Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Need the answers to both the parts. No partial answer will be accepted. This is a two period certainty model problem. Assume that William Brown

Need the answers to both the parts. No partial answer will be accepted.

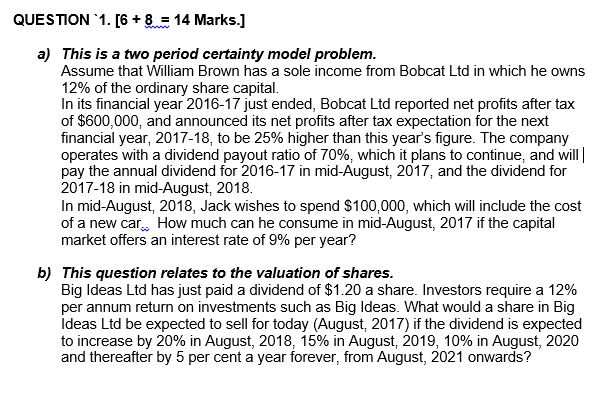

This is a two period certainty model problem. Assume that William Brown has a sole income from Bobcat Ltd in which he owns 12% of the ordinary share capital. In its financial year 2016-17 just ended, Bobcat Ltd reported net profits after tax of $600, 000, and announced its net profits after tax expectation for the next financial year, 2017-18, to be 25% higher than this year's figure. The company operates with a dividend payout ratio of 70%, which it plans to continue, and will pay the annual dividend for 2016-17 in mid-August, 2017, and the dividend for 2017-18 in mid-August, 2018. In mid-August, 2018, Jack wishes to spend $100, 000, which will include the cost of a new car. How much can he consume in mid-August, 2017 if the capital market offers an interest rate of 9% per year? This question relates to the valuation of shares. Big Ideas Ltd has just paid a dividend of $1.20 a share. Investors require a 12% per annum return on investments such as Big Ideas. What would a share in Big Ideas Ltd be expected to sell for today (August, 2017) if the dividend is expected to increase by 20% in August, 2018, 15% in August, 2019, 10% in August, 2020 and thereafter by 5 per cent a year forever, from August, 2021 onwards

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started