Answered step by step

Verified Expert Solution

Question

1 Approved Answer

need these andwers asap! Ajax Investment, LLC is contemplating the acquisition of an apartment complex in a rapidly growing suburban area of the city. The

need these andwers asap!

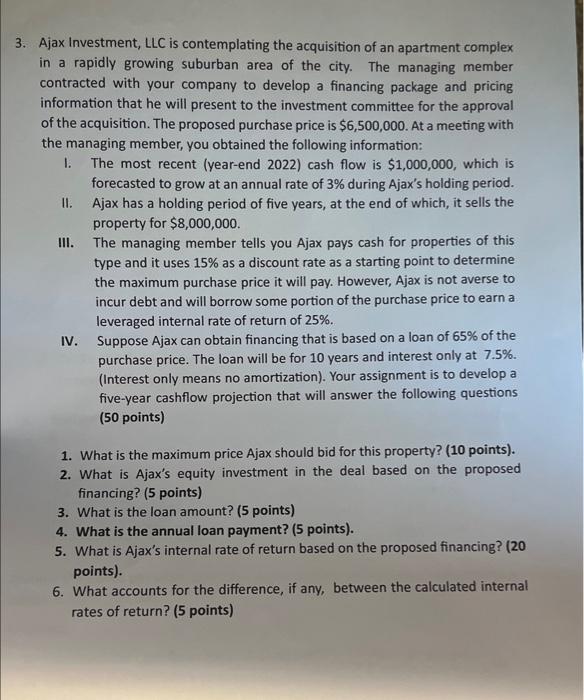

Ajax Investment, LLC is contemplating the acquisition of an apartment complex in a rapidly growing suburban area of the city. The managing member contracted with your company to develop a financing package and pricing information that he will present to the investment committee for the approval of the acquisition. The proposed purchase price is $6,500,000. At a meeting with the managing member, you obtained the following information: I. The most recent (year-end 2022) cash flow is $1,000,000, which is forecasted to grow at an annual rate of 3% during Ajax's holding period. II. Ajax has a holding period of five years, at the end of which, it sells the property for $8,000,000. III. The managing member tells you Ajax pays cash for properties of this type and it uses 15% as a discount rate as a starting point to determine the maximum purchase price it will pay. However, Ajax is not averse to incur debt and will borrow some portion of the purchase price to earn a leveraged internal rate of return of 25%. IV. Suppose Ajax can obtain financing that is based on a loan of 65% of the purchase price. The loan will be for 10 years and interest only at 7.5%. (Interest only means no amortization). Your assignment is to develop a five-year cashflow projection that will answer the following questions (50 points) 1. What is the maximum price Ajax should bid for this property? (10 points). 2. What is Ajax's equity investment in the deal based on the proposed financing? ( 5 points) 3. What is the loan amount? ( 5 points) 4. What is the annual loan payment? (5 points). 5. What is Ajax's internal rate of return based on the proposed financing? ( 20 points). 6. What accounts for the difference, if any, between the calculated internal rates of return? ( 5 points)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started