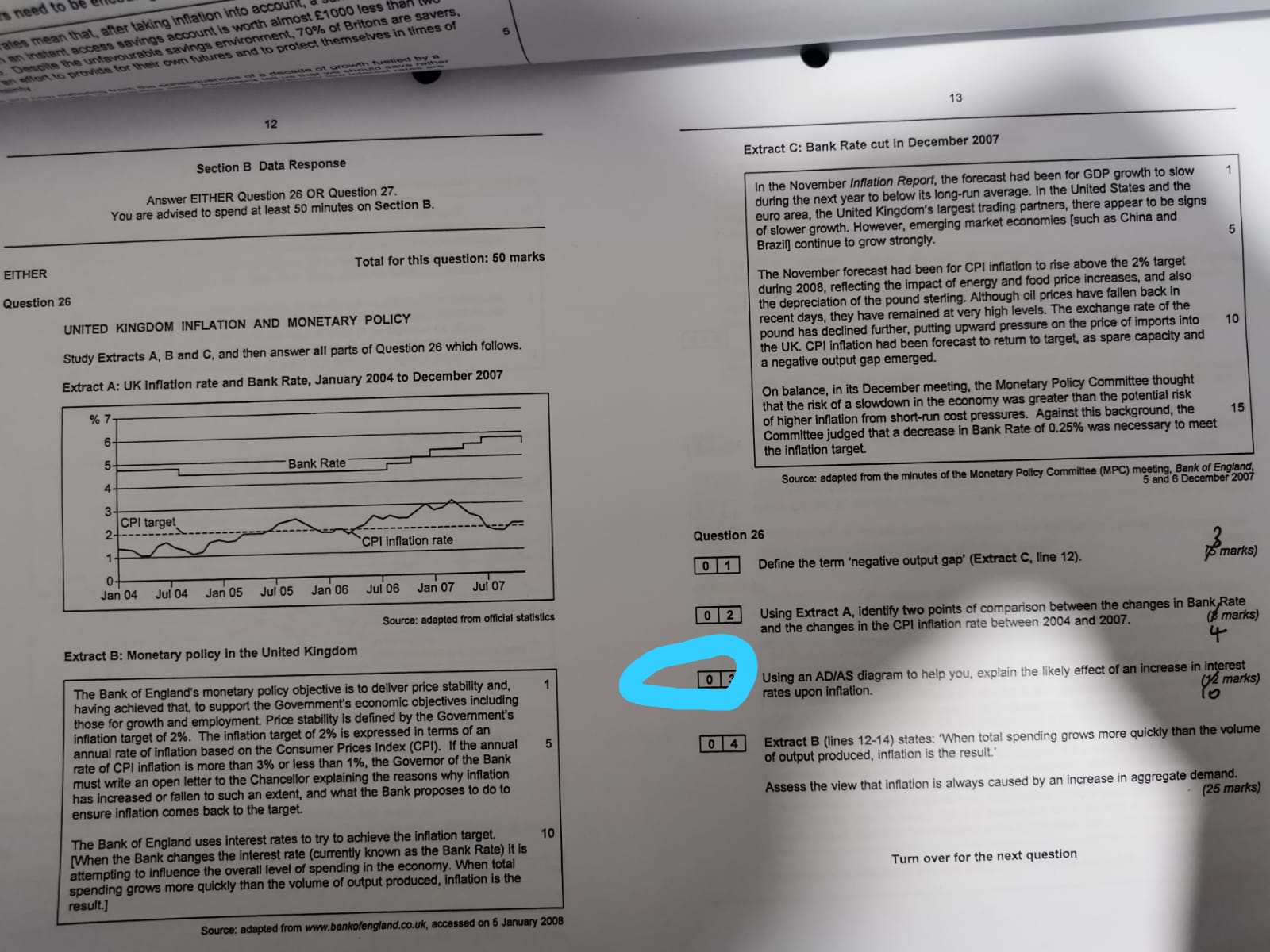

need to ates mean that, after taking inflation into account an instant access savings account is worth almost $1000 less that Despite The unfavourable savings environment, 70% of Britons are savers, 5 effort to provide for Their own futures and to protect themselves in times of 12 13 Section B Data Response Extract C: Bank Rate cut In December 2007 Answer EITHER Question 26 OR Question 27. You are advised to spend at least 50 minutes on Section B. In the November Inflation Report, the forecast had been for GDP growth to slow during the next year to below its long-run average. In the United States and the euro area, the United Kingdom's largest trading partners, there appear to be signs of slower growth. However, emerging market economies [such as China and EITHER Total for this question: 50 marks Brazil] continue to grow strongly. 5 Question 26 The November forecast had been for CPI inflation to rise above the 2% target during 2008, reflecting the impact of energy and food price increases, and also UNITED KINGDOM INFLATION AND MONETARY POLICY the depreciation of the pound sterling. Although oil prices have fallen back in recent days, they have remained at very high levels. The exchange rate of the Study Extracts A, B and C, and then answer all parts of Question 26 which follows. pound has declined further, putting upward pressure on the price of imports into the UK. CPI inflation had been forecast to retum to target, as spare capacity and 10 Extract A: UK Inflation rate and Bank Rate, January 2004 to December 2007 a negative output gap emerged. % 7 On balance, in its December meeting, the Monetary Policy Committee thought that the risk of a slowdown in the economy was greater than the potential risk 6- of higher inflation from short-run cost pressures. Against this background, the 5- Bank Rate Committee judged that a decrease in Bank Rate of 0.25% was necessary to meet 15 the inflation target. 4- 3- Source: adapted from the minutes of the Monetary Policy Committee (MPC) meeting. Bank of England 5 and 6 December 2007 CPI target `CPI inflation rate Question 26 Jan 04 Jul 04 Jan 05 Jul 05 Jan 06 Jul 06 Jan 07 . Jul 07 0 1 Define the term 'negative output gap' (Extract C, line 12). ( marks ) Source: adapted from official statistics 0 2 Using Extract A, identify two points of comparison between the changes in Bank Rate Extract B: Monetary policy in the United Kingdom and the changes in the CPI inflation rate between 2004 and 2007. (8 marks) 4 The Bank of England's monetary policy objective is to deliver price stability and, having achieved that, to support the Government's economic objectives including OF Using an AD/AS diagram to help you, explain the likely effect of an increase in interest those for growth and employment. Price stability is defined by the Government's rates upon inflation. (1/2 marks) inflation target of 2%. The inflation target of 2% is expressed in terms of an annual rate of inflation based on the Consumer Prices Index (CPI). If the annual 5 rate of CPI inflation is more than 3% or less than 1%, the Governor of the Bank 0 4 Extract B (lines 12-14) states: "When total spending grows more quickly than the volume must write an open letter to the Chancellor explaining the reasons why inflation of output produced, inflation is the result.' has increased or fallen to such an extent, and what the Bank proposes to do to ensure inflation comes back to the target. Assess the view that inflation is always caused by an increase in aggregate demand. (25 marks) The Bank of England uses interest rates to try to achieve the inflation target. [When the Bank changes the interest rate (currently known as the Bank Rate) it is 10 attempting to influence the overall level of spending in the economy. When total spending grows more quickly than the volume of output produced, inflation is the Turn over for the next question result.] Source: adapted from www.bankofengland.co.uk, accessed on 5 January 2008