NEED THE ANSWER ASAP!!

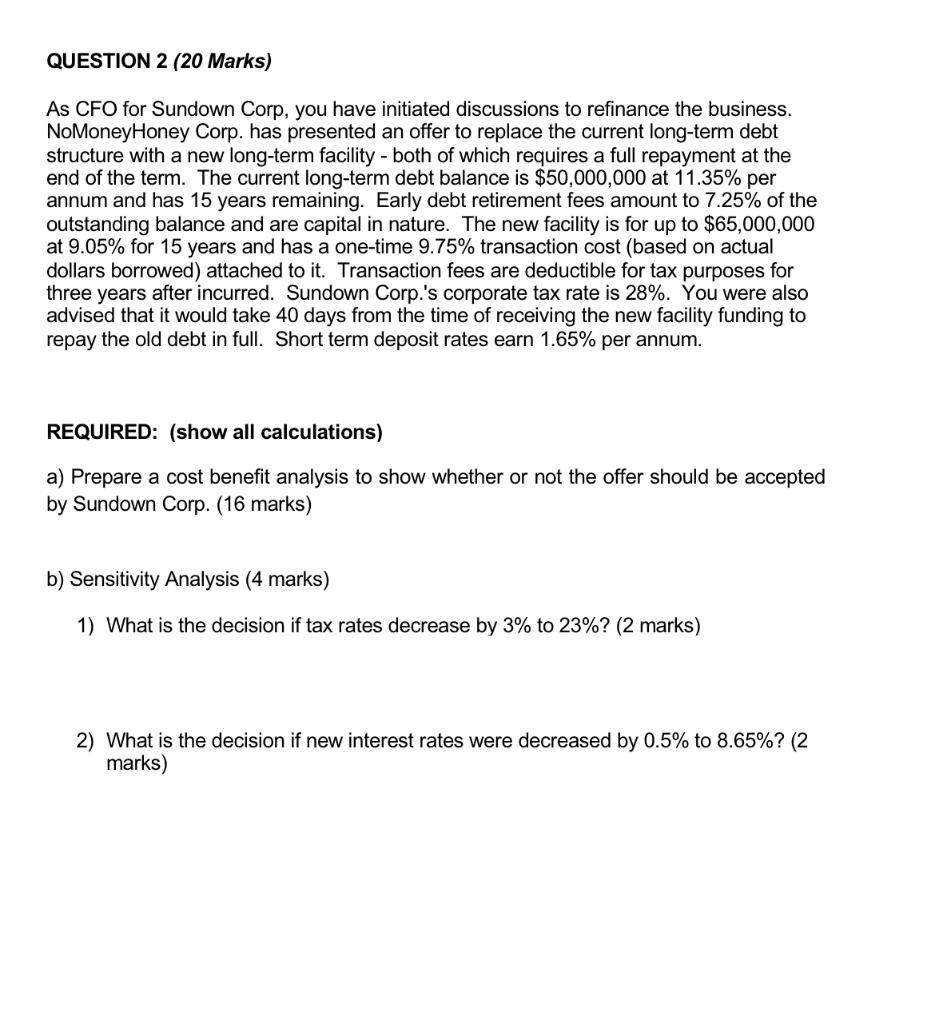

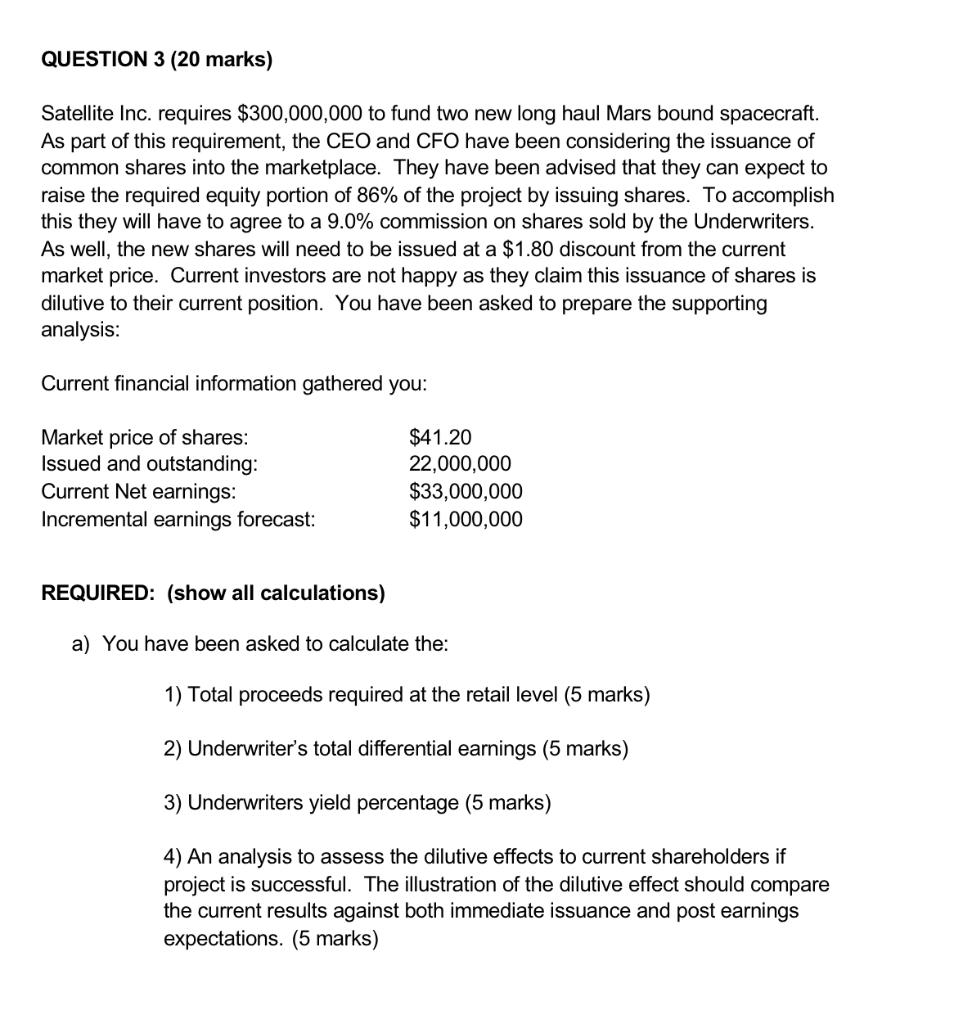

QUESTION 1 (20 Marks) Chowdown Inc. is assessing the construction of a new food processing plant. To date $0.75 million has been spent to identify this option. The construction and commissioning cost of this facility is $12,800,000, with an additional capital expenditure for equipment of $1,000,000 required at the end of year 3 and $1,500,000 is required at the end of year 9. The useful life of the facility to Chowdown Inc. is expected to be 11 years however the Company expects to be relocating all operations offshore in December of fiscal year 8 in an all out effort to lower cost operations. A one-time permanent working capital investment is required for primarily inventory and is forecast to be $450,000 during Year 4 of the project's operations. The terminal value of the facility is expected to be $2,250,000 after selling costs and on an after tax basis. Pre-tax operating cash flows for the entire operation are expected to be $3,700,000 for Year 1, $3,800,000 for Year 2, $3,700,000 for Year 3, $3,600,000 for Year 4, $4,000,000 for Years 5 and 6, $3,200,000 for Years 7 and $2,600,000 thereafter. Cost savings arising from a special partially recoverable tax incentive are estimated to be $100,000 for each year 1 through 5 at which time the special incentive ends. This special tax incentive is partially recovered by the government as it is by treated as taxable income Chowdown Inc. has a corporate tax rate of 24%, and its current cost of capital is 12%. A risk adjustment of 3% is considered appropriate. REQUIRED: (Show all work) a) Calculate the net present value of the manufacturing facility project. (15 marks) b) Should the project proceed - why? Is the IRR higher or lower? (2 marks) - c) What is the undiscounted payback? (3 marks) QUESTION 2 (20 Marks) As CFO for Sundown Corp, you have initiated discussions to refinance the business. NoMoneyHoney Corp. has presented an offer to replace the current long-term debt structure with a new long-term facility - both of which requires a full repayment at the end of the term. The current long-term debt balance is $50,000,000 at 11.35% per annum and has 15 years remaining. Early debt retirement fees amount to 7.25% of the outstanding balance and are capital in nature. The new facility is for up to $65,000,000 at 9.05% for 15 years and has a one-time 9.75% transaction cost (based on actual dollars borrowed) attached to it. Transaction fees are deductible for tax purposes for three years after incurred. Sundown Corp.'s corporate tax rate is 28%. You were also advised that it would take 40 days from the time of receiving the new facility funding to repay the old debt in full. Short term deposit rates earn 1.65% per annum. REQUIRED: (show all calculations) a) Prepare a cost benefit analysis to show whether or not the offer should be accepted by Sundown Corp. (16 marks) b) Sensitivity Analysis (4 marks) 1) What is the decision if tax rates decrease by 3% to 23%? (2 marks) 2) What is the decision if new interest rates were decreased by 0.5% to 8.65%? (2 marks) QUESTION 3 (20 marks) Satellite Inc. requires $300,000,000 to fund two new long haul Mars bound spacecraft. As part of this requirement, the CEO and CFO have been considering the issuance of common shares into the marketplace. They have been advised that they can expect to raise the required equity portion of 86% of the project by issuing shares. To accomplish this they will have to agree to a 9.0% commission on shares sold by the Underwriters. As well, the new shares will need to be issued at a $1.80 discount from the current market price. Current investors are not happy as they claim this issuance of shares is dilutive to their current position. You have been asked to prepare the supporting analysis: Current financial information gathered you: Market price of shares: Issued and outstanding: Current Net earnings: Incremental earnings forecast: $41.20 22,000,000 $33,000,000 $11,000,000 REQUIRED: (show all calculations) a) You have been asked to calculate the: 1) Total proceeds required at the retail level (5 marks) 2) Underwriter's total differential earnings (5 marks) 3) Underwriters yield percentage (5 marks) 4) An analysis to assess the dilutive effects to current shareholders if project is successful. The illustration of the dilutive effect should compare the current results against both immediate issuance and post earnings expectations. (5 marks) QUESTION 1 (20 Marks) Chowdown Inc. is assessing the construction of a new food processing plant. To date $0.75 million has been spent to identify this option. The construction and commissioning cost of this facility is $12,800,000, with an additional capital expenditure for equipment of $1,000,000 required at the end of year 3 and $1,500,000 is required at the end of year 9. The useful life of the facility to Chowdown Inc. is expected to be 11 years however the Company expects to be relocating all operations offshore in December of fiscal year 8 in an all out effort to lower cost operations. A one-time permanent working capital investment is required for primarily inventory and is forecast to be $450,000 during Year 4 of the project's operations. The terminal value of the facility is expected to be $2,250,000 after selling costs and on an after tax basis. Pre-tax operating cash flows for the entire operation are expected to be $3,700,000 for Year 1, $3,800,000 for Year 2, $3,700,000 for Year 3, $3,600,000 for Year 4, $4,000,000 for Years 5 and 6, $3,200,000 for Years 7 and $2,600,000 thereafter. Cost savings arising from a special partially recoverable tax incentive are estimated to be $100,000 for each year 1 through 5 at which time the special incentive ends. This special tax incentive is partially recovered by the government as it is by treated as taxable income Chowdown Inc. has a corporate tax rate of 24%, and its current cost of capital is 12%. A risk adjustment of 3% is considered appropriate. REQUIRED: (Show all work) a) Calculate the net present value of the manufacturing facility project. (15 marks) b) Should the project proceed - why? Is the IRR higher or lower? (2 marks) - c) What is the undiscounted payback? (3 marks) QUESTION 2 (20 Marks) As CFO for Sundown Corp, you have initiated discussions to refinance the business. NoMoneyHoney Corp. has presented an offer to replace the current long-term debt structure with a new long-term facility - both of which requires a full repayment at the end of the term. The current long-term debt balance is $50,000,000 at 11.35% per annum and has 15 years remaining. Early debt retirement fees amount to 7.25% of the outstanding balance and are capital in nature. The new facility is for up to $65,000,000 at 9.05% for 15 years and has a one-time 9.75% transaction cost (based on actual dollars borrowed) attached to it. Transaction fees are deductible for tax purposes for three years after incurred. Sundown Corp.'s corporate tax rate is 28%. You were also advised that it would take 40 days from the time of receiving the new facility funding to repay the old debt in full. Short term deposit rates earn 1.65% per annum. REQUIRED: (show all calculations) a) Prepare a cost benefit analysis to show whether or not the offer should be accepted by Sundown Corp. (16 marks) b) Sensitivity Analysis (4 marks) 1) What is the decision if tax rates decrease by 3% to 23%? (2 marks) 2) What is the decision if new interest rates were decreased by 0.5% to 8.65%? (2 marks) QUESTION 3 (20 marks) Satellite Inc. requires $300,000,000 to fund two new long haul Mars bound spacecraft. As part of this requirement, the CEO and CFO have been considering the issuance of common shares into the marketplace. They have been advised that they can expect to raise the required equity portion of 86% of the project by issuing shares. To accomplish this they will have to agree to a 9.0% commission on shares sold by the Underwriters. As well, the new shares will need to be issued at a $1.80 discount from the current market price. Current investors are not happy as they claim this issuance of shares is dilutive to their current position. You have been asked to prepare the supporting analysis: Current financial information gathered you: Market price of shares: Issued and outstanding: Current Net earnings: Incremental earnings forecast: $41.20 22,000,000 $33,000,000 $11,000,000 REQUIRED: (show all calculations) a) You have been asked to calculate the: 1) Total proceeds required at the retail level (5 marks) 2) Underwriter's total differential earnings (5 marks) 3) Underwriters yield percentage (5 marks) 4) An analysis to assess the dilutive effects to current shareholders if project is successful. The illustration of the dilutive effect should compare the current results against both immediate issuance and post earnings expectations