Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Need to include a filled in Schedule 1, A, B, 8812, 8812 Worksheet A, Qualified dividend sheets to complete this question Jamie and Cecilia Reyes

Need to include a filled in Schedule 1, A, B, 8812, 8812 Worksheet A, Qualified dividend sheets to complete this question

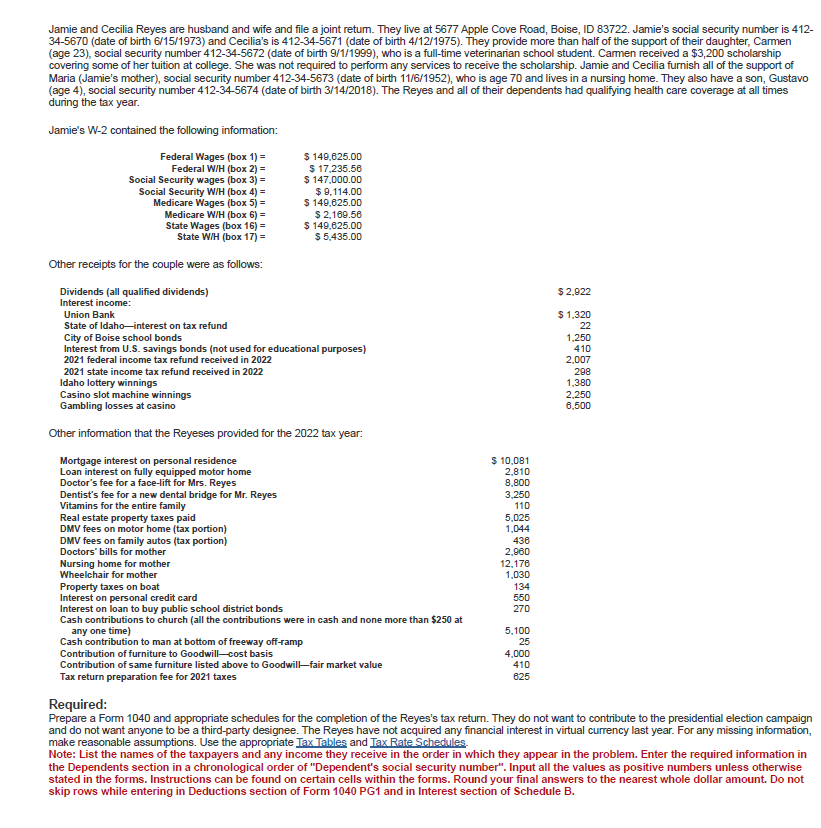

Jamie and Cecilia Reyes are husband and wife and file a joint retum. They live at 5677 Apple Cove Road, Boise, ID 83722 . Jamie's social security number is 412 34-5670 (date of birth 6/15/1973 ) and Cecilia's is 412-34-5671 (date of birth 4/12/1975 ). They provide more than half of the support of their daughter, Carmen (age 23), social security number 412-34-5672 (date of birth 9/1/1999 ), who is a full-time veterinarian school student. Cammen received a $3,200 scholarship covering some of her tuition at college. She was not required to perform any services to receive the scholarship. Jamie and Cecilia furnish all of the support of Maria (Jamie's mother), social security number 412-34-5673 (date of birth 11/6/1952), who is age 70 and lives in a nursing home. They also have a son, Gustavo (age 4), social security number 412-34-5674 (date of birth 3/14/2018 ). The Reyes and all of their dependents had qualifying health care coverage at all times during the tax year. Jamie's W-2 contained the following information: Ather raneinto finr the mainle unere de fillnuse. Other information that the Reyeses provided for the 2022 tax year: Required: Prepare a Form 1040 and appropriate schedules for the completion of the Reyes's tax return. They do not want to contribute to the presidential election campaign and do not want anyone to be a third-party designee. The Reyes have not acauired anv financial interest in virtual currency last year. For any missing information, make reasonable assumptions. Use the appropriate Tax Tables and Note: List the names of the taxpayers and any income they receive in the order in which they appear in the problem. Enter the required information in the Dependents section in a chronological order of "Dependent's social security number". Input all the values as positive numbers unless otherwise stated in the forms. Instructions can be found on certain cells within the forms. Round your final answers to the nearest whole dollar amount. Do not skip rows while entering in Deductions section of Form 1040 PG1 and in Interest section of Schedule BStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started