Need some help with this problem.

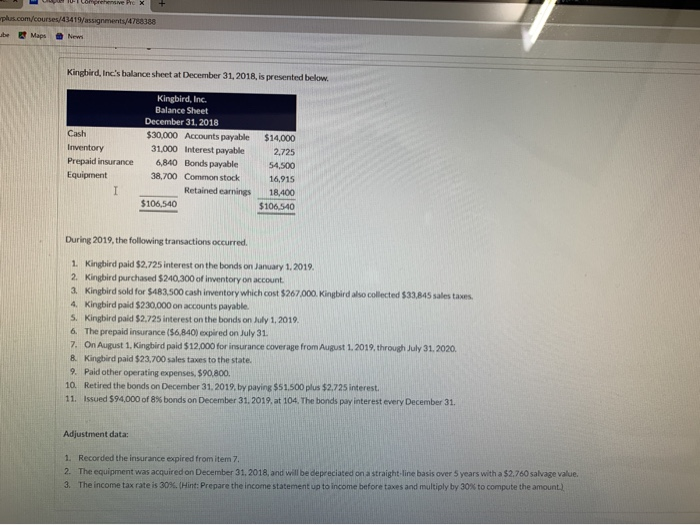

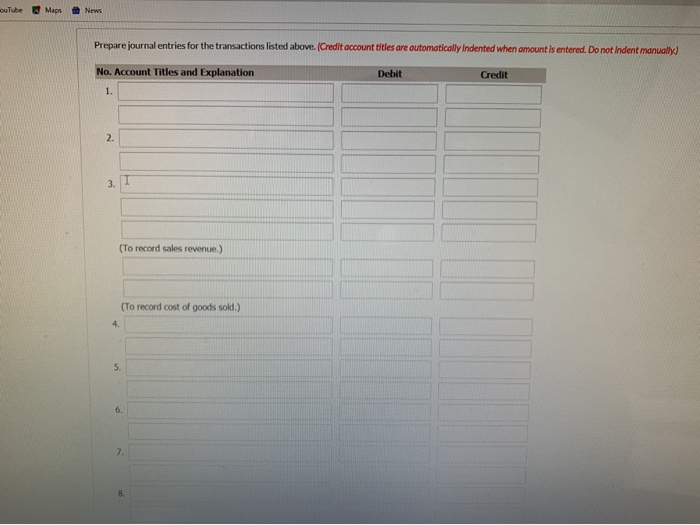

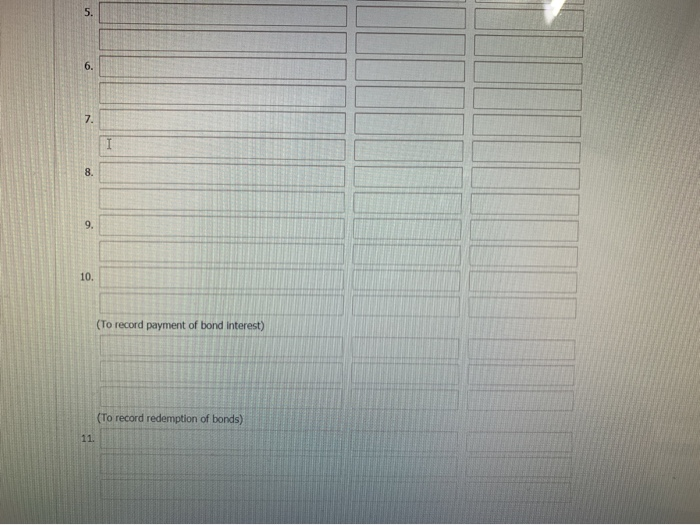

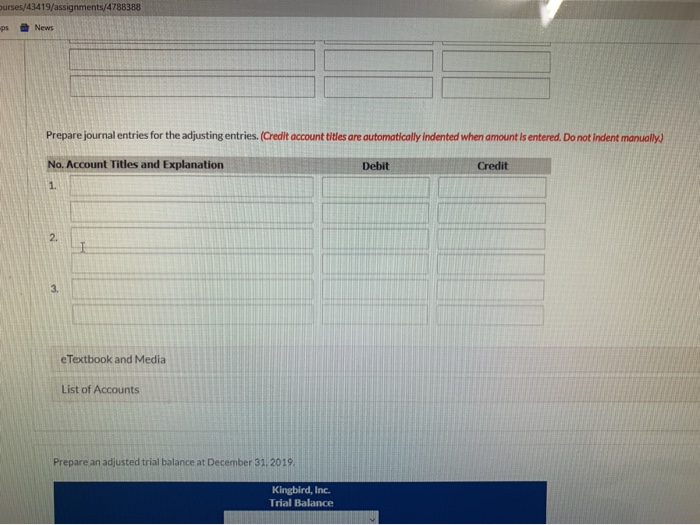

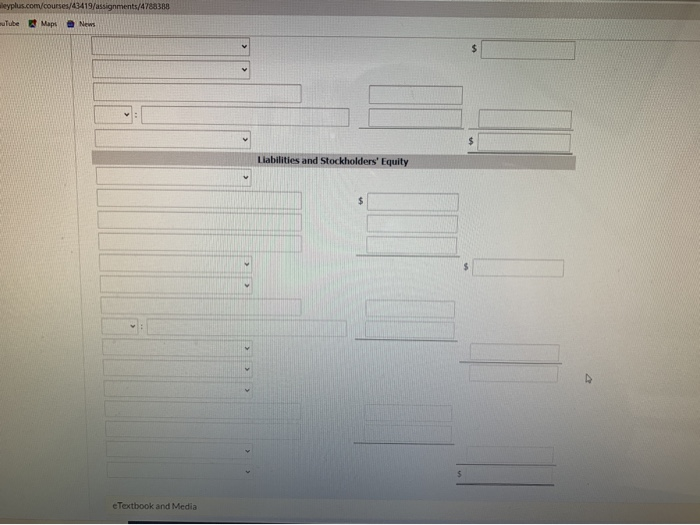

Compree FX plus.com/courses/43419/assignments/4788388 Libe Maps h New Kingbird, Inc.'s balance sheet at December 31, 2018, is presented below. Cash Inventory Prepaid insurance Equipment 1 Kingbird, Inc. Balance Sheet December 31, 2018 $30,000 Accounts payable 31.000 Interest payable 6,840 Bonds payable 38,700 Common stock Retained earnings $106,540 $14,000 2.725 54,500 16,915 18,400 $106.540 During 2019, the following transactions occurred. 1. Kingbird paid $2,725 interest on the bonds on January 1, 2019, 2. Kingbird purchased $240,300 of inventory on account. 3. Kingbird sold for $483,500 cash inventory which cost $267.000. Kingbird also collected $33,845 sales taxes 4. Kingbird paid $230,000 on accounts payable. S. Kingbird paid $2.725 interest on the bonds on July 1, 2019. 6. The prepaid insurance ($6,840) expired on July 31. 7. On August 1, Kingbird paid $12,000 for insurance coverage from August 1, 2019, through July 31, 2020 8. Kingbird paid $23,700 sales taxes to the state. 9. Pald other operating expenses, 590,800. 10. Retired the bonds on December 31, 2019. by paying $51.500 plus $2.725 interest 11. Issued $94,000 of 8% bonds on December 31, 2019. at 104. The bonds pay interest every December 31. Adjustment data: 1. Recorded the insurance expired from item 7. 2. The equipment was acquired on December 31, 2018, and will be depreciated on a straight-line basis over 5 years with a $2.760 salvage value. 3. The income tax rate is 30%. (Hint: Prepare the income statement up to income before taxes and multiply by 30% to compute the amount.) ouTube Maps News Prepare journal entries for the transactions listed above. (Credit account titles are automatically indented when amount is entered. Do not Indent manually) No. Account Titles and Explanation Debit Credit 1. 2. 3. I (To record sales revenue.) (To record cost of goods sold.) 4. 5. 6. 7 8. 5. 6. 7. 8. 9. 10. (To record payment of bond interest) (To record redemption of bonds) 11. urses/43419/assignments/4788388 ps News Prepare journal entries for the adjusting entries. (Credit account titles are automatically Indented when amount is entered. Do not indent manually) No. Account Titles and Explanation Debit Credit 1. 2. I 3. e Textbook and Media List of Accounts Prepare an adjusted trial balance at December 31, 2019 Kingbird, Inc. Trial Balance uTube Maps News Prepare an adjusted trial balance at December 31, 2019. Kingbird, Inc. Trial Balance Debit Credit $ $ I Totals ouTube Maps News Prepare an income statement for the year ending December 31, 2019. Kingbird, Inc. Income Statement $ e Textbook and Media Tube Maps News Prepare a retained earnings statement for the year ending December 31, 2019. (List Items that increase retained earnings first.) Kingbird, Inc. Retained Earnings Statement $ e Textbook and Media List of Accounts Prepare a classified balance sheet as of December 31, 2019. (List current assets in order of liquidity) Kingbird, Inc. Balance Sheet Assets $ eyplus.com/courses/43419/assignments/4788388 wuTube Maps News Liabilities and Stockholders' Equity $ 5 e Textbook and Media