need this asap

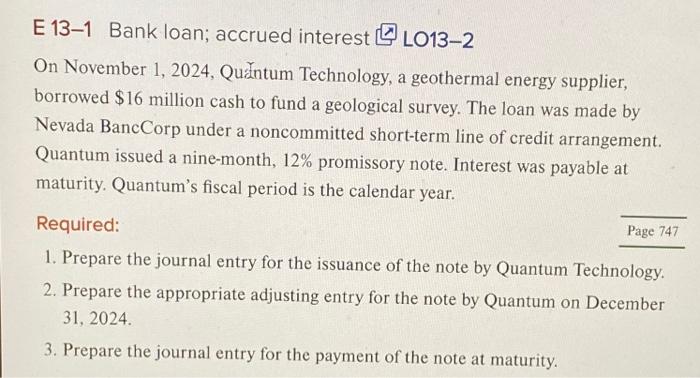

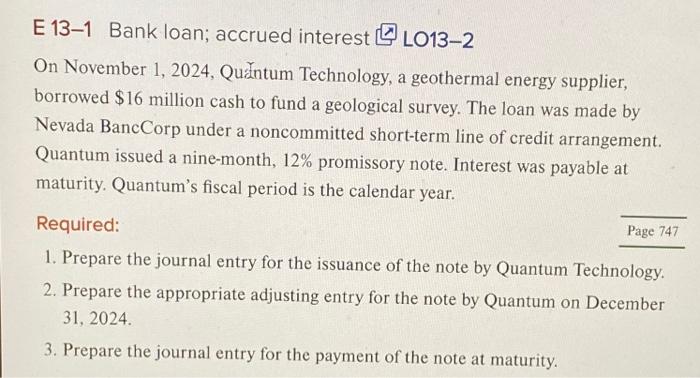

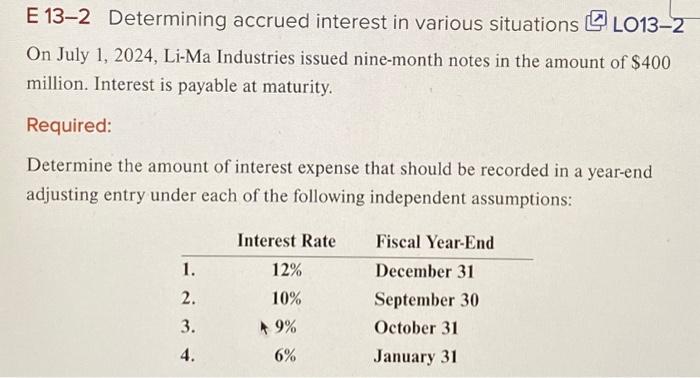

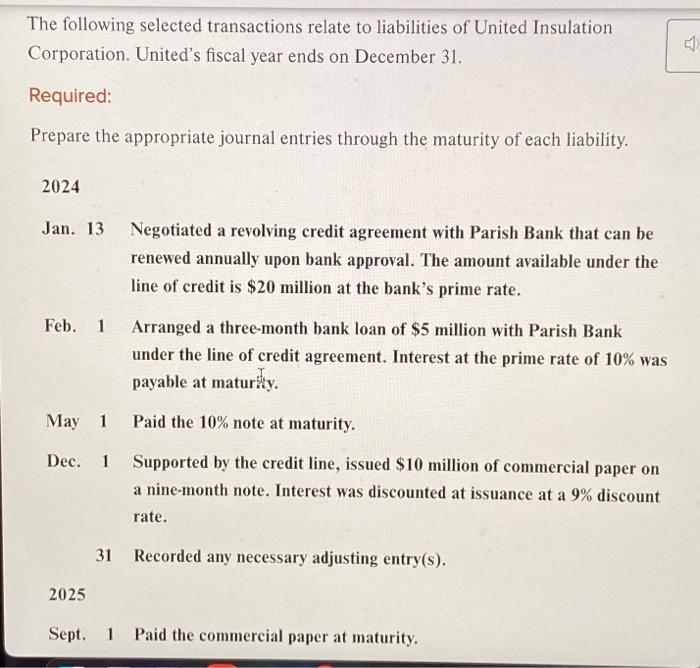

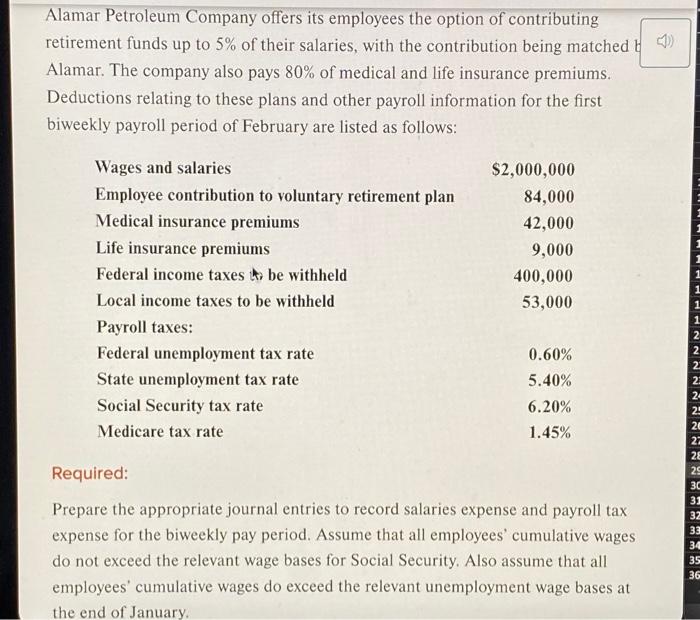

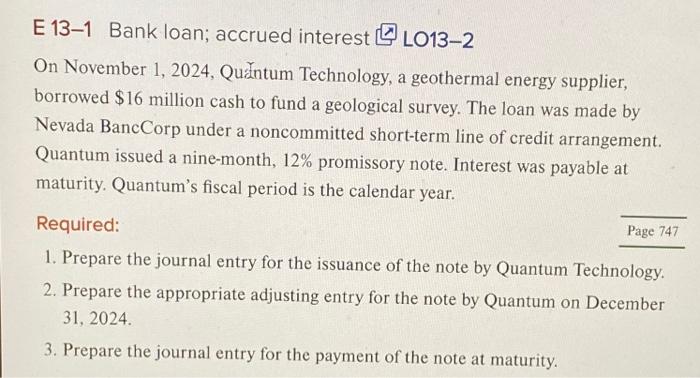

E 13-1 Bank loan; accrued interest LO13-2 On November 1, 2024, Quntum Technology, a geothermal energy supplier, borrowed \$16 million cash to fund a geological survey. The loan was made by Nevada BancCorp under a noncommitted short-term line of credit arrangement. Quantum issued a nine-month, 12% promissory note. Interest was payable at maturity. Quantum's fiscal period is the calendar year. Required: Page 747 1. Prepare the journal entry for the issuance of the note by Quantum Technology. 2. Prepare the appropriate adjusting entry for the note by Quantum on December 31, 2024. 3. Prepare the journal entry for the payment of the note at maturity. E 13-2 Determining accrued interest in various situations [\] LO13-2 On July 1, 2024, Li-Ma Industries issued nine-month notes in the amount of $400 million. Interest is payable at maturity. Required: Determine the amount of interest expense that should be recorded in a year-end adjusting entry under each of the following independent assumptions: The following selected transactions relate to liabilities of United Insulation Corporation. United's fiscal year ends on December 31. Required: Prepare the appropriate journal entries through the maturity of each liability. 2024 Jan. 13 Negotiated a revolving credit agreement with Parish Bank that can be renewed annually upon bank approval. The amount available under the line of credit is $20 million at the bank's prime rate. Feb. 1 Arranged a three-month bank loan of $5 million with Parish Bank under the line of credit agreement. Interest at the prime rate of 10% was payable at maturity. May 1 Paid the 10% note at maturity. Dec. 1 Supported by the credit line, issued \$10 million of commercial paper on a nine-month note. Interest was discounted at issuance at a 9% discount rate. 31 Recorded any necessary adjusting entry(s). 2025 Sept. 1 Paid the commercial paper at maturity. Alamar Petroleum Company offers its employees the option of contributing retirement funds up to 5% of their salaries, with the contribution being matched Alamar. The company also pays 80% of medical and life insurance premiums. Deductions relating to these plans and other payroll information for the first biweekly payroll period of February are listed as follows: Required: Prepare the appropriate journal entries to record salaries expense and payroll tax expense for the biweekly pay period. Assume that all employees' cumulative wages do not exceed the relevant wage bases for Social Security. Also assume that all employees' cumulative wages do exceed the relevant unemployment wage bases at the end of January