Answered step by step

Verified Expert Solution

Question

1 Approved Answer

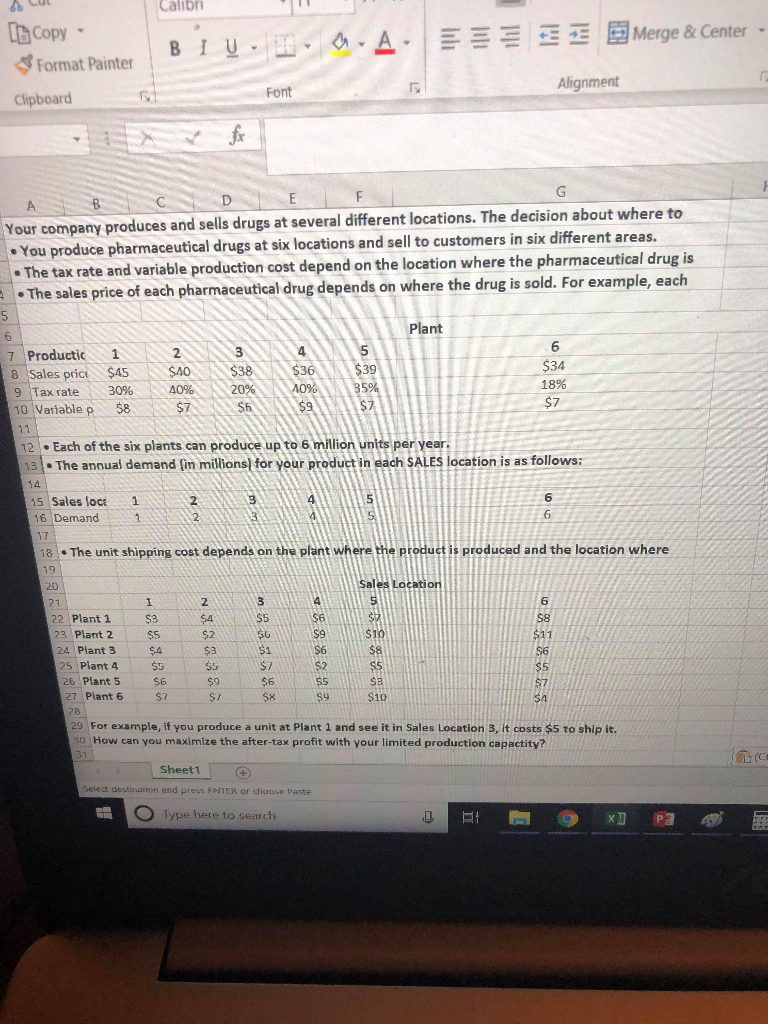

need step by step solution using solver Calibr b Copy Merge & Center Format Painter i B 1--.0-A-| Alignment Font Clipboard Your company produces and

need step by step solution using solver

Calibr b Copy Merge & Center Format Painter i B 1--.0-A-| Alignment Font Clipboard Your company produces and sells drugs at several different locations. The decision about where to You produce pharmaceutical drugs at six locations and sell to customers in six different areas. . The tax rate and variable production cost depend on the location where the pha . The sales price of each pharmaceutical drug depends on where the drug is sold. For example, eac iable production cost depend on the location where the pharmaceutical drug is Plant 6 $34 18% 7.1 Productic 1 2 39 Sales price-S45 30% 58 40% 20% AO%\ \35% 9(Tax rate : 10 Variable p : 2 Each of the six plants can produce up to 6 million units per year 3l The annual demand (im millionsl for your product in each SALES location is as follows: 15 Sales loca1 16 Demand 6 6 2 8 The unit shipping cost depends on the plant where the product is produced and the location where 20 6 22 Plant 1 23 Plant 2 24 Plant 3 25 Plant 4 26 Plant 5 $5 $8 $9 $8 $6 $9$65S 27 Plant 6 $10 29 For example, if you produce a unit at Plant 1 and see it in Sales Location 3, it costs $5 to ship it. 30 How can you maximize the after-tax profit with your limited production capactity? 31 n and press ENTER or choase Paste O Type here to search @ x] PStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started