Answered step by step

Verified Expert Solution

Question

1 Approved Answer

need this done asap will like From Chavez Company's Accounting Records View transaction list View journal entry worksheet Hequired 2 Nakashima Gallery had the following

need this done asap will like

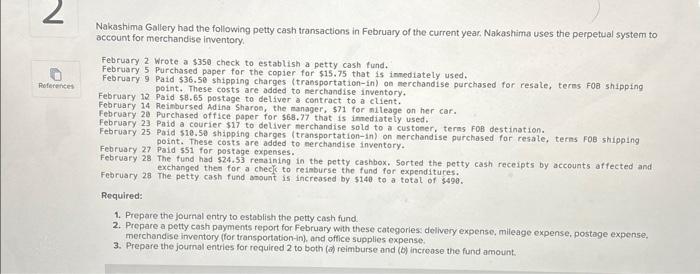

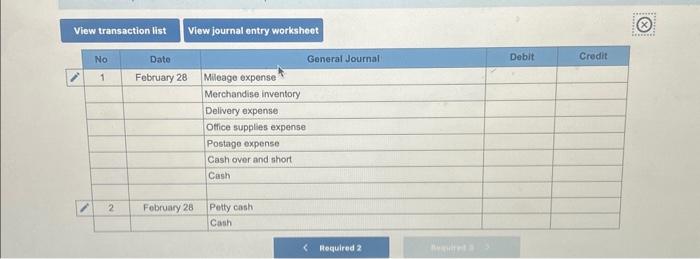

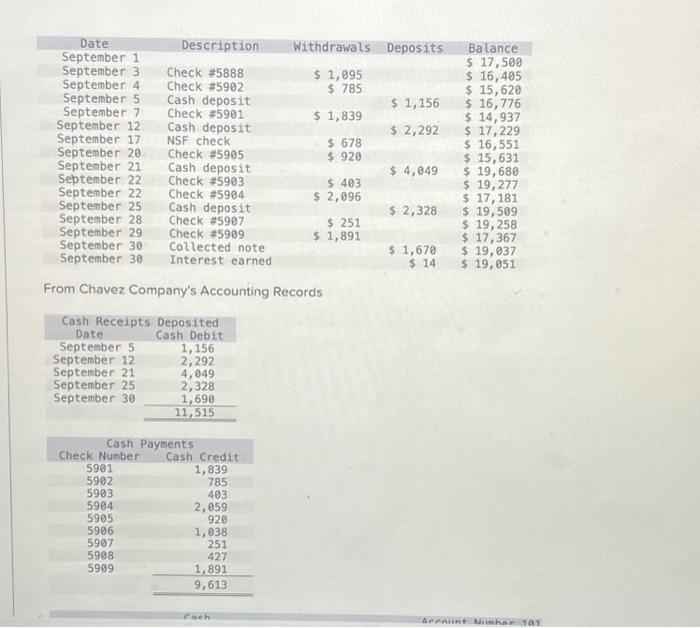

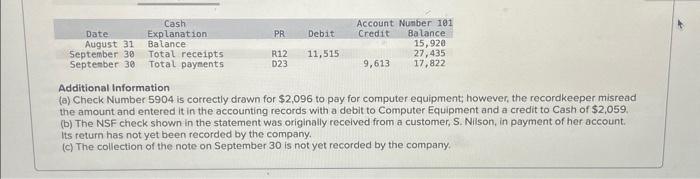

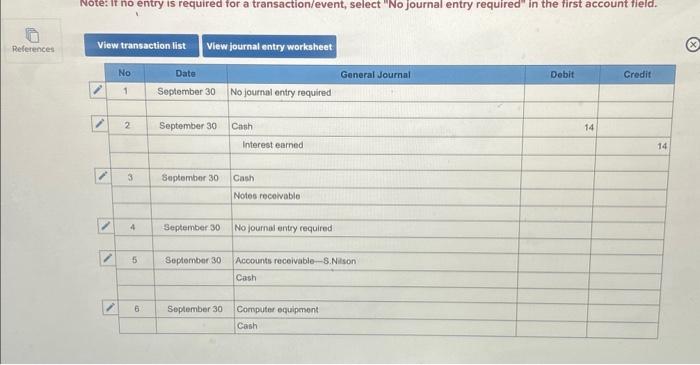

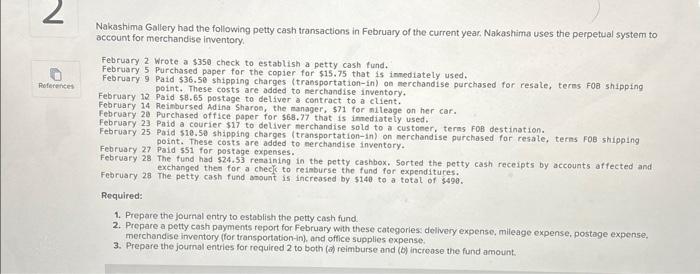

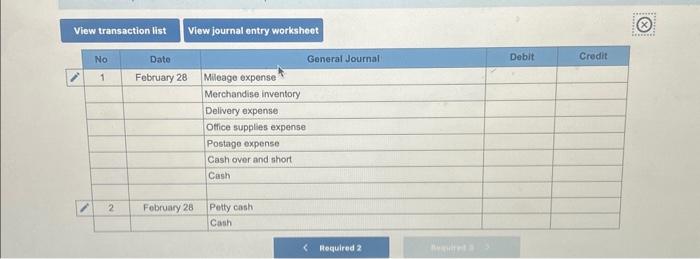

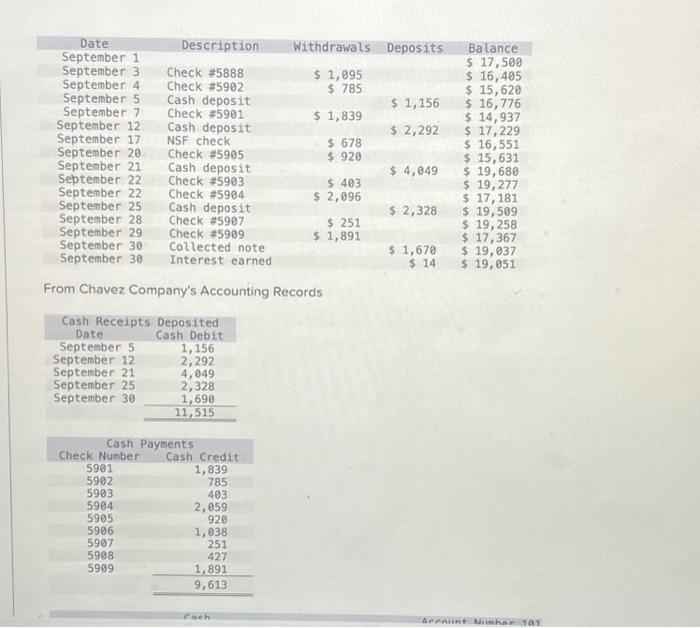

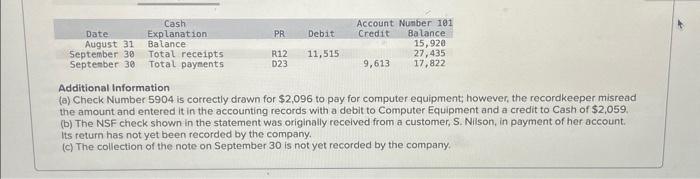

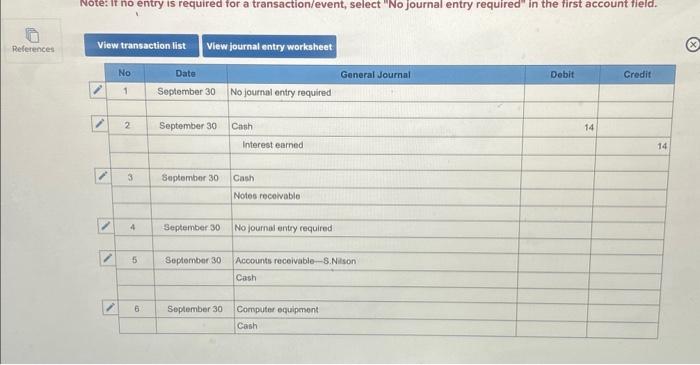

From Chavez Company's Accounting Records View transaction list View journal entry worksheet Hequired 2 Nakashima Gallery had the following petty cash transactions in February of the current year. Nakashima uses the perpetual system to account for merchandise inventory. February 2 Wrote a $350 check to establish a petty cash fund. February 5 purchased paper for the copier for $15.75 that is inmediately used. February 9 Paid $36.50 shipping charges (transportation-in) on merchandise purchased for resate, terns fob shipping. point. These costs are added to nerchandise inventory. February 12 Paid $8.65 postage to deliver a contract to a client. February 14. Reinbursed Adina Sharoo, the manager, $71 for nileage on her car. February 20 Purchased of fice paper for $65.77 that is innediately used. February 23 Paid a courier $17 to deliver nerchandise sold to a custoner, teras FOB destination. February 25 Paid $10.50 shipping charges (transportation-in) on ocrehandise purchased for resate, terns FoB shipping. point. These costs are added to merchandise inventory. February 27 Pald 551 for postage expenses. February 28 The fund had $24,53 renaining in the petty cashbox, sorted the petty cash receipts by accounts affected and exchanged thes for a check to reimburse the fund for expenditures. Fearuary 28 The petty cash fund anount is increased by $140 to a totat of 5490 . Required: 1. Prepare the journal entry to establish the petty cash fund. 2. Prepare a petty cash payments report for February with these categorlesi diclivery expense, mileage expense, postage expense. merchandise imventory (for transportation-in), and offlice supplies expense. 3. Prepare the journal entries for required 2 to both (a) reimburse and (b) incroose the fund amount. Additional Information (a) Check Number 5904 is correctly drawn for $2,096 to pay for computer equipment, however, the recordkeeper misread the amount and entered it in the accounting records with a debit to Computer Equipment and a credit to Cash of $2,059. (b) The NSF check shown in the statement was originally recelved from a customer, S. Nilson, in payment of her account. its return has not yet been recorded by the company. (c) The collection of the note on September 30 is not yet recorded by the company. Note: It no entry is required for a transaction/event, select "No journal entry required" in the first account field. References View transaction list View journal entry worksheet \begin{tabular}{|c|c|c|c|c|c|} \hline & No & Date & General Journal & Debit & Credit \\ \hline & 1 & September 30 & No journal entry required & & \\ \hline & & & & & \\ \hline & 2 & September 30 & Cash & 14 & \\ \hline & & & Interest earned & & 14 \\ \hline & 3 & September 30 & Cash & & \\ \hline & & & Notes receivable & & \\ \hline & & & & & \\ \hline & 4 & September 30 & No journal entry required & & \\ \hline \multirow[t]{3}{*}{7} & 5 & September 30 : & Accounts receivable-S.Nilson & & \\ \hline & & & Cash & & \\ \hline & & & & & \\ \hline \multirow[t]{2}{*}{7} & 6 & September 30 & Computer equipenent & & \\ \hline & & 7 & Cash & & \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started