Answered step by step

Verified Expert Solution

Question

1 Approved Answer

need the ans asap Thank you Question 10 5 points On January 1, 2016. Hanson Inc purchased 4.000 voting shares out of Marvinno's 90,000 tarde

need the ans asap

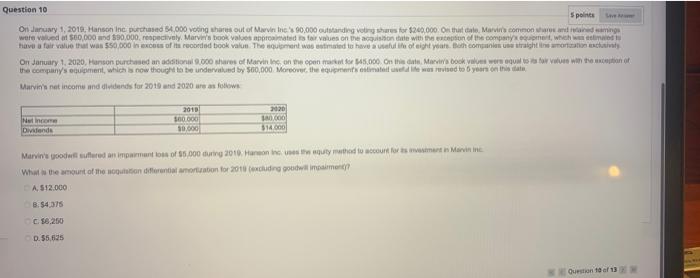

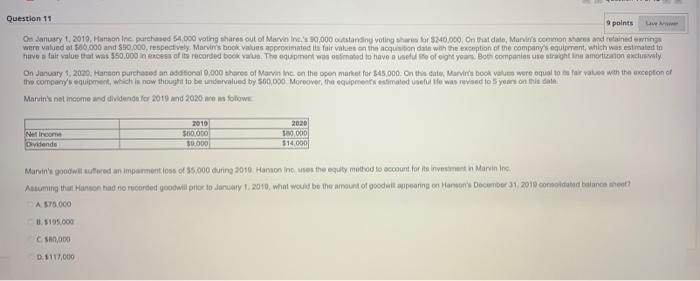

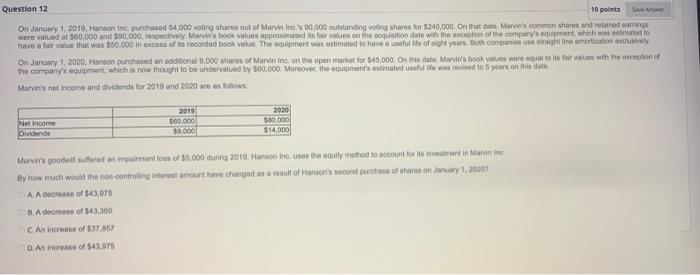

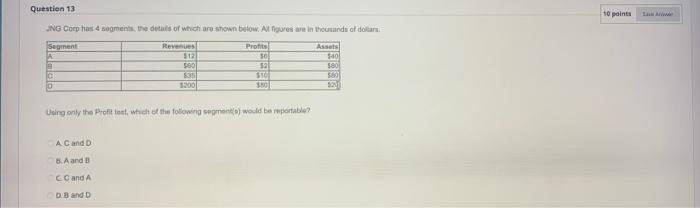

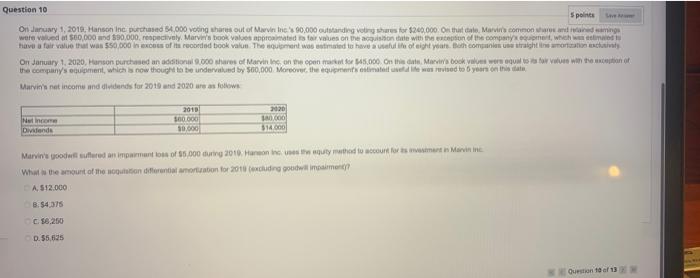

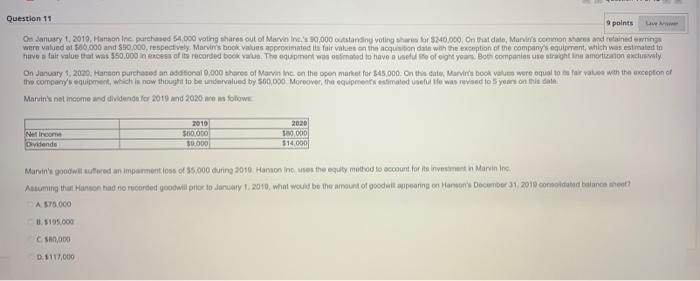

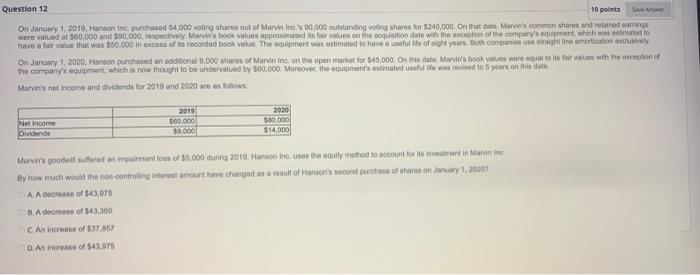

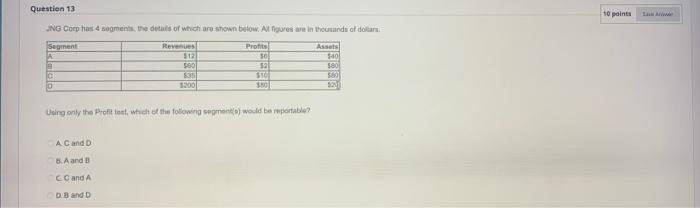

Question 10 5 points On January 1, 2016. Hanson Inc purchased 4.000 voting shares out of Marvinno's 90,000 tarde votre shares for $200.000. On that date. Marvis common naming were value of $60,000 and $90,000, respectively. Marvin's book values appointed for values on the countle with son of the companyamet, with wou have a fair value that was 550.000 in us of the recorded book valon The Quiment was said to have a life of eight years. Both comes a right noch On January 1, 2020, Manson purchased an additional cores of Marvinne, on the open 8.000. On the Maw ook values were equal to win the con the company's equipment, which is now thought to be undervalued by 500,000 Moreover, the estimate was revised to 6 years on this Marvin's net income and dividends for 2019 and 2020 are as follows 2010 S600 income Dividende 2020 co 314600 50.000 Marvine vooder fred an important ton of 15,000 during 2016. Haron este equity method to account for is rart Marine What the amount of the solution differential amoration for 2016 excludragowa mame A, 512.000 B.54,375 C. 56.250 D. 55,625 Question of 13 Creme Question 11 9 points On January 1, 2010. naon Inc. purchased 54.000 voting shares out of Marvel's 90.000 outstanding voting of M0,000. On that date, Manis commons and retained ning were valued at $66.000 and $80.000, respectively. Marvin's book values approximated its fair values on the acquisition date with the exception of the company's equipment, which was estimated in have a fait value that was 550.000 in aces of its recorded book van The equipment was moted to have use of contyon. Bon companies are straight in amortizery On January 5, 2000, anton purchased an additional 0,000 spare of Marvin in on the open market for $45.000. On this date, Marvine book values were equal to for you with the exception of the company's equipment, which is now thought to be undervalued by 500,000 Moreover, the equipments estimated neue was revised to 5 years on this dat Marvin's net income and dividende for 2019 and 2020 fotowe Netcom Dividende 2010 Soooo SOOD 2020 10 000 514,000 Marvin' goodwill suffered an impormentions of 35.000 during 2010 Hannine was the equity method to account for its inement Marvin Inc. Asuming thu Hanson had to corded goodwill prior to doory 1, 2010, what would be the amount of goodwill appearing on Mon December 31 2018 comoldead balance ? A 375.000 0.5195.000 C,000 0.1117,000 Question 12 10 points On January 1, 2010, Hanson Inc. purchased 54.000 voting shares out of Marvin in 10.000 standing voting shares for $240,000. On that date Marvis common shan and stained eam were valued at $60,000 and 100,000, respectively. Marvel's book values approximated far is in the susition date with the exception of the company's nument which was inated to have a faire that won 550.000 in exces of its recorded book value. The equipment was stimuled to have a life of eight your own come to tight line moration On January 1, 2020, Harson purchased and on 0,000 shares of Marvin in on the open market for 545,000. Ons dat Marvis book values wire que to its for win the phone the company's equipment which is now thought to be undervalued by 500,000. Moreover, the equipments estimated selle was revised 10 years on this data Marvin's net income and dividends for 2019 and 2020 are folows Ner income Dividende 2015 SOD.000 38.000 2020 580,000 614,000 Marvin' goodwill suffered an impairments of $5.000 during 2010. Hennes the equity method to account for its were in Marvining By how much we non controlling interest amount have changed romult of Hanion' on chase of shares ondary 1.2007 A Ace of 543,075 B. A den of 543,050 An increase of $37.57 D.An increase of 543,075 Question 13 10 points JNG Corp has 4 segments, the details of which are shown below. Al figures are in thousands of dollar Segment Reves Profit Assets 512 30 $40 $80 sa 580 $35 STO 0 1200 Using only the Profit tout, which of the following segment would be portable? A Cand 8. A and B CC and A 0.3 and D Thank you

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started