Answered step by step

Verified Expert Solution

Question

1 Approved Answer

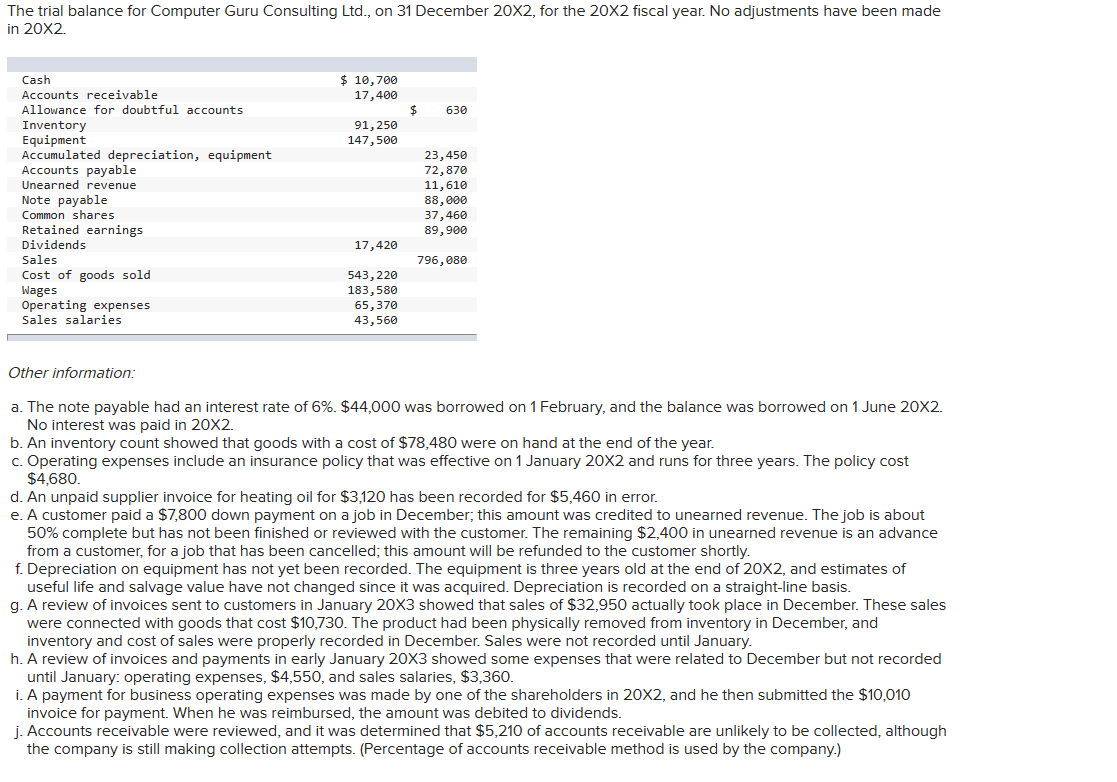

need this asap please The trial balance for Computer Guru Consulting Ltd., on 31 December 202, for the 202 fiscal year. No adjustments have been

need this asap please

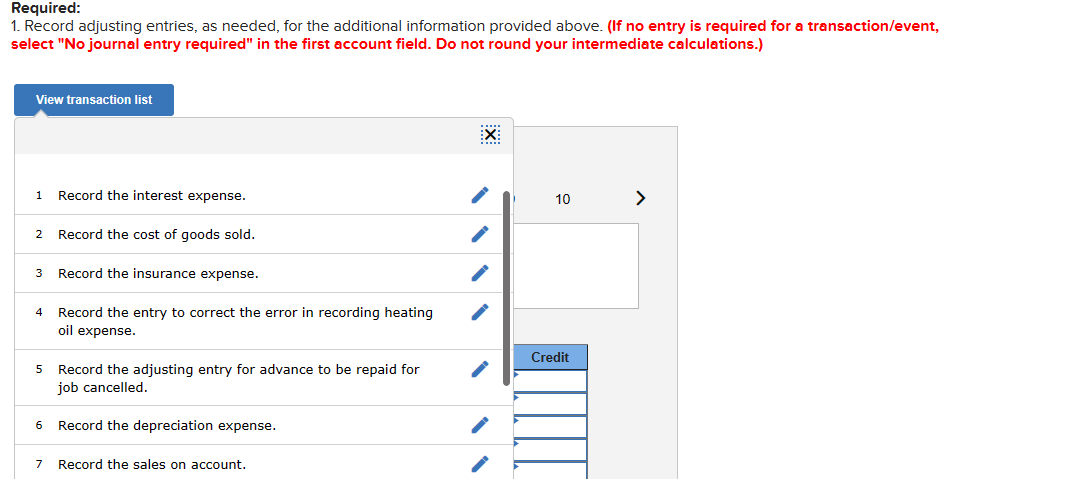

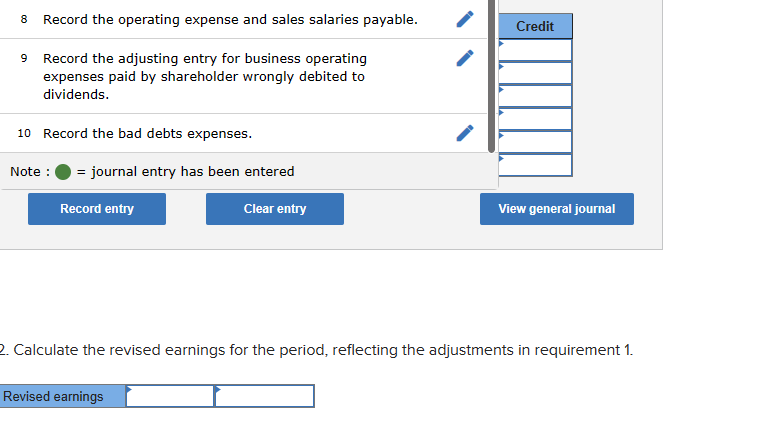

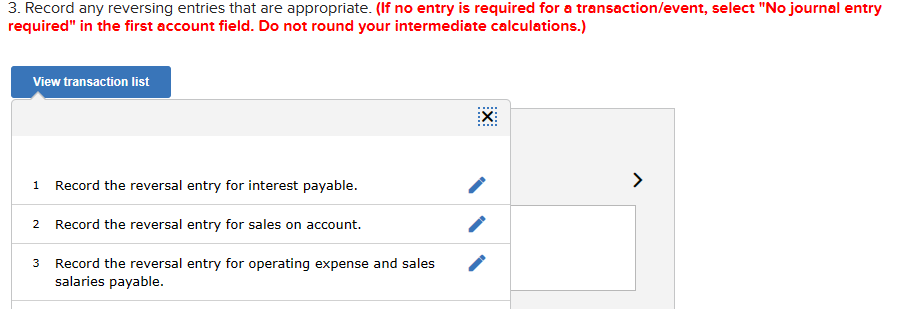

The trial balance for Computer Guru Consulting Ltd., on 31 December 202, for the 202 fiscal year. No adjustments have been made in 202. Other information: a. The note payable had an interest rate of 6%.$44,000 was borrowed on 1 February, and the balance was borrowed on 1 June 202. No interest was paid in 202. b. An inventory count showed that goods with a cost of $78,480 were on hand at the end of the year. c. Operating expenses include an insurance policy that was effective on 1 January 202 and runs for three years. The policy cost $4,680. d. An unpaid supplier invoice for heating oil for $3,120 has been recorded for $5,460 in error. e. A customer paid a $7,800 down payment on a job in December; this amount was credited to unearned revenue. The job is about 50% complete but has not been finished or reviewed with the customer. The remaining $2,400 in unearned revenue is an advance from a customer, for a job that has been cancelled; this amount will be refunded to the customer shortly. f. Depreciation on equipment has not yet been recorded. The equipment is three years old at the end of 202, and estimates of useful life and salvage value have not changed since it was acquired. Depreciation is recorded on a straight-line basis. g. A review of invoices sent to customers in January 203 showed that sales of $32,950 actually took place in December. These sales were connected with goods that cost $10,730. The product had been physically removed from inventory in December, and inventory and cost of sales were properly recorded in December. Sales were not recorded until January. h. A review of invoices and payments in early January 203 showed some expenses that were related to December but not recorded until January: operating expenses, $4,550, and sales salaries, $3,360. i. A payment for business operating expenses was made by one of the shareholders in 202, and he then submitted the $10,010 invoice for payment. When he was reimbursed, the amount was debited to dividends. j. Accounts receivable were reviewed, and it was determined that $5,210 of accounts receivable are unlikely to be collected, although the company is still making collection attempts. (Percentage of accounts receivable method is used by the company.) Required: 1. Record adjusting entries, as needed, for the additional information provided above. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Do not round your intermediate calculations.) 8 Record the operating expense and sales salaries payable. Credit 9 Record the adjusting entry for business operating expenses paid by shareholder wrongly debited to dividends. 10 Record the bad debts expenses. Note : = journal entry has been entered Calculate the revised earnings for the period, reflecting the adjustments in requirement 1 . 3. Record any reversing entries that are appropriate. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Do not round your intermediate calculations.) \begin{tabular}{|l|l|} \hline 1 & Record the reversal entry for interest payable. \\ \hline 2 Record the reversal entry for sales on account. \\ \hline 3 Record the reversal entry for operating expense and sales \\ salaries payable. \end{tabular}

The trial balance for Computer Guru Consulting Ltd., on 31 December 202, for the 202 fiscal year. No adjustments have been made in 202. Other information: a. The note payable had an interest rate of 6%.$44,000 was borrowed on 1 February, and the balance was borrowed on 1 June 202. No interest was paid in 202. b. An inventory count showed that goods with a cost of $78,480 were on hand at the end of the year. c. Operating expenses include an insurance policy that was effective on 1 January 202 and runs for three years. The policy cost $4,680. d. An unpaid supplier invoice for heating oil for $3,120 has been recorded for $5,460 in error. e. A customer paid a $7,800 down payment on a job in December; this amount was credited to unearned revenue. The job is about 50% complete but has not been finished or reviewed with the customer. The remaining $2,400 in unearned revenue is an advance from a customer, for a job that has been cancelled; this amount will be refunded to the customer shortly. f. Depreciation on equipment has not yet been recorded. The equipment is three years old at the end of 202, and estimates of useful life and salvage value have not changed since it was acquired. Depreciation is recorded on a straight-line basis. g. A review of invoices sent to customers in January 203 showed that sales of $32,950 actually took place in December. These sales were connected with goods that cost $10,730. The product had been physically removed from inventory in December, and inventory and cost of sales were properly recorded in December. Sales were not recorded until January. h. A review of invoices and payments in early January 203 showed some expenses that were related to December but not recorded until January: operating expenses, $4,550, and sales salaries, $3,360. i. A payment for business operating expenses was made by one of the shareholders in 202, and he then submitted the $10,010 invoice for payment. When he was reimbursed, the amount was debited to dividends. j. Accounts receivable were reviewed, and it was determined that $5,210 of accounts receivable are unlikely to be collected, although the company is still making collection attempts. (Percentage of accounts receivable method is used by the company.) Required: 1. Record adjusting entries, as needed, for the additional information provided above. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Do not round your intermediate calculations.) 8 Record the operating expense and sales salaries payable. Credit 9 Record the adjusting entry for business operating expenses paid by shareholder wrongly debited to dividends. 10 Record the bad debts expenses. Note : = journal entry has been entered Calculate the revised earnings for the period, reflecting the adjustments in requirement 1 . 3. Record any reversing entries that are appropriate. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Do not round your intermediate calculations.) \begin{tabular}{|l|l|} \hline 1 & Record the reversal entry for interest payable. \\ \hline 2 Record the reversal entry for sales on account. \\ \hline 3 Record the reversal entry for operating expense and sales \\ salaries payable. \end{tabular} Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started