Need some help please, there are 3 questions attached;

Question 1:

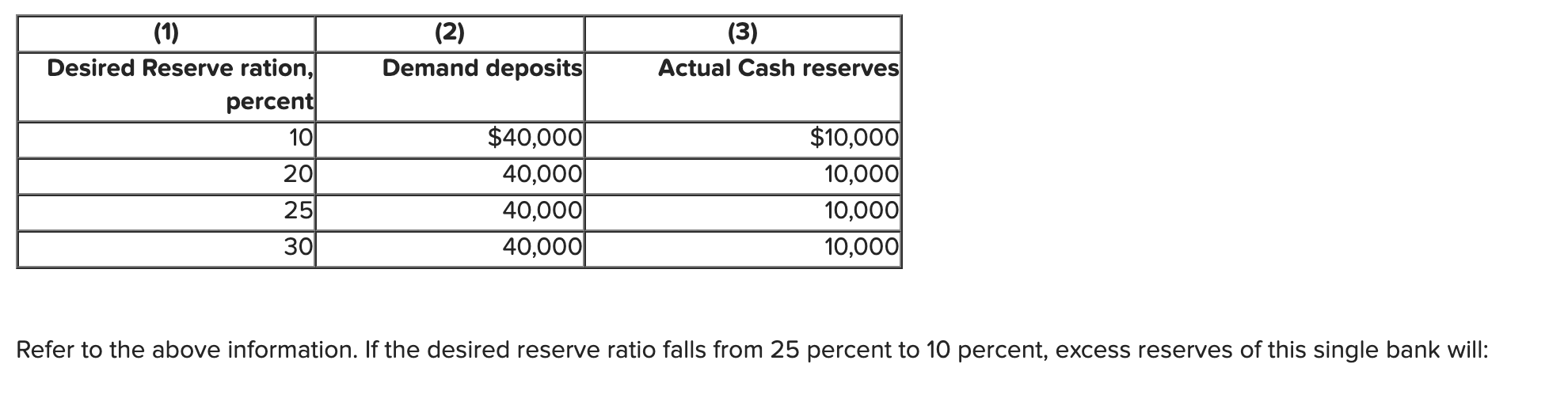

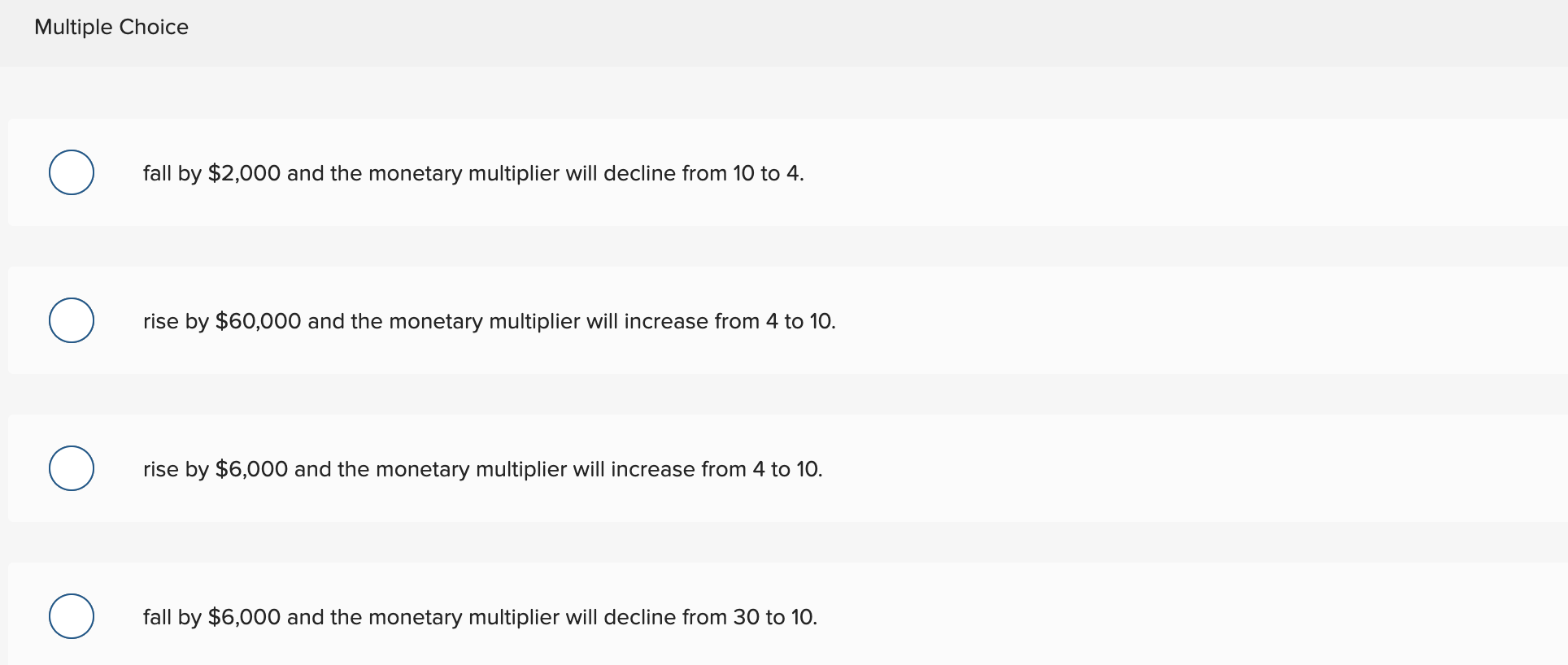

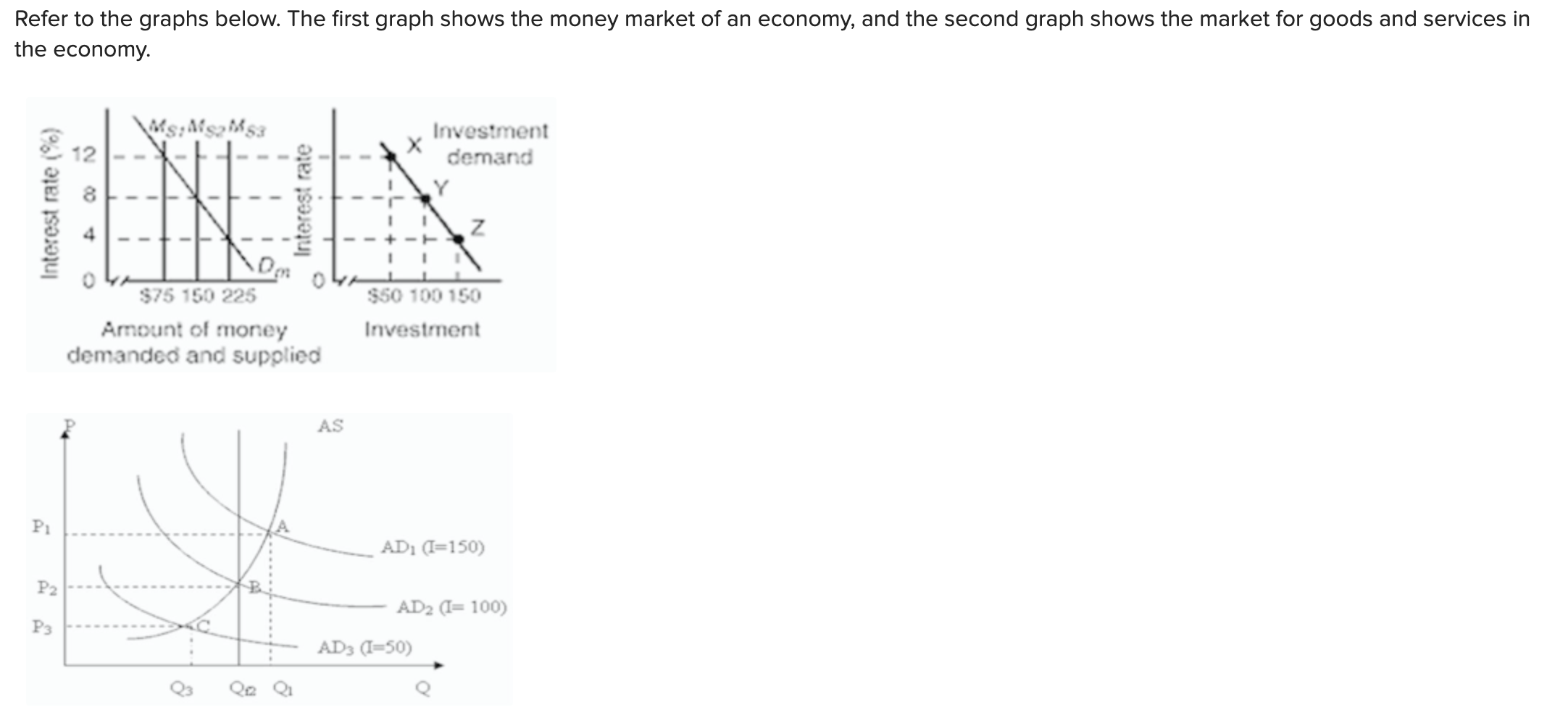

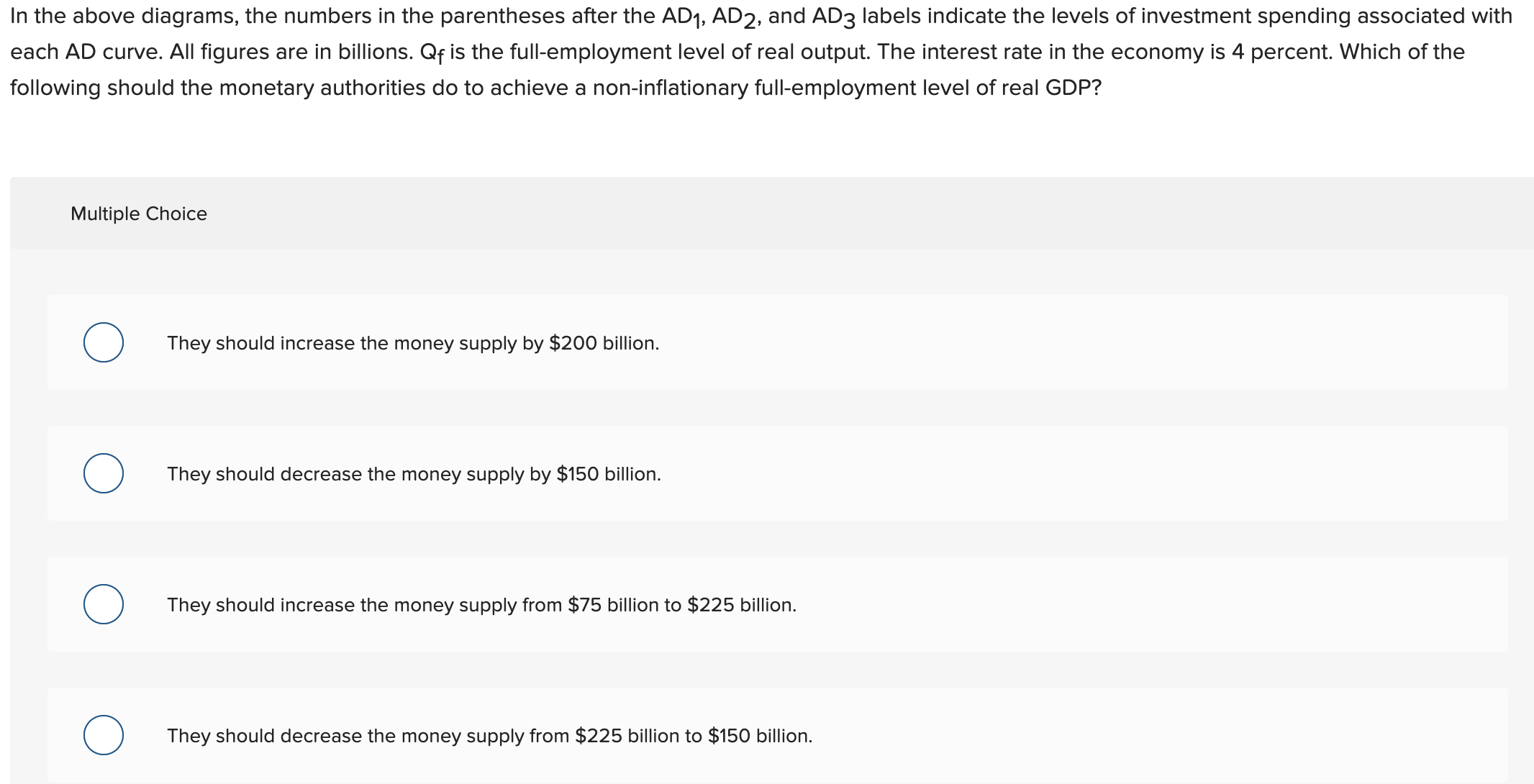

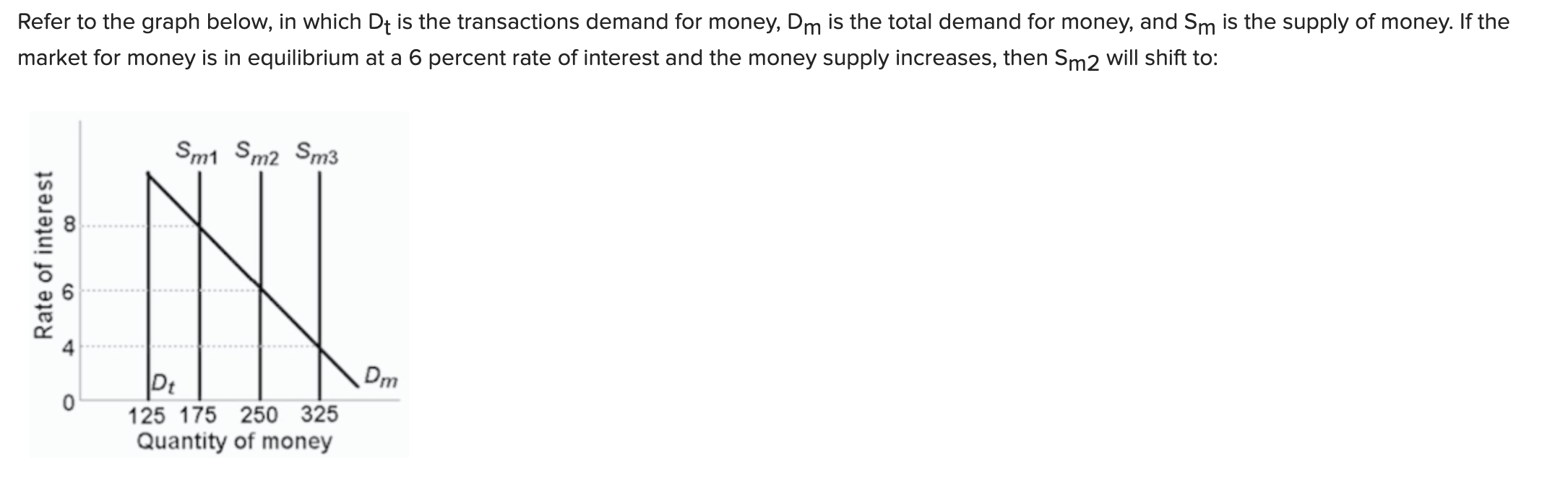

(1) (2) (3) Desired Reserve ration, Demand deposits Actual Cash reserves percent 10 $40,000 $10,000 20 40,000 10,000 25 40,000 10,000 30 40,000 10,000 Refer to the above information. If the desired reserve ratio falls from 25 percent to 10 percent, excess reserves of this single bank will:Multiple Choice O fall by $2,000 and the monetary multiplier will decline from 10 to 4. rise by $60,000 and the monetary multiplier will increase from 4 to 10. rise by $6,000 and the monetary multiplier will increase from 4 to 10. GOO fall by $6,000 and the monetary multiplier will decline from 30 to 10. Refer to the graphs below. The first graph shows the money market of an economy, and the second graph shows the market for goods and services in the economy. Ms: Mis2 1 53 Investment X 12 demand 8 Y Interest rate Interest rate (%) A O Dm $75 150 225 $50 100 150 Amount of money Investment demanded and supplied AS A AD, (I=150) P2 B AD2 (I= 100) P3 AD3 (1=50) Q3 Q2 QIIn the above diagrams, the numbers in the parentheses after the AD1, AD2, and AD3 labels indicate the levels of investment spending associated with each AD curve. All figures are in billions. Qf is the full-employment level of real output. The interest rate in the economy is 4 percent. Which of the following should the monetary authorities do to achieve a non-inflationary full-employment level of real GDP? Multiple Choice 0 They should increase the money supply by $200 billion. 0 They should decrease the money supply by $150 billion. 0 They should increase the money supply from $75 billion to $225 billion. 0 They should decrease the money supply from $225 billion to $150 billion. Refer to the graph below, in which Dt is the transactions demand for money, Dm is the total demand for money, and Sm is the supply of money. If the market for money is in equilibrium at a 6 percent rate of interest and the money supply increases, then Sm2 will shift to: 8 Rate of interest A Dm 0 125 175 250 325 Quantity of moneyMultiple Choice 0 Sm3 and the interest rate will be 4 percent. Sm3 and the interest rate will be 8 percent. 5".\" and the interest rate will be 4 percent. OOO Sm1 and the interest rate will be 8 percent