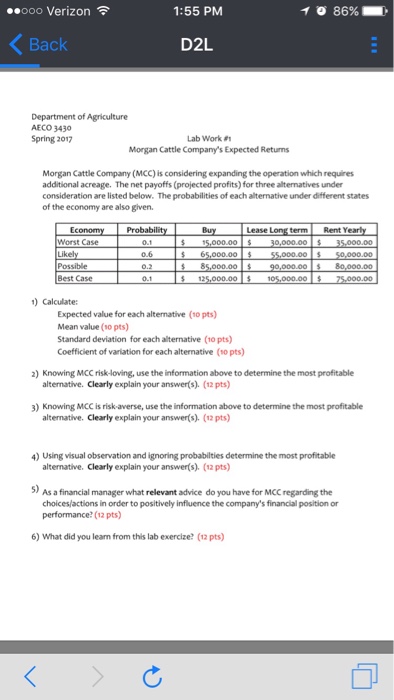

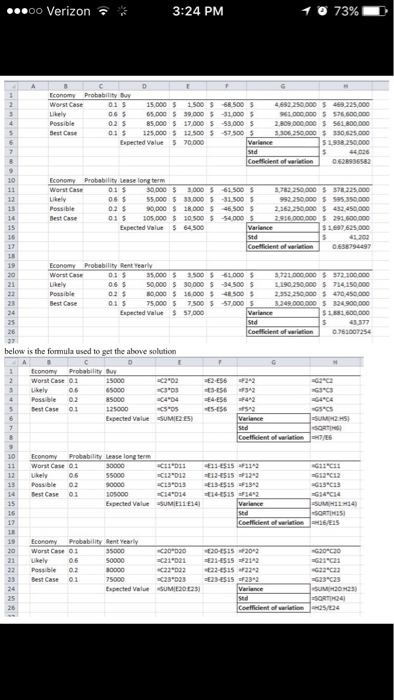

Need to answer 2-6 based on all of the information here.

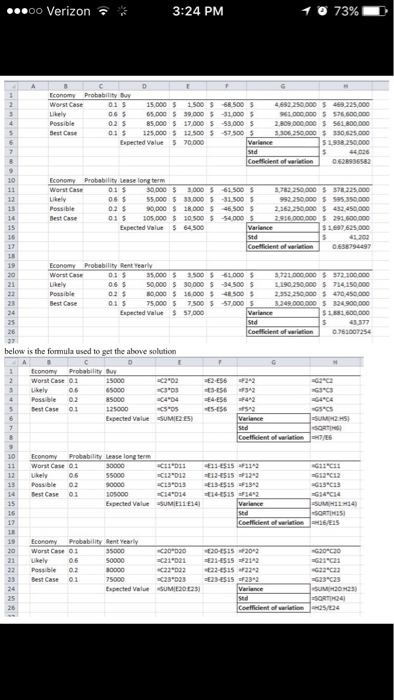

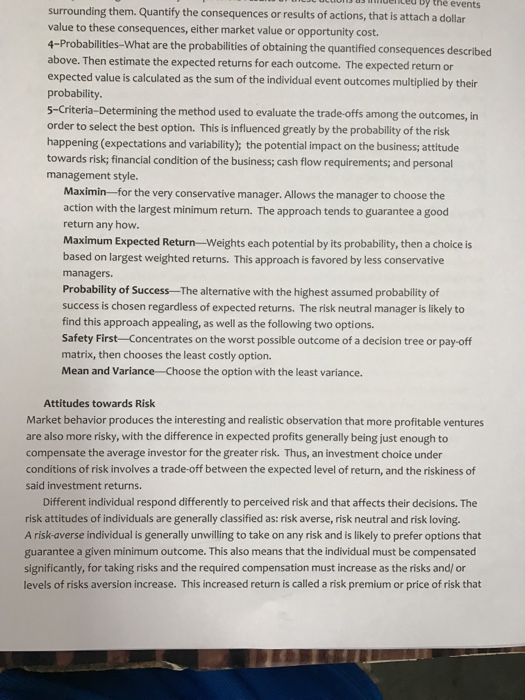

e by the events. surrounding them. Quantify the consequences or results of actions, that is attach a dollar value to these consequences, either market value or opportunity cost. 4-Probabilities-What are the probabilities of obtaining the quantified consequences described above. Then estimate the expected returns for each outcome. The expected return or expected value is calculated as the sum of the individual event outcomes multiplied by their probability. 5-Criteria-Determining the method used to evaluate the trade-offs among the outcomes, in order to select the best option. This isinfluenced greatly by the probability of the risk happening (expectations and variability); the potential impact on the business, attitude towards risk; financial condition of the business; cash flow requirements; and personal management style Maximin-for the very conservative manager. Allows the manager to choose the action with the largest minimum return. The approach tends to guarantee a good return any how. Maximum Expected Return--weights each potential by its probability, then a choice is based on largest weighted returns. This approach is favored by less conservative managers Probability of success-The alternative with the highest assumed probability of success is chosen regardless of expected returns. The risk neutral manager is likely to find this approach appealing, as well as the following two options. Safety First-concentrates on the worst possible outcome of a decision tree or pay-off matrix, then chooses the least costly option Mean and variance Choose the option with the least variance Attitudes towards Risk Market behavior produces the interesting and realistic observation that more profitable ventures are also more risky, with the difference in expected profits generally being just enough to compensate the average investor for the greater risk. Thus, an investment choice under conditions of risk involves a trade-off between the expected level of return, and the riskiness of said investment returns Different individual respond differently to perceived risk and that affects their decisions. The titudes of individuals are generally classified as: risk averse, risk neutral and risk loving, A risk-averse individual is generally unwilling to take on any risk and is likely to prefer options that guarantee a given minimum outcome. This also means that the individual must be compensated significantly, for taking risks and the required compensation must increase as the risks and/or evels of risks aversion increase. This increased return is called a risk premium or price of risk that e by the events. surrounding them. Quantify the consequences or results of actions, that is attach a dollar value to these consequences, either market value or opportunity cost. 4-Probabilities-What are the probabilities of obtaining the quantified consequences described above. Then estimate the expected returns for each outcome. The expected return or expected value is calculated as the sum of the individual event outcomes multiplied by their probability. 5-Criteria-Determining the method used to evaluate the trade-offs among the outcomes, in order to select the best option. This isinfluenced greatly by the probability of the risk happening (expectations and variability); the potential impact on the business, attitude towards risk; financial condition of the business; cash flow requirements; and personal management style Maximin-for the very conservative manager. Allows the manager to choose the action with the largest minimum return. The approach tends to guarantee a good return any how. Maximum Expected Return--weights each potential by its probability, then a choice is based on largest weighted returns. This approach is favored by less conservative managers Probability of success-The alternative with the highest assumed probability of success is chosen regardless of expected returns. The risk neutral manager is likely to find this approach appealing, as well as the following two options. Safety First-concentrates on the worst possible outcome of a decision tree or pay-off matrix, then chooses the least costly option Mean and variance Choose the option with the least variance Attitudes towards Risk Market behavior produces the interesting and realistic observation that more profitable ventures are also more risky, with the difference in expected profits generally being just enough to compensate the average investor for the greater risk. Thus, an investment choice under conditions of risk involves a trade-off between the expected level of return, and the riskiness of said investment returns Different individual respond differently to perceived risk and that affects their decisions. The titudes of individuals are generally classified as: risk averse, risk neutral and risk loving, A risk-averse individual is generally unwilling to take on any risk and is likely to prefer options that guarantee a given minimum outcome. This also means that the individual must be compensated significantly, for taking risks and the required compensation must increase as the risks and/or evels of risks aversion increase. This increased return is called a risk premium or price of risk that

Need to answer 2-6 based on all of the information here.

Need to answer 2-6 based on all of the information here.