Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Need the work for the problems please and explanation for the last ones as well. Answers already provided. Recommended Problems The following balances were taken

Need the work for the problems please and explanation for the last ones as well. Answers already provided.

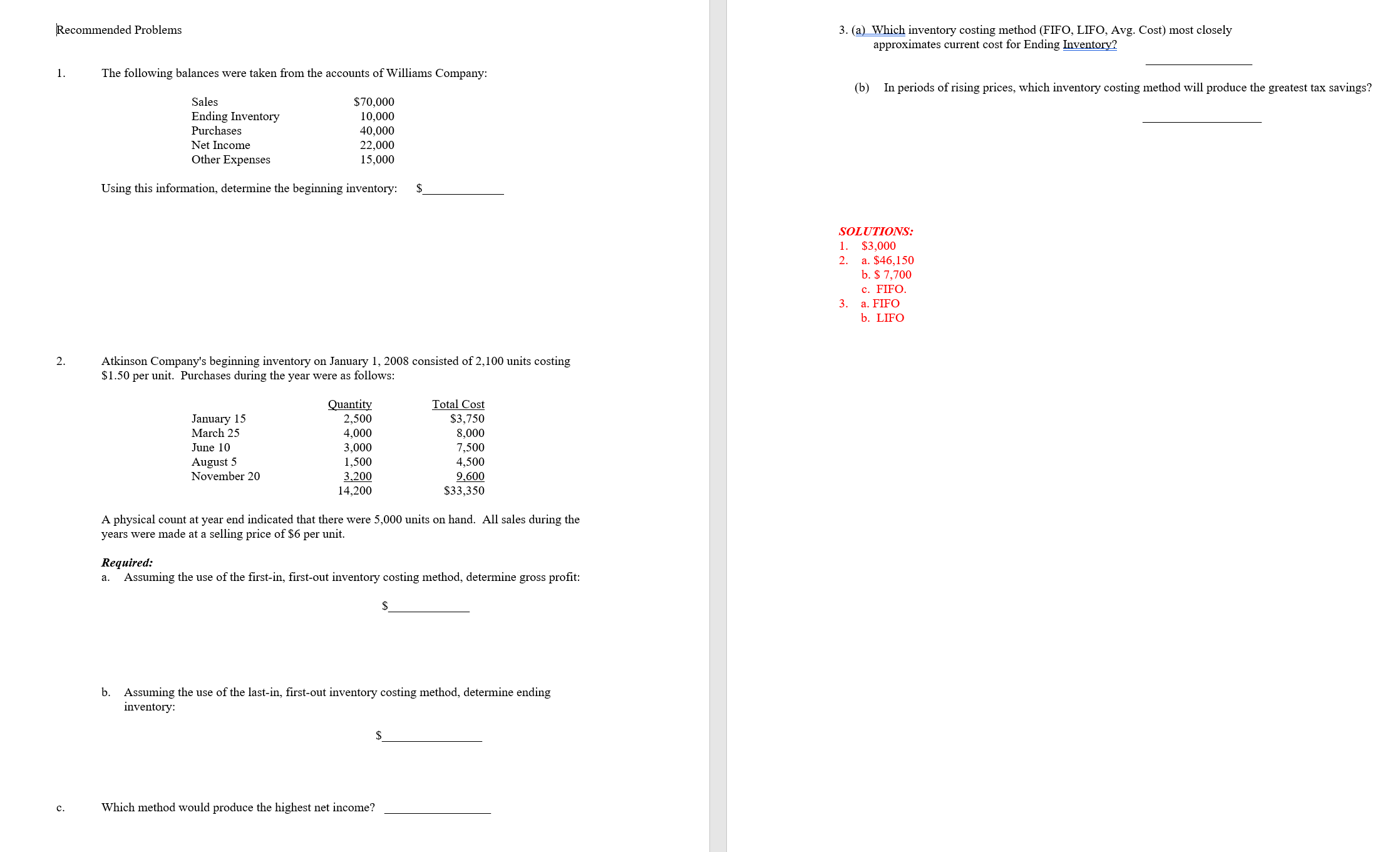

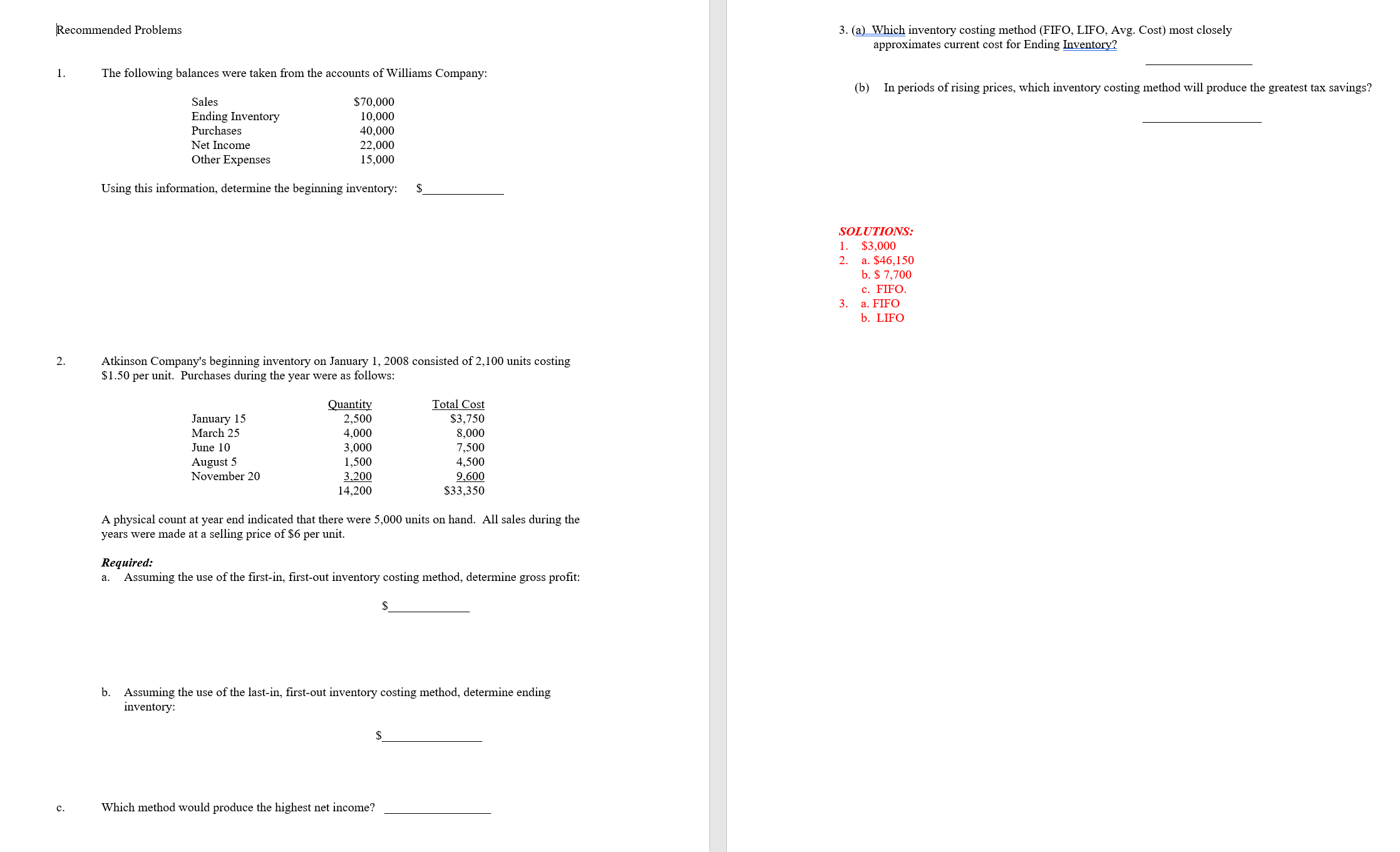

Recommended Problems The following balances were taken from the accounts of Williams Company: Sales Ending Inventory Purchases Net Income Other Expenses $70,000 10,000 40,000 22,000 15,000 3. inventory costing method (FIFO, LIFO, Avg. Cost) most closely approximates current cost for Ending (b) In periods of rising prices, which inventory costing method will produce the greatest tax savings? SOLUTIONS: $3,000 2. Using this information, determine the beginning inventory: Atkinson Company's beginning inventory on January I , 2008 consisted of 2, 100 units costing S 1.50 per unit. Purchases during the year were as follows: 2. 3. a. $46,150 b. S 7,700 c. FIFO. a. FIFO b. LIFO January 15 March 25 June 10 August 5 November 20 anti 2,500 4,000 3,000 1,500 3 200 14,200 Total Cost $3,750 8,000 7,500 4,500 9 600 $33,350 A physical count at year end indicated that there were 5,000 units on hand. All sales during the years were made at a selling price of $6 per unit. Required: a. b. Assuming the use of the first-in, first-out inventoryr costing method, determine gross profit: Assuming the use of the last-in, first-out inventory costing method, determine ending inventory: Which method would produce the highest net income?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started