Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Need the adjusted trial balance (1) Prepare journal entries to record the June 2017 transactions listed on the following page (refer to the chart of

Need the adjusted trial balance

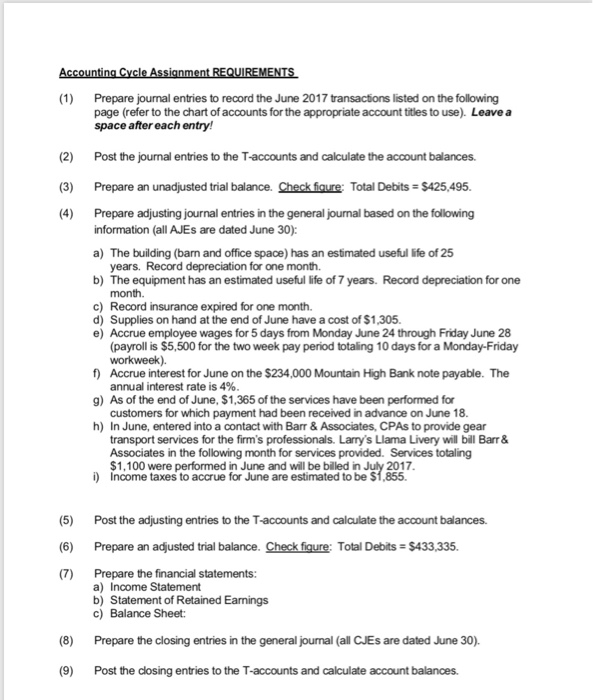

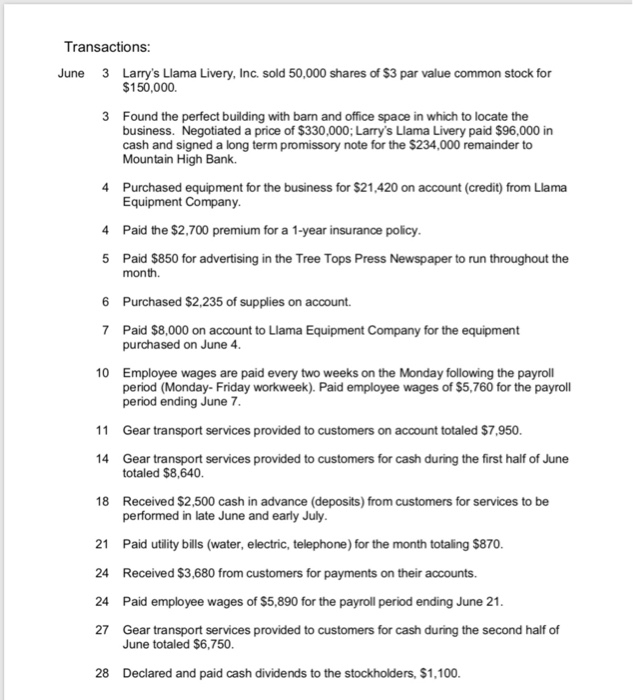

(1) Prepare journal entries to record the June 2017 transactions listed on the following page (refer to the chart of accounts for the appropriate account titles to use). space after each entry! Leavea (2) Post the journal entries to the T-accounts and calculate the account balances (3) Prepare an unadjusted trial balance. Check fiaure: Total Debits $425,495. (4) Prepare adjusting journal entries in the general journal based on the following information (all AJEs are dated June 30): a) The building (barn and office space) has an estimated useful life of 25 years. Record depreciation for one month. b) The equipment has an estimated useful life of 7 years. Record depreciation for one month c) Record insurance expired for one month. d) Supplies on hand at the end of June have a cost of $1,305. e) Accrue employee wages for 5 days from Monday June 24 through Friday June 28 (payroll is $5,500 for the two week pay period totaling 10 days for a Monday-Friday workweek). f) Accrue interest for June on the $234,000 Mountain High Bank note payable. The g) As of the end of June, $1,365 of the services have been performed for h) In June, entered into a contact with Barr &Associates, CPAs to provide gear annual interest rate is 4% customers for which payment had been received in advance on June 18. transport services for the firm's professionals. Larry's Llama Livery will bill Barr& Associates in the following month for services provided. Services totaling $1,100 were performed in June and will be billed in July 2017 i Income taxes to accrue for June are estimated to be $1,855. (5) (6) (7) Post the adjusting entries to the T-accounts and calculate the account balances. Prepare an adjusted trial balance. Check figure: Total Debits $433,335. Prepare the financial statements: a) Income Statement b) Statement of Retained Eanings c) Balance Sheet: (8) Prepare the closing entries in the general journal (all CJEs are dated June 30). (9) Post the closing entries to the T-accounts and calculate account balances

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started