Answered step by step

Verified Expert Solution

Question

1 Approved Answer

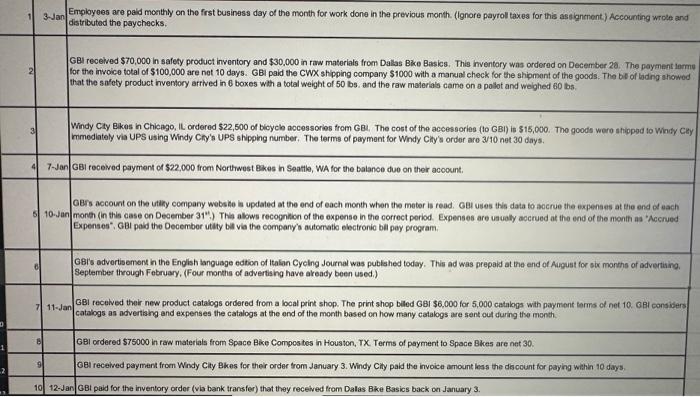

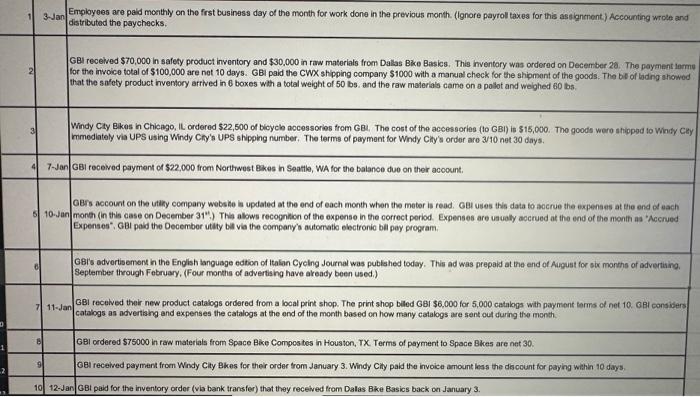

Need to create a General Journal Events: Adjustments: Accounts: Beg. Balance begin{tabular}{|c|c|c|} hline 1 & 3-Jan & Employeesarepaidmonthlyonthefrstbusinessdayofthemonthforworkdoneinthepreviousmonth.(Ignorepayrolltaxesforthisasalgnenent)Accountingwroleanddistributedthepaychecks. hline 2 & & hline

Need to create a General Journal

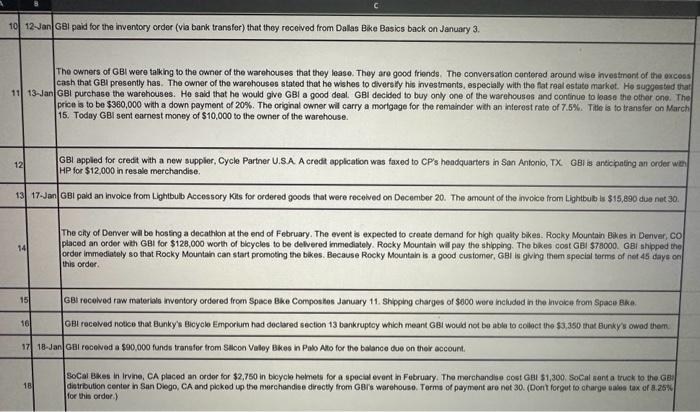

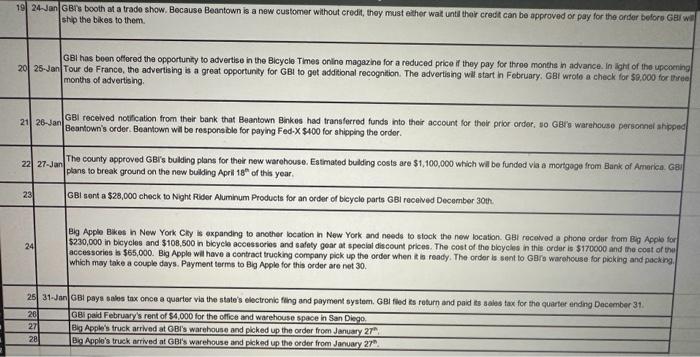

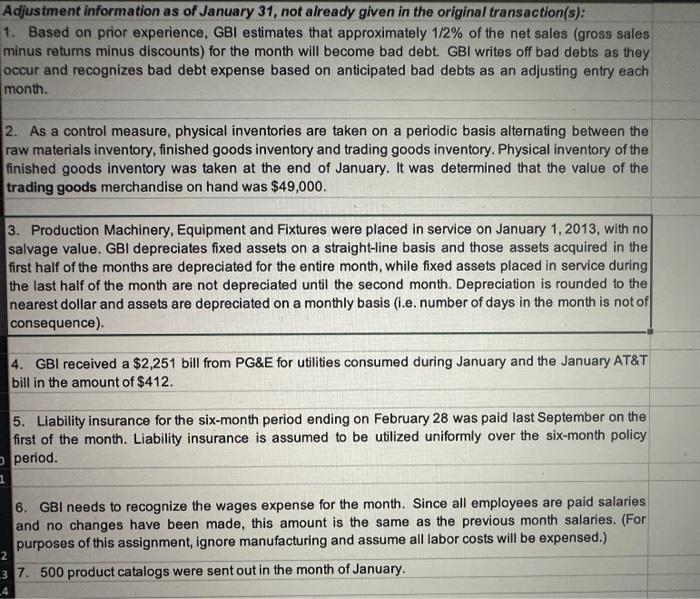

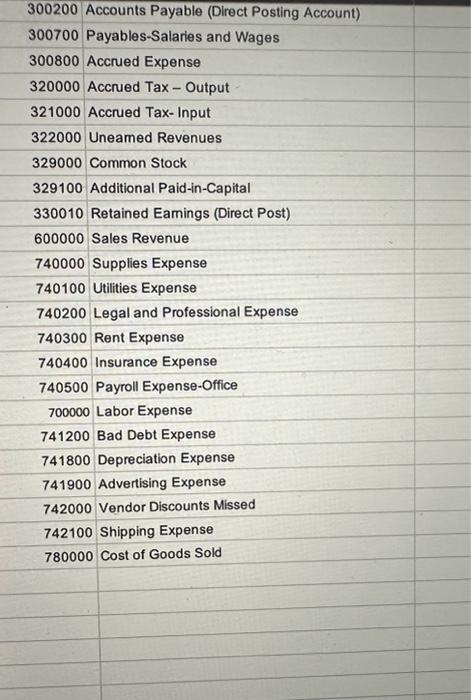

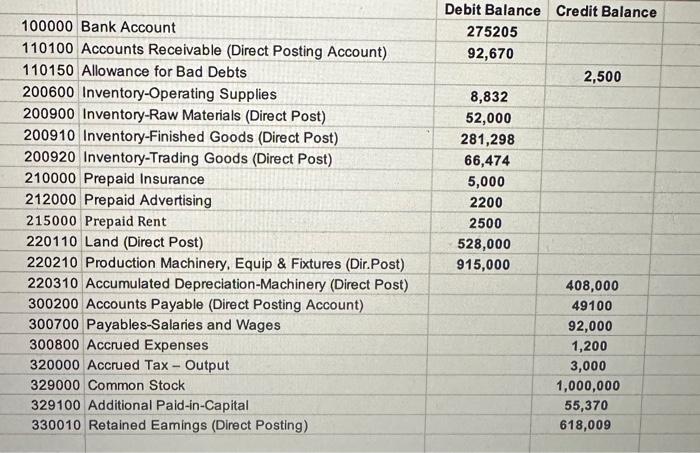

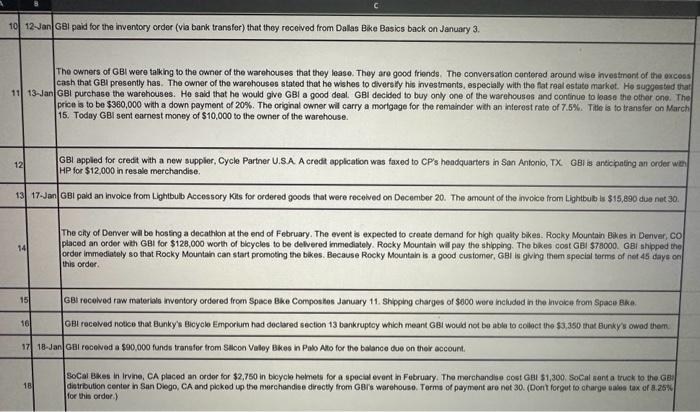

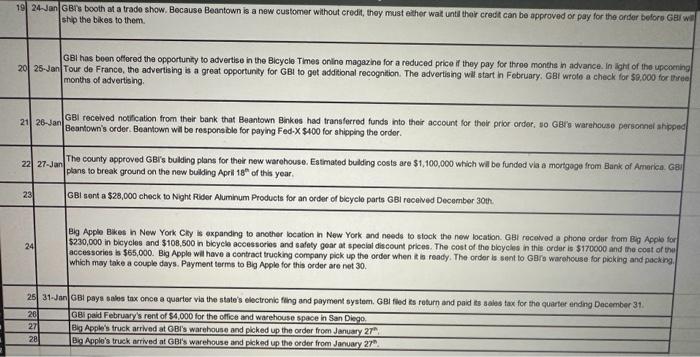

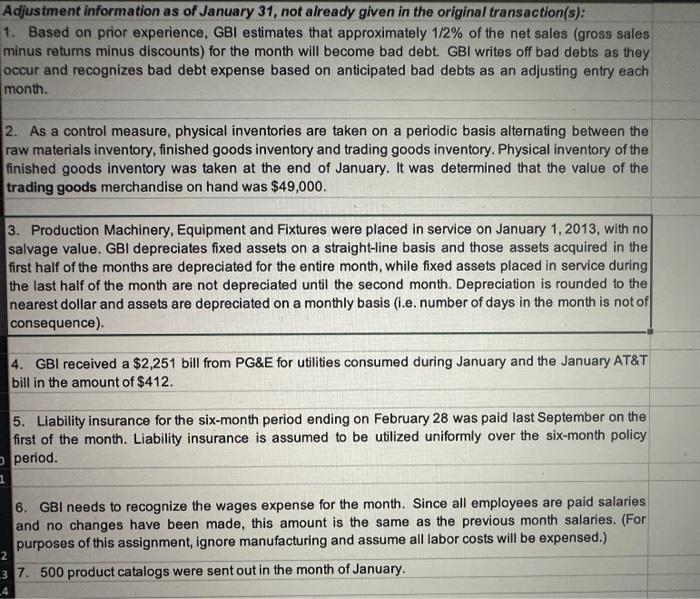

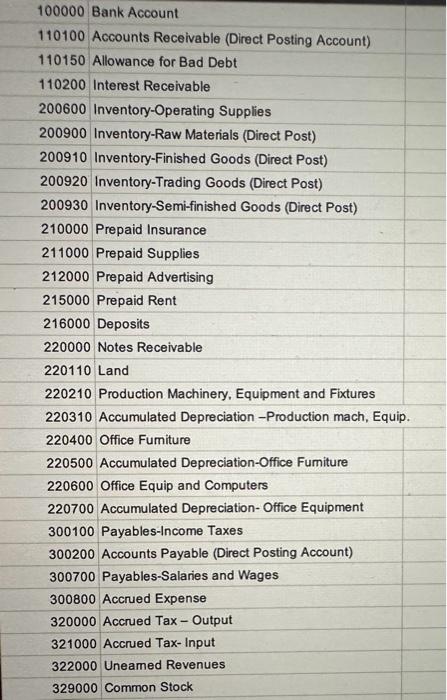

\begin{tabular}{|c|c|c|} \hline 1 & 3-Jan & Employeesarepaidmonthlyonthefrstbusinessdayofthemonthforworkdoneinthepreviousmonth.(Ignorepayrolltaxesforthisasalgnenent)Accountingwroleanddistributedthepaychecks. \\ \hline 2 & & \\ \hline 3 & & \\ \hline 4 & 7Jan & GBi receivod payment of $22,000 from Northwest Bikes in Seatte, WA for the balance due on their account. \\ \hline s) & 10-Jan & \\ \hline 6 & & GBisadvertisementintheEnclishlanguageedbionofItalanCycingJournalwaspublishedtoday.ThisadwasprepaidattheendofAugustforskxmonthsofadvertising.SeptemberthroughFebruary.(Fourmonkhsofadvertishghaveakeadybeenused.) \\ \hline 7 & 11-Jan & GBIrecelvedtheirnewproductcatalogsorderedfromabcalprintshop.TheprintshopbiledGBI$6,000for5,000catalopswithpaymenttermsofnet10.GBIconsiberscatalogsasadvertishyandexpensesthecatalogsattheondofthemonthbasedonhowmanycatalogsaresentoutduringthemonth. \\ \hline B. & & GBI crdered $75000 in raw materials from Space Bike Compos tes in Houston, TX. Terms of payment to Space Bkes are net 30. \\ \hline 9 & & OBi received payment from Whdy City Bkes for their order trom January 3. Windy City paid the invoice amount less the discount for paying with 10 days. \\ \hline 10 & & in GBI paid for the inventory order (via bank transfer) that they received from Dalas Bike Basics back \\ \hline \end{tabular} \begin{tabular}{|c|c|c|} \hline 19 & 24Jan[5C & GBrsboothatatradoshow.BecauseBeantownisanewcustomerwithoutcredit,theymustetcherwatuntiltheircreditcanbeapprovedorpayfortheorderbeloreCshipthebikestothem. \\ \hline 20 & 253 an & GBIhasbeenofferedtheopportunitytoadvertiseintheBicycleTimesonlinemagazineforareducedpriceiftheypayforthroemonthsinadvance.inlightoftheupcocninTourdeFrance,theadvertisingisagreatopportunityforGBItogetadditionalrecognition.TheadvertisingwilstartinFebruary.GBiwroleacheckfor$0,000forBremonthsofadvertising. \\ \hline 21 & 26-Jan & \\ \hline 22 & 27-Jan & ThecountyapprovedGBisbuldingplansfortheirnewwarohouse.Estmatedbuldingcostsare$1,100,000whichwilbefundodvlaamortgogefromBankofAmenca.G8:planstobreakgroundonthenewbuldingApril18ofthisyear. \\ \hline 23 & & GBI sont a $28,000 chock to Night Rider Auminum Products for an order of bicycle parts GBI recelved December 30th. \\ \hline 24 & & \\ \hline 25 & 31-Jan & Ian CBi pays sabes tax once a quarter vis the state's eloctronic fing and payment system. GBi fled is foturn and paid ts sales tax for the quarter ending Docember 31. \\ \hline 26 & & G8i paid February's rent of $4,000 for the office and warehouse space in San Diego. \\ \hline 27 & & Big Apples truck arrived at GBr's warehouse and picked up the croder froen January 2Th; \\ \hline 28 & & Big Applo's truek arrived at GBi's warehouse and picked up the order from January 27. \\ \hline \end{tabular} Adiustment information as of January 31. not alreadv given in the oriqinal transaction(s): 7. 500 product catalogs were sent out in the month of January. 100000 Bank Account 110100 Accounts Receivable (Direct Posting Account) 110150 Allowance for Bad Debt 110200 Interest Receivable 200600 Inventory-Operating Supplies 200900 Inventory-Raw Materials (Direct Post) 200910 Inventory-Finished Goods (Direct Post) 200920 Inventory-Trading Goods (Direct Post) 200930 Inventory-Semi-finished Goods (Direct Post) 210000 Prepaid Insurance 211000 Prepaid Supplies 212000 Prepaid Advertising 215000 Prepaid Rent 216000 Deposits 220000 Notes Receivable 220110 Land 220210 Production Machinery, Equipment and Fixtures 220310 Accumulated Depreciation -Production mach, Equip. 220400 Office Fumiture 220500 Accumulated Depreciation-Office Fumiture 220600 Office Equip and Computers 220700 Accumulated Depreciation- Office Equipment 300100 Payables-Income Taxes 300200 Accounts Payable (Direct Posting Account) 300700 Payables-Salaries and Wages 300800 Accrued Expense 320000 Accrued Tax - Output 321000 Accrued Tax-Input 322000 Uneamed Revenues 329000 Common Stock 300200 Accounts Payable (Direct Posting Account) 300700 Payables-Salaries and Wages 300800 Accrued Expense 320000 Accrued Tax - Output 321000 Accrued Tax-Input 322000 Uneamed Revenues 329000 Common Stock 329100 Additional Paid-in-Capital 330010 Retained Eamings (Direct Post) 600000 Sales Revenue 740000 Supplies Expense 740100 Utilities Expense 740200 Legal and Professional Expense 740300 Rent Expense 740400 Insurance Expense 740500 Payroll Expense-Office 700000 Labor Expense 741200 Bad Debt Expense 741800 Depreciation Expense 741900 Advertising Expense 742000 Vendor Discounts Missed 742100 Shipping Expense 780000 Cost of Goods Sold \begin{tabular}{|c|c|c|c|} \hline & & Debit Balance & Credit Balance \\ \hline 100000 & Bank Account & 275205 & \\ \hline 110100 & Accounts Receivable (Direct Posting Account) & 92,670 & \\ \hline 110150 & Allowance for Bad Debts & & 2,500 \\ \hline 200600 & Inventory-Operating Supplies & 8,832 & \\ \hline 2009001 & Inventory-Raw Materials (Direct Post) & 52,000 & \\ \hline 200910 & Inventory-Finished Goods (Direct Post) & 281,298 & \\ \hline 200920 & Inventory-Trading Goods (Direct Post) & 66,474 & \\ \hline 210000 & Prepaid Insurance & 5,000 & \\ \hline 212000 & Prepaid Advertising & 2200 & \\ \hline 215000 & Prepaid Rent & 2500 & \\ \hline 220110 & Land (Direct Post) & 528,000 & \\ \hline 220210 & Production Machinery, Equip \& Fixtures (Dir.Post) & 915,000 & \\ \hline 220310 & Accumulated Depreciation-Machinery (Direct Post) & & 408,000 \\ \hline 300200 & Accounts Payable (Direct Posting Account) & & 49100 \\ \hline 300700 & Payables-Salaries and Wages & & 92,000 \\ \hline 300800 & Accrued Expenses & & 1,200 \\ \hline 320000 & 0 Accrued Tax - Output & & 3,000 \\ \hline 329000 & 0 Common Stock & & 1,000,000 \\ \hline 329100 & 0 Additional Paid-in-Capital & & 55,370 \\ \hline 330010 & 0 Retained Eamings (Direct Posting) & & 618,009 \\ \hline \end{tabular} Events:

Adjustments:

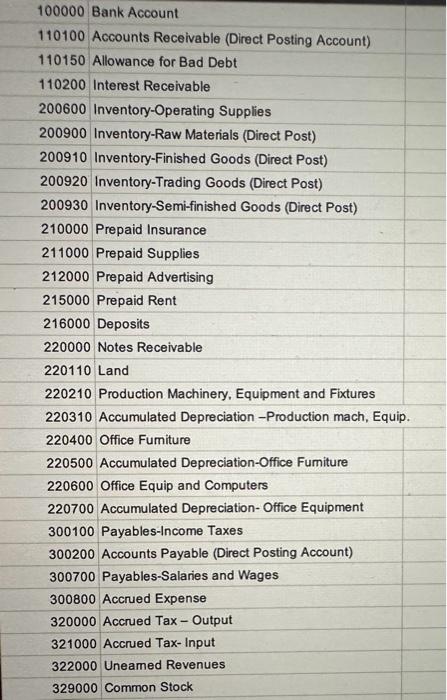

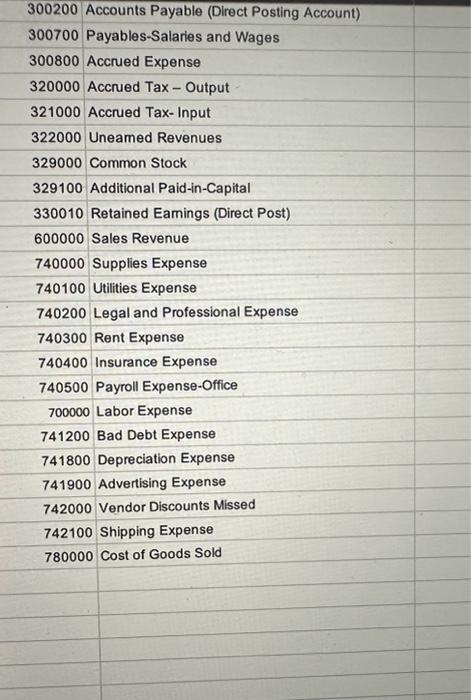

Accounts:

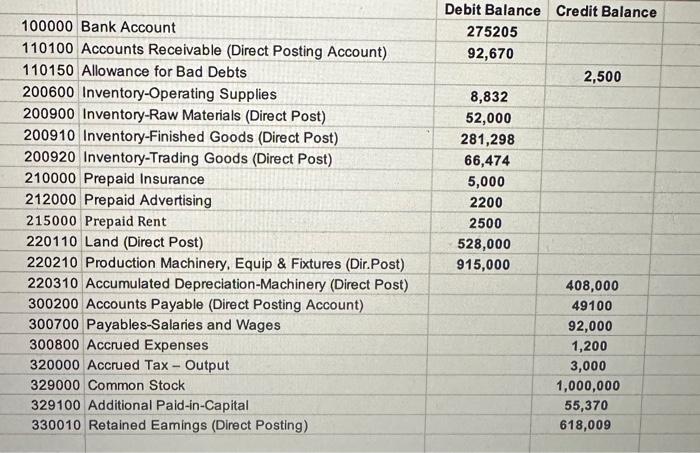

Beg. Balance

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started