Need the answers right now!!. Please help!!!

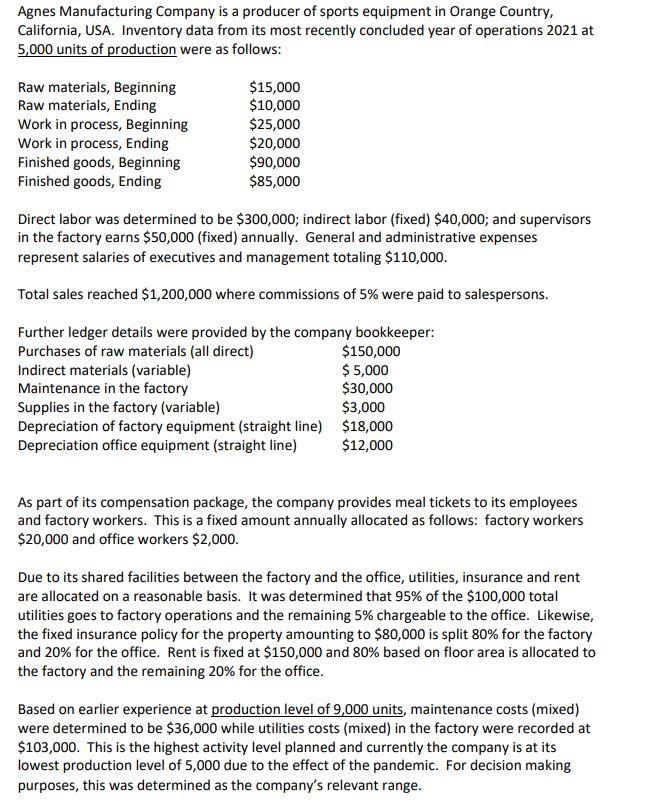

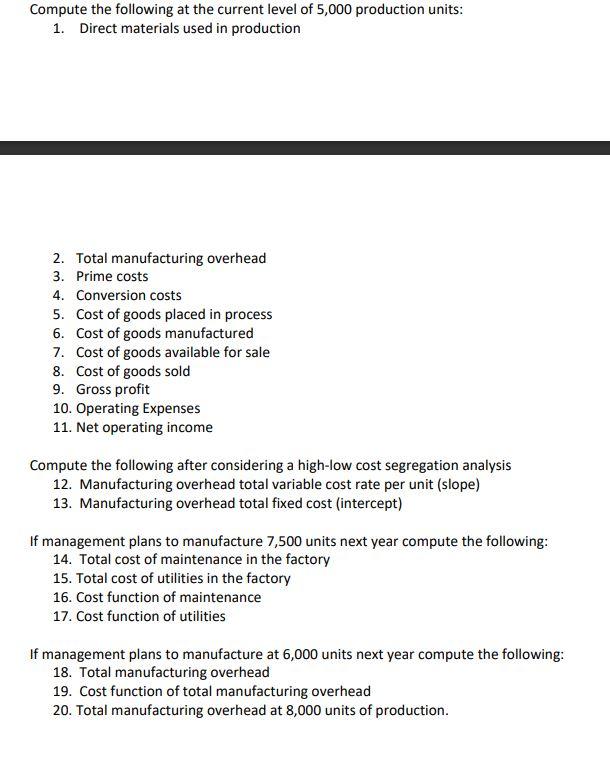

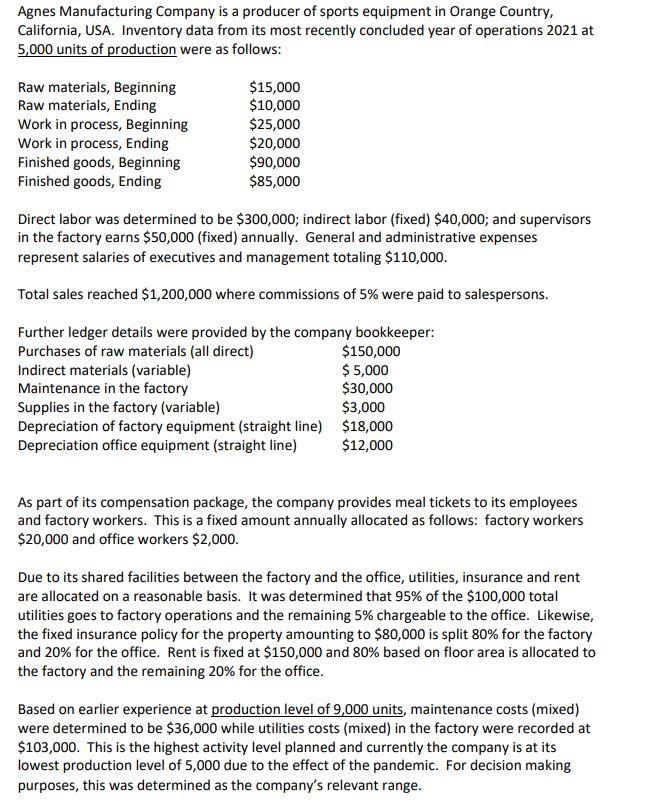

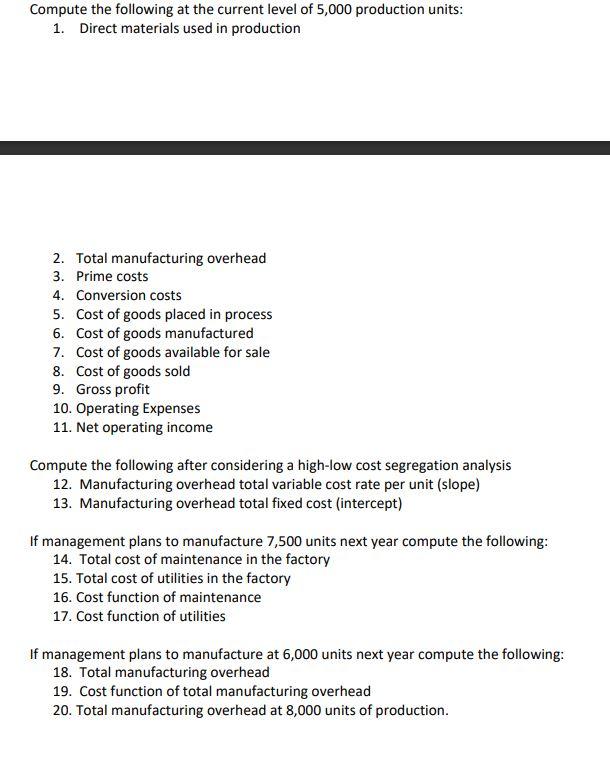

Agnes Manufacturing Company is a producer of sports equipment in Orange Country, California, USA. Inventory data from its most recently concluded year of operations 2021 at 5,000 units of production were as follows: Raw materials, Beginning Raw materials, Ending Work in process, Beginning Work in process, Ending Finished goods, Beginning Finished goods, Ending $15,000 $10,000 $25,000 $20,000 $90,000 $85,000 Direct labor was determined to be $300,000; indirect labor (fixed) $40,000; and supervisors in the factory earns $50,000 (fixed) annually. General and administrative expenses represent salaries of executives and management totaling $110,000. Total sales reached $1,200,000 where commissions of 5% were paid to salespersons. Further ledger details were provided by the company bookkeeper: Purchases of raw materials (all direct) Indirect materials (variable) Maintenance in the factory Supplies in the factory (variable) Depreciation of factory equipment (straight line) Depreciation office equipment (straight line) $150,000 $ 5,000 $30,000 $3,000 $18,000 $12,000 As part of its compensation package, the company provides meal tickets to its employees and factory workers. This is a fixed amount annually allocated as follows: factory workers $20,000 and office workers $2,000. Due to its shared facilities between the factory and the office, utilities, insurance and rent are allocated on a reasonable basis. It was determined that 95% of the $100,000 total utilities goes to factory operations and the remaining 5% chargeable to the office. Likewise, the fixed insurance policy for the property amounting to $80,000 is split 80% for the factory and 20% for the office. Rent is fixed at $150,000 and 80% based on floor area is allocated to the factory and the remaining 20% for the office. Based on earlier experience at production level of 9,000 units, maintenance costs (mixed) were determined to be $36,000 while utilities costs (mixed) in the factory were recorded at $103,000. This is the highest activity level planned and currently the company is at its lowest production level of 5,000 due to the effect of the pandemic. For decision making purposes, this was determined as the company's relevant range. Compute the following at the current level of 5,000 production units: 1. Direct materials used in production 2. Total manufacturing overhead 3. Prime costs 4. Conversion costs 5. Cost of goods placed in process 6. Cost of goods manufactured 7. Cost of goods available for sale 8. Cost of goods sold 9. Gross profit 10. Operating Expenses 11. Net operating income Compute the following after considering a high-low cost segregation analysis 12. Manufacturing overhead total variable cost rate per unit (slope) 13. Manufacturing overhead total fixed cost (intercept) If management plans to manufacture 7,500 units next year compute the following: 14. Total cost of maintenance in the factory 15. Total cost of utilities in the factory 16. Cost function of maintenance 17. Cost function of utilities If management plans to manufacture at 6,000 units next year compute the following: 18. Total manufacturing overhead 19. Cost function of total manufacturing overhead 20. Total manufacturing overhead at 8,000 units of production. Agnes Manufacturing Company is a producer of sports equipment in Orange Country, California, USA. Inventory data from its most recently concluded year of operations 2021 at 5,000 units of production were as follows: Raw materials, Beginning Raw materials, Ending Work in process, Beginning Work in process, Ending Finished goods, Beginning Finished goods, Ending $15,000 $10,000 $25,000 $20,000 $90,000 $85,000 Direct labor was determined to be $300,000; indirect labor (fixed) $40,000; and supervisors in the factory earns $50,000 (fixed) annually. General and administrative expenses represent salaries of executives and management totaling $110,000. Total sales reached $1,200,000 where commissions of 5% were paid to salespersons. Further ledger details were provided by the company bookkeeper: Purchases of raw materials (all direct) Indirect materials (variable) Maintenance in the factory Supplies in the factory (variable) Depreciation of factory equipment (straight line) Depreciation office equipment (straight line) $150,000 $ 5,000 $30,000 $3,000 $18,000 $12,000 As part of its compensation package, the company provides meal tickets to its employees and factory workers. This is a fixed amount annually allocated as follows: factory workers $20,000 and office workers $2,000. Due to its shared facilities between the factory and the office, utilities, insurance and rent are allocated on a reasonable basis. It was determined that 95% of the $100,000 total utilities goes to factory operations and the remaining 5% chargeable to the office. Likewise, the fixed insurance policy for the property amounting to $80,000 is split 80% for the factory and 20% for the office. Rent is fixed at $150,000 and 80% based on floor area is allocated to the factory and the remaining 20% for the office. Based on earlier experience at production level of 9,000 units, maintenance costs (mixed) were determined to be $36,000 while utilities costs (mixed) in the factory were recorded at $103,000. This is the highest activity level planned and currently the company is at its lowest production level of 5,000 due to the effect of the pandemic. For decision making purposes, this was determined as the company's relevant range. Compute the following at the current level of 5,000 production units: 1. Direct materials used in production 2. Total manufacturing overhead 3. Prime costs 4. Conversion costs 5. Cost of goods placed in process 6. Cost of goods manufactured 7. Cost of goods available for sale 8. Cost of goods sold 9. Gross profit 10. Operating Expenses 11. Net operating income Compute the following after considering a high-low cost segregation analysis 12. Manufacturing overhead total variable cost rate per unit (slope) 13. Manufacturing overhead total fixed cost (intercept) If management plans to manufacture 7,500 units next year compute the following: 14. Total cost of maintenance in the factory 15. Total cost of utilities in the factory 16. Cost function of maintenance 17. Cost function of utilities If management plans to manufacture at 6,000 units next year compute the following: 18. Total manufacturing overhead 19. Cost function of total manufacturing overhead 20. Total manufacturing overhead at 8,000 units of production