NEED THIS ANSWERED RAPIDLY PLEASE.

Michael and Jeanette Boyds Tax Return Michael D. and Jeanette S. Boyd live with their family at the Rock Glen House Bed & Breakfast, which Michael operates. The Bed & Breakfast (B&B) is located at 33333 Fume Blanc Way, Temecula, CA 92591. Michael (born May 4, 1977) and Jeanette (born June 12, 1978) enjoy good health and eyesight.

The Boyds have three sons. Maxwell was born April 16, 2003, Seve was born December 2, 2008, and Denzel was born January 13, 2010. All three boys live at home and the Boyds provide more than 50 percent of their support.

The Rock Glen House B&B is operated as a sole proprietorship and had the following income and expenses for the year:

Room rental income $137,900 Vending machine income 2,000 Advertising expense 4,800 Depreciation for book and tax purposes 18,000 Mortgage interest on the B&B 23,000 Wages of cleaning people 17,540 Taxes and licenses 6,420 Supplies consumed 19,000 Business insurance 6,300 Laundry expenses 4,300 Accounting fees 1,800 Office expenses 2,400 Utilities 6,300

All of the above amounts relate to the business portion of the Bed & Breakfast; the personal portion is accounted for separately. The Rock Glen House B&B uses the cash method of accounting and has no inventory. The employer tax ID number is 95-1234567. Michael contracted the coronavirus in 2020 and the bed and breakfast was forced to close for 24 days. Shortly after recovering, Michael was required to close the bed and breakfast for another 15 days while he cared for his son Denzel, who was unable to attend school. Michael elects to take any sick and family leave credits associated with this leave, but does not defer his self-employment tax payments.

The Boyds made estimated federal income tax payments of $2,000 and estimated state income tax payments of $6,000 (all made during 2020).

Jeanette worked about 1,000 hours as a substitute schoolteacher with the local school district. She also spent $246 out-of-pocket for various supplies for her classroom. For the current year, Jeanettes Form W-2 from the school district is presented on the previous page.

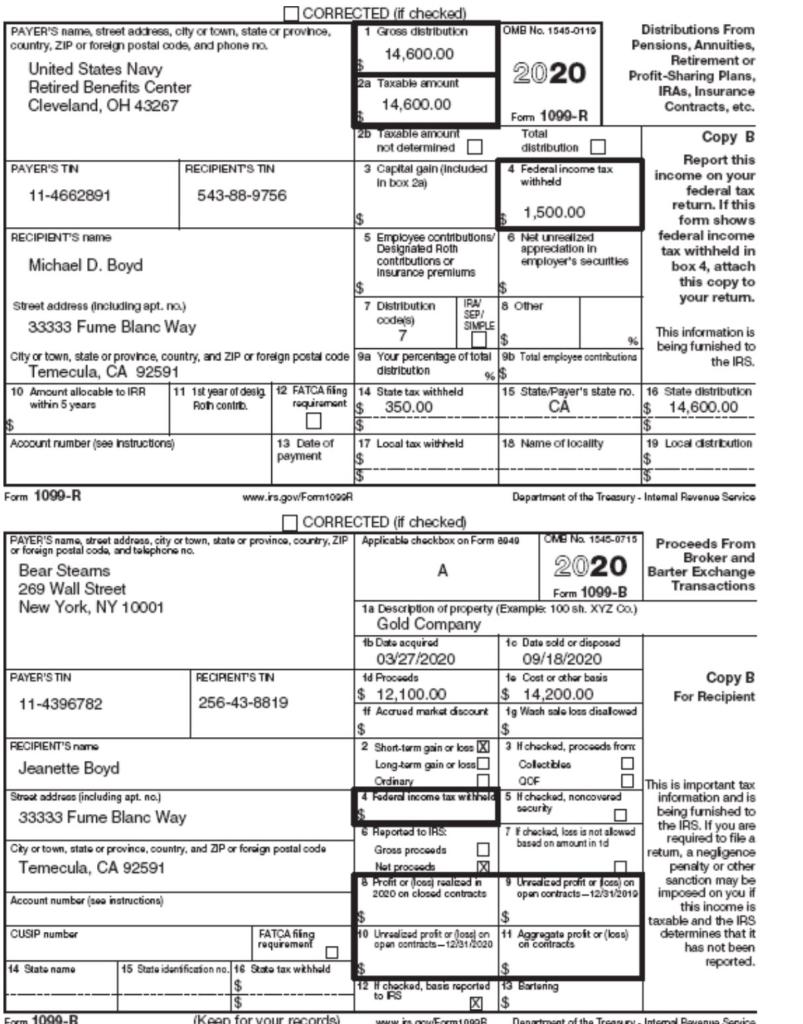

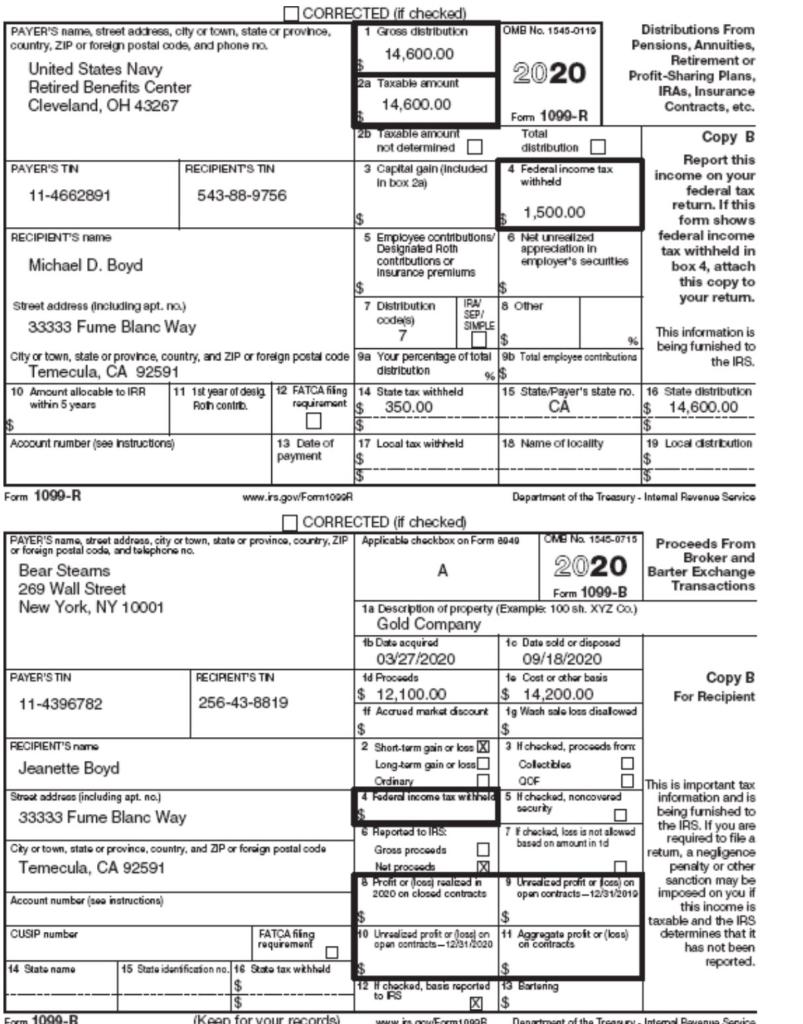

Michael is retired from the U.S. Navy. His annual statement from the Navy, Form 1099-R.

Michael and Jeanette paid (and can substantiate) the following amounts during the year:

Mastercard interest $1,480 Dental expenses (orthodontics for Maxwell) 5,457 California state income tax (for 2019) 2,130 Charitable contributions 875 Life insurance premiums 845 Automobile registration fees (deductible portion) 45 Tax return preparation fee 475 Contributions to the presidents re-election campaign 1,000

The Boyds are taking the standard deduction in 2020.

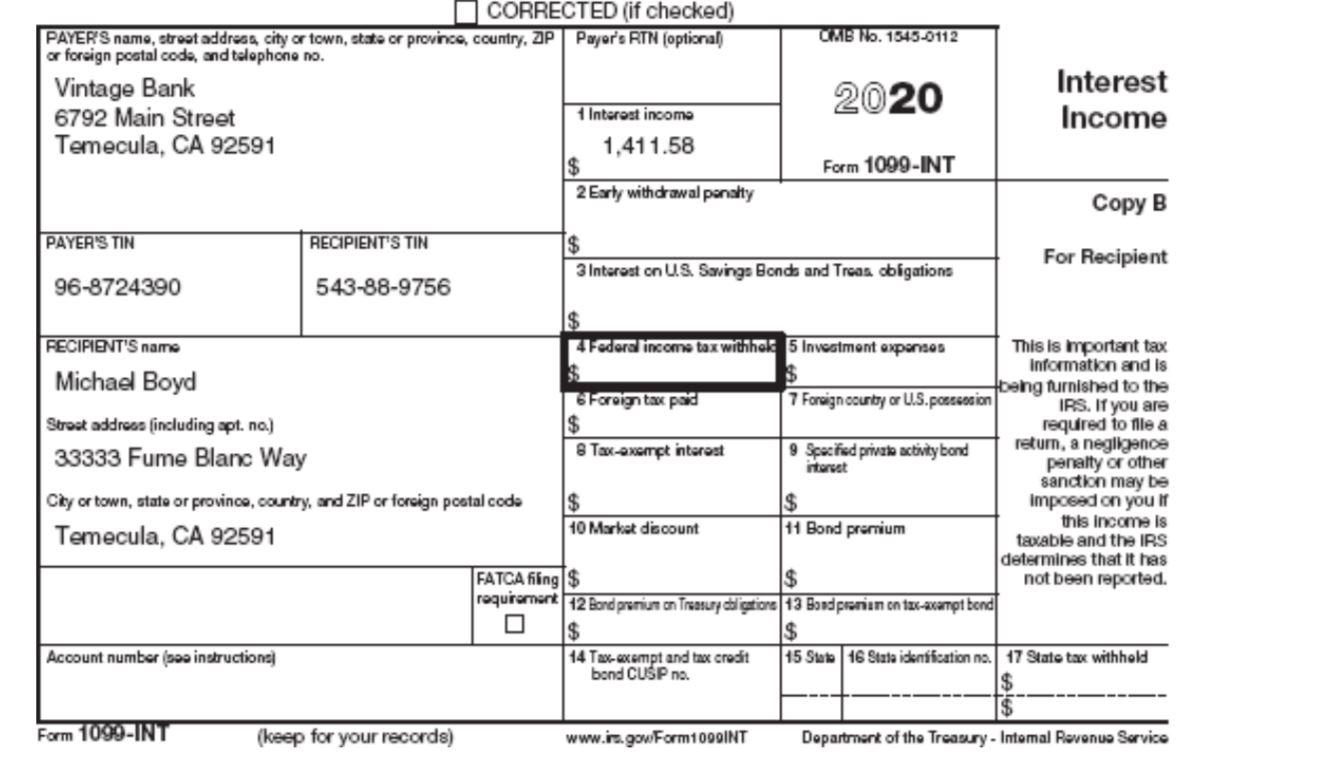

During the year, Michael and Jeanette received the following qualifying dividends and interest:

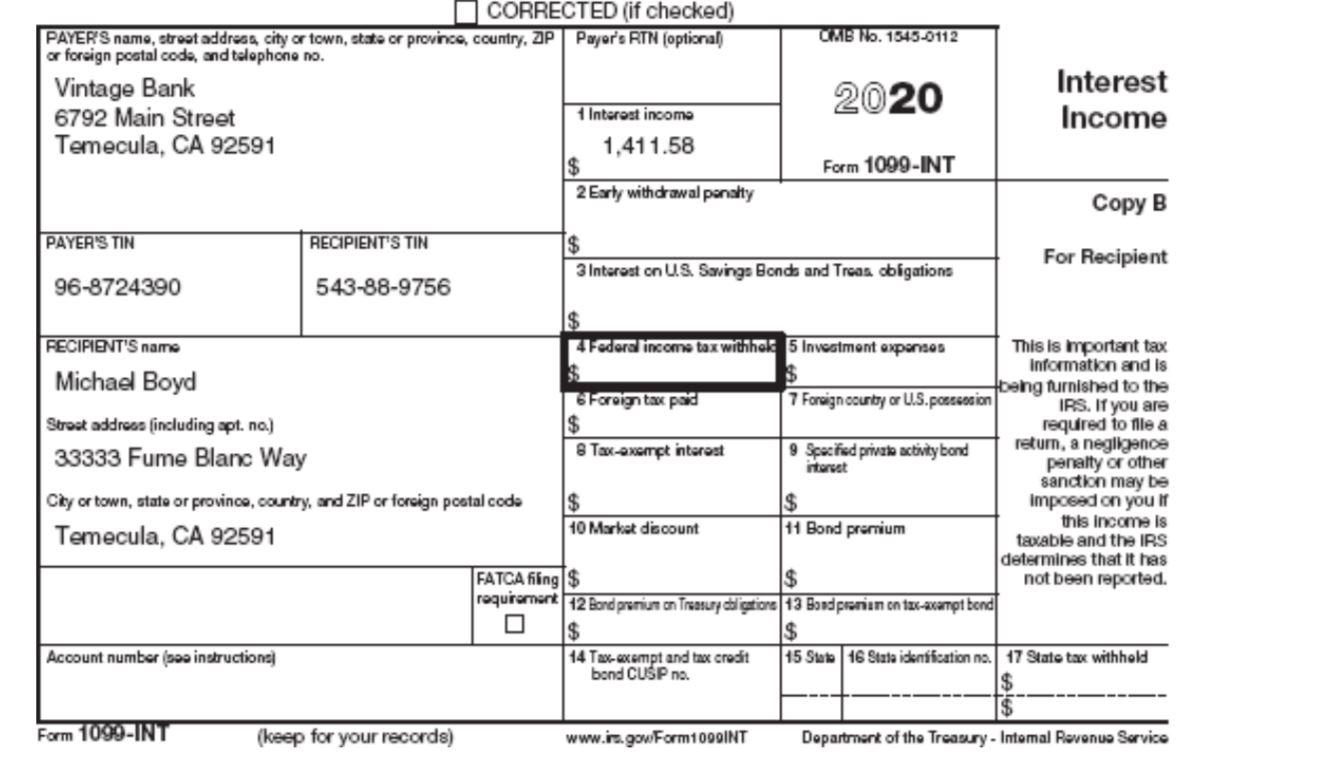

Interest: Bobs Big Bank $ 390 Bank of England 290 City of Temecula Tax-Exempt Bonds 1,500 Vintage Bank See 1099-INT Qualified dividends: Southwest Airlines $ 250 Heinz Foods 550

Also, Jeanette owns Series EE U.S. savings bonds. During the year, the bond redemption value increased by $1,300. Jeanette has not elected the accrual method for these bonds. There were no British taxes paid on the interest from the Bank of England. All the above stocks, bonds, and bank accounts are community property.

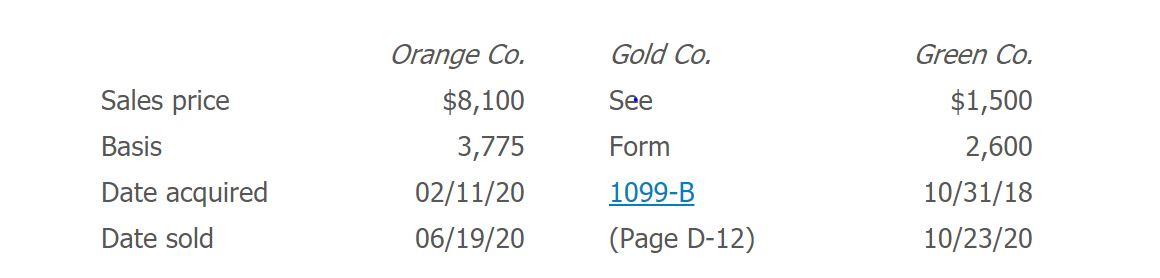

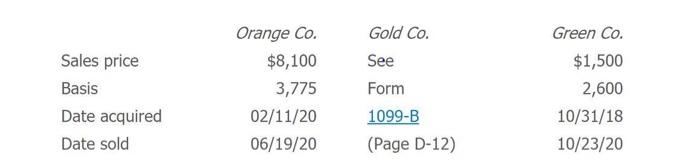

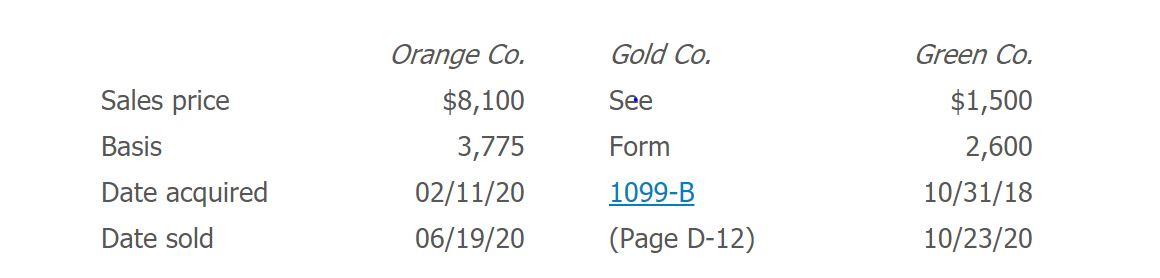

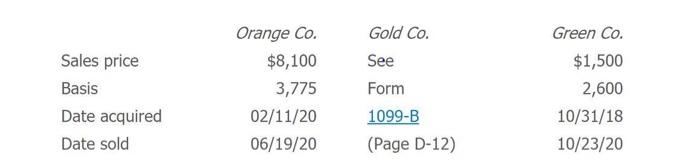

Jeanette has a stock portfolio. During the year, she sold the following stock, shown on her Forms 1099-B as follows (basis was provided to the IRS in all cases):

Jeanette paid her ex-husband $4,600 alimony in the current year, as required under the 2003 divorce decree. Her ex-husbands name is Hector Leach and his Social Security number is 566-23-5431.

Michael does all the significant work in the Bed & Breakfast and therefore he pays selfemployment tax on 100 percent of the earnings from the B&B.

During the year, Michaels uncle Boris died. Boris had a $50,000 life insurance policy that named Michael as the beneficiary. Michael received the check for the benefits payable under the policy on November 30 of the current year. Boris also left Michael a parcel of land with an appraised value of $120,000.

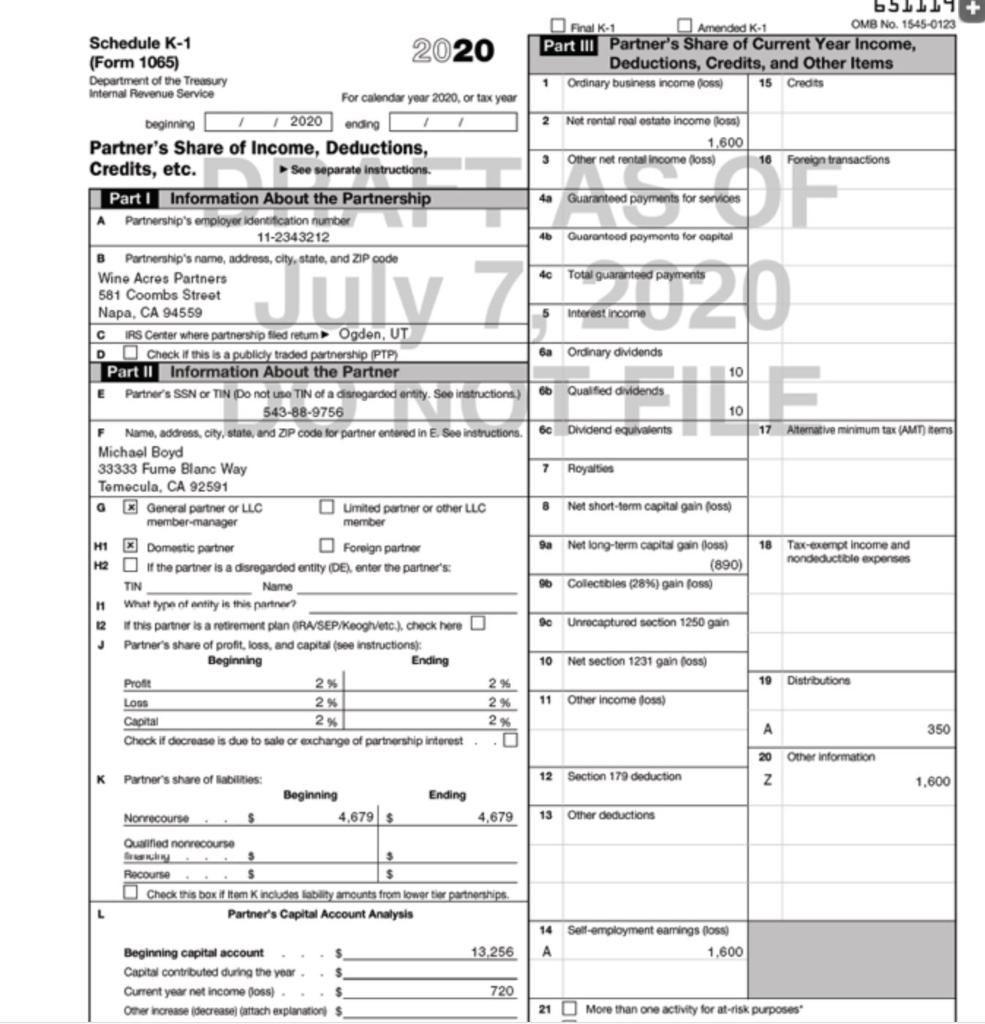

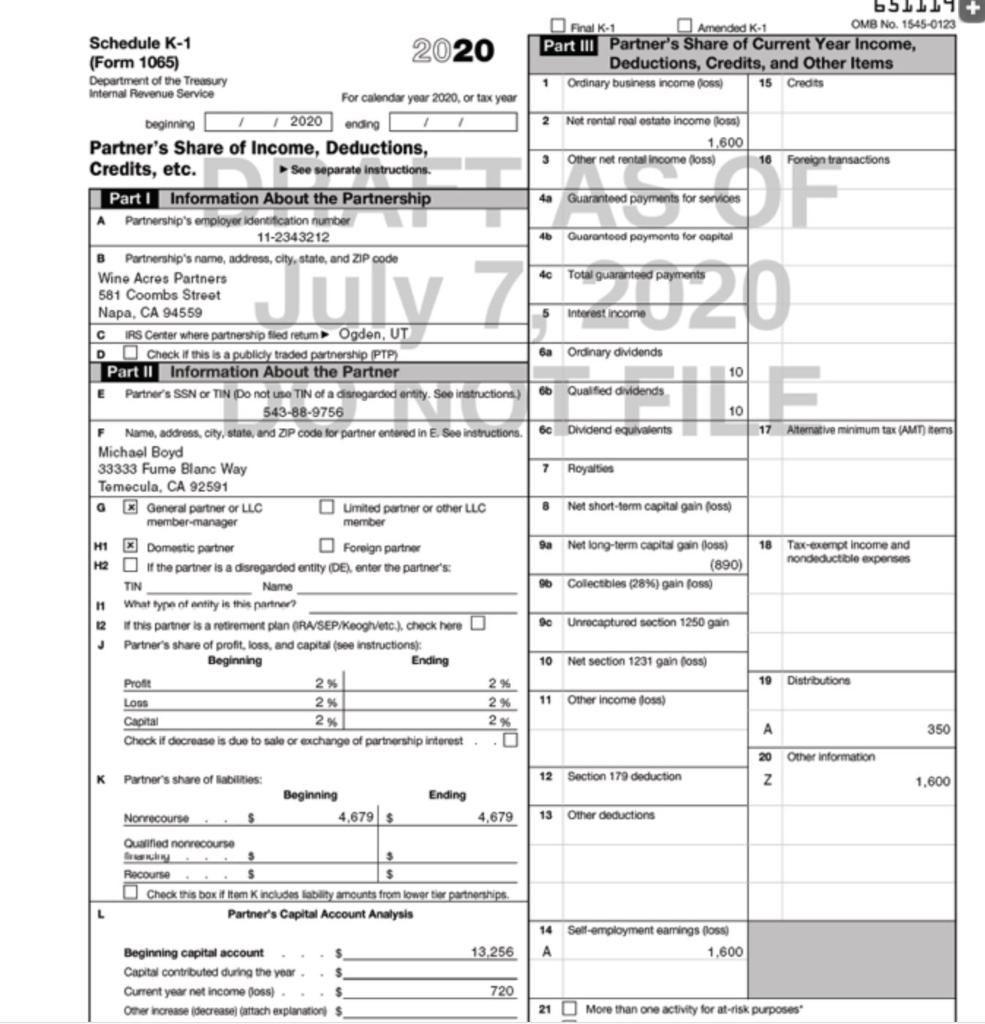

Michael is a general partner in a partnership that owns a boutique hotel in northern California and leases the property to a hotel management company. Michael does not materially participate in the partnership activity but the partnership activity does rise to the level of a trade or business. The Schedule K-1 from the partnership.

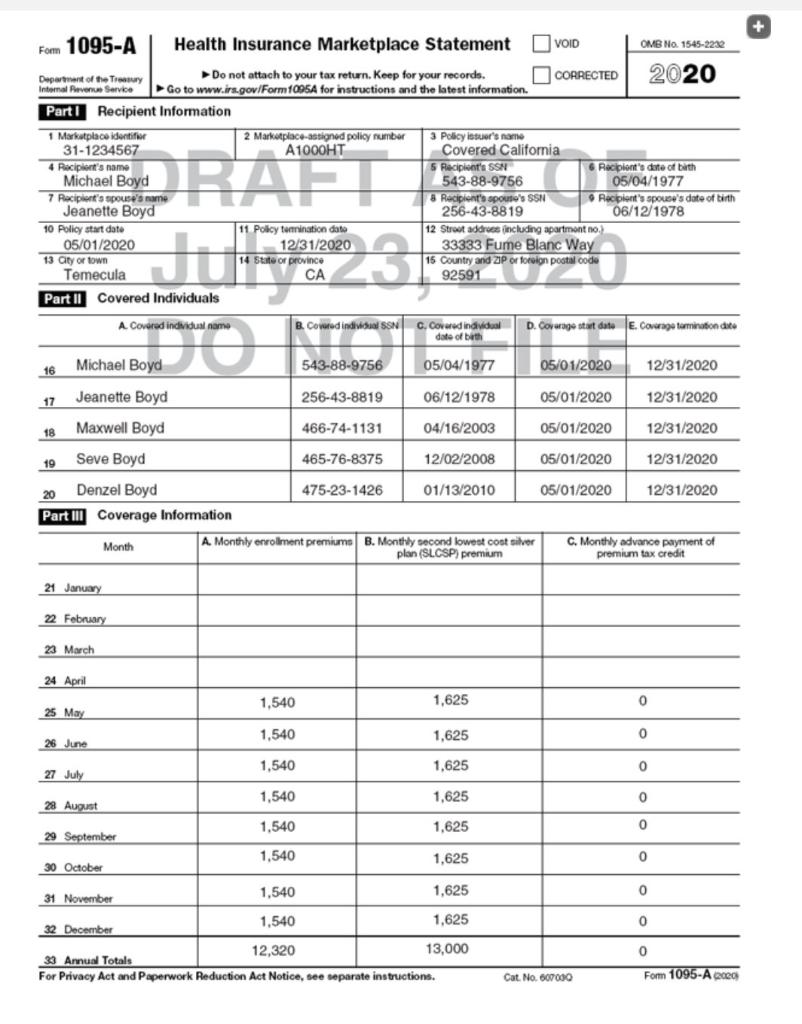

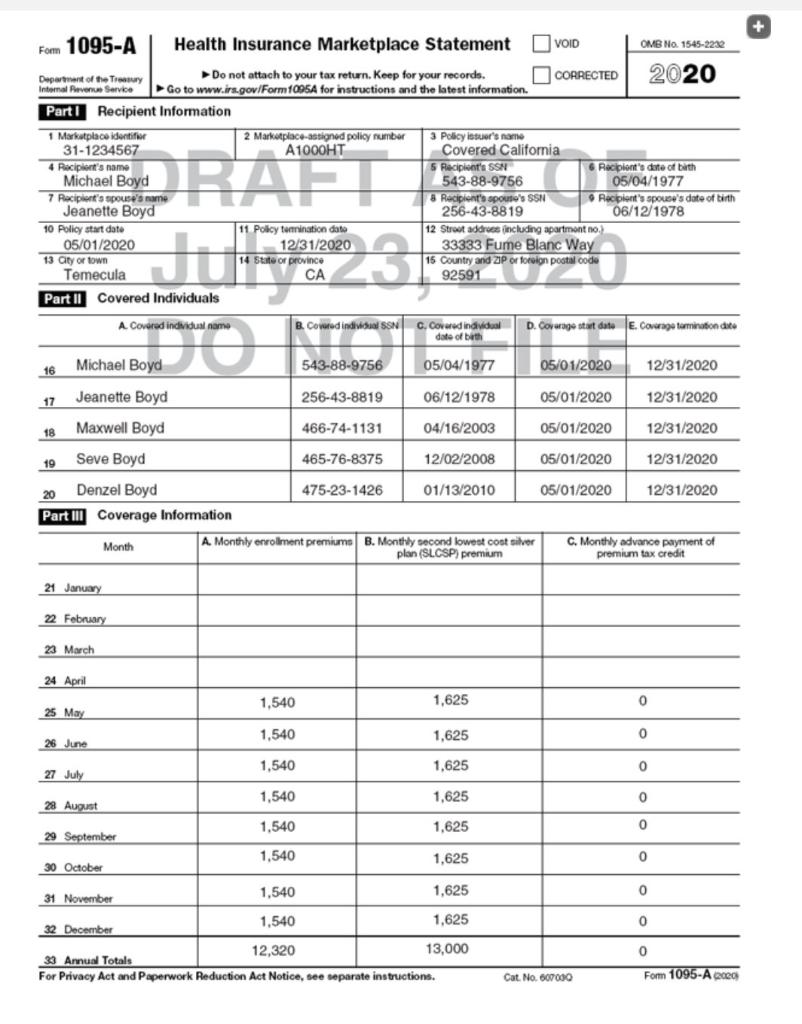

Jeanette was not eligible for health care benefits due to the part-time nature of her job, thus health insurance for the Boyd household was purchased through the Covered California program and the Boyds received the Form 1095-A. They had no other health insurance during 2020. Assume that the self-employed health insurance deduction is $1,472. The Boyds did not claim an advance premium tax credit.

The Boyds received a $3,400 EIP in 2020.

Required: Michael and Jeanette have come to you to prepare their 2020 federal income tax return. Do not complete a California state income tax return. Michael and Jeanette have given you several IRS forms (see ). Make realistic assumptions about any missing data that you need. Do not file a federal Form 4952. The following is a list of the forms and schedules that you will need to complete the tax return: Form 1040 Schedule SE Schedule 1 Form 7202 Schedule 2 Form 8812 Schedule 3 Form 8949 Schedule B Form 8962 Schedule C Form 8995 Schedule D Child Tax Credit Worksheet Schedule E Qualified Dividends and Capital Gain Tax Worksheet Note: The forms included in Appendix D are provided for the student to work on only one of the two additional comprehensive problems. If desired, additional tax forms may be obtained from the IRS website at www.irs.gov.

Gold Co. Green Co. See Orange Co. $8,100 3,775 02/11/20 06/19/20 Sales price Basis Date acquired Date sold Form $1,500 2,600 10/31/18 10/23/20 1099-B (Page D-12) bSLLLS Final K-1 Amended K-1 OMB No 1545-0123 Part III Partner's Share of Current Year Income, Deductions, Credits, and Other Items 1 Ordinary business income foss) 15 Credits 2 Not rontal real estate income foss) 1,600 Other net rental income foss) 16 Foreign transactions 4a Guaranteed payments for services 46 Guaranteed payment for capital *** JULY : 120 7 4c Total guaranteed payments 5 Interest income ba Ordinary dividends 10 Schedule K-1 2020 (Form 1065) Department of the Treasury Internal Revenue Service For calendar year 2020, or tax year beginning / 2020 ending 1 Partner's Share of Income, Deductions, Credits, etc. See separate instructions. Part 1 Information About the Partnership A Partnership's employer identification number 11-2343212 B Partnership's name, address, city, state, and ZIP code Wine Acres Partners 581 Coombs Street Napa, CA 94559 IRS Certer where partnership filed retum Ogden, UT D Check if this is a publicly traded partnership PTP) Part II Information About the Partner E Partner's SSN CF TIN Do not use TIN of a disregarded entity. See instructions.) 543-88-9756 F Name, address, city, state, and ZIP code for partner entered in E. See instructions. Michael Boyd 33333 Fume Blanc Way Temecula, CA 92591 Ex General partner or LLC Umited partner or other LLC member-manager member 11 Domestic partner Foreign partner H2 If the partner is a disregarded entity (DE). enter the partner's TIN Name H What type of entity is the partner 12 this partner is a retirement plan (RA SEP/Keoghvetc.), check here u Partner's share of profit, loss, and capital (see Instructions: Beginning Ending 2% 2% LOG 2% 2% Capital 2% 2% Check it decrease is due to sale or exchange of partnership interest. 0 66 Qualified dividends CENTE 10 6c Dividend equivalents 17 Alternative minimum tax (AMT) items 7 Royalties 0 8 Net short-term capital gain foss) Sa Net long-term capital gain loss) (890) Collectibles (28%) gain foss) 18 Tax-exempt income and nondeductible expenses ac Unrecaptured section 1250 gain 10 Net section 1231 gain foss) 19 Profit Distributions 11 Other income foss) A 350 20 Other information K 12 Section 179 deduction N 1,600 13 Other deductions Partner's share of abilities: Beginning Ending Nonrecourse $ 4.679 $ 4,679 Qualified nonrecourse . Recourse $ Check this box iftom k includes ability amounts from lower the partnerships Partner's Capital Account Analysis L 14 Self-employment earrings loss 1,600 13,256 A Beginning capital account Capital contributed during the you $ Current year net income foss) $ Other increase decrease attach explanations 720 21 More than one activity for at-risk purposes Fom 1095-A Health Insurance Marketplace Statement void OMB No 1545-2232 Department of the Troy Do not attach to your tax return. Keep for your records. CORRECTED 2020 Internal Revenue Service Go to www.irs.gov/Form 1095A for instructions and the latest information. Part1 Recipient Information 1 Marketplace identifier 2 Marketplaco-assigned policy number 3 Policy issuer's name 31-1234567 A1000HT Covered California 4 Recipient's name 5 Recipient's SSN GRecipiont's date of birth Michael Boyd 543-88-9756 05/04/1977 7 Recipient's spouse's name Recipient's spouto's SSN Recipient's spouse's date of birth Jeanette Boyd 256-43-8819 06/12/1978 10 Policy start date 11 Policy Termination date 12 Strout address including apartment no 05/01/2020 12/31/2020 33333 Fume Blanc Way 13 aty or town or province 15 Country and ZIP or foreign postal code Temecula CA 92591 Part II Covered Individuals ERAT. A. Covered individual name B. Covered individual SSN C. Covered individual date of birth D. Coverage start date E. Coverage termination die Michael Boyd 543-88-9756 05/04/1977 05/01/2020 16 12/31/2020 17 Jeanette Boyd 256-43-8819 06/12/1978 05/01/2020 12/31/2020 18 Maxwell Boyd 466-74-1131 04/16/2003 05/01/2020 12/31/2020 19 Seve Boyd 465-76-8375 12/02/2008 05/01/2020 12/31/2020 20 Denzel Boyd 475-23-1426 01/13/2010 05/01/2020 12/31/2020 Part III Coverage Information Month A. Monthly enrolment premium B. Monthly second lowest cost silver C. Monthly advance payment of plan (SLCSP) premium premium tax credit 21 January 22 February 23 March 24 April 1.540 1,625 0 25 May 1,540 1,625 0 26 June 1.540 1,625 0 27 July 1,540 1,625 0 28 August 1.540 1.625 0 29 September 1,540 1,625 0 30 October 0 0 31 November 1,540 1,625 1,540 1,625 32 December 12,320 13,000 33 Annual Totals For Privacy Act and Paperwork Reduction Act Notice, see separate instructions. 0 Cat. No. 607000 Form 1095-A 000 2020 CORRECTED (if checked) PAYER'S name, street adress, city or town, state or provhos, 1 Gross distribution OMB No. 1545-0119 Distributions From country. ZIP or foreign postal code and phone na 14,600.00 Pensions, Annuities, Retirement or United States Navy Profit-Sharing Plans, Retired Benefits Center 2a Taxable amount IRAs, Insurance Cleveland, OH 43267 14,600.00 Contracts, etc. Form 1099-R 2D Surable amount Total not determined 0 distribution Copy B Report this PAYER'S TN RECIPIENTS TIN 3 Capital gain (Induded Federal income tax In box 2a) withhold income on your 11-4662891 543-88-9756 federal tax return. If this 1,500.00 form shows RECIPIENT'S neme 5 Employee contributions/6NER unrealized federal income Designated Roth appreciation in tax withheld in Michael D. Boyd contributions or employer's securities box 4, attach Insurance premiums this copy to Street address including apt.no) 7 Distribution IPA 8 Other SEP 33333 Fume Blanc Way codes) SIMPLE 7 Is This information is being furnished to city or town, state or province, country, and ZIP or foreign postal code 9a Your percentage of total 9b Total employee contributiona the IRS. Temecula, CA 92591 distribution 9 $ 10 Amount allocable to IRR 11 1st year of desig 12 FATCA fiing 14 State tax withheld 15 State/Payer's state no. 18 State distribution within 5 years Roh contit regrunnent le 350.00 $ 14,600.00 $ Account number (see nstructions 13 Date of 17 Local tax withheld 18 Name of locality 19 Local distribution payment 1$ your retum. 2020 Barter Exchange Form 1099-R www.rs.gov/Form1000R Department of the Treasury - Intemal Revenue Service N CORRECTED (if checked PAYER'S namo strcat address, city or town, state or province, courtry.ZIP Applicable checkbox on Form 2040 OM NA 1545-0715 Proceeds From or foreign postal code, and telephone no. Broker and Bear Steams A 269 Wall Street Transactions Form 1099-B New York, NY 10001 1a Description of property (Example: 100 sh.XYZ CO.) Gold Company 1b Date acquired ic Dato sold or disposed 03/27/2020 09/18/2020 PAYER'S TIN PECIRENTS TN 1d Proceeds te Cost or other basis $ 12,100.00 $ 14,200.00 11-4396782 256-43-8819 For Recipient tf Accrued market discount 19 Wash sale loss dialowed Copy B FECIPIENT'S name Jeanette Boyd Stroal address including apt.no) 33333 Fume Blanc Way City or town, state or province, country, and AP or foreign postal code Temecula, CA 92591 2 Short-term gain orkes 3 checked. proceeds from Long.com gain or los Colectibles Ordinary OOF This is important tax deral income tax wei 5 I checked, noncovered information and is Security being furnished to Heported to AS 1 Fchecked, loss is not allowed the IRS. If you are required to file a Gross proceeds based on amount in 1d retum, a negligence Not proceeds X penalty or other Port or loos realcedin Urrediced profit or on sanction may be 2000 on closed contracts open contracts - 12/31/2010 imposed on you if this income is $ taxable and the IRS Ho Urrealized profit or lose on 14 Aggregate prostor (los) determines that it open contracts-12/312020 ch contracts has not been reported. 112 Checked, bass reported 13 Bartening to RS $ wwwins Farming Terment of the Treated Downs Series Account number ses instructions) CUSIP number FATCA filing requirement 14 Stato namo 15 State identificaron no. 16 Sate tax withheld Form 1099.R (Kean for your records UMB No. 1845-0112 CORRECTED (if checked) PAYER S namo, stroot address, city or town, state or province, country, AP Payor's RTN (optional or foreign postal code, and telephone no. Vintage Bank 6792 Main Street 1 Interest income Temecula, CA 92591 1,411.58 $ 2 Early withdrawal penalty 2020 Interest Income Form 1099-INT Copy B For Recipient PAYER'S TIN RECIPIENT'S TIN $ 3 Interest on U.S. Savings Bonds and Troas obigations 96-8724390 543-88-9756 FECIPIENT'S name 4 Federal income tax withhok 5 Investment expenses This is mportant tax 35 Michael Boyd Information and is Heng furnished to the Foreign taxpand 7 Foreign county or U.S.porcusion IRS. If you are Strout address including ept. no.) $ required to nie a 33333 Fume Blanc Way 8 Tax-exempt interest 9 Specified private activity bond retum, a negligence interest penalty or other sanction may be City or town, state or province, country, and ZIP or foreign postal code $ $ Imposed on your Temecula, CA 92591 10 Market discount 11 Bond premium this income is taxable and the IRS determines that it has FATCA filing $ $ not been reported. requirement 12 Bordpremium on Treasury diligatione 13 Band pronien on tax-xxampt bond $ $ Account number (900 instructions 14 Tax-exempt and tax credit 15 State 16 Stata identification no. 17 State tax withhold bond CUP no. $ Form 1099-INT (keep for your records) www.ic.gow Form1099INT Department of the Treasury - Intemal Revenue Service Green Co. $1,500 Orange Co. $8,100 3,775 02/11/20 06/19/20 Sales price Basis Date acquired Date sold Gold Co. See Form 1099-B (Page D-12) 2,600 10/31/18 10/23/20 Gold Co. Green Co. See Orange Co. $8,100 3,775 02/11/20 06/19/20 Sales price Basis Date acquired Date sold Form $1,500 2,600 10/31/18 10/23/20 1099-B (Page D-12) bSLLLS Final K-1 Amended K-1 OMB No 1545-0123 Part III Partner's Share of Current Year Income, Deductions, Credits, and Other Items 1 Ordinary business income foss) 15 Credits 2 Not rontal real estate income foss) 1,600 Other net rental income foss) 16 Foreign transactions 4a Guaranteed payments for services 46 Guaranteed payment for capital *** JULY : 120 7 4c Total guaranteed payments 5 Interest income ba Ordinary dividends 10 Schedule K-1 2020 (Form 1065) Department of the Treasury Internal Revenue Service For calendar year 2020, or tax year beginning / 2020 ending 1 Partner's Share of Income, Deductions, Credits, etc. See separate instructions. Part 1 Information About the Partnership A Partnership's employer identification number 11-2343212 B Partnership's name, address, city, state, and ZIP code Wine Acres Partners 581 Coombs Street Napa, CA 94559 IRS Certer where partnership filed retum Ogden, UT D Check if this is a publicly traded partnership PTP) Part II Information About the Partner E Partner's SSN CF TIN Do not use TIN of a disregarded entity. See instructions.) 543-88-9756 F Name, address, city, state, and ZIP code for partner entered in E. See instructions. Michael Boyd 33333 Fume Blanc Way Temecula, CA 92591 Ex General partner or LLC Umited partner or other LLC member-manager member 11 Domestic partner Foreign partner H2 If the partner is a disregarded entity (DE). enter the partner's TIN Name H What type of entity is the partner 12 this partner is a retirement plan (RA SEP/Keoghvetc.), check here u Partner's share of profit, loss, and capital (see Instructions: Beginning Ending 2% 2% LOG 2% 2% Capital 2% 2% Check it decrease is due to sale or exchange of partnership interest. 0 66 Qualified dividends CENTE 10 6c Dividend equivalents 17 Alternative minimum tax (AMT) items 7 Royalties 0 8 Net short-term capital gain foss) Sa Net long-term capital gain loss) (890) Collectibles (28%) gain foss) 18 Tax-exempt income and nondeductible expenses ac Unrecaptured section 1250 gain 10 Net section 1231 gain foss) 19 Profit Distributions 11 Other income foss) A 350 20 Other information K 12 Section 179 deduction N 1,600 13 Other deductions Partner's share of abilities: Beginning Ending Nonrecourse $ 4.679 $ 4,679 Qualified nonrecourse . Recourse $ Check this box iftom k includes ability amounts from lower the partnerships Partner's Capital Account Analysis L 14 Self-employment earrings loss 1,600 13,256 A Beginning capital account Capital contributed during the you $ Current year net income foss) $ Other increase decrease attach explanations 720 21 More than one activity for at-risk purposes Fom 1095-A Health Insurance Marketplace Statement void OMB No 1545-2232 Department of the Troy Do not attach to your tax return. Keep for your records. CORRECTED 2020 Internal Revenue Service Go to www.irs.gov/Form 1095A for instructions and the latest information. Part1 Recipient Information 1 Marketplace identifier 2 Marketplaco-assigned policy number 3 Policy issuer's name 31-1234567 A1000HT Covered California 4 Recipient's name 5 Recipient's SSN GRecipiont's date of birth Michael Boyd 543-88-9756 05/04/1977 7 Recipient's spouse's name Recipient's spouto's SSN Recipient's spouse's date of birth Jeanette Boyd 256-43-8819 06/12/1978 10 Policy start date 11 Policy Termination date 12 Strout address including apartment no 05/01/2020 12/31/2020 33333 Fume Blanc Way 13 aty or town or province 15 Country and ZIP or foreign postal code Temecula CA 92591 Part II Covered Individuals ERAT. A. Covered individual name B. Covered individual SSN C. Covered individual date of birth D. Coverage start date E. Coverage termination die Michael Boyd 543-88-9756 05/04/1977 05/01/2020 16 12/31/2020 17 Jeanette Boyd 256-43-8819 06/12/1978 05/01/2020 12/31/2020 18 Maxwell Boyd 466-74-1131 04/16/2003 05/01/2020 12/31/2020 19 Seve Boyd 465-76-8375 12/02/2008 05/01/2020 12/31/2020 20 Denzel Boyd 475-23-1426 01/13/2010 05/01/2020 12/31/2020 Part III Coverage Information Month A. Monthly enrolment premium B. Monthly second lowest cost silver C. Monthly advance payment of plan (SLCSP) premium premium tax credit 21 January 22 February 23 March 24 April 1.540 1,625 0 25 May 1,540 1,625 0 26 June 1.540 1,625 0 27 July 1,540 1,625 0 28 August 1.540 1.625 0 29 September 1,540 1,625 0 30 October 0 0 31 November 1,540 1,625 1,540 1,625 32 December 12,320 13,000 33 Annual Totals For Privacy Act and Paperwork Reduction Act Notice, see separate instructions. 0 Cat. No. 607000 Form 1095-A 000 2020 CORRECTED (if checked) PAYER'S name, street adress, city or town, state or provhos, 1 Gross distribution OMB No. 1545-0119 Distributions From country. ZIP or foreign postal code and phone na 14,600.00 Pensions, Annuities, Retirement or United States Navy Profit-Sharing Plans, Retired Benefits Center 2a Taxable amount IRAs, Insurance Cleveland, OH 43267 14,600.00 Contracts, etc. Form 1099-R 2D Surable amount Total not determined 0 distribution Copy B Report this PAYER'S TN RECIPIENTS TIN 3 Capital gain (Induded Federal income tax In box 2a) withhold income on your 11-4662891 543-88-9756 federal tax return. If this 1,500.00 form shows RECIPIENT'S neme 5 Employee contributions/6NER unrealized federal income Designated Roth appreciation in tax withheld in Michael D. Boyd contributions or employer's securities box 4, attach Insurance premiums this copy to Street address including apt.no) 7 Distribution IPA 8 Other SEP 33333 Fume Blanc Way codes) SIMPLE 7 Is This information is being furnished to city or town, state or province, country, and ZIP or foreign postal code 9a Your percentage of total 9b Total employee contributiona the IRS. Temecula, CA 92591 distribution 9 $ 10 Amount allocable to IRR 11 1st year of desig 12 FATCA fiing 14 State tax withheld 15 State/Payer's state no. 18 State distribution within 5 years Roh contit regrunnent le 350.00 $ 14,600.00 $ Account number (see nstructions 13 Date of 17 Local tax withheld 18 Name of locality 19 Local distribution payment 1$ your retum. 2020 Barter Exchange Form 1099-R www.rs.gov/Form1000R Department of the Treasury - Intemal Revenue Service N CORRECTED (if checked PAYER'S namo strcat address, city or town, state or province, courtry.ZIP Applicable checkbox on Form 2040 OM NA 1545-0715 Proceeds From or foreign postal code, and telephone no. Broker and Bear Steams A 269 Wall Street Transactions Form 1099-B New York, NY 10001 1a Description of property (Example: 100 sh.XYZ CO.) Gold Company 1b Date acquired ic Dato sold or disposed 03/27/2020 09/18/2020 PAYER'S TIN PECIRENTS TN 1d Proceeds te Cost or other basis $ 12,100.00 $ 14,200.00 11-4396782 256-43-8819 For Recipient tf Accrued market discount 19 Wash sale loss dialowed Copy B FECIPIENT'S name Jeanette Boyd Stroal address including apt.no) 33333 Fume Blanc Way City or town, state or province, country, and AP or foreign postal code Temecula, CA 92591 2 Short-term gain orkes 3 checked. proceeds from Long.com gain or los Colectibles Ordinary OOF This is important tax deral income tax wei 5 I checked, noncovered information and is Security being furnished to Heported to AS 1 Fchecked, loss is not allowed the IRS. If you are required to file a Gross proceeds based on amount in 1d retum, a negligence Not proceeds X penalty or other Port or loos realcedin Urrediced profit or on sanction may be 2000 on closed contracts open contracts - 12/31/2010 imposed on you if this income is $ taxable and the IRS Ho Urrealized profit or lose on 14 Aggregate prostor (los) determines that it open contracts-12/312020 ch contracts has not been reported. 112 Checked, bass reported 13 Bartening to RS $ wwwins Farming Terment of the Treated Downs Series Account number ses instructions) CUSIP number FATCA filing requirement 14 Stato namo 15 State identificaron no. 16 Sate tax withheld Form 1099.R (Kean for your records UMB No. 1845-0112 CORRECTED (if checked) PAYER S namo, stroot address, city or town, state or province, country, AP Payor's RTN (optional or foreign postal code, and telephone no. Vintage Bank 6792 Main Street 1 Interest income Temecula, CA 92591 1,411.58 $ 2 Early withdrawal penalty 2020 Interest Income Form 1099-INT Copy B For Recipient PAYER'S TIN RECIPIENT'S TIN $ 3 Interest on U.S. Savings Bonds and Troas obigations 96-8724390 543-88-9756 FECIPIENT'S name 4 Federal income tax withhok 5 Investment expenses This is mportant tax 35 Michael Boyd Information and is Heng furnished to the Foreign taxpand 7 Foreign county or U.S.porcusion IRS. If you are Strout address including ept. no.) $ required to nie a 33333 Fume Blanc Way 8 Tax-exempt interest 9 Specified private activity bond retum, a negligence interest penalty or other sanction may be City or town, state or province, country, and ZIP or foreign postal code $ $ Imposed on your Temecula, CA 92591 10 Market discount 11 Bond premium this income is taxable and the IRS determines that it has FATCA filing $ $ not been reported. requirement 12 Bordpremium on Treasury diligatione 13 Band pronien on tax-xxampt bond $ $ Account number (900 instructions 14 Tax-exempt and tax credit 15 State 16 Stata identification no. 17 State tax withhold bond CUP no. $ Form 1099-INT (keep for your records) www.ic.gow Form1099INT Department of the Treasury - Intemal Revenue Service Green Co. $1,500 Orange Co. $8,100 3,775 02/11/20 06/19/20 Sales price Basis Date acquired Date sold Gold Co. See Form 1099-B (Page D-12) 2,600 10/31/18 10/23/20