Answered step by step

Verified Expert Solution

Question

1 Approved Answer

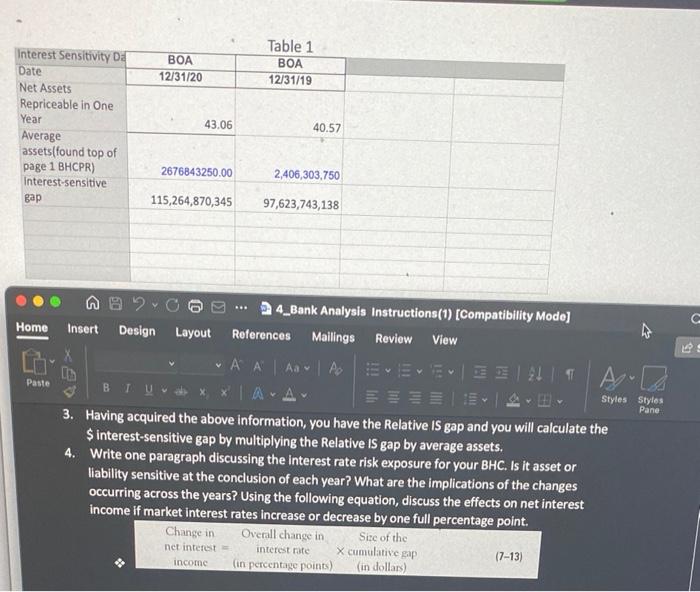

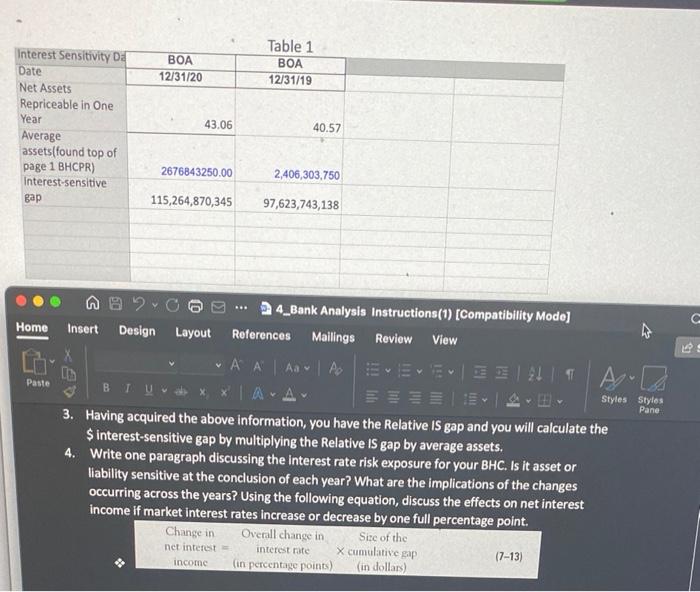

need to answer number 4 using excel sheet BOA 12/31/20 Table 1 BOA 12/31/19 Interest Sensitivity Da Date Net Assets Repriceable in One Year Average

need to answer number 4 using excel sheet

BOA 12/31/20 Table 1 BOA 12/31/19 Interest Sensitivity Da Date Net Assets Repriceable in One Year Average assets(found top of page 1 BHCPR) Interest-sensitive 43.06 40.57 2676843250.00 2,406,303,750 115,264,870,345 97,623,743,138 C Home Paste B Pane 4_Bank Analysis Instructions (1) Compatibility Mode] Insert Design Layout References Mailings Review View A A A A E 2 1 9 A " X LALA Styles Styles 3. Having acquired the above information, you have the relative IS gap and you will calculate the $ interest-sensitive gap by multiplying the Relative Is gap by average assets. 4. Write one paragraph discussing the interest rate risk exposure for your BHC. Is it asset or liability sensitive at the conclusion of each year? What are the implications of the changes occurring across the years? Using the following equation, discuss the effects on net interest income if market interest rates increase or decrease by one full percentage point. Change in Overall change in Size of the X cumulative gap (7-13) (in percentage points) in dollars) interest rate net interest income BOA 12/31/20 Table 1 BOA 12/31/19 Interest Sensitivity Da Date Net Assets Repriceable in One Year Average assets(found top of page 1 BHCPR) Interest-sensitive 43.06 40.57 2676843250.00 2,406,303,750 115,264,870,345 97,623,743,138 C Home Paste B Pane 4_Bank Analysis Instructions (1) Compatibility Mode] Insert Design Layout References Mailings Review View A A A A E 2 1 9 A " X LALA Styles Styles 3. Having acquired the above information, you have the relative IS gap and you will calculate the $ interest-sensitive gap by multiplying the Relative Is gap by average assets. 4. Write one paragraph discussing the interest rate risk exposure for your BHC. Is it asset or liability sensitive at the conclusion of each year? What are the implications of the changes occurring across the years? Using the following equation, discuss the effects on net interest income if market interest rates increase or decrease by one full percentage point. Change in Overall change in Size of the X cumulative gap (7-13) (in percentage points) in dollars) interest rate net interest income

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started