Answered step by step

Verified Expert Solution

Question

1 Approved Answer

need the income statement please with formulas X G23 Fx A B H C D E F G 7 You work in the corporate controller's

need the income statement please with formulas

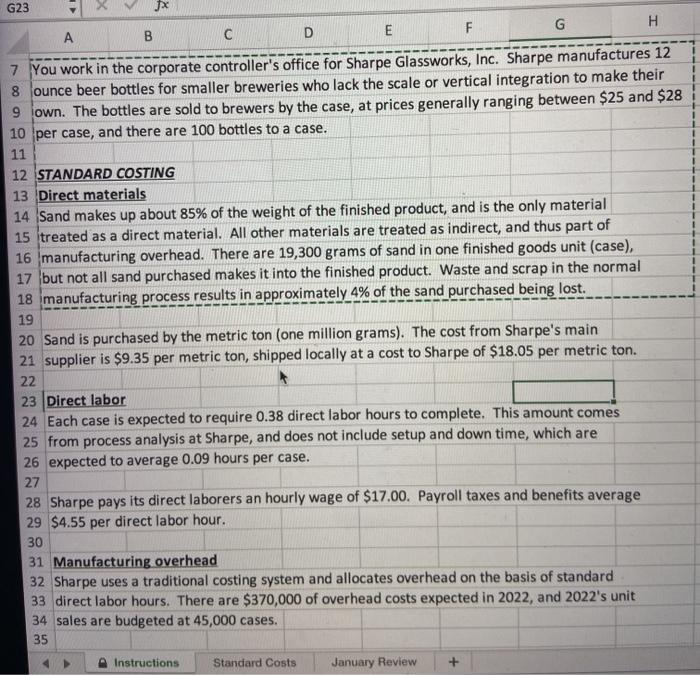

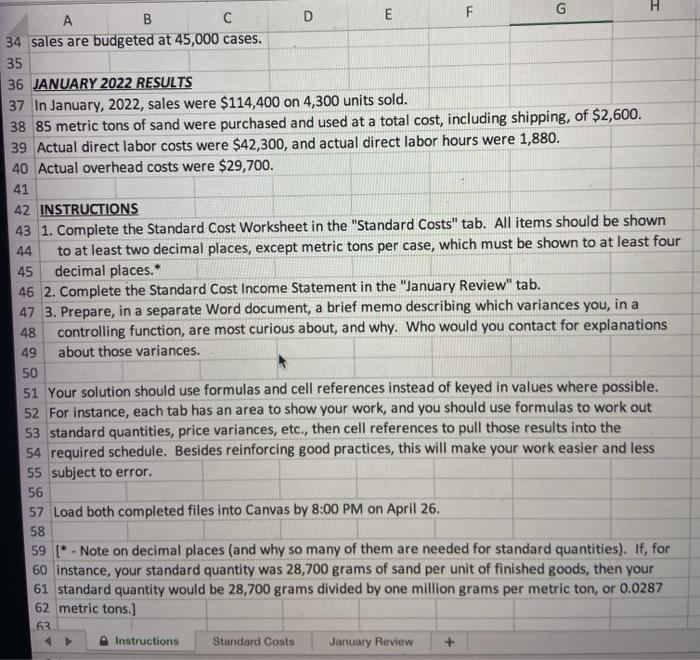

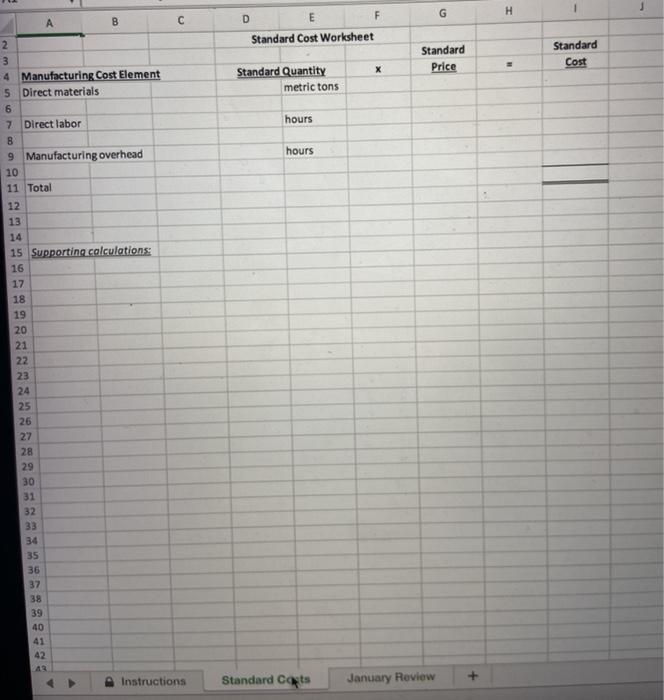

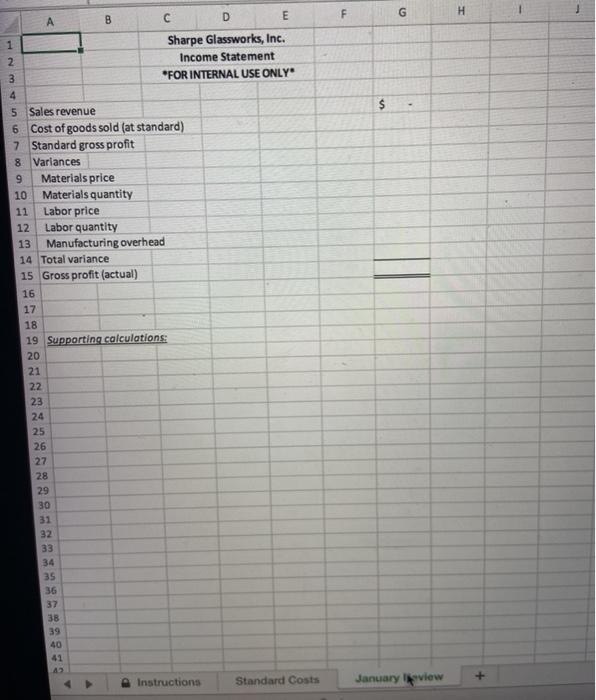

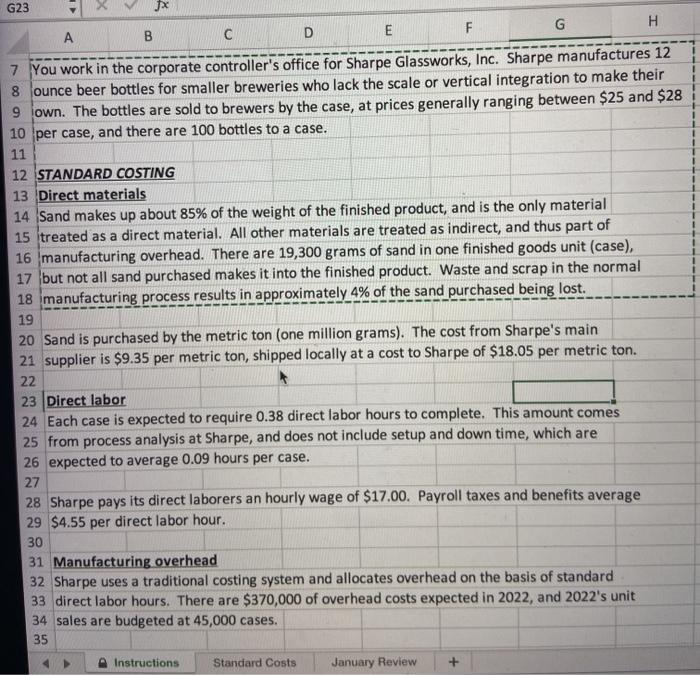

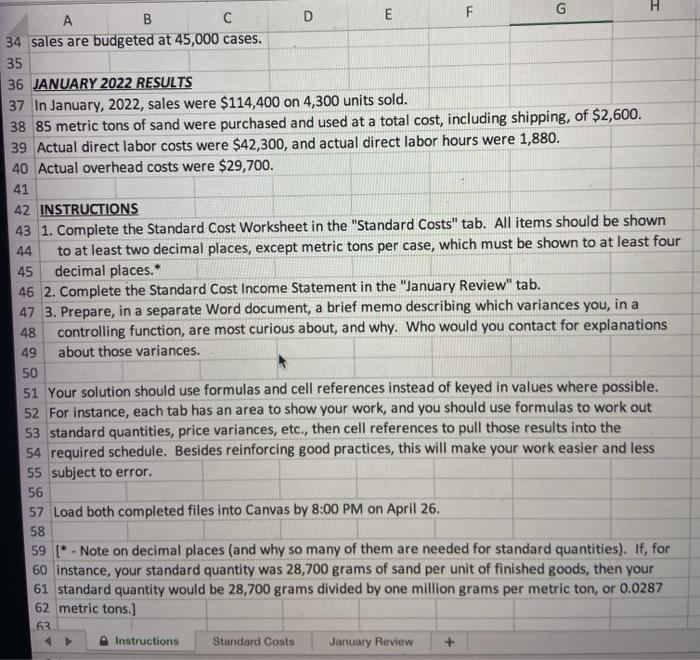

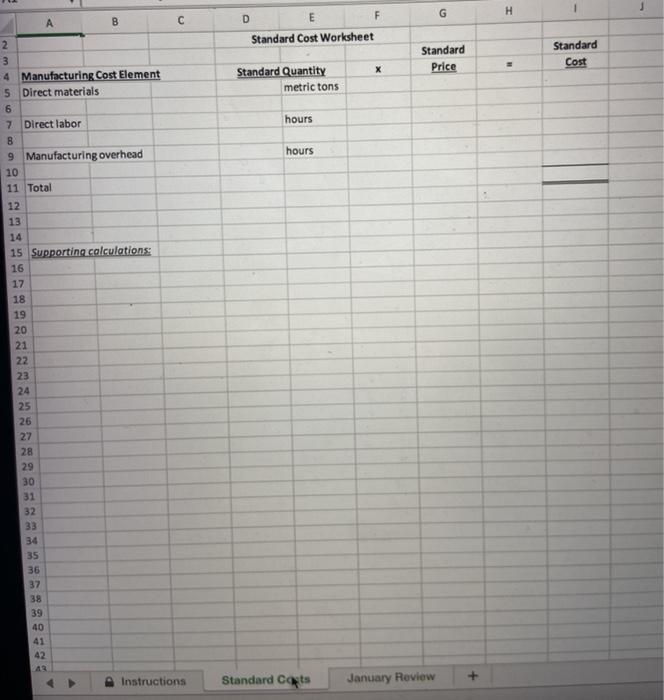

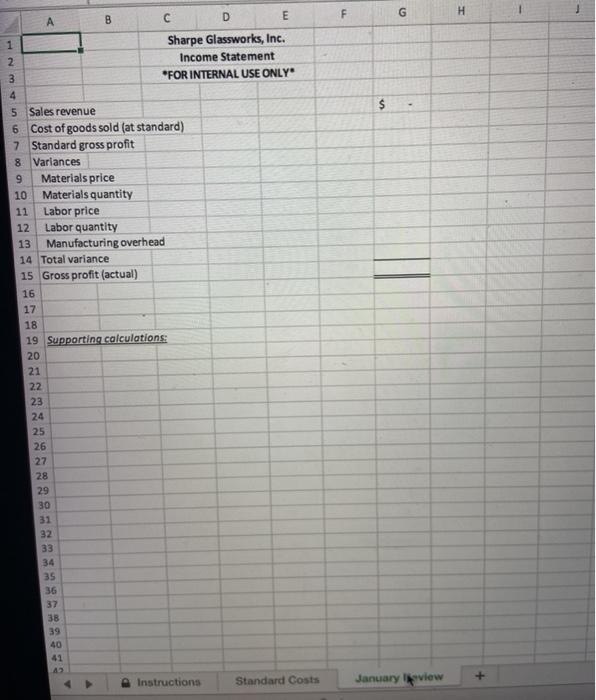

X G23 Fx A B H C D E F G 7 You work in the corporate controller's office for Sharpe Glassworks, Inc. Sharpe manufactures 12 8 ounce beer bottles for smaller breweries who lack the scale or vertical integration to make their 9 own. The bottles are sold to brewers by the case, at prices generally ranging between $25 and $28 10 per case, and there are 100 bottles to a case. 11 12 STANDARD COSTING 13 Direct materials 14 Sand makes up about 85% of the weight of the finished product, and is the only material 15 treated as a direct material. All other materials are treated as indirect, and thus part of 16 manufacturing overhead. There are 19,300 grams of sand in one finished goods unit (case), 17 but not all sand purchased makes it into the finished product. Waste and scrap in the normal 18 manufacturing process results in approximately 4% of the sand purchased being lost. 19 20 Sand is purchased by the metric ton (one million grams). The cost from Sharpe's main 21 supplier is $9.35 per metric ton, shipped locally at a cost to Sharpe of $18.05 per metric ton. 22 23 Direct labor 24 Each case is expected to require 0.38 direct labor hours to complete. This amount comes 25 from process analysis at Sharpe, and does not include setup and down time, which are 26 expected to average 0.09 hours per case. 27 28 Sharpe pays its direct laborers an hourly wage of $17.00. Payroll taxes and benefits average 29 $4.55 per direct labor hour. 30 31 Manufacturing overhead 32 Sharpe uses a traditional costing system and allocates overhead on the basis of standard 33 direct labor hours. There are $370,000 of overhead costs expected in 2022, and 2022's unit 34 sales are budgeted at 45,000 cases. 35 Instructions Standard Costs January Review D B E F G 34 sales are budgeted at 45,000 cases. 35 36 JANUARY 2022 RESULTS 37 In January, 2022, sales were $114,400 on 4,300 units sold. 38 85 metric tons of sand were purchased and used at a total cost, including shipping, of $2,600. 39 Actual direct labor costs were $42,300, and actual direct labor hours were 1,880. 40 Actual overhead costs were $29,700. 41 42 INSTRUCTIONS 43 1. Complete the Standard Cost Worksheet in the "Standard Costs" tab. All items should be shown 44 to at least two decimal places, except metric tons per case, which must be shown to at least four 45 decimal places.* 46 2. Complete the Standard Cost Income Statement in the "January Review" tab. 47 3. Prepare, in a separate Word document, a brief memo describing which variances you, in a 48 controlling function, are most curious about, and why. Who would you contact for explanations 49 about those variances. 50 51 Your solution should use formulas and cell references instead of keyed in values where possible. 52 For instance, each tab has an area to show your work, and you should use formulas to work out 53 standard quantities, price variances, etc., then cell references to pull those results into the 54 required schedule. Besides reinforcing good practices, this will make your work easier and less 55 subject to error. 56 57 Load both completed files into Canvas by 8:00 PM on April 26. 58 59 [*- Note on decimal places (and why so many of them are needed for standard quantities). If, for 60 instance, your standard quantity was 28,700 grams of sand per unit of finished goods, then your 61 standard quantity would be 28,700 grams divided by one million grams per metric ton, or 0.0287 62 metric tons.] 63 Instructions Standard Costs January Review + 1 H F G E A D B Standard Cost Worksheet Standard Price Standard Cost X Standard Quantity metric tons hours hours 2 3 4 Manufacturing Cost Element 5 Direct materials 6 7 Direct labor 8 9 Manufacturing overhead 10 11 Total 12 13 14 15 Supporting calculations: 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 Instructions Standard Costs January Review F G H $ A B D E 1 Sharpe Glassworks, Inc. 2 Income Statement 3 FOR INTERNAL USE ONLY 4 5 Sales revenue 6 Cost of goods sold (at standard) 7 Standard gross profit 8 Variances 9 Materials price 10 Materials quantity 11 Labor price 12 Labor quantity 13 Manufacturing overhead 14 Total variance 15 Gross profit (actual) 16 17 18 19 Supporting calculations: 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 40 41 42 Instructions Standard Costs January leview

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started