Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Need the cash flow begin{tabular}{l|r|} hline multicolumn{1}{|c|}{ S Savor Bites Inc } & C hline multicolumn{1}{|c|}{ Retained Earnings Statement } hline For the

Need the cash flow

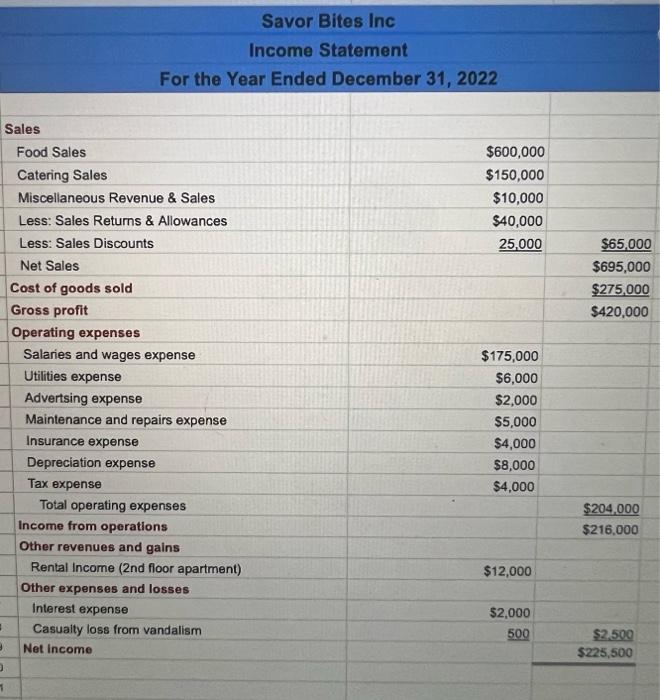

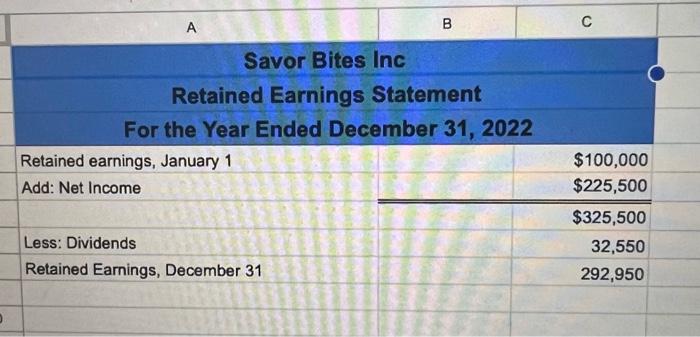

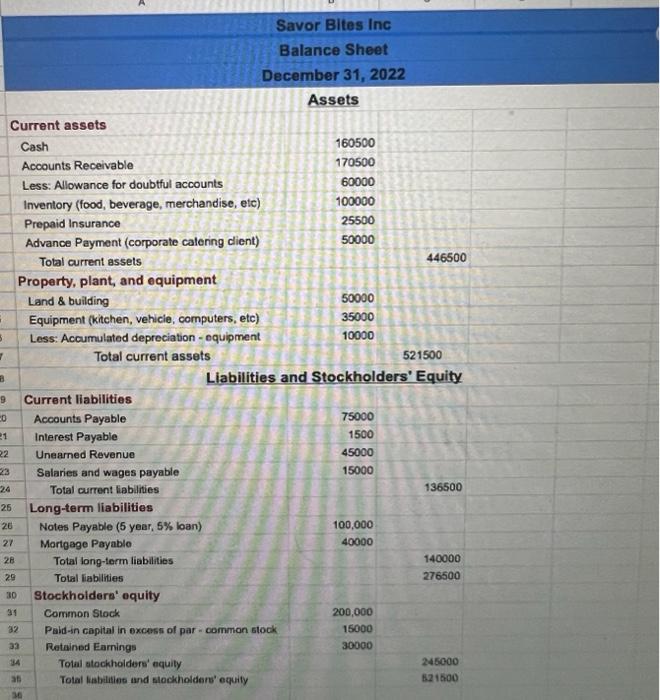

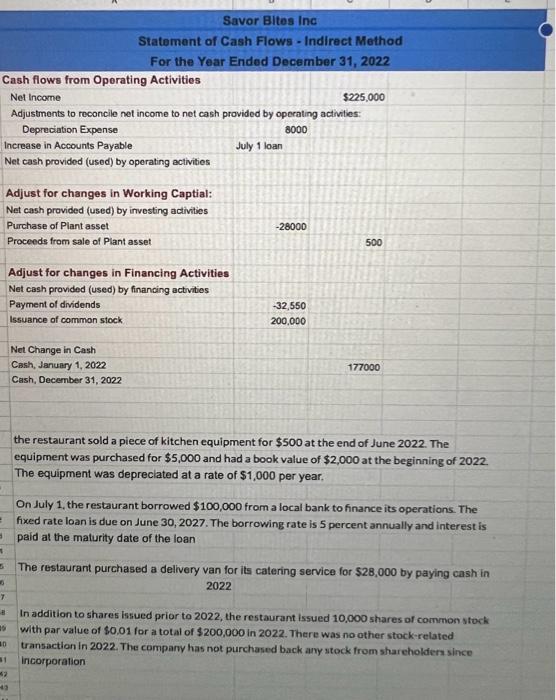

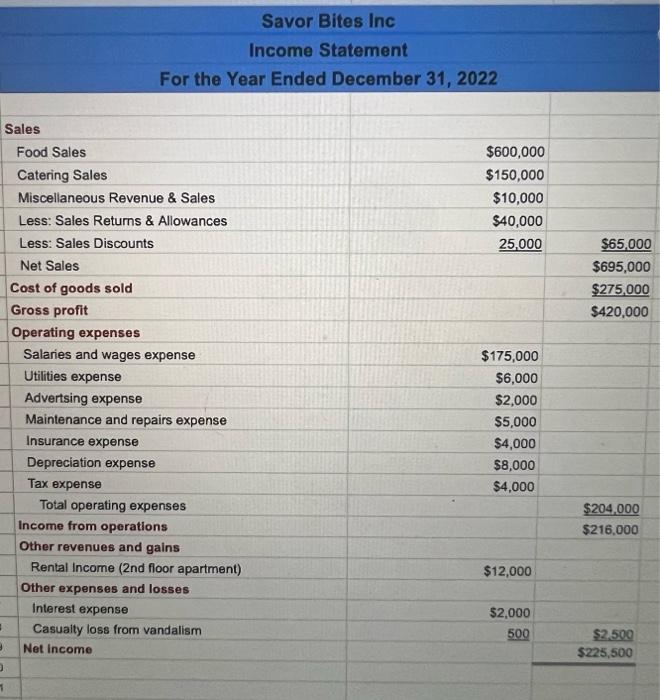

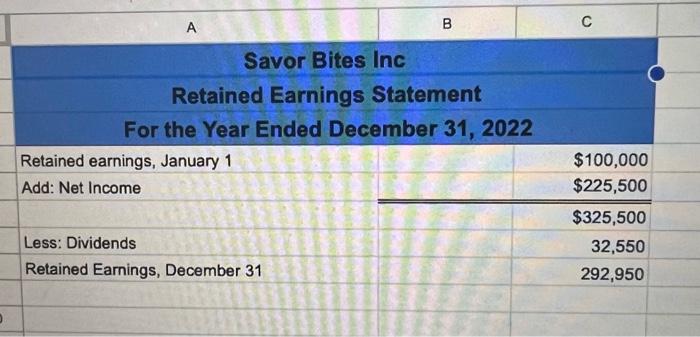

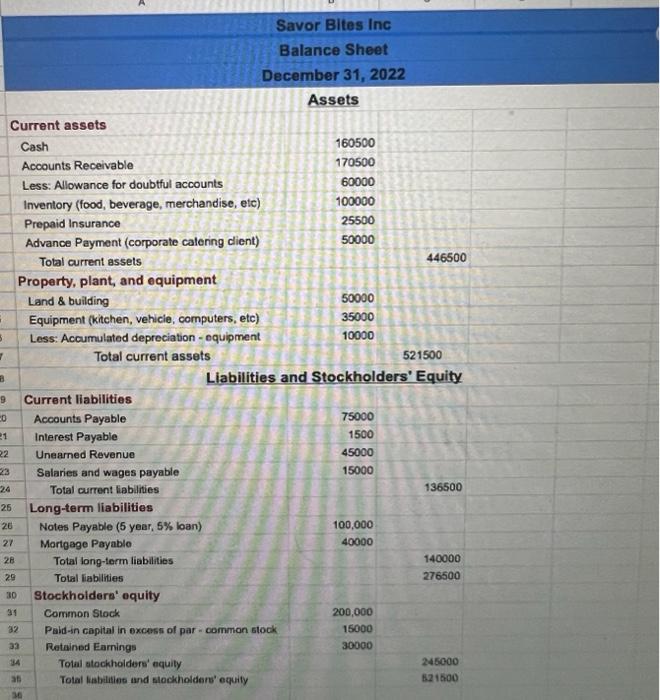

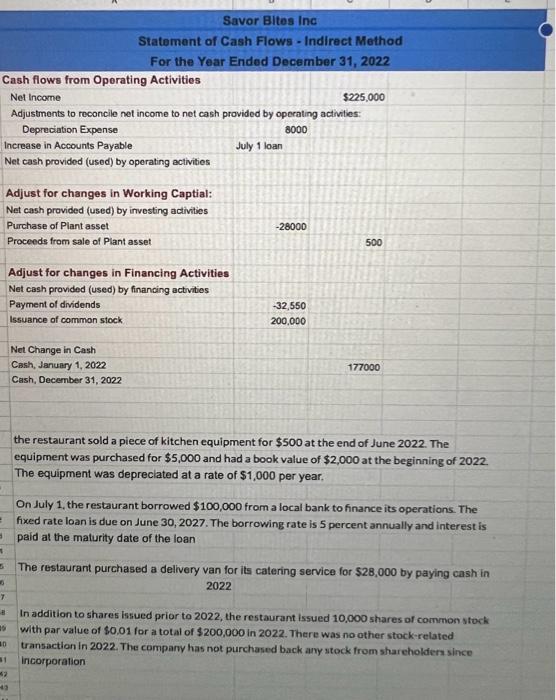

\begin{tabular}{l|r|} \hline \multicolumn{1}{|c|}{ S Savor Bites Inc } & C \\ \hline \multicolumn{1}{|c|}{ Retained Earnings Statement } \\ \hline For the Year Ended December 31, 2022 \\ \hline Retained earnings, January 1 & $100,000 \\ \hline Add: Net Income & $225,500 \\ \hline Less: Dividends & $325,500 \\ \hline Retained Earnings, December 31 & 32,550 \\ \hline \end{tabular} Savor Bites Inc Income Statement For the Year Ended December 31, 2022 Sales Food Sales Catering Sales Miscellaneous Revenue \& Sales Less: Sales Returns \& Allowances Less: Sales Discounts Net Sales Cost of goods sold Gross profit Operating expenses Salaries and wages expense Utilities expense Advertsing expense Maintenance and repairs expense Insurance expense Depreciation expense Tax expense Total operating expenses Income from operations Other revenues and gains Rental Income (2nd floor apartment) Other expenses and losses Interest expense Casuaity loss from vandalism Net income $600,000 $150,000 $10,000 $40,000 25,000 $65,000 $695,000 $275,000 $420,000 $175,000 $6,000 $2,000 $5,000 $4,000 $8,000 $4,000 $204,000 $216,000 $12,000 $2,000 500 $2,500$225,500 the restaurant sold a piece of kitchen equipment for $500 at the end of June 2022 . The equipment was purchased for $5,000 and had a book value of $2,000 at the beginning of 2022 . The equipment was depreclated at a rate of $1,000 per year. On July 1 , the restaurant borrowed $100,000 from a local bank to finance its operations. The fixed rate loan is due on June 30,2027 . The borrowing rate is 5 percent annually and interest is paid at the maturity date of the loan The restaurant purchased a delivery van for its catering service for $28,000 by paying cash in 2022 In addition to shares issued prior to 2022 , the restaurant issued 10,000 shares of common stock with par value of $0.01 for a total of $200,000 in 2022 . There was no other stock-related transaction in 2022. The company has not purchased back any stock from shareholden since incorporation Savor Bites Inc Balance Sheet December 31, 2022 Assets Current assets Cash 160500 Accounts Receivable 170500 Less: Allowance for doubtful accounts 60000 Inventory (food, beverage, merchandise, etc) 100000 Prepaid Insurance Advance Payment (corporate calering client) 25500 Total current assets 446500 Property, plant, and equipment Land \& building Equipment (kitchen, vehicle, computers, etc) 50000 Less: Accumulated depreciation - equipment 35000 Total current assets 10000 521500 Liabilities and Stockholders' Equity Current liabilities Accounts Payable Interest Payable Unearned Revenue Salaries and wages payable 75000 Total current liabilities 1500 45000 15000 Long-term liabilities Notes Payable ( 5 year, 5% loan) 100,000 Mortgage Peyablo 40000 Total long-torm liabilitios 140000 Total fiablities 276500 Stockhoiders' equity Common Stock Paid-in capital in excess of par - common stock 200,000 136500 Retained Earnings 15000 Total atockhoiders' equily 30000 Total fisbilities and slockholders' equify 245000 821600 \begin{tabular}{l|r|} \hline \multicolumn{1}{|c|}{ S Savor Bites Inc } & C \\ \hline \multicolumn{1}{|c|}{ Retained Earnings Statement } \\ \hline For the Year Ended December 31, 2022 \\ \hline Retained earnings, January 1 & $100,000 \\ \hline Add: Net Income & $225,500 \\ \hline Less: Dividends & $325,500 \\ \hline Retained Earnings, December 31 & 32,550 \\ \hline \end{tabular} Savor Bites Inc Income Statement For the Year Ended December 31, 2022 Sales Food Sales Catering Sales Miscellaneous Revenue \& Sales Less: Sales Returns \& Allowances Less: Sales Discounts Net Sales Cost of goods sold Gross profit Operating expenses Salaries and wages expense Utilities expense Advertsing expense Maintenance and repairs expense Insurance expense Depreciation expense Tax expense Total operating expenses Income from operations Other revenues and gains Rental Income (2nd floor apartment) Other expenses and losses Interest expense Casuaity loss from vandalism Net income $600,000 $150,000 $10,000 $40,000 25,000 $65,000 $695,000 $275,000 $420,000 $175,000 $6,000 $2,000 $5,000 $4,000 $8,000 $4,000 $204,000 $216,000 $12,000 $2,000 500 $2,500$225,500 the restaurant sold a piece of kitchen equipment for $500 at the end of June 2022 . The equipment was purchased for $5,000 and had a book value of $2,000 at the beginning of 2022 . The equipment was depreclated at a rate of $1,000 per year. On July 1 , the restaurant borrowed $100,000 from a local bank to finance its operations. The fixed rate loan is due on June 30,2027 . The borrowing rate is 5 percent annually and interest is paid at the maturity date of the loan The restaurant purchased a delivery van for its catering service for $28,000 by paying cash in 2022 In addition to shares issued prior to 2022 , the restaurant issued 10,000 shares of common stock with par value of $0.01 for a total of $200,000 in 2022 . There was no other stock-related transaction in 2022. The company has not purchased back any stock from shareholden since incorporation Savor Bites Inc Balance Sheet December 31, 2022 Assets Current assets Cash 160500 Accounts Receivable 170500 Less: Allowance for doubtful accounts 60000 Inventory (food, beverage, merchandise, etc) 100000 Prepaid Insurance Advance Payment (corporate calering client) 25500 Total current assets 446500 Property, plant, and equipment Land \& building Equipment (kitchen, vehicle, computers, etc) 50000 Less: Accumulated depreciation - equipment 35000 Total current assets 10000 521500 Liabilities and Stockholders' Equity Current liabilities Accounts Payable Interest Payable Unearned Revenue Salaries and wages payable 75000 Total current liabilities 1500 45000 15000 Long-term liabilities Notes Payable ( 5 year, 5% loan) 100,000 Mortgage Peyablo 40000 Total long-torm liabilitios 140000 Total fiablities 276500 Stockhoiders' equity Common Stock Paid-in capital in excess of par - common stock 200,000 136500 Retained Earnings 15000 Total atockhoiders' equily 30000 Total fisbilities and slockholders' equify 245000 821600

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started