Question

Need the following answers to the ratios below for Tim Horton's company. Answers must be for the 2016 year. Please show your work so I

Need the following answers to the ratios below for Tim Horton's company. Answers must be for the 2016 year. Please show your work so I can understand where you got your answers from

Profitability Ratios

Return on Total Assets

Return on stockholders equity

Return on common equity

Operating profit margin

Net Profit margin

Liquidity Ratios

Current Ratio

Quick Ratio

Inventory to net working capital

Leverage Ratios

Debt-to-assets

Debt-to-equity

Long-term debt-to-equity

Times-interest-earned

Fixed charge coverage

Activity Ratios

Inventory Turnover

Fixed-assets turnover

Total assets turnover

Accounts receivables turnover

Average collecting period

Shareholders Return Ratios

Dividend yield common stock

Price-earnings ratio

Dividend payout ratio

Cash flow per share

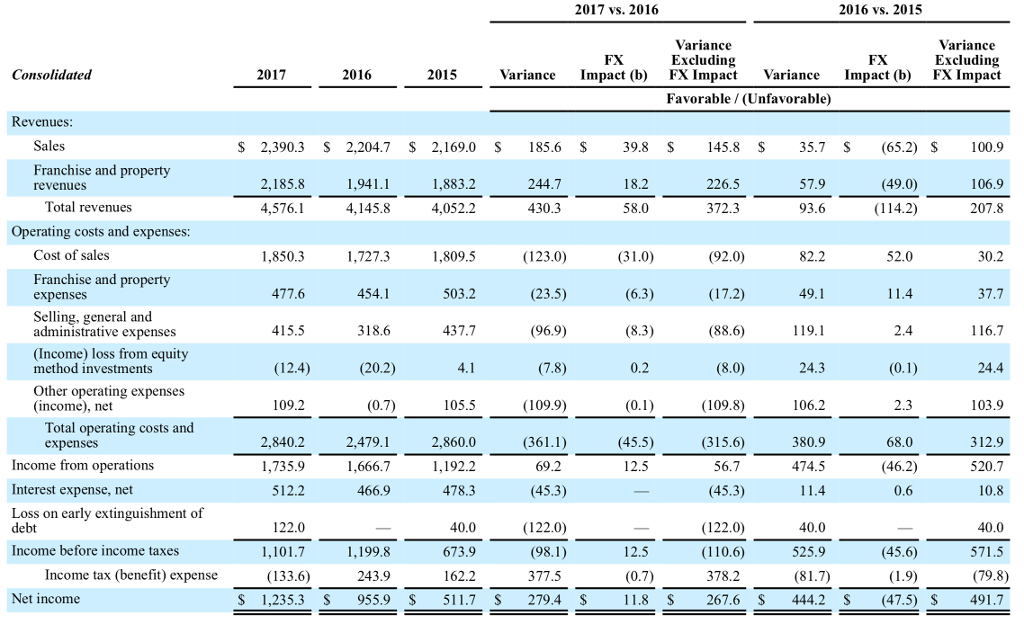

2017 vs. 2016 2016 vs. 2015 Variance Excluding VarianceImpact (b) FX Impact Variance Impact (b) FX Impact Variance Excluding FX FX Consolidated 2017 2016 2015 Favorable (Unfavorable) Revenues S 2,390.3 S 2,204.7 S 2,169.0 S 185.6 39.8 S 145.8 100.9 106.9 207.8 35.7 S(65.2) es Franchise and property revenues 2,185.8 4,576.1 (49.0) (114.2) 1,941.1 1,883.2 244.7 226.5 57.9 Total revenues 4,145.8 4,052.2 430.3 372.3 93.6 Operating costs and expenses: Cost of sales Franchise and property expenses Selling, general and administrative expenses Income) loss from equity 1,850.3 477.6 415.5 1,727.3 454.1 318.6 (20.2) 1,809.5 503.2 437.7 (123.0) (23.5) (96.9) 82.2 52.0 30.2 method investments Other operating expenses (income), net 109.2 105.5 (109.9) (109.8) 106.2 103.9 Total operating costs and expenses 2,840.2 1,735.9 512.2 2,479.1 1,666.7 466.9 2,860.0 1,192.2 478.3 40.0 673.9 162.2 (315.6) 380.9 (361.1) 69.2 (45.3) 68.0 312.9 Income from operations Interest expense, net Loss on early extinguishment of 12.5 56.7 474.5 (46.2) 520.7 debt 40.0 (122.0) 110.6) 378.2 22.0 (122.0) Income before income taxes 1,199.8 525.9 45.6) Income tax (benefit) expense (133.6) 243.9 377.5 (79.8) Net income $ 1,235.3 S 955.9 $ 511.7 S 279.4 S 11.8 S 267.6 S 444.2 S (47.5) $ 491.7Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started