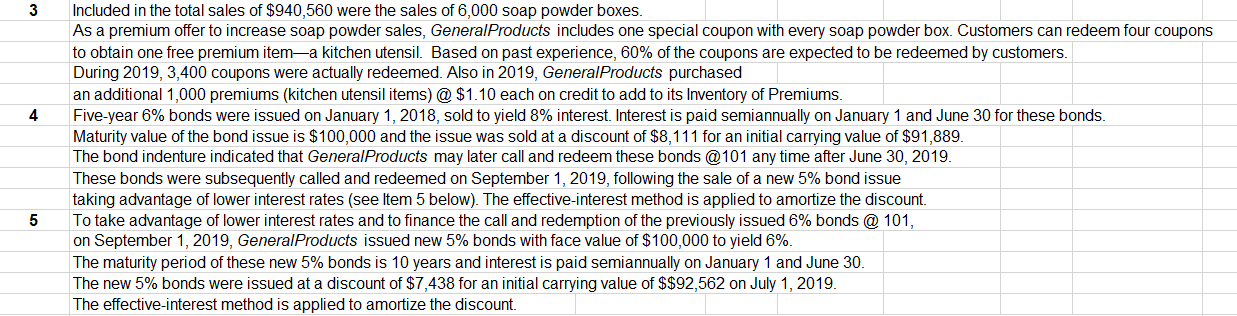

D E F I J K L G H As of December 31, 2018 11,980 20,520 317,060 660 350,220 ASSETS Current Assets Cash Accounts Receivable Inventory Inventory of Premiums (@$1.10 per premium item) Total Current Assets Long-Term Assets Investments Property, Plant, and Equipment (PP&E) 750,000 Less: Accumulated Depreciation (90,000) Total Long-Term Assets Intangible Assets Trademarks Total Assets 66,775 660,000 726,775 190,000 1,266,995 50,722 550 3,000 LIABILITIES Current Liabilities Accounts Payable Liability for Premiums Interest Payable (on 6% Bonds) Total Current Liabilities Long-Term Liabilities 6% Bonds Payable (due 2023) Unamortized Discount on Bonds Payable Total Long-Term Liabilities Total Liabilities 54,272 100,000 (6,732) 93,268 147,540 STOCKHOLDERS' EQUITY Common Stock (150,000 shares authorized, par value $1. 130,000 shares issued and outstanding) 130,000 Paid-in Capital in Excess of Par - Common Stock 954,000 Retained Earnings 35,455 Total Stockholders' Equity 1.119,455 Total Liabilities and Stockholders' Equity 1,266,995 3 4 Included in the total sales of $940,560 were the sales of 6,000 soap powder boxes. As a premium offer to increase soap powder sales, General Products includes one special coupon with every soap powder box. Customers can redeem four coupons to obtain one free premium itema kitchen utensil. Based on past experience, 60% of the coupons are expected to be redeemed by customers. During 2019, 3,400 coupons were actually redeemed. Also in 2019, General Products purchased an additional 1,000 premiums (kitchen utensil items) @ $1.10 each on credit to add to its Inventory of Premiums. Five-year 6% bonds were issued on January 1, 2018, sold to yield 8% interest. Interest is paid semiannually on January 1 and June 30 for these bonds. Maturity value of the bond issue is $100,000 and the issue was sold at a discount of $8,111 for an initial carrying value of $91,889. The bond indenture indicated that General Products may later call and redeem these bonds @101 any time after June 30, 2019. These bonds were subsequently called and redeemed on September 1, 2019, following the sale of a new 5% bond issue taking advantage of lower interest rates (see Item 5 below). The effective-interest method is applied to amortize the discount. To take advantage of lower interest rates and to finance the call and redemption of the previously issued 6% bonds @ 101, on September 1, 2019, General Products issued new 5% bonds with face value of $100,000 to yield 6%. The maturity period of these new 5% bonds is 10 years and interest is paid semiannually on January 1 and June 30. The new 5% bonds were issued at a discount of $7,438 for an initial carrying value of $$92,562 on July 1, 2019. The effective interest method is applied to amortize the discount. 5

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started