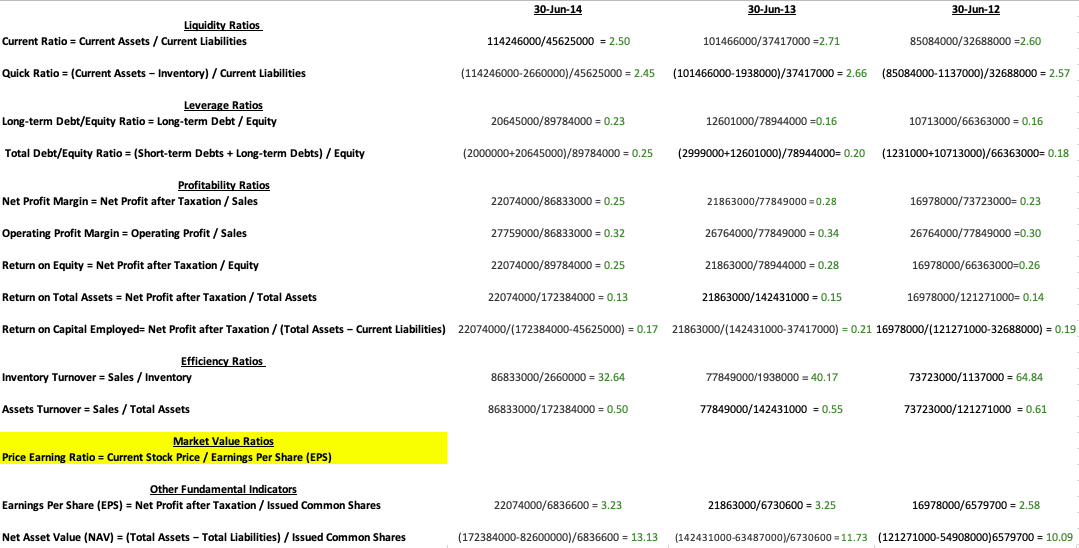

Need the Price Earning Ratio from the following financials:

BALANCE SHEET

CASH FLOW

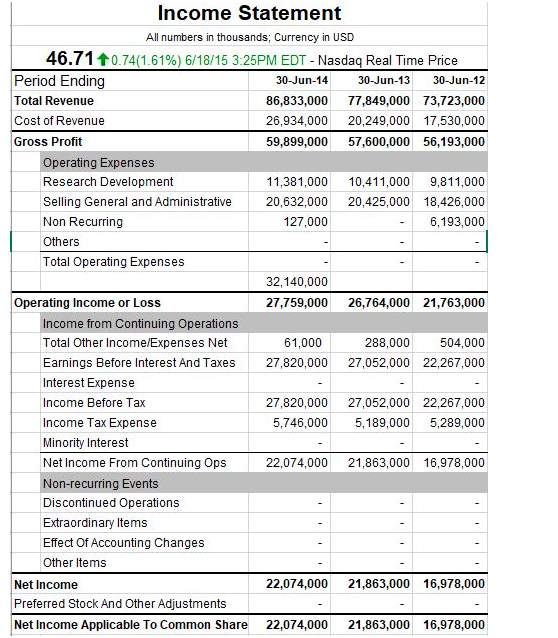

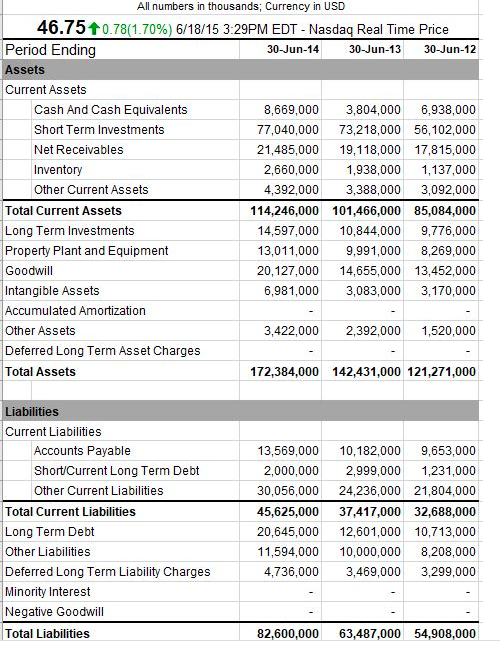

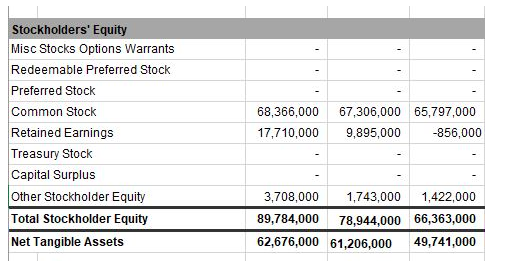

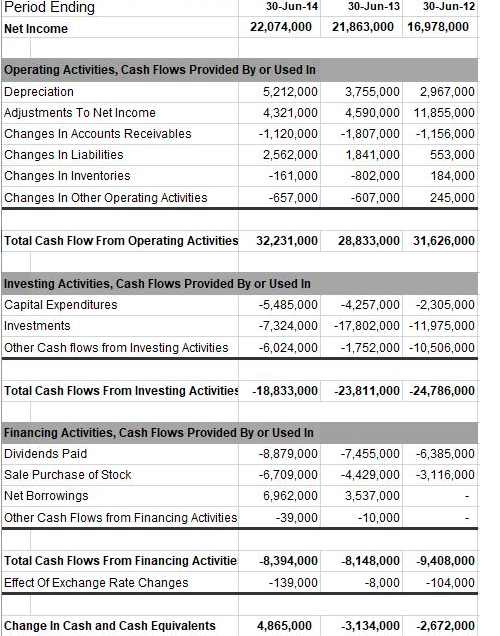

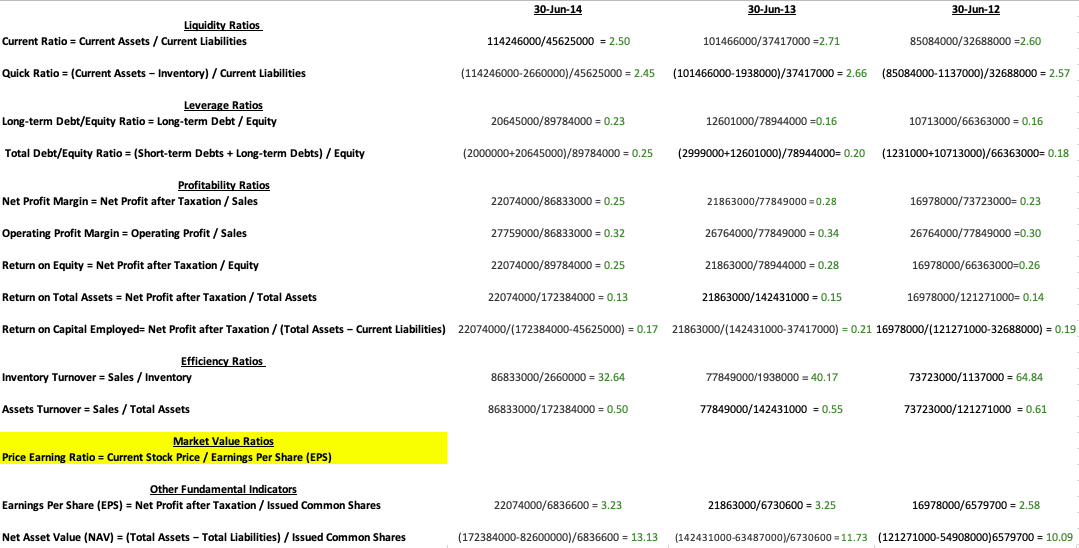

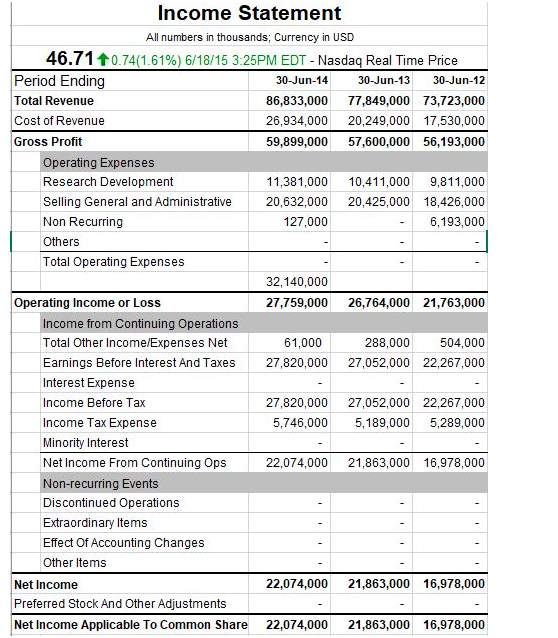

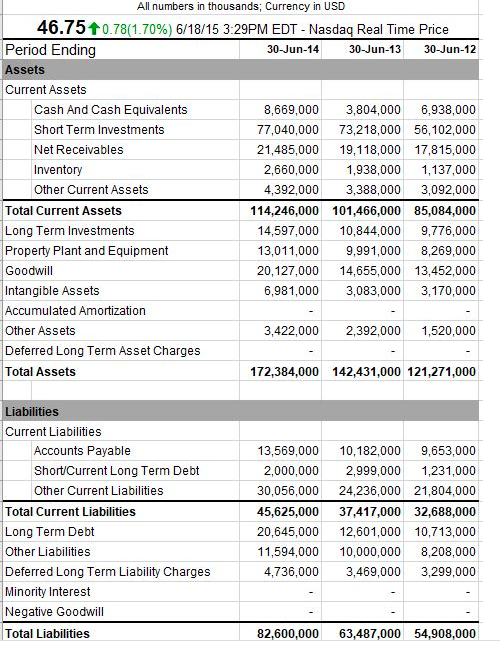

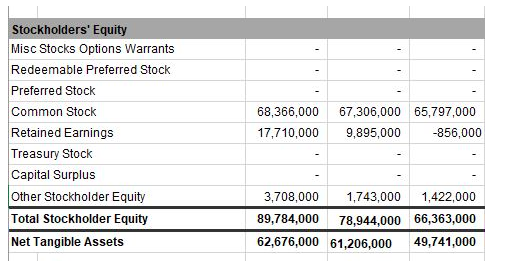

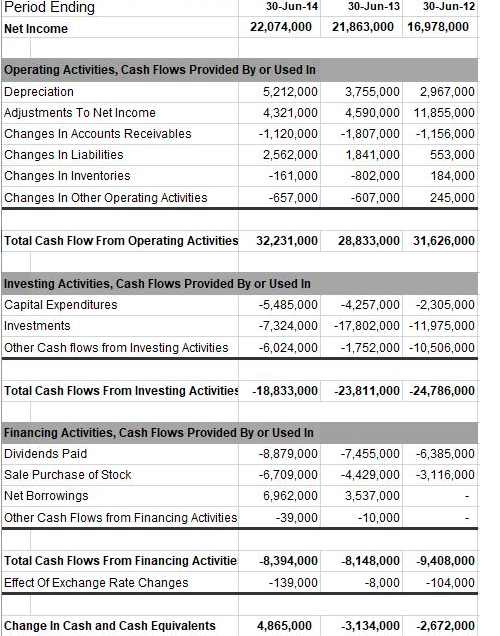

Income Statement All numbers in thousands; Currency in USD 46.71 +0.74(1.61%) 6/18/15 3:25PM EDT - Nasdaq Real Time Price Period Ending 30-Jun-14 30-Jun-13 30-Jun-12 Total Revenue 86,833,000 77,849,000 73,723,000 Cost of Revenue 26,934,000 20,249,000 17,530,000 Gross Profit 59,899,000 57,600,000 56,193,000 Operating Expenses Research Development 11,381,000 10,411,000 9,811,000 Selling General and Administrative 20,632,000 20,425,000 18,426,000 Non Recurring 127,000 6,193,000 Others Total Operating Expenses 32,140,000 Operating Income or Loss 27,759,000 26,764,000 21,763,000 Income from Continuing Operations Total Other Income/Expenses Net 61,000 288,000 504,000 Earnings Before Interest And Taxes 27,820,000 27,052,000 22,267,000 Interest Expense Income Before Tax 27,820,000 27,052,000 22,267,000 Income Tax Expense 5,746,000 5,189,000 5,289,000 Minority Interest Net Income From Continuing Ops 22,074,000 21,863,000 16,978,000 Non-recurring Events Discontinued Operations Extraordinary Items Effect of Accounting Changes Other Items Net Income 22,074,000 21,863,000 16,978,000 Preferred Stock And Other Adjustments Net Income Applicable To Common Share 22,074,000 21,863,000 16,978,000 All numbers in thousands; Currency in USD 46.75 +0.78(1.70%) 6/18/15 3:29PM EDT - Nasdaq Real Time Price Period Ending 30-Jun-14 30-Jun-13 30-Jun-12 Assets Current Assets Cash And Cash Equivalents 8,669,000 3,804,000 6,938,000 Short Term Investments 77,040,000 73,218,000 56,102,000 Net Receivables 21,485,000 19,118,000 17,815,000 Inventory 2,660,000 1,938,000 1,137,000 Other Current Assets 4,392,000 3,388,000 3,092,000 Total Current Assets 114,246,000 101,466,000 85,084,000 Long Term Investments 14,597,000 10,844,000 9,776,000 Property Plant and Equipment 13,011,000 9,991,000 8,269,000 Goodwill 20,127,000 14,655,000 13,452,000 Intangible Assets 6,981,000 3,083,000 3,170,000 Accumulated Amortization Other Assets 3,422,000 2,392,000 1,520,000 Deferred Long Term Asset Charges Total Assets 172,384,000 142,431,000 121,271,000 Liabilities Current Liabilities Accounts Payable Short/Current Long Term Debt Other Current Liabilities Total Current Liabilities Long Term Debt Other Liabilities Deferred Long Term Liability Charges Minority Interest Negative Goodwill Total Liabilities 13,569,000 2,000,000 30,056,000 45,625,000 20,645,000 11,594,000 4,736,000 10,182,000 9,653,000 2,999,000 1,231,000 24,236,000 21,804,000 37,417,000 32,688,000 12,601,000 10,713,000 10,000,000 8,208,000 3,469,000 3,299,000 82,600,000 63,487,000 54,908,000 Stockholders' Equity Misc Stocks Options Warrants Redeemable Preferred Stock Preferred Stock Common Stock Retained Earnings Treasury Stock Capital Surplus Other Stockholder Equity Total Stockholder Equity Net Tangible Assets 68,366,000 17,710,000 67,306,000 65,797,000 9,895,000 -856,000 3,708,000 1,743,000 1,422,000 89,784,000 78,944,000 66,363,000 62,676,000 61,206,000 49,741,000 Period Ending Net Income 30-Jun-14 30-Jun-13 30-Jun-12 22,074,000 21,863,000 16,978,000 Operating Activities, Cash Flows Provided By or Used In Depreciation 5,212,000 Adjustments To Net Income 4,321,000 Changes in Accounts Receivables -1,120,000 Changes in Liabilities 2,562,000 Changes In Inventories -161,000 Changes in Other Operating Activities -657,000 3,755,000 2,967,000 4,590,000 11,855,000 -1,807,000 -1,156,000 1,841,000 553,000 -802,000 184,000 -607,000 245,000 Total Cash Flow From Operating Activities 32,231,000 28,833,000 31,626,000 Investing Activities, Cash Flows Provided By or Used In Capital Expenditures -5,485,000 -4,257,000 -2,305,000 Investments -7,324,000 -17,802,000 -11,975,000 Other Cash flows from Investing Activities -6,024,000 -1,752,000 -10,506,000 Total Cash Flows From Investing Activities -18,833,000 -23,811,000 -24,786,000 Financing Activities, Cash Flows Provided By or Used In Dividends Paid -8,879,000 Sale Purchase of Stock -6,709,000 Net Borrowings 6,962,000 Other Cash Flows from Financing Activities -39,000 -7,455,000 -6,385,000 -4,429,000 -3,116,000 3,537,000 -10,000 Total Cash Flows From Financing Activitie Effect Of Exchange Rate Changes -8,394,000 -139,000 -8,148,000 -9,408,000 -8,000 -104,000 Change In Cash and Cash Equivalents 4,865,000 -3,134,000 -2,672,000 30-Jun-14 30-Jun-13 30-Jun-12 Liquidity Ratios Current Ratio = Current Assets / Current Liabilities 114246000/45625000 = 2.50 101466000/37417000 =2.71 85084000/32688000 =2.60 Quick Ratio = (Current Assets - Inventory) / Current Liabilities (114246000-2660000)/45625000 = 2.45 (101466000-1938000)/37417000 = 2.66 (85084000-1137000)/32688000 = 2.57 Leverage Ratios Long-term Debt/Equity Ratio = Long-term Debt / Equity 20645000/89784000 = 0.23 12601000/78944000 =0.16 10713000/66363000 = 0.16 Total Debt/Equity Ratio = (Short-term Debts + Long-term Debts) / Equity (2000000+20645000)/89784000 = 0.25 (2999000+12601000)/78944000=0.20 (1231000+10713000)/66363000= 0.18 Profitability Ratios Net Profit Margin = Net Profit after Taxation / Sales 22074000/86833000 = 0.25 21863000/77849000 -0.28 16978000/73723000=0.23 Operating Profit Margin = Operating Profit / Sales 27759000/86833000 = 0.32 26764000/77849000 = 0.34 26764000/77849000 =0.30 Return on Equity = Net Profit after Taxation / Equity 22074000/89784000 = 0.25 21863000/78944000 = 0.28 16978000/66363000=0.26 Return on Total Assets = Net Profit after Taxation / Total Assets 22074000/172384000 = 0.13 21863000/142431000 = 0.15 16978000/121271000+ 0.14 Return on Capital Employed= Net Profit after Taxation / (Total Assets - Current Liabilities) 22074000/(172384000-45625000) = 0.17 21863000/(142431000-37417000) = 0.21 16978000/(121271000-32688000) = 0.19 Efficiency Ratios Inventory Turnover = Sales / Inventory 86833000/2660000 = 32.64 77849000/1938000 = 40.17 73723000/1137000 = 64.84 Assets Turnover = Sales / Total Assets 86833000/172384000 = 0.50 77849000/142431000 = 0.55 73723000/121271000 = 0.61 Market Value Ratios Price Earning Ratio = Current Stock Price / Earnings Per Share (EPS) Other Fundamental Indicators Earnings Per Share (EPS) = Net Profit after Taxation / Issued Common Shares 22074000/6836600 = 3.23 21863000/6730600 = 3.25 16978000/6579700 = 2.58 Net Asset Value (NAV) = (Total Assets - Total Liabilities) / Issued Common Shares (172384000-82600000)/6836600 = 13.13 (142431000-63487000/6730600 = 11.73 (121271000-54908000)6579700 = 10.09