Need to answer requirements L-Q

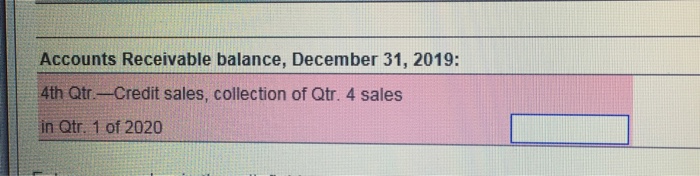

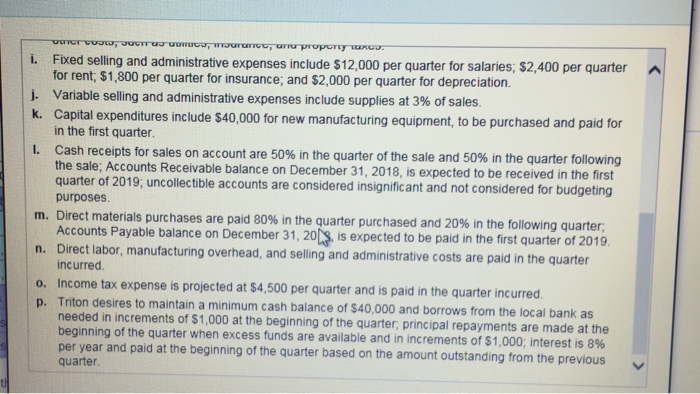

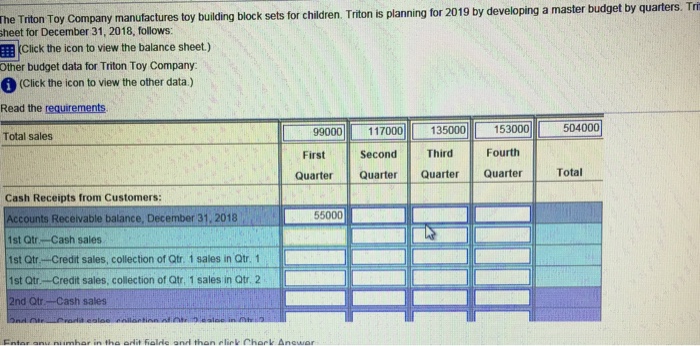

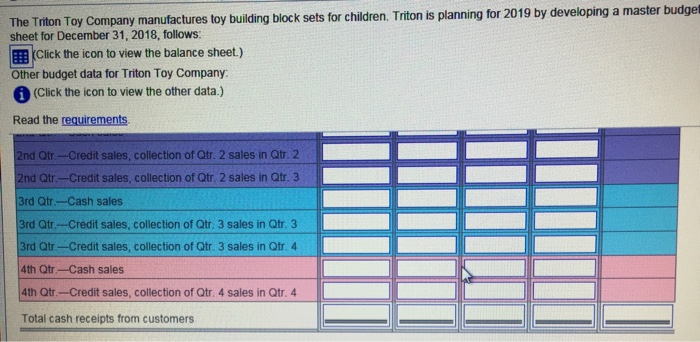

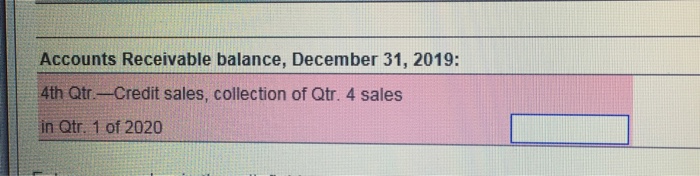

Fixed selling and administrative expenses include S 12,000 per quarter for salaries, s2.400 per quarter for rent, $1,800 per quarter for insurance; and $2,000 per quarter for depreciation Variable selling and administrative expenses include supplies at 3% of sales. Capital expenditures include $40,000 for new manufacturing equipment, to be purchased and paid for in the first quarter i. j. k. Cash receipts for sales on account are 50% in the quarter of the sale and 50% in the quarter following the sale; Accoun quarter of 2019, uncollectib purposes I. ts Receivable balance on December 31, 2018, is expected to be received in the first le accounts are considered insignificant and not considered for budgeting m. Direct materials purchases are paid 80% in the quarter purchased and 20% in the following quarter; Accounts Payable balance on December 31, 20 is expected to be paid in the first quarter of 2019 n. Direct labor, manufacturing overhead, and selling and administrative costs are paid in the quarter incurred Income tax expense is projected at $4,500 per quarter and is paid in the quarter incurred. Triton desires to maintain a minimum cash balance of $40,000 and borrows from the local bank as needed in increments of $1,000 at the beginning of the quarter, principal repayments are made at the o. beginning of the quarter when excess funds are available and in increments of $1,000, interest is 8% per year and paid at the beginning of the quarter based on the amount outstanding from the previous quarter Fixed selling and administrative expenses include S 12,000 per quarter for salaries, s2.400 per quarter for rent, $1,800 per quarter for insurance; and $2,000 per quarter for depreciation Variable selling and administrative expenses include supplies at 3% of sales. Capital expenditures include $40,000 for new manufacturing equipment, to be purchased and paid for in the first quarter i. j. k. Cash receipts for sales on account are 50% in the quarter of the sale and 50% in the quarter following the sale; Accoun quarter of 2019, uncollectib purposes I. ts Receivable balance on December 31, 2018, is expected to be received in the first le accounts are considered insignificant and not considered for budgeting m. Direct materials purchases are paid 80% in the quarter purchased and 20% in the following quarter; Accounts Payable balance on December 31, 20 is expected to be paid in the first quarter of 2019 n. Direct labor, manufacturing overhead, and selling and administrative costs are paid in the quarter incurred Income tax expense is projected at $4,500 per quarter and is paid in the quarter incurred. Triton desires to maintain a minimum cash balance of $40,000 and borrows from the local bank as needed in increments of $1,000 at the beginning of the quarter, principal repayments are made at the o. beginning of the quarter when excess funds are available and in increments of $1,000, interest is 8% per year and paid at the beginning of the quarter based on the amount outstanding from the previous quarter

Need to answer requirements L-Q

Need to answer requirements L-Q