Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Need some help with part b mainly l am struggle with the t bill only being 3 month do l need to convert it annually

Need some help with part b mainly l am struggle with the t bill only being 3 month do l need to convert it annually

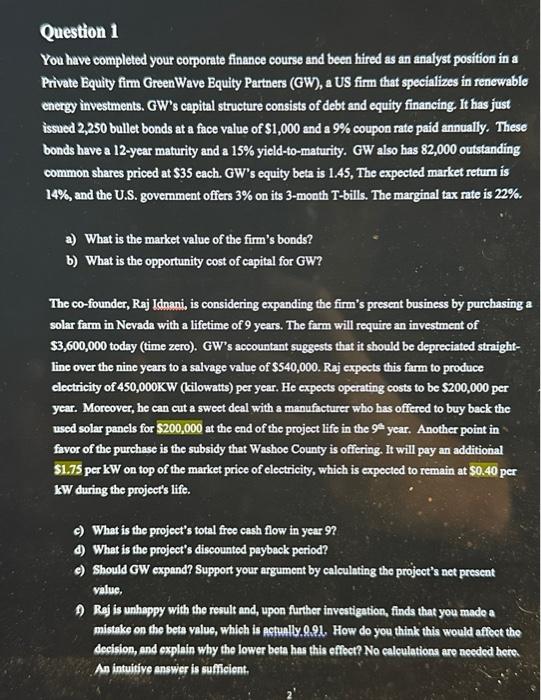

Question 1 You have completed your corporate finance course and been hired as an analyst position in a Private Equity firm GreenWave Equity Partners (GW), a US firm that specializes in renewable energy investments. GW's capital structure consists of debt and equity financing. It has just issued 2,250 bullet bonds at a face value of $1,000 and a 9% coupon rate paid annually. These bonds have a 12-year maturity and a 15% yield-to-maturity. GW also has 82,000 outstanding common shares priced at $35 each. GW's equity beta is 1.45 , The expected market retum is 14%, and the U.S. Bovernment offers 3% on its 3 -month T-bills. The marginal tax nate is 22%. a) What is the market value of the firm's bonds? b) What is the opportunity cost of capital for GW? The co-founder, Raj Idnani, is considering expanding the firm's present business by purchasing a solar farm in Nevada with a lifetime of 9 years. The farm will require an investment of $3,600,000 today (time zero). GW's accountant suggests that it should be depreciated straightline over the nine years to a salvage value of $40,000. Raj expects this farm to produce electricity of 450,000KW (kilowatts) per year. He expects operating costs to be $200,000 per year. Moreover, he can cut a sweet deal with a manufacturer who has offered to buy back the used solar panels for $200,000 at the end of the project life in the 9 year. Another point in favor of the purchase is the subsidy that Washoe County is offering. It will pay an additional $1.75perkW on top of the market price of electricity, which is expected to remain at $0.40 per kW during the project's life. c) What is the project's total free cash flow in year 9? d) What is the project's discounted payback period? e) Should GW expand? Support your argument by calculating the project's net present value, 7) R j is unheppy with the result and, upon further investigation, finds that you made a mistake on the beta value, which is netunlly, 092 . How do you think this would affect the decision, and explain why the lower beta has this effect? No calculations are needed here. An intuitive enswer is suficient. 2

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started