Need to describe two separate potential solutions to illustrate how this disparity may be rectified and explain why you think your potential solutions would be effective. I may create my own solutions or refer to the material discussed in these articles. Be creative. You may also reflect on life experiences and include information outside the scope and posted articles. Some research may help to provide further insight related to your suggested solutions.

I have attached the articles that we were given as materials below.

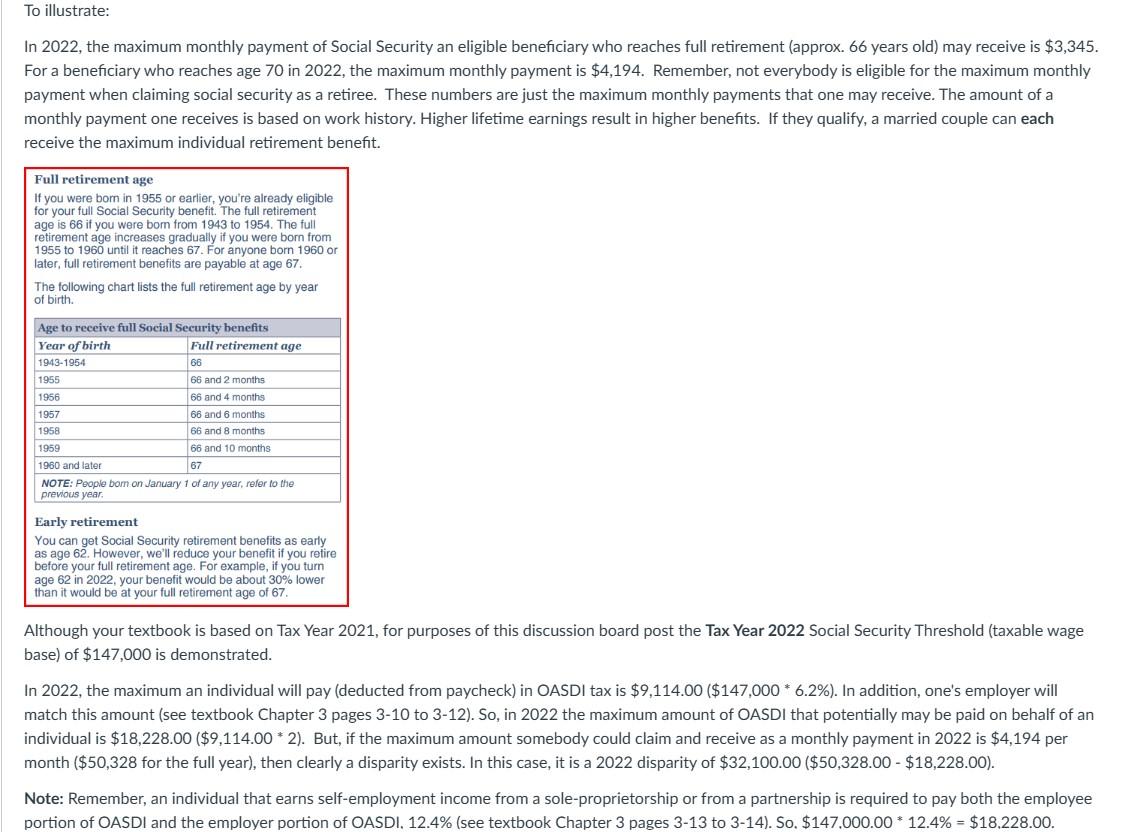

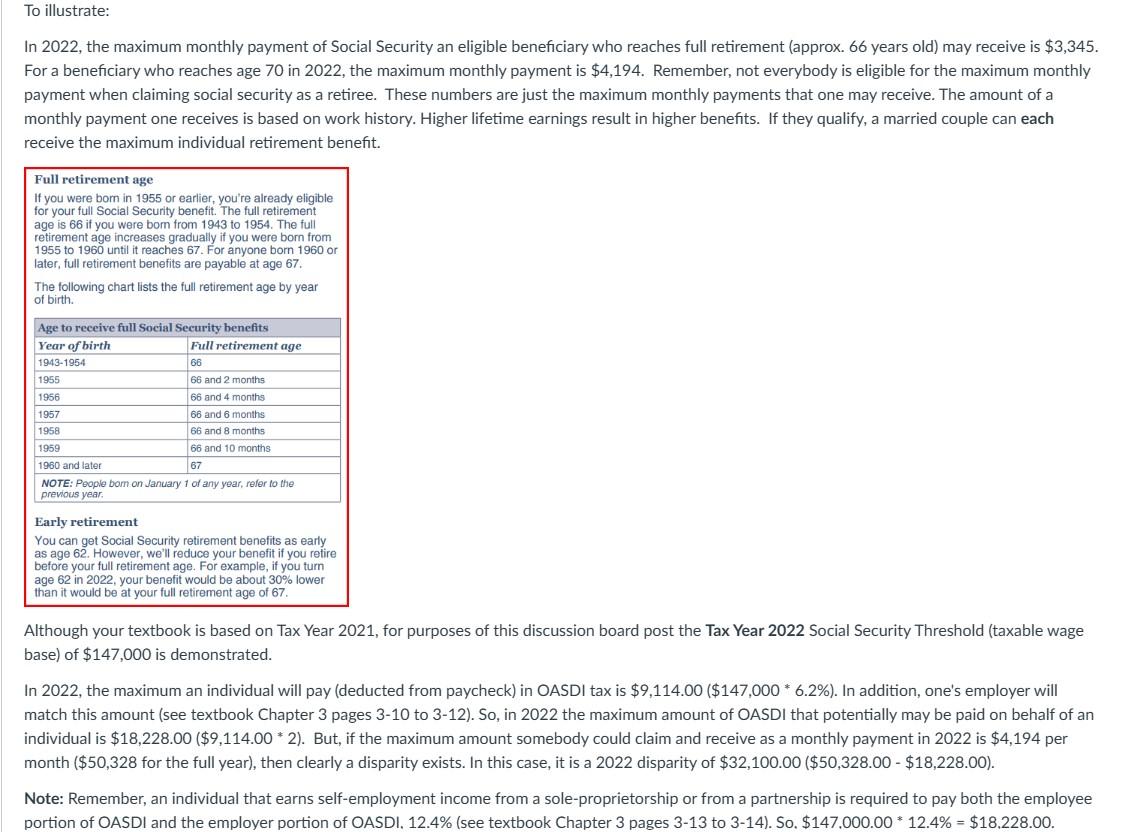

In 2022, the maximum monthly payment of Social Security an eligible beneficiary who reaches full retirement (approx. 66 years old) may receive is $3,345. For a beneficiary who reaches age 70 in 2022 , the maximum monthly payment is $4,194. Remember, not everybody is eligible for the maximum monthly payment when claiming social security as a retiree. These numbers are just the maximum monthly payments that one may receive. The amount of a monthly payment one receives is based on work history. Higher lifetime earnings result in higher benefits. If they qualify, a married couple can each receive the maximum individual retirement benefit. Early retirement You can get Social Security retirement benefits as early as age 62 . However, we'll reduce your benefit if you retire before your full retirement age. For example, if you turn age 62 in 2022, your benefit would be about 30% lower than it would be at your full retirement age of 67 . Although your textbook is based on Tax Year 2021, for purposes of this discussion board post the Tax Year 2022 Social Security Threshold (taxable wage base) of $147,000 is demonstrated. In 2022, the maximum an individual will pay (deducted from paycheck) in OASDI tax is $9,114.00 ( $147,0006.2%). In addition, one's employer will match this amount (see textbook Chapter 3 pages 3-10 to 3-12). So, in 2022 the maximum amount of OASDI that potentially may be paid on behalf an individual is $18,228.00 ( $9,114.002). But, if the maximum amount somebody could claim and receive as a monthly payment in 2022 is $4,194 per month ( $50,328 for the full year), then clearly a disparity exists. In this case, it is a 2022 disparity of $32,100.00($50,328.00$18,228.00). Note: Remember, an individual that earns self-employment income from a sole-proprietorship or from a partnership is required to pay both the employee portion of OASDI and the employer portion of OASDI. 12.4% (see textbook Chapter 3 pages 313 to 314 ). So. $147.000.0012.4%=$18.228.00. Social Security Is Staring at Its First Real Shortfall in Decades By leat Sarmer lurw 12,2019 A slow-moving crisis is approaching for Social Security threatening to undermine a central pillar in the retirement of tens of millions of Americans. Next year, for the first time since 19g2, the program must start drawing down its assets in order to pay retirees all of the benefits they have been promised, according to the latest government projections. Unless a political solution is reached, Social Security's so-called trust funds are expected to be depleted within about 15 years. Then, soenething that has been unimaginable for decades would be required under current law: Denefit checks for retirees would be cut by about 20 percent across the board. 'Old people not getting the Social Security checks they have been promised? That has been unthinkable in America - and I don't think it will really happen in the end this time, because it's just too horrible," said Alicia Munnell, the director af the Center for Retirement Research at Boston College. "But action bas to be taken to prevent it." While the issue is certain to be politically contentious, it is barely being talked about in Washingtun and at 2000 campaign events. The last time Social Security faced a crisis of this kind, in the early 19808 , at high-level bipartisan effort was needed to keep retirees' checks whole. Since that episode, the program has aften been called "the third rail of American politics" - an entitlement too dangerous to touch - and it's possible that another campramise could be reached in the current era. Benefit cuts would be devastating for about half of retired Americans, who rely on Social Security for most of their retirement income. A survey released in May by the Federal Reserve found that a quarter of working Americans had saved nothing for retirement. The shrinking af Social Secarity's assets expected in 2020 would mark a significant change in the programs cash flows ane that could camplicate Americans' retirement planning - even for the many relatively affluent citizens for whom Social Security is still a major source of income in old age. "Pifteen years is really just around the corner for people planning their retirements," said John B. Shoven, a Stanford economist who is also affiliated with the Hoover Institution and the National Bureau of Ecunomic Research. "The cuts that are being projected woukd be terrible for a lot of people," be said. "This needn't happen and it shouldn't happen, but we' ve known about these problems for a long time and they haven't been solved. They're getting closer." Social Security has a long-known basic math problem: more money will be going out than coming in. Roughly 10,000 baby boomers are retiring each day, with insufficient numbers of younger people entering the work force to pay into the system and suppurt them. And life expectancy is increasing. By 2085 , Social Security estimates, the number of Americans 65 or older will increase to more than 79 millian, from about 49 milion now. If the program has not been repaired, they will encounter a much poorer Social Security thain the one seniors rely on today. How cuts would affect a typical person Under current law, cuts would start in 2034, when the main trust fund is expected to be depleted, ar in 2035 , if Congress authorizes Social Security to pay oldage benefits through the Disability Insurance Trust Fund. Consider a woman with average annual earnings of \$51,295 (in current dollars) over the course of her career, who retires at age 67 in 2053 . The latest Social Security study indicates that she will be entitled to $27,366 in inflation-adjusted benefits. Put if the trust fund shortfall has not been remedied, Social Security would be permitted to pay her anly $21,669 - a 21 percent cut. httpe:/hwaw.nydimes.com/2019/06/12/business/social-security-shortfal-2020.html 1/3 Nearly every older American would be affected, but those at the lowest incame levels would be hurt the most. Social Security benefits are progressive, providing gresater assistance for those with greater need. A worker with average career earnings of $12,949 until 2037 is entitled to receive the equivalent af 76.6 percent of that income, but with mandatory cuts, this person would have to survive on just 59.9 percent, the Social Security repart says. Nccording to a study by the Center on Budget and Policy Priorities, 9 percent of all retirees lived in poverty in 2017 - but the figure would have been 39 percent if not for Social Security. For African Americars, the study found, the anti-poverty effect has been even greater: 19 percent lived in powerty, but 52 percent would have done so if they had not received Social Security payments. For Hispanics, the numbers were 17 percent and 46 percent. Dusines il tronerry Latest Updates s ipalaist 2 hou mes as - Canadian pipeline company sayz it is suspending work on Heystone Xa. ahead of Biden's inauguration. - Ford is ordered to recal theee million cars for faulty airbage. - Stocks hoad for a record as Biden administration takes over. The reductions of roughly 20 percent on average are just a starting point. If current laws are unchanged and current econumic projections remain intact, the cuts woald rise to 25 percent in later years, a New York Times analysis of Social Security data indicates. Lnless Congress and the White House reach an agreement before the trust funds are emptied, most Americans will face hard choices: delaying retirement and warling lnnger if they can, ar simply surviving on kess. The Social Security mess alresdy complicates some commonly accepted retirement-planning wisdom - such as the advice to delay claiming benefits until age io. People who do so are entitled to an 8 percent anmual increase in benefits. That makes Social Security "the best annuity that money could buy" said Wade Pfau, a professor of retirement incume at the American College of Financial Services, in a 2015 repurt. But he redid his calculations at the request of The Times, and for workers who are 55 now, statutory benefit cuts just when they turn 20 could make that appraach far less attractive, Professor Pfau said. The "third rail' Cutting the Social Security chedes of people in retirement is, to say the least, politically dangerous, David Stockman, President Ronald Reagan's budget director, tried to do just that in 1981 What bappened in that episode gives some clues for a possible solution today. Like other conservatives of that era, Mr. Stockman viewed Social Security as a form of "closet socialism" that needed to be scaled back. With the program facing a solvency crisis, he proposed immediate reductions in retirees' benefits. Older Americans rebelled, and members of Cangress listened to them. "I just hadn't thought through the inmpact of making it effective immediately, Mr. Stockman observed ruefully in his 1986 book, "The Triumph of Politics: Why the Reagan Revolution Failed." A nimble politician, Reagan rejected Mr. Stockman's recommendations and formed a baipartisan commission to study the issue. Ultimately, Reagan reached a Jang-term agreement with the Demncratic speaker of the House, Thomas R. ONeill Jr, who viewed the preservation of Social Security as essential. While they made no immediate cuts in Social Security checks, they reduced benefits in more subtle ways, using measures that are still being used, like gradually delaying the standard retirement age from 65 to 66 , where it stands today, and eventually to 67. Taxes increased, too - bolstering cash flows and creating the trust fund surpluses that have given retirees and current politicians some breathing room. But in ways large and small, the Reagan-O'Neill Social Security fix is coming undone. Notably, the hefty balances in those trust fund accounts today - some $29 trillian - may be having an unintended cunsequence. "The trust fund surpluses were intended to provide a buffer that would give politicians enough time to show some fiscal responsibility," said Robert D. Reischauer, a former Social Security trustee who was also head of the Congressional Budget Office and is now president emeritus of the Urban lnstitute. "But the problem is that without an immecliate crisis, the politicians dan't have to act. And really, they would rather sleep. So when the crisis eventually comes, as it will, it is likely to be much, much worse because of the delay" Joth Cogan, a professor of public podicy at Stanford, said Social Security's fundamental problem was that benefits had been rising faster than revenue. Cuts, he said, will be umpsiatable but inevitable. "The salution, I think, is to slow the growth in real benefits promised to future recipients," he said. Democrats in Congress have suggested an increase in Social Security benefits, acenmpanied by higher taxes fnr the wealthy. In cumbination, the bill's various measures would eliminate the program's financial shortfall, according to projections by Stephen C. Goss, the chief actuary of Social Security. Canservatives continue to push for sharp redacticuns in the size of Social Security as well as Medicare, saying the United States can't afford the growing burden of the two "entitlement programs." "Entitlement programs in the United States have expanded more than tenfold since their inception, but worlvers are nowhere near 10 times better off as a result," the Heritage Foundation said in a May 20 policy propusal. The coenservative think tank favors cuts to benefits and siphoning money from payrall taves into individual investment accounts. That echoes an initiative that President George W. Bush ance embraced but Democrats blocked. There are no signs of an imminent breakthrough, though Professor Cogan said that, as in the past, the impending prospect of benefit cuts "is likely to change the political atmosphere and make it possible to find a compramise" But Mr. Reischaner fears that, given the current acrimony of American politics, there will be no compoumise until the last minute "We will need a combination of increased taxes and reduced benefits, undoubtedly, he said, "But if we wait, the deficits will anly grow and the eventual solution will be much mure painful." Real Reform for Social Security By David Brooks Dec. 11, 2004 Before we get lost in the policy details, let's be clear about what this Social Security reform debate is really about. It's about the market. People who instinctively trust the markets support the Bush reform ideas, and people who are suspicious oppose them. The people setting the tone for the opposition to the Bush Social Security effort depict the financial markets as huge, organized scams where the rich prey upon the weak. Their phrases are already familiar: a risky scheme, Enron accounting, a gift to the securities industry, greedy speculators preying upon Grandma's pension. Gone is the day when President Clinton could propose another plan diverting 15 percent of Social Security reserves into the stock market. Now the Democratic Party's tone is much more populist and even antibusiness. Harry Reid has begun his tenure as Senate minority leader by doing his best imitation of Huey Long: "They are trying to destroy Social Security by giving this money to the fat cats on Wall Street, and I think it's wrong!" What you hear these days is not liberalism. It's conspiracyism. It's the belief that the Bushite corporate cabal is going to do to domestic programs what the Bushite neocon cabal did in the realm of foreign affairs. It's the belief in malevolent and shadowy forces that will grab everything for their own greedy ends. This is Michael Moore-ism applied to domestic affairs, and it will leave the Democrats only deeper in the hole. I don't deny that many business and Wall Street types would like to capture the system for their own benefit. As Theodore Roosevelt observed, every new social arrangement begets its own kind of sin, which has to be punished by law. But as Roosevelt and his great hero Alexander Hamilton understood, corruption is the price we pay for economic freedom, and the benefits of that freedom vastly outweigh the costs. Hamilton and Roosevelt championed markets because they arouse energies, channel information, allocate resources and create enormous wealth. Plans to create private Social Security accounts aren't sops to the securities industry. They use the power of the market to solve an otherwise intractable problem. The outline of the problem is clear. When the Social Security program was created, there were 42 workers for each retiree. Now there are about three workers per retiree, and in 2030 there will be two. The White House is heading toward a reform plan that would tie the benefit levels to prices rather than wages, which is a serious benefit cut. It would then use the power of the markets to compensate retirees for those cuts and to create a reserve fund to make the system solvent. The government would essentially borrow at 2 percent in real terms, invest that money through regulated private accounts in the market and get a return, based on conservative historical averages, of about 4.6 percent. Those returns would, over time, cover the $11 trillion in liabilities that threaten to bring down the system. People who think the markets are a rigged game, or who think financial profits are just paper profits, won't like this approach. But the fact is that over the next decade -- whether we are talking about pensions, health care or even schools - the central argument is not going to be over whether to apply market competition to these problems. It's going to be over how to structure competition to produce the most dynamic results. I may be a complete idiot, but I actually believe that Democrats and Republicans can reach a grand bargain that includes personal Social Security accounts while addressing Democratic objections. You already see some Democrats growing concerned over the perception that their party is trying to build a bridge to the 1930's. On Thursday, the House minority leader, Nancy Pelosi, struck a very different tone than her Senate colleague. She is willing to enter into discussions about Social Security reform with no preconditions. Meanwhile, a Democratic underground is forming, made up of members of Congress willing to consider a grand compromise with Bush to make the system solvent. Even the White House folks seem to know they can't do this without Democratic support. They will have to protect the system's progressivity and have mechanisms built in to combat the corruption. They're going to have to do something about the deficit. This is not 1932 any more. This is not the age of big, static state institutions. This is actually about building a bridge to the 22 nd century. Op-Ed Columnist E-mail: dabrooks@nytimes.com Social Security Is Worth More Than You Think, but Needs Your Help Low interest rates have made Social Security more valuable. But the coronavirus crisis is likely to make its bong-term shontfall worse. by dedi Sommer Mry22, 2000 The stock market has been erratic, real estate is hurting, bond yields are painfully low and dividends are shrinking. In the coronavirus recession, most financial assets have been disturbingly volatile. But one wifely held financial asset, perhaps the most important ooe for the vast majority of Americans, has performed splendidly: their stake in Social Security. It trasn't merely been a solid support for millions of people in a difficult time While the income-producing power of so many oeher assets has been sapped by economic weakness and low interest rates, Social Security payments have held steady. And thanks to those rock-bottom interest rates, the market value of the Social Security income stream has soared in a measurable way. You may not think of Social Security as a personal asset, like a bank account, a portfolio of stocks and bonds or a house But Social Security retirement benefits are a kind of annuity, as I'll explain, and annuities have a definite market value, Considered this way, Social Security's value has been rising. Even if you aren' receiving payments now, you have a stake in the asset, and it is in your interest to protect it. "The most important financial asset for most Americans by far is Social Security," said Willaam I. Bernstein, a financial adviser and author on financial subjects. "We are in a retirement erisis, and the only foreseeable answer is Social Security" Perhaps if more people understiod the impressive, countercyclical performance of their share in Social Security, there would be more clamor to protect it. But critical as the benefits are proving to be in this crisis, as in so many others, the entire Social Security system faces a cash shartfall down the road, and it needs help from Congress. The pandemic has complicated these long-term issues, which can be resolved only in Washington. First, consider the good news. In the coronavirus crisis, Social Security has succeeded in daing just what it was designed to do: keeping old people, disabled people and their dependents out of dire poverty, and providing a retirement cushion for nearly everyone else. About 178 million working people of all ages are covered by Social Security, government statistics show. Even if thase people are not eligible for benefits now, they will be entitled to them later. Plenty of people are alreauly getting them, however: About 65 million Americans will receive more than $1 trillion this year. That includes nine out of 10 of those 65 and older, as well as millions of disabled people, dependents and survivars. With more than 100,000 Covid-19 deaths in America and millions of people financially desperate, a program that supplies regular income to so many can surely be ssid to be more valuable than ever. But I concede that is a subjective judgment. The program has also risen in value in a measurable way that may not be intuitively obvious. The Carcentuinu Dutbreak + Latest Updates ? - Doctors in Peru stage a hunger strike over the government's pandemic response. - The Netheranda will ban many tights and implement a nationwide curtow. - litaly says it will sue Pfizer over delyss in vaccine delivery. This is a little wonky, so bear with me. Financial markets put a price on almost everything, and they can provide an approximate cash value for Social Security, too, cookine: Daity inspiration, delicious necipes and other updates from Sam sifton and NYT Cooking- Your benefits, now or in the future, accrue gradually, over years of work and paying taves into the Social Security system. But as I pointed aut recently, low interest rates have reduced bond yields and made commercial annuities extremely expensive. With the belp of Dale Kintzel, a former Social Security economist who studied its pricing in a 2017 paper, I've checked the market values of annuities and compared them with Social Security. httpe:llwww.nydimes.com/2020/05/29/business/Social-Security-benefits-shortfall-coronavirus.html 1/2 1/20/2021 Social Security Is Worth More Than You Think, but Needs Your Help - The New York Times Those federal retirement benefits are essentially annuities: bonds wrapped in insurance. So-called single-premium immediate annuities - in which an insurance company will provide you with income, in exchange for a sum of cash - can't do everything Social Security does, but they come close. Mr. Kintzel has used annuities to approximate the cash value of Social Security benefits. Those values are startlingly high. Mr. Kintzel found that for the average 65 -year-old man, who last year received a retirement benefit of $1,375 a month, an annuity supplying that lifetime cash flow would cost at least $459,866 - 13 percent more than a comparable annuity in 2014 . For a 65 -year-old woman, the average monthly benefit was $1,102 last year. A comparable commercial annuity, Mr. Kintzel said, would cost $368,562. These figures are based on data from immediateannuities.com, which tracks annuity prices. These are just average amounts and would be much bigger - perhaps as much as $1 million - for high-income people who delay claiming benefits until they are 70, my own calculations suggest. Note that all of these estimates understate the value of Social Security, which provides disability benefits and supplemental income in addition to basic retirement benefits. And these estimates don't take into account the effects of the further decline in interest rates since the beginning of this year, which have reduced income streams from many assets, but not for Social Security. Perhaps the best thing about Social Security is that unlike a stock portfolio, it can be counted on, Mr. Kintzel said. "It is backed by the government, and so it's virtually risk-free, or it should be. I've always thought that Social Security is one thing that everybody can agree on. It's a good thing." Yet Social Security continues to have an odd problem. Although its stability has been among its greatest virtues, it remains underfunded. I pointed out a year ago that Social Security benefit payouts were greater than the system's revenues. That is still true. To receive all of the benefits you have been promised, a reluctant Congress will need to fix Social Security, which is likely to dip into the principal of its trust funds for the first time this year. Interest payments from the trust funds have made up the gap, allowing full benefits until now. Without help from Congress, these trust funds, are likely to be exhausted within 15 years - and perhaps sooner. If that were to happen, benefits would be cut, perhaps to 79 percent of the promised levels, Social Security estimates. In an online conference in late April, Stephen C. Goss, Social Security's chief actuary, said that the current recession would almost certainly reduce the system's payroll tax receipts and could lead to trust fund depletion by 2033 or even sooner. Precise estimates are impossible now, with the economy shrinking so rapidly, he said. "All bets are off, and we will just have to see what happens, because we really don't know whether we'll be back to normal," Mr. Goss said. As a matter of basic math, Social Security needs more revenue or lower expenses. But I think this recession suggests that increasing revenue is the way to go, because Social Security benefits have been so crucial. If they were to be cut, even bigger rescue programs would be needed from other sources. Far better to maintain and improve Social Security, which works automatically and well. Last year, I said that the most important thing you could probably do to improve your personal finances was to make sure that Congress took action to bolster the program's funding. That's even truer today, when its benefits are more valuable, and more badly needed. In 2022, the maximum monthly payment of Social Security an eligible beneficiary who reaches full retirement (approx. 66 years old) may receive is $3,345. For a beneficiary who reaches age 70 in 2022 , the maximum monthly payment is $4,194. Remember, not everybody is eligible for the maximum monthly payment when claiming social security as a retiree. These numbers are just the maximum monthly payments that one may receive. The amount of a monthly payment one receives is based on work history. Higher lifetime earnings result in higher benefits. If they qualify, a married couple can each receive the maximum individual retirement benefit. Early retirement You can get Social Security retirement benefits as early as age 62 . However, we'll reduce your benefit if you retire before your full retirement age. For example, if you turn age 62 in 2022, your benefit would be about 30% lower than it would be at your full retirement age of 67 . Although your textbook is based on Tax Year 2021, for purposes of this discussion board post the Tax Year 2022 Social Security Threshold (taxable wage base) of $147,000 is demonstrated. In 2022, the maximum an individual will pay (deducted from paycheck) in OASDI tax is $9,114.00 ( $147,0006.2%). In addition, one's employer will match this amount (see textbook Chapter 3 pages 3-10 to 3-12). So, in 2022 the maximum amount of OASDI that potentially may be paid on behalf an individual is $18,228.00 ( $9,114.002). But, if the maximum amount somebody could claim and receive as a monthly payment in 2022 is $4,194 per month ( $50,328 for the full year), then clearly a disparity exists. In this case, it is a 2022 disparity of $32,100.00($50,328.00$18,228.00). Note: Remember, an individual that earns self-employment income from a sole-proprietorship or from a partnership is required to pay both the employee portion of OASDI and the employer portion of OASDI. 12.4% (see textbook Chapter 3 pages 313 to 314 ). So. $147.000.0012.4%=$18.228.00. Social Security Is Staring at Its First Real Shortfall in Decades By leat Sarmer lurw 12,2019 A slow-moving crisis is approaching for Social Security threatening to undermine a central pillar in the retirement of tens of millions of Americans. Next year, for the first time since 19g2, the program must start drawing down its assets in order to pay retirees all of the benefits they have been promised, according to the latest government projections. Unless a political solution is reached, Social Security's so-called trust funds are expected to be depleted within about 15 years. Then, soenething that has been unimaginable for decades would be required under current law: Denefit checks for retirees would be cut by about 20 percent across the board. 'Old people not getting the Social Security checks they have been promised? That has been unthinkable in America - and I don't think it will really happen in the end this time, because it's just too horrible," said Alicia Munnell, the director af the Center for Retirement Research at Boston College. "But action bas to be taken to prevent it." While the issue is certain to be politically contentious, it is barely being talked about in Washingtun and at 2000 campaign events. The last time Social Security faced a crisis of this kind, in the early 19808 , at high-level bipartisan effort was needed to keep retirees' checks whole. Since that episode, the program has aften been called "the third rail of American politics" - an entitlement too dangerous to touch - and it's possible that another campramise could be reached in the current era. Benefit cuts would be devastating for about half of retired Americans, who rely on Social Security for most of their retirement income. A survey released in May by the Federal Reserve found that a quarter of working Americans had saved nothing for retirement. The shrinking af Social Secarity's assets expected in 2020 would mark a significant change in the programs cash flows ane that could camplicate Americans' retirement planning - even for the many relatively affluent citizens for whom Social Security is still a major source of income in old age. "Pifteen years is really just around the corner for people planning their retirements," said John B. Shoven, a Stanford economist who is also affiliated with the Hoover Institution and the National Bureau of Ecunomic Research. "The cuts that are being projected woukd be terrible for a lot of people," be said. "This needn't happen and it shouldn't happen, but we' ve known about these problems for a long time and they haven't been solved. They're getting closer." Social Security has a long-known basic math problem: more money will be going out than coming in. Roughly 10,000 baby boomers are retiring each day, with insufficient numbers of younger people entering the work force to pay into the system and suppurt them. And life expectancy is increasing. By 2085 , Social Security estimates, the number of Americans 65 or older will increase to more than 79 millian, from about 49 milion now. If the program has not been repaired, they will encounter a much poorer Social Security thain the one seniors rely on today. How cuts would affect a typical person Under current law, cuts would start in 2034, when the main trust fund is expected to be depleted, ar in 2035 , if Congress authorizes Social Security to pay oldage benefits through the Disability Insurance Trust Fund. Consider a woman with average annual earnings of \$51,295 (in current dollars) over the course of her career, who retires at age 67 in 2053 . The latest Social Security study indicates that she will be entitled to $27,366 in inflation-adjusted benefits. Put if the trust fund shortfall has not been remedied, Social Security would be permitted to pay her anly $21,669 - a 21 percent cut. httpe:/hwaw.nydimes.com/2019/06/12/business/social-security-shortfal-2020.html 1/3 Nearly every older American would be affected, but those at the lowest incame levels would be hurt the most. Social Security benefits are progressive, providing gresater assistance for those with greater need. A worker with average career earnings of $12,949 until 2037 is entitled to receive the equivalent af 76.6 percent of that income, but with mandatory cuts, this person would have to survive on just 59.9 percent, the Social Security repart says. Nccording to a study by the Center on Budget and Policy Priorities, 9 percent of all retirees lived in poverty in 2017 - but the figure would have been 39 percent if not for Social Security. For African Americars, the study found, the anti-poverty effect has been even greater: 19 percent lived in powerty, but 52 percent would have done so if they had not received Social Security payments. For Hispanics, the numbers were 17 percent and 46 percent. Dusines il tronerry Latest Updates s ipalaist 2 hou mes as - Canadian pipeline company sayz it is suspending work on Heystone Xa. ahead of Biden's inauguration. - Ford is ordered to recal theee million cars for faulty airbage. - Stocks hoad for a record as Biden administration takes over. The reductions of roughly 20 percent on average are just a starting point. If current laws are unchanged and current econumic projections remain intact, the cuts woald rise to 25 percent in later years, a New York Times analysis of Social Security data indicates. Lnless Congress and the White House reach an agreement before the trust funds are emptied, most Americans will face hard choices: delaying retirement and warling lnnger if they can, ar simply surviving on kess. The Social Security mess alresdy complicates some commonly accepted retirement-planning wisdom - such as the advice to delay claiming benefits until age io. People who do so are entitled to an 8 percent anmual increase in benefits. That makes Social Security "the best annuity that money could buy" said Wade Pfau, a professor of retirement incume at the American College of Financial Services, in a 2015 repurt. But he redid his calculations at the request of The Times, and for workers who are 55 now, statutory benefit cuts just when they turn 20 could make that appraach far less attractive, Professor Pfau said. The "third rail' Cutting the Social Security chedes of people in retirement is, to say the least, politically dangerous, David Stockman, President Ronald Reagan's budget director, tried to do just that in 1981 What bappened in that episode gives some clues for a possible solution today. Like other conservatives of that era, Mr. Stockman viewed Social Security as a form of "closet socialism" that needed to be scaled back. With the program facing a solvency crisis, he proposed immediate reductions in retirees' benefits. Older Americans rebelled, and members of Cangress listened to them. "I just hadn't thought through the inmpact of making it effective immediately, Mr. Stockman observed ruefully in his 1986 book, "The Triumph of Politics: Why the Reagan Revolution Failed." A nimble politician, Reagan rejected Mr. Stockman's recommendations and formed a baipartisan commission to study the issue. Ultimately, Reagan reached a Jang-term agreement with the Demncratic speaker of the House, Thomas R. ONeill Jr, who viewed the preservation of Social Security as essential. While they made no immediate cuts in Social Security checks, they reduced benefits in more subtle ways, using measures that are still being used, like gradually delaying the standard retirement age from 65 to 66 , where it stands today, and eventually to 67. Taxes increased, too - bolstering cash flows and creating the trust fund surpluses that have given retirees and current politicians some breathing room. But in ways large and small, the Reagan-O'Neill Social Security fix is coming undone. Notably, the hefty balances in those trust fund accounts today - some $29 trillian - may be having an unintended cunsequence. "The trust fund surpluses were intended to provide a buffer that would give politicians enough time to show some fiscal responsibility," said Robert D. Reischauer, a former Social Security trustee who was also head of the Congressional Budget Office and is now president emeritus of the Urban lnstitute. "But the problem is that without an immecliate crisis, the politicians dan't have to act. And really, they would rather sleep. So when the crisis eventually comes, as it will, it is likely to be much, much worse because of the delay" Joth Cogan, a professor of public podicy at Stanford, said Social Security's fundamental problem was that benefits had been rising faster than revenue. Cuts, he said, will be umpsiatable but inevitable. "The salution, I think, is to slow the growth in real benefits promised to future recipients," he said. Democrats in Congress have suggested an increase in Social Security benefits, acenmpanied by higher taxes fnr the wealthy. In cumbination, the bill's various measures would eliminate the program's financial shortfall, according to projections by Stephen C. Goss, the chief actuary of Social Security. Canservatives continue to push for sharp redacticuns in the size of Social Security as well as Medicare, saying the United States can't afford the growing burden of the two "entitlement programs." "Entitlement programs in the United States have expanded more than tenfold since their inception, but worlvers are nowhere near 10 times better off as a result," the Heritage Foundation said in a May 20 policy propusal. The coenservative think tank favors cuts to benefits and siphoning money from payrall taves into individual investment accounts. That echoes an initiative that President George W. Bush ance embraced but Democrats blocked. There are no signs of an imminent breakthrough, though Professor Cogan said that, as in the past, the impending prospect of benefit cuts "is likely to change the political atmosphere and make it possible to find a compramise" But Mr. Reischaner fears that, given the current acrimony of American politics, there will be no compoumise until the last minute "We will need a combination of increased taxes and reduced benefits, undoubtedly, he said, "But if we wait, the deficits will anly grow and the eventual solution will be much mure painful." Real Reform for Social Security By David Brooks Dec. 11, 2004 Before we get lost in the policy details, let's be clear about what this Social Security reform debate is really about. It's about the market. People who instinctively trust the markets support the Bush reform ideas, and people who are suspicious oppose them. The people setting the tone for the opposition to the Bush Social Security effort depict the financial markets as huge, organized scams where the rich prey upon the weak. Their phrases are already familiar: a risky scheme, Enron accounting, a gift to the securities industry, greedy speculators preying upon Grandma's pension. Gone is the day when President Clinton could propose another plan diverting 15 percent of Social Security reserves into the stock market. Now the Democratic Party's tone is much more populist and even antibusiness. Harry Reid has begun his tenure as Senate minority leader by doing his best imitation of Huey Long: "They are trying to destroy Social Security by giving this money to the fat cats on Wall Street, and I think it's wrong!" What you hear these days is not liberalism. It's conspiracyism. It's the belief that the Bushite corporate cabal is going to do to domestic programs what the Bushite neocon cabal did in the realm of foreign affairs. It's the belief in malevolent and shadowy forces that will grab everything for their own greedy ends. This is Michael Moore-ism applied to domestic affairs, and it will leave the Democrats only deeper in the hole. I don't deny that many business and Wall Street types would like to capture the system for their own benefit. As Theodore Roosevelt observed, every new social arrangement begets its own kind of sin, which has to be punished by law. But as Roosevelt and his great hero Alexander Hamilton understood, corruption is the price we pay for economic freedom, and the benefits of that freedom vastly outweigh the costs. Hamilton and Roosevelt championed markets because they arouse energies, channel information, allocate resources and create enormous wealth. Plans to create private Social Security accounts aren't sops to the securities industry. They use the power of the market to solve an otherwise intractable problem. The outline of the problem is clear. When the Social Security program was created, there were 42 workers for each retiree. Now there are about three workers per retiree, and in 2030 there will be two. The White House is heading toward a reform plan that would tie the benefit levels to prices rather than wages, which is a serious benefit cut. It would then use the power of the markets to compensate retirees for those cuts and to create a reserve fund to make the system solvent. The government would essentially borrow at 2 percent in real terms, invest that money through regulated private accounts in the market and get a return, based on conservative historical averages, of about 4.6 percent. Those returns would, over time, cover the $11 trillion in liabilities that threaten to bring down the system. People who think the markets are a rigged game, or who think financial profits are just paper profits, won't like this approach. But the fact is that over the next decade -- whether we are talking about pensions, health care or even schools - the central argument is not going to be over whether to apply market competition to these problems. It's going to be over how to structure competition to produce the most dynamic results. I may be a complete idiot, but I actually believe that Democrats and Republicans can reach a grand bargain that includes personal Social Security accounts while addressing Democratic objections. You already see some Democrats growing concerned over the perception that their party is trying to build a bridge to the 1930's. On Thursday, the House minority leader, Nancy Pelosi, struck a very different tone than her Senate colleague. She is willing to enter into discussions about Social Security reform with no preconditions. Meanwhile, a Democratic underground is forming, made up of members of Congress willing to consider a grand compromise with Bush to make the system solvent. Even the White House folks seem to know they can't do this without Democratic support. They will have to protect the system's progressivity and have mechanisms built in to combat the corruption. They're going to have to do something about the deficit. This is not 1932 any more. This is not the age of big, static state institutions. This is actually about building a bridge to the 22 nd century. Op-Ed Columnist E-mail: dabrooks@nytimes.com Social Security Is Worth More Than You Think, but Needs Your Help Low interest rates have made Social Security more valuable. But the coronavirus crisis is likely to make its bong-term shontfall worse. by dedi Sommer Mry22, 2000 The stock market has been erratic, real estate is hurting, bond yields are painfully low and dividends are shrinking. In the coronavirus recession, most financial assets have been disturbingly volatile. But one wifely held financial asset, perhaps the most important ooe for the vast majority of Americans, has performed splendidly: their stake in Social Security. It trasn't merely been a solid support for millions of people in a difficult time While the income-producing power of so many oeher assets has been sapped by economic weakness and low interest rates, Social Security payments have held steady. And thanks to those rock-bottom interest rates, the market value of the Social Security income stream has soared in a measurable way. You may not think of Social Security as a personal asset, like a bank account, a portfolio of stocks and bonds or a house But Social Security retirement benefits are a kind of annuity, as I'll explain, and annuities have a definite market value, Considered this way, Social Security's value has been rising. Even if you aren' receiving payments now, you have a stake in the asset, and it is in your interest to protect it. "The most important financial asset for most Americans by far is Social Security," said Willaam I. Bernstein, a financial adviser and author on financial subjects. "We are in a retirement erisis, and the only foreseeable answer is Social Security" Perhaps if more people understiod the impressive, countercyclical performance of their share in Social Security, there would be more clamor to protect it. But critical as the benefits are proving to be in this crisis, as in so many others, the entire Social Security system faces a cash shartfall down the road, and it needs help from Congress. The pandemic has complicated these long-term issues, which can be resolved only in Washington. First, consider the good news. In the coronavirus crisis, Social Security has succeeded in daing just what it was designed to do: keeping old people, disabled people and their dependents out of dire poverty, and providing a retirement cushion for nearly everyone else. About 178 million working people of all ages are covered by Social Security, government statistics show. Even if thase people are not eligible for benefits now, they will be entitled to them later. Plenty of people are alreauly getting them, however: About 65 million Americans will receive more than $1 trillion this year. That includes nine out of 10 of those 65 and older, as well as millions of disabled people, dependents and survivars. With more than 100,000 Covid-19 deaths in America and millions of people financially desperate, a program that supplies regular income to so many can surely be ssid to be more valuable than ever. But I concede that is a subjective judgment. The program has also risen in value in a measurable way that may not be intuitively obvious. The Carcentuinu Dutbreak + Latest Updates ? - Doctors in Peru stage a hunger strike over the government's pandemic response. - The Netheranda will ban many tights and implement a nationwide curtow. - litaly says it will sue Pfizer over delyss in vaccine delivery. This is a little wonky, so bear with me. Financial markets put a price on almost everything, and they can provide an approximate cash value for Social Security, too, cookine: Daity inspiration, delicious necipes and other updates from Sam sifton and NYT Cooking- Your benefits, now or in the future, accrue gradually, over years of work and paying taves into the Social Security system. But as I pointed aut recently, low interest rates have reduced bond yields and made commercial annuities extremely expensive. With the belp of Dale Kintzel, a former Social Security economist who studied its pricing in a 2017 paper, I've checked the market values of annuities and compared them with Social Security. httpe:llwww.nydimes.com/2020/05/29/business/Social-Security-benefits-shortfall-coronavirus.html 1/2 1/20/2021 Social Security Is Worth More Than You Think, but Needs Your Help - The New York Times Those federal retirement benefits are essentially annuities: bonds wrapped in insurance. So-called single-premium immediate annuities - in which an insurance company will provide you with income, in exchange for a sum of cash - can't do everything Social Security does, but they come close. Mr. Kintzel has used annuities to approximate the cash value of Social Security benefits. Those values are startlingly high. Mr. Kintzel found that for the average 65 -year-old man, who last year received a retirement benefit of $1,375 a month, an annuity supplying that lifetime cash flow would cost at least $459,866 - 13 percent more than a comparable annuity in 2014 . For a 65 -year-old woman, the average monthly benefit was $1,102 last year. A comparable commercial annuity, Mr. Kintzel said, would cost $368,562. These figures are based on data from immediateannuities.com, which tracks annuity prices. These are just average amounts and would be much bigger - perhaps as much as $1 million - for high-income people who delay claiming benefits until they are 70, my own calculations suggest. Note that all of these estimates understate the value of Social Security, which provides disability benefits and supplemental income in addition to basic retirement benefits. And these estimates don't take into account the effects of the further decline in interest rates since the beginning of this year, which have reduced income streams from many assets, but not for Social Security. Perhaps the best thing about Social Security is that unlike a stock portfolio, it can be counted on, Mr. Kintzel said. "It is backed by the government, and so it's virtually risk-free, or it should be. I've always thought that Social Security is one thing that everybody can agree on. It's a good thing." Yet Social Security continues to have an odd problem. Although its stability has been among its greatest virtues, it remains underfunded. I pointed out a year ago that Social Security benefit payouts were greater than the system's revenues. That is still true. To receive all of the benefits you have been promised, a reluctant Congress will need to fix Social Security, which is likely to dip into the principal of its trust funds for the first time this year. Interest payments from the trust funds have made up the gap, allowing full benefits until now. Without help from Congress, these trust funds, are likely to be exhausted within 15 years - and perhaps sooner. If that were to happen, benefits would be cut, perhaps to 79 percent of the promised levels, Social Security estimates. In an online conference in late April, Stephen C. Goss, Social Security's chief actuary, said that the current recession would almost certainly reduce the system's payroll tax receipts and could lead to trust fund depletion by 2033 or even sooner. Precise estimates are impossible now, with the economy shrinking so rapidly, he said. "All bets are off, and we will just have to see what happens, because we really don't know whether we'll be back to normal," Mr. Goss said. As a matter of basic math, Social Security needs more revenue or lower expenses. But I think this recession suggests that increasing revenue is the way to go, because Social Security benefits have been so crucial. If they were to be cut, even bigger rescue programs would be needed from other sources. Far better to maintain and improve Social Security, which works automatically and well. Last year, I said that the most important thing you could probably do to improve your personal finances was to make sure that Congress took action to bolster the program's funding. That's even truer today, when its benefits are more valuable, and more badly needed